Economics > LECTURE NOTES > Lecture 5: Fiscal Policy (All)

Lecture 5: Fiscal Policy

Document Content and Description Below

What is fiscal policy? To smooth out economic fluctuations and achieve a full-employment and non-inflationary level of GDP, the government manipulates aggregate demand by changing government ex... penditures and taxes. Fiscal policy consists of: Government spending Taxes and transfer payments Keynes: G is the most effective tool Great Depression (1930s): The GFC ? Are G and C perfect substitutes? But what about T? Assessing the fiscal stance: structural versus cyclical Is the Government is pursuing an expansionary or contractionary fiscal policy? Or is it pursuing any active fiscal policy at all? To assess the fiscal stance, the budget deficit (or surplus) figure is not accurate enough The phase of the business cycle will change the size of the budget deficit (or surplus) even in the absence of any active fiscal policy Structural versus cyclical budget deficit/surplus Fiscal policy: two broad tools Automatic stabilizers: act to dampen fluctuations in economic activity without direct intervention by policymakers. They are structural features in government transfers and taxation that automatically smooth out fluctuations in disposable income (hence consumption, hence aggregate expenditure) over the business cycle. Discretionary fiscal policy Change in G and/or T. A change in t (the marginal tax rate) can also be used as discretionary fiscal policy. Structural versus cyclical budget deficit/surplus (continued) The structural budget balance is the budget balance that would arise if the economy was producing at full employment (potential output level) The cyclical budget balance Structural versus cyclical deficits Structural and cyclical budget deficit/surplus and the fiscal stance A change in those automatic stabilizers mean a change in the propensity to tax (t) and the multiplier Discretionary fiscal policy Changing government spending G to change PAE If the government injects G=$10billion of additional spending, and c is 0.8, the final change in GDP is: The multiplier effect of an increase in government expenditure Discretionary fiscal policy: examples in open economy with progressive taxes Discretionary fiscal policy Discretionary fiscal policy: effect of increasing government spending G Discretionary fiscal policy: effect of lower progressive tax rate Discretionary fiscal policy: effect of decreasing exogenous net taxes T We have seen that an increase in government spending (G) will increase GDP or Y We have also seen that an increase in net taxes (T) will reduce GDP (Y) An equal increase in government expenditures (G) and taxation (T) by $X will increase GDP by $X (with simple multiplier). This is because a change in government expenditure has a LARGER impact on the PAE than a change in taxation OF THE SAME SIZE. Why? Because ΔG =>ΔPAE directly, but ΔT =>ΔPAE indirectly through Δ(Y-T) and then ΔC The balance budget multiplier (assuming exogenous taxes, net exports and no progressive taxes) Identical changes in government spending G and net taxes T change output Y by that same amount. Remember: C = C + c (Y-T) where T (net taxes) = TA (taxes)- TR(transfer) Case 1 Assuming taxes are exogenous, net exports are exogenous and t=0) PAE = C + c (Y – T) + Ip + G + NX In equilibrium, Y = PAE so Y = C + c (Y – T) + I + G + NX or Y= [1/(1-c)] *(C + I + G + NX - cT) and ΔY = ΔT*[-c/(1-c)] The macroeconomic affect of a bonus payment Effectiveness of fiscal policy as a stabilisation tool A few qualifications 1. Fiscal policy affects also potential output Capital expenditures Tax and transfers can alter the behaviour of economic agents 2.need to keep budget deficit under control Sustained budget deficit reduces national saving (and increases the public debt) and therefore investment (a key to long term growth) 3. relative inflexibility of fiscal policy Changes in government spending must go through a lengthy legislative process - lags Competing goals for allocation of government funds Effectiveness of fiscal policy as a stabilisation tool he magnitude of the impact of changes in government spending and taxes on GDP, employment and inflation depends on: A. The extent to which a changes in G or in T will affect planned aggregate expenditure B. The extent to which the change in PAE will affect GDP Those magnitudes are hard to forecast Gini coefficient and Lorenz curve Contemporary fiscal policy: 3 key roles in Australia International Gini Coefficients Contemporary fiscal policy: 3 key roles in Australia 3. Managing the public debt The difference between debt and deficit Budget deficit: when government's revenues fall short of its expenses, and refers to net expenditure flows in a single financial year. The debt is the cumulative balance of these flows over time. Gross debt is the value of Commonwealth Government Securities, which the government issues to investors when it needs to borrow money to cover its costs. Net debt is calculated by taking into account money owed to the government, along with selected financial assets it can sell to meet its financial obligations. Net debt = deposits held + government securities + loans and other borrowing - cash and deposits + advances paid + and investments + loans and placements Increasing net debt means that the budget deficit is increasing faster than the increase in the value of financial assets. The government budget constraint Definition: the government budget constraint is the relation between debt, deficits , government spending and taxes Financing a budget deficit and