Finance > EXAM REVIEW > FNCE 3001 - Exam - Week 6 practice questions solution latest solution 2020 (96 out of 100) Walden (All)

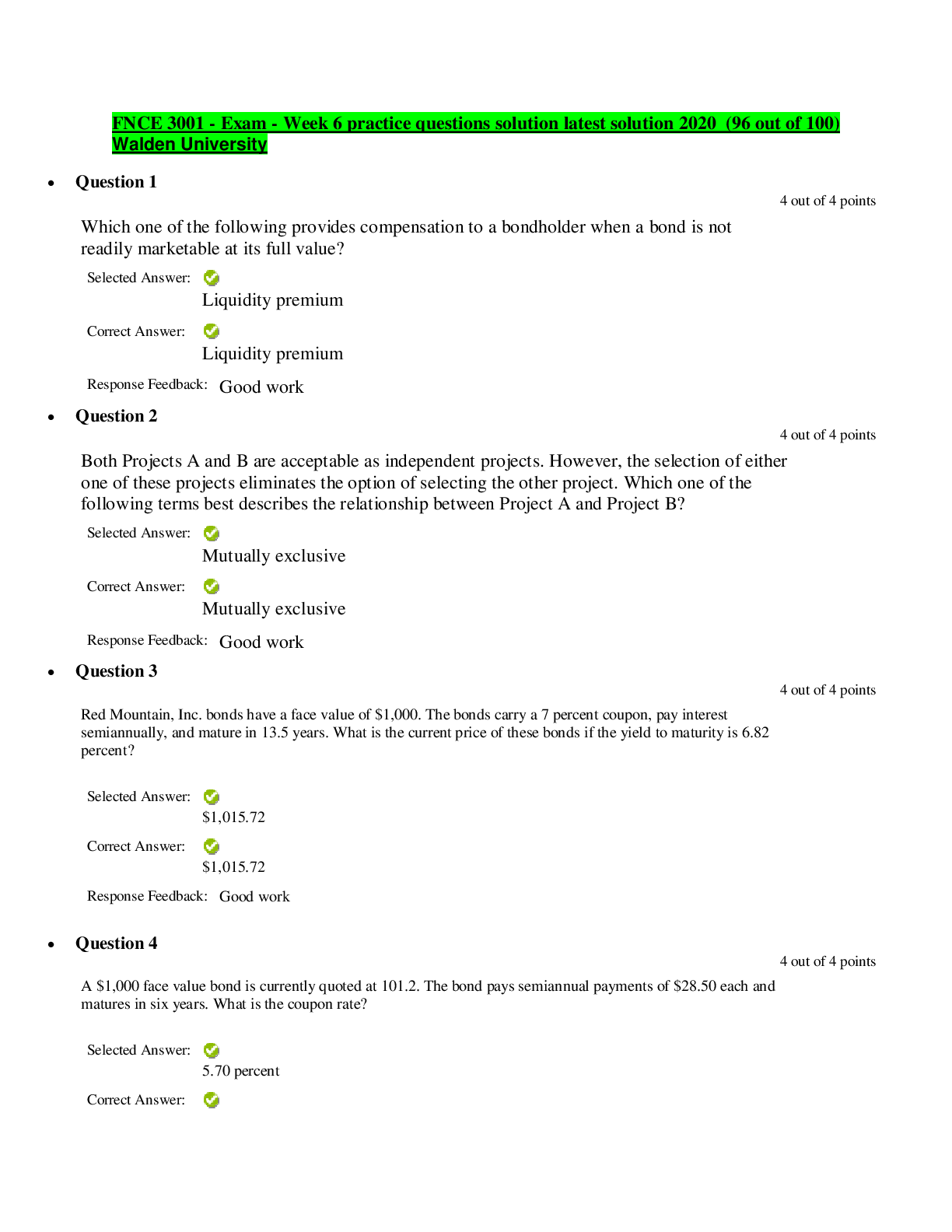

FNCE 3001 - Exam - Week 6 practice questions solution latest solution 2020 (96 out of 100) Walden University

