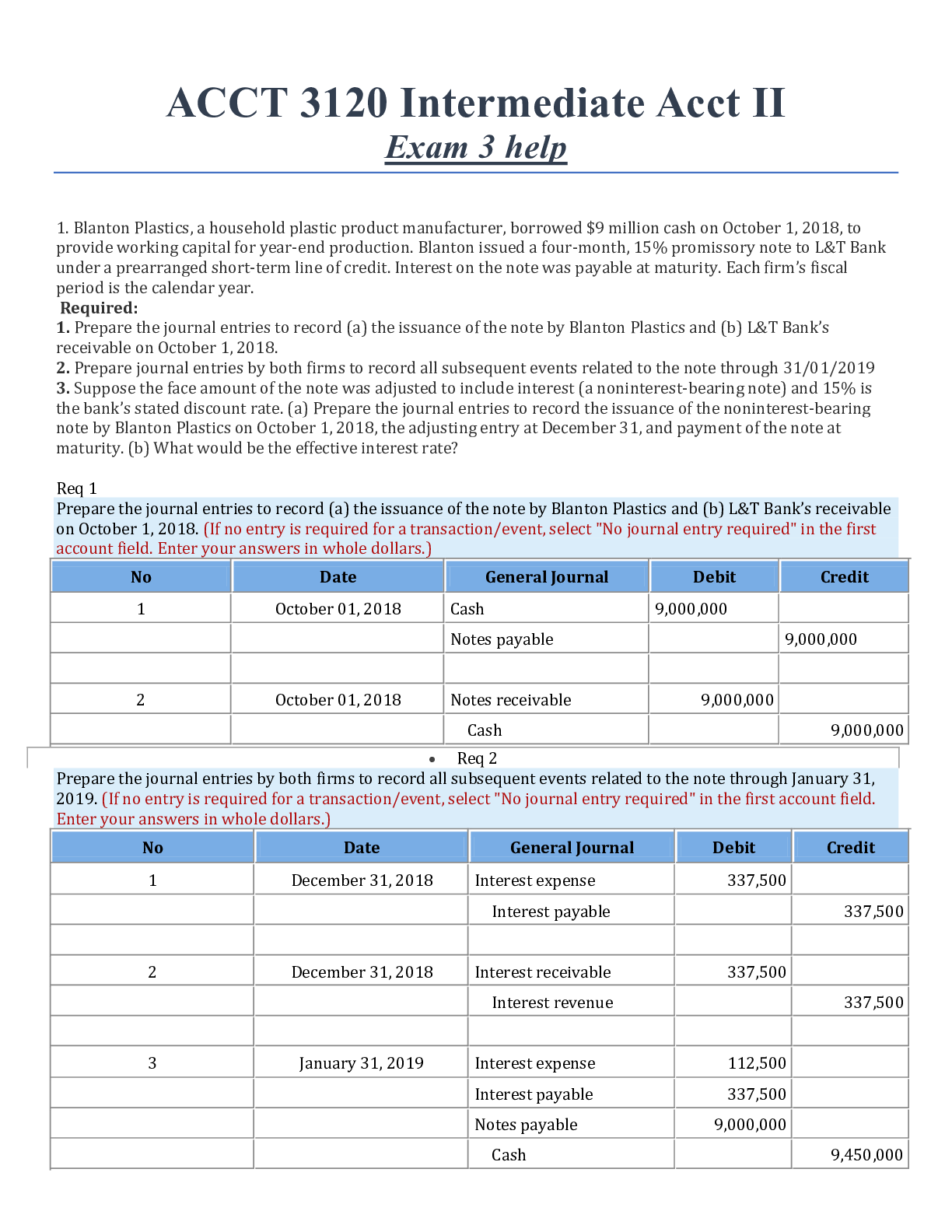

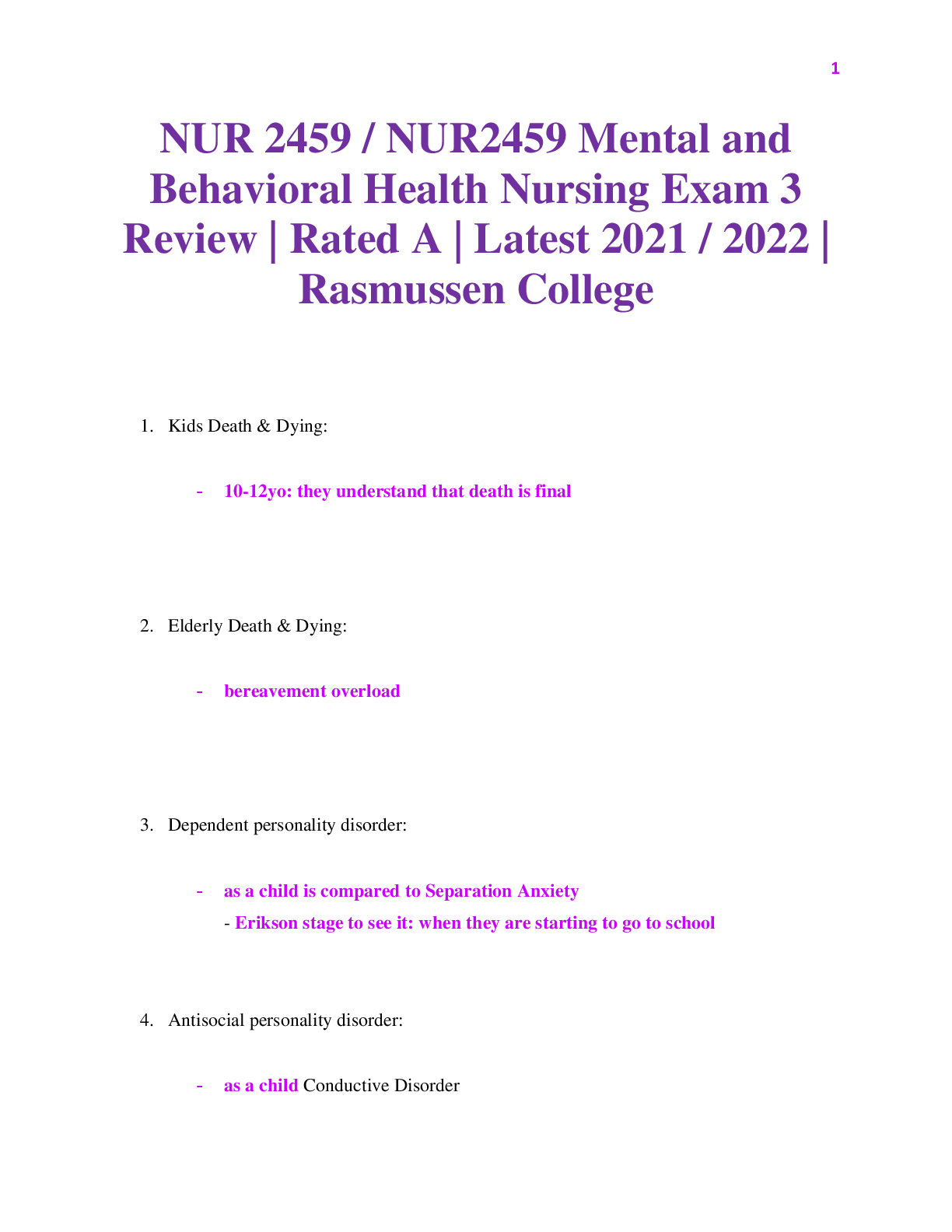

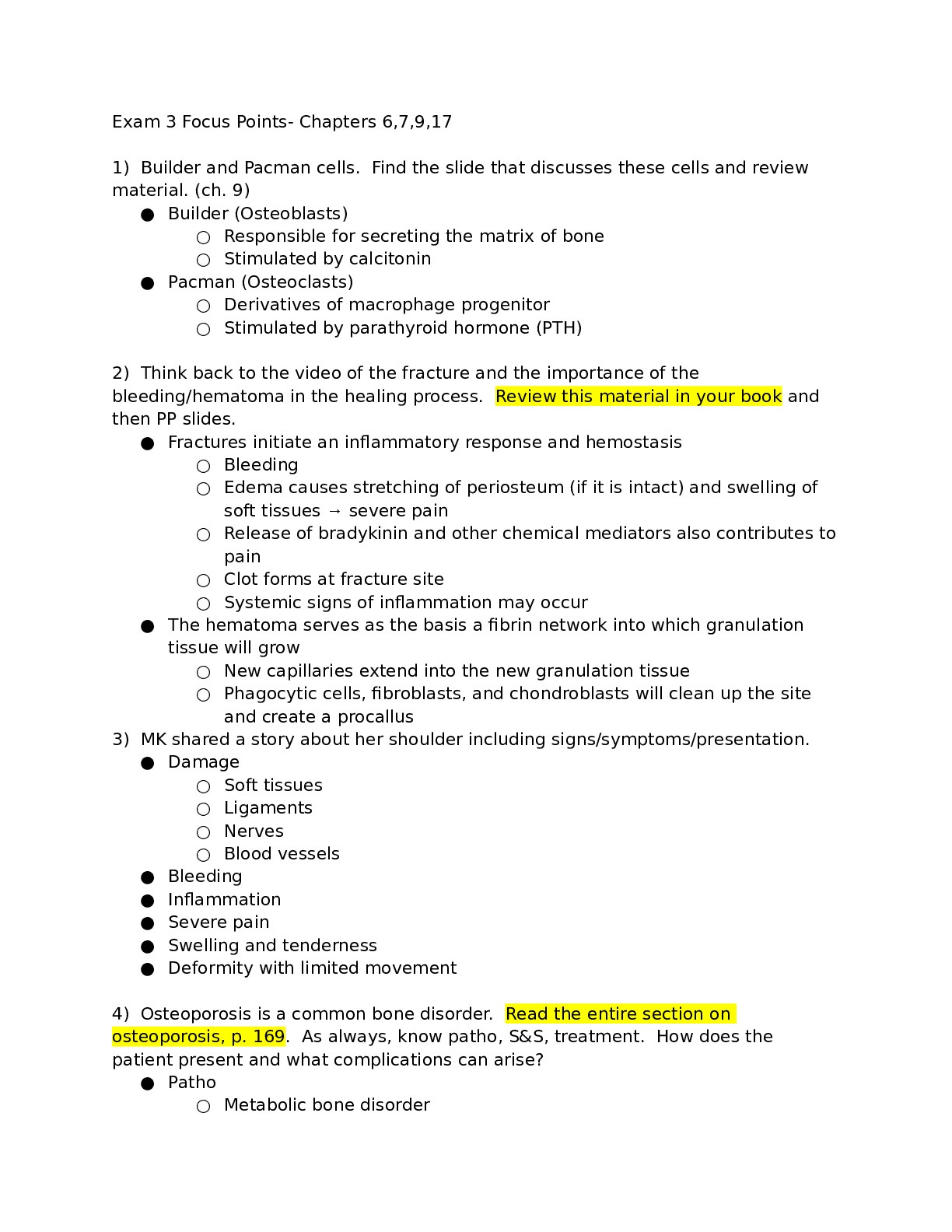

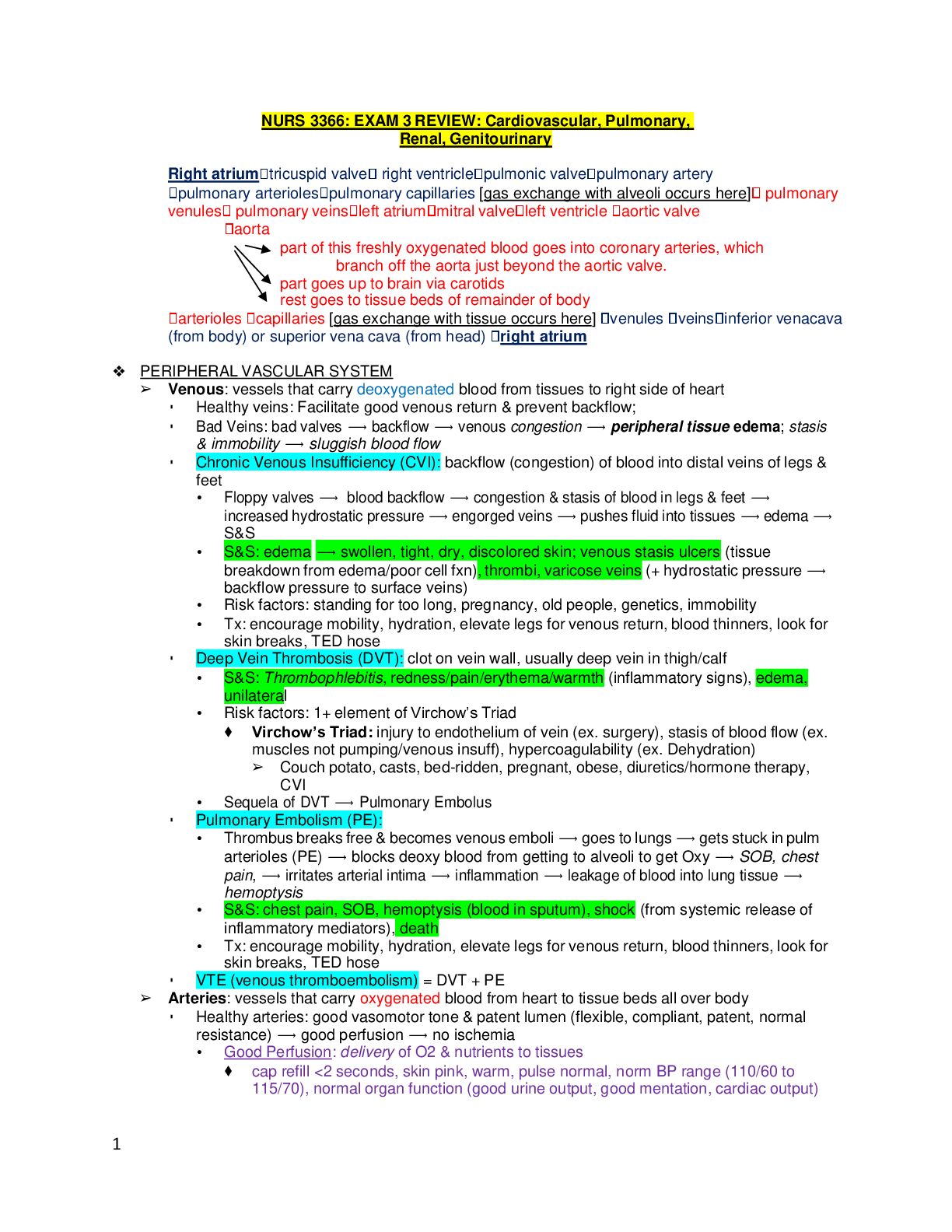

Financial Accounting > EXAM REVIEW > University of Memphis: ACCT 3120 Intermediate Acct II Exam 3 help. 118 Pages of Questions, Worked S (All)

University of Memphis: ACCT 3120 Intermediate Acct II Exam 3 help. 118 Pages of Questions, Worked Solutions and Explantions. 100%.

Document Content and Description Below