Document Content and Description Below

FNCE 3001 - Exam - Week 6 practice questions solution latest solution 2020 (96 out of 100) Walden University • Question 1 4 out of 4 points Which one of the following provides compensat... ion to a bondholder when a bond is not readily marketable at its full value? • Question 2 4 out of 4 points Both Projects A and B are acceptable as independent projects. However, the selection of either one of these projects eliminates the option of selecting the other project. Which one of the following terms best describes the relationship between Project A and Project B? • Question 3 4 out of 4 points Red Mountain, Inc. bonds have a face value of $1,000. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 13.5 years. What is the current price of these bonds if the yield to maturity is 6.82 percent? • Question 4 4 out of 4 points A $1,000 face value bond is currently quoted at 101.2. The bond pays semiannual payments of $28.50 each and matures in six years. What is the coupon rate? • Question 5 4 out of 4 points A call provision grants the bond issuer the: • Question 6 4 out of 4 points Miller Farm Products is issuing a 15-year, unsecured bond. Based on this information, you know that this debt can be described as a: • Question 7 4 out of 4 points Weston Steel purchased a new coal furnace six years ago at a cost of $2.2 million. Last year, the government changed the emission requirements and this furnace cannot meet those standards. Thus, Weston can no longer use the furnace, nor has it been able to locate anyone willing to purchase the furnace. Given the current situation, the furnace is best described as which type of cost? • Question 8 4 out of 4 points A pro forma financial statement is a financial statement that: • Question 9 4 out of 4 points Mary owns 100 shares of stock. Each share entitles her to one vote per open seat on the board of directors. Assume there are three open seats in the current election and Mary casts all 300 of her votes for a single candidate. What is the term used to describe this type of voting? • Question 10 4 out of 4 points An all-equity firm has net income of $28,300, depreciation of $7,500, and taxes of $2,050. What is the firm's operating cash flow? • Question 11 4 out of 4 points Which one of the following best describes an arithmetic average return? • Question 12 4 out of 4 points Reynolds Metals common stock is selling for $25 a share and has a dividend yield of 3.1 percent. What is the dividend amount? • Question 13 4 out of 4 points Mike's Fish Market is implementing a project that will initially increase accounts payable by $4,600, increase inventory by $4,800, and decrease accounts receivable by $800. All net working capital will be recouped when the project terminates. What is the cash flow related to the net working capital for the last year of the project? • Question 14 4 out of 4 points Which one of the following statements is true? • Question 15 4 out of 4 points The Greasy Spoon Restaurant is considering a project with an initial cost of $525,000. The project will not produce any cash flows for the first three years. Starting in year 4, the project will produce cash inflows of $721,000 a year for three years. This project is risky, so the firm has assigned it a discount rate of 16 percent. What is the project's net present value? • Question 16 4 out of 4 points One year ago, LaTresa purchased 600 shares of Outland Co. stock for $3,600. The stock does not pay any regular dividends but it did pay a special dividend of $0.30 a share last week. This morning, she sold her shares for $7.25 a share. What was the total return on this investment? • Question 17 0 out of 4 points Your portfolio has provided you with returns of 8.6 percent, 14.2 percent, -3.7 percent, and 12.0 percent over the past four years, respectively. What is the geometric average return for this period? • Question 18 4 out of 4 points A project has the following cash flows. What is the payback period? Years Cash flow 0 -$31,000 1 15,600 2 10,200 3 8,700 4 7,100 • Question 19 4 out of 4 points A nine-year project is expected to generate annual revenues of $114,500, variable costs of $73,600, and fixed costs of $14,000. The annual depreciation is $3,500 and the tax rate is 34 percent. What is the annual operating cash flow? • Question 20 4 out of 4 points One year ago, you purchased 500 shares of stock for $12 a share. The stock pays $0.22 a share in dividends each year. Today, you sold your shares for $28.30 a share. What is your total dollar return on this investment? • Question 21 4 out of 4 points Braxton's Cleaning Company stock is selling for $32.60 a share based on a 14 percent rate of return. What is the amount of the next annual dividend if the dividends are increasing by 5 percent annually? • Question 22 4 out of 4 points An agent who buys and sells securities from inventory is called a: • Question 23 4 out of 4 points Suppose a stock had an initial price of $74 per share, paid a dividend of $0.80 per share during the year, and had an ending share price of $77. What was the capital gains yield? • Question 24 4 out of 4 points On which one of the following dates do dividends become a liability of the issuer for accounting purposes? • Question 25 4 out of 4 points Which one of the following is defined as the average compound return earned per year over a multiyear period? [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Reviews( 0 )

Recommended For You

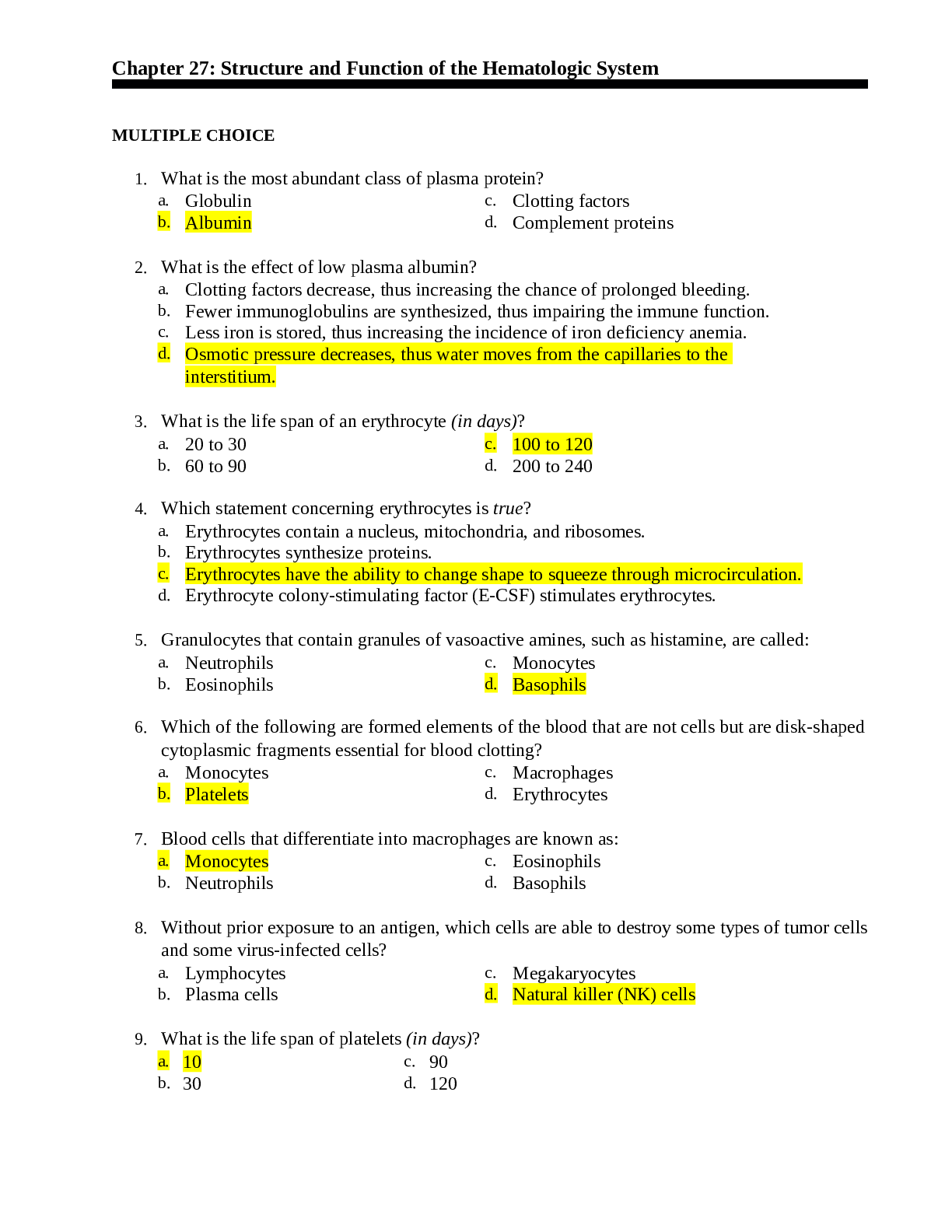

*NURSING> EXAM REVIEW > NSG 5003- Advanced Pathophysiology Exam week 6 practice questions and answers South University, (All)

NSG 5003- Advanced Pathophysiology Exam week 6 practice questions and answers South University,

NSG 5003- Advanced Pathophysiology Exam week 6 practice questions and answers South University, NSG 5003- Advanced Pathophysiology Exam week 6 practice questions and answers South University,NSG 5003...

By VERIFIED A+ , Uploaded: Jul 26, 2021

$13

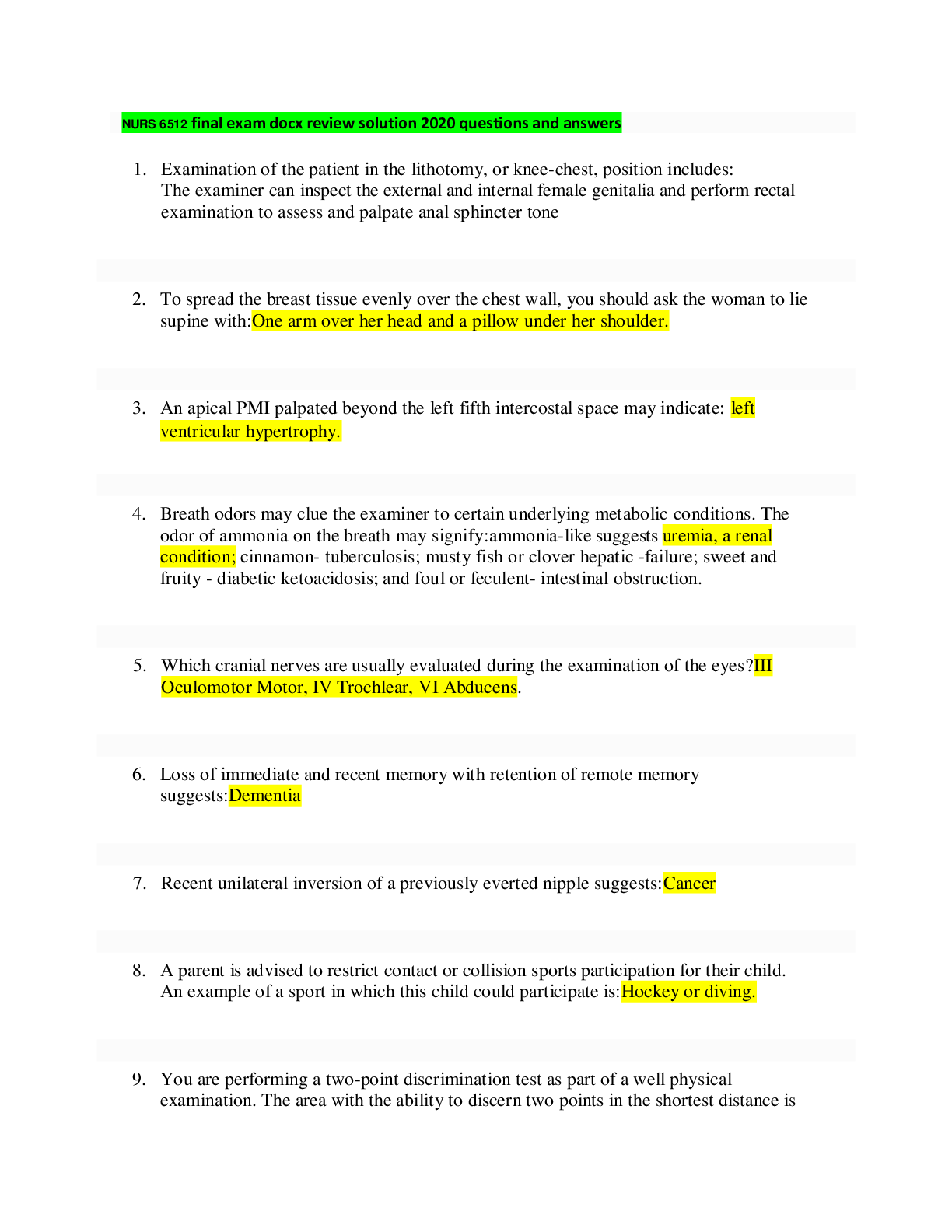

*NURSING> EXAM REVIEW > NURS 6512 Final1 practice questions solution all 100 questions with all correct answers latest solution 2020 Walden University (All)

NURS 6512 Final1 practice questions solution all 100 questions with all correct answers latest solution 2020 Walden University

NURS 6512 Final1 practice questions solution all 100 questions with all correct answers latest solution 2020 Walden University 1. Examination of the patient in the lithotomy, or knee-chest, posi...

By YongSam , Uploaded: Sep 05, 2020

$14.5

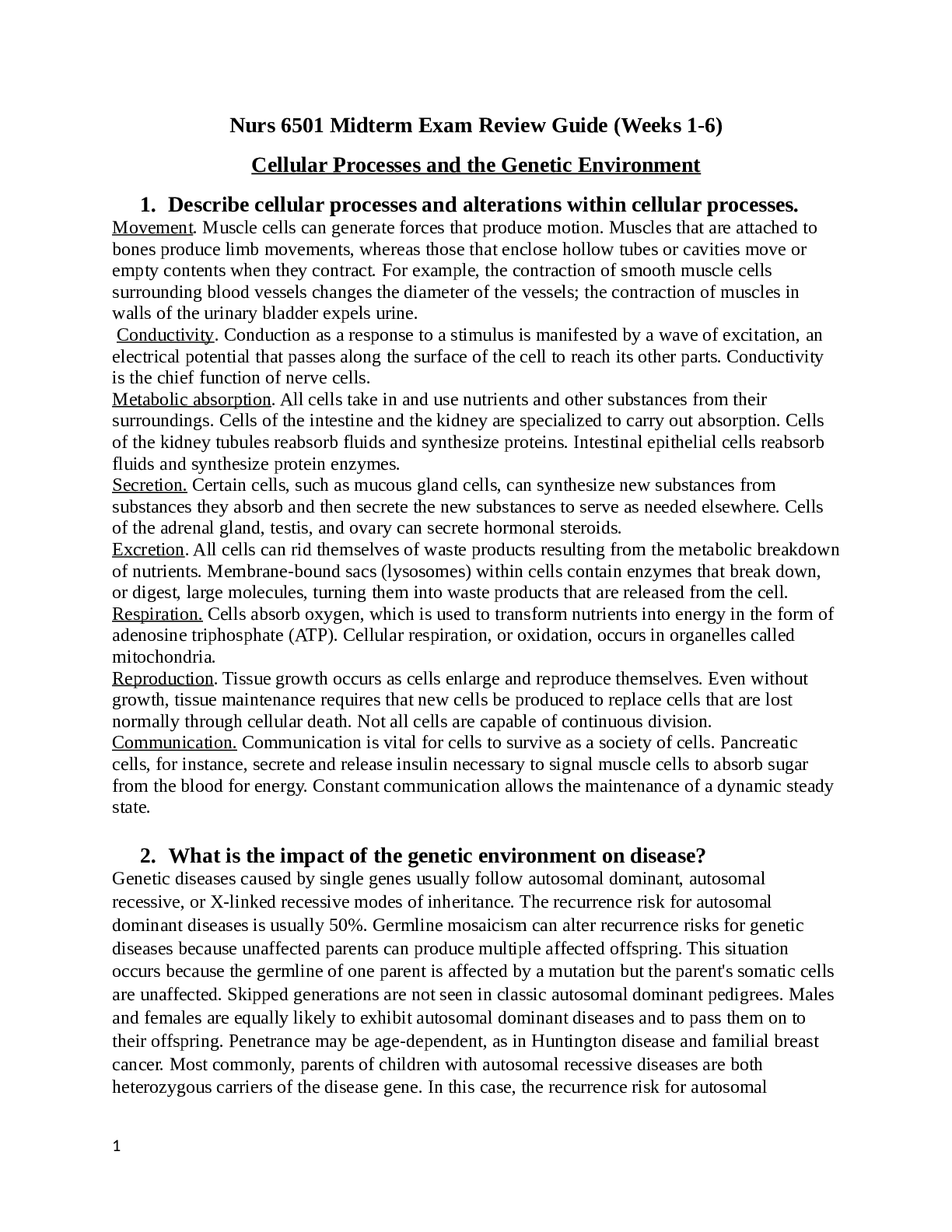

*NURSING> EXAM REVIEW > NURS 6501 Midterm Exam Review Guide (Weeks 1-6. Compilation in 99 Pages) (All)

NURS 6501 Midterm Exam Review Guide (Weeks 1-6. Compilation in 99 Pages)

Nurs 6501 Midterm Exam Review Guide (Weeks 1-6) Cellular Processes and the Genetic Environment 1. Describe cellular processes and alterations within cellular processes. 2. What is the impact of t...

By SuperSolutions© , Uploaded: Nov 24, 2020

$15

*NURSING> EXAM REVIEW > NUR2063 / NUR 2063 Essentials of Pathophysiology Exam Review Latest Update Rasmussen College (All)

NUR2063 / NUR 2063 Essentials of Pathophysiology Exam Review Latest Update Rasmussen College

NUR 2063 Essentials of Pathophysiology Exam Review 1. A potentially lethal condition in which there is an acute elevation of circulating thyroid hormones is called _______________ - ANS: Thy...

By quiz_bit , Uploaded: Oct 28, 2020

$12

*NURSING> EXAM REVIEW > Multidimensional Care (MDC) 1 MDC EXAM 2 REVIEW -. (Rasmussen College) (All)

Multidimensional Care (MDC) 1 MDC EXAM 2 REVIEW -. (Rasmussen College)

MDC EXAM 2 REVIEW 11:19:19 1. The effects of Immobility a) Interventions that improve flexibility • P.R.E.P.(Perform passive ROM, Reposition Q2HR, Encourage independent activity as much as possible...

By SuperSolutions© , Uploaded: Dec 11, 2020

$11

*NURSING> EXAM REVIEW > NUR 2356 / NUR2356 Multidimensional Care I (MDC I) Exam 2 Review. Rasmusssen College (All)

NUR 2356 / NUR2356 Multidimensional Care I (MDC I) Exam 2 Review. Rasmusssen College

1. What is a function of the musculoskeletal system? -Assist with movement 2. As a nurse you know that during aging, a normal musculoskeletal change would be? -A patient that came to the cli...

By nurse_steph , Uploaded: Nov 15, 2020

$11

*NURSING> EXAM REVIEW > NR566 / NR 566 Advanced Pharmacology for Care of the Family Final Exam Week 5 Review (Graded A) Chamberlain College of Nursing (All)

NR566 / NR 566 Advanced Pharmacology for Care of the Family Final Exam Week 5 Review (Graded A) Chamberlain College of Nursing

NR-566 Advanced Pharmacology for Care of the Family Final Exam Week 5 Review 1. What therapy and its dose is started within 48 hours of a TIA or ischemic stroke? - 2. Causes of sickling / S...

By quiz_bit , Uploaded: Oct 08, 2020

$9

*NURSING> EXAM REVIEW > NUR 2063 / NUR2063 Essentials of Pathophysiology Final Exam Review Modules 1 & 2 & 3 Latest Update Rasmussen (All)

NUR 2063 / NUR2063 Essentials of Pathophysiology Final Exam Review Modules 1 & 2 & 3 Latest Update Rasmussen

Modules 1 & 2 & 3 Essentials of Pathophysiology Final Exam Review

By quiz_bit , Uploaded: Nov 02, 2020

$15

*NURSING> EXAM REVIEW > NURS 6501 / NURS6501 Advanced Pathophysiology - Module 8 Knowledge Check (Latest Update) Walden University (All)

NURS 6501 / NURS6501 Advanced Pathophysiology - Module 8 Knowledge Check (Latest Update) Walden University

Review Test Submission: Module 8 Knowledge Check

By quiz_bit , Uploaded: Jan 13, 2021

$9.5

*NURSING> EXAM REVIEW > NR566 / NR 566 Advanced Pharmacology for Care of the Family Week 3 Quiz Study Guide . (Graded A) Chamberlain College of Nursing (All)

NR566 / NR 566 Advanced Pharmacology for Care of the Family Week 3 Quiz Study Guide . (Graded A) Chamberlain College of Nursing

NR-566 Advanced Pharmacology for Care of the Family Week 3 Quiz Study Guide If a patient is taking an ACEI and develops a persistent dry cough, what should the provider do? Which cl...

By quiz_bit , Uploaded: Oct 08, 2020

$15

Document information

Connected school, study & course

About the document

Uploaded On

Sep 05, 2020

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Sep 05, 2020

Downloads

0

Views

93