the national debt The budget deficit equals spending (G), including interest payments on the debt that has already been accumulated, minus taxes net of transfers. To finance a budget deficit, the Government will borrow money by selling government securities (bonds) Do not confuse the words deficit and debt. Debt is a stock, what the government owes as a result of past deficits. The deficit is a flow, how much the government borrows during a given year Financing a budget deficit and the national debt (continued) The budget deficit equals the debt incurred by the Government over a year. The budget constraint simply states that the change in government debt during year t is equal to the deficit during year t. Budget deficits, debt reduction and debt stabilization Budget balance and net debt The dangers of very high debt levels Twin deficits: the budget balance and the current account Money, prices and the Reserve Bank The financial system: the allocation of saving to productive uses The role of banks: Financial intermediation Stand between savers and investors Asymmetric information Help identify productive borrowers Pool saving of small savers; only need to evaluate each large loan request once. Provide access to credit that may otherwise be unavailable (e.g. to a small business) Easy to make payments Bonds A legal promise to repay a debt at a specific date in future (maturation): principal + interest payments. Issued by governments Issued by firms The coupon rate: rate at time bond issued (ex: 5%). Coupon payment (if annual) = principal x coupon rate (ex: 5%*$1,000)=$50. Term: 24hrs – 30 years Bond prices and interest rates Interest, bond prices and bond yields A share or stock (equity) is a claim on partial ownership of a firm. Regular income in the form of a dividend. Capital gains if price of stock increases Stock price, interest rate and risk premium Bond and stock risks Bond and stock market: the benefits of diversification Money has 3 uses: 1. Medium of exchange 2. Unit of account 3. Store of value How is money measured Currency: notes & coins Base Money : currency + reserves. M1: currency + current bank deposits M3: M1 + deposits of private non-banks Broad money: M3 + other AFI borrowings Money supply growth Money aggregates Banks and money creation Currency, reserves, deposits, R-D ratio and the money supply If $100 is held by public in the form of currency and $200 is held in reserves. If also, the desired R-D ratio is 10% What is the money supply? The money supply are currency in hand of the public + deposits. Deposits = reserves/R-D ratio =$200/0.1=2000 Money supply =100+2000=2100 Money supply and inflation Velocity = value of transactions / money stock = nominal GDP/money stock => V= (P x Y) / M The ―quantity equation‖ M x V = P x Y If V and Y fixed, then ↑M ↑P If the quantity of goods and services Y is constant, and so is V, then an increase in the supply of money leads to increasing inflation P Money supply and inflation The RBA and interest rates RBA uses open market operations to change supply of reserves: The RBA can influence the amount of excess reserves, and hence the level of the cash rate, by buying and selling government securities in open-market operations Open market operations and the money supply If the central bank buys govt bonds from commercial banks ↑ reserves Given the desired R-D ratio, banks will be inclined to increase loans ↑ deposits to level determined by reserves/R-D ratio. Central bank, saving and investment Addendum: Money Creation in the Modern Economy McLeay et al (2014) Bank of England Quarterly Bulletin The central bank controls the quantity of money in circulation (so that it is consistent with its goal of low and stable inflation) by setting the ―price‖ of reserves, i. Given i, economic agents decide how much to borrow and banks decide how much to lend Deposits created determine reserves needed90 Money creation Banks first decide how much to lend depending on the profitable lending opportunities available to them — which crucially, depend on the interest rate set by the central bank. It is these lending decisions that determine how many bank deposits are created by the banking system. The amount of bank deposits in turn influences how much central bank money banks need to hold in reserve (to meet withdrawals by the public, make payments to other banks, or meet regulatory liquidity requirements), which is then, in normal times, supplied on demand by the central ban Creating and destroying money Money/deposits created when Banks issue new loans Banks buy govt bonds from private non-banks Central Bank buys assets (government bonds) (QE) Money/deposits destroyed when Loans are repayed Banks issue long-term debt/equity (i.e. non-deposit liabilities) International considerations … Limits to money creation Factors that constrain lending: Competition between banks Risk management by banks Regulatory requirements Behaviour of money holders Central bank monetary policy affects loan demand (via i and impact on economic activity) Price of loans – limits borrowing Limits to money creation: the central bank’s monetary policy Another monetary policy tool: quantitative easing Central bank can buys assets from NBFIs (and bypasses commercial banks). But these institutions don‘t have reserves; use banks as intermediary. The central bank thus credits the reserve account of the NBFI‘s bank with the funds, and that bank credits the NBFI‘s account with a deposit Quantitative easing: transmission mechanisms [Show More]

Last updated: 1 year ago

Preview 1 out of 110 pages

Reviews( 0 )

Recommended For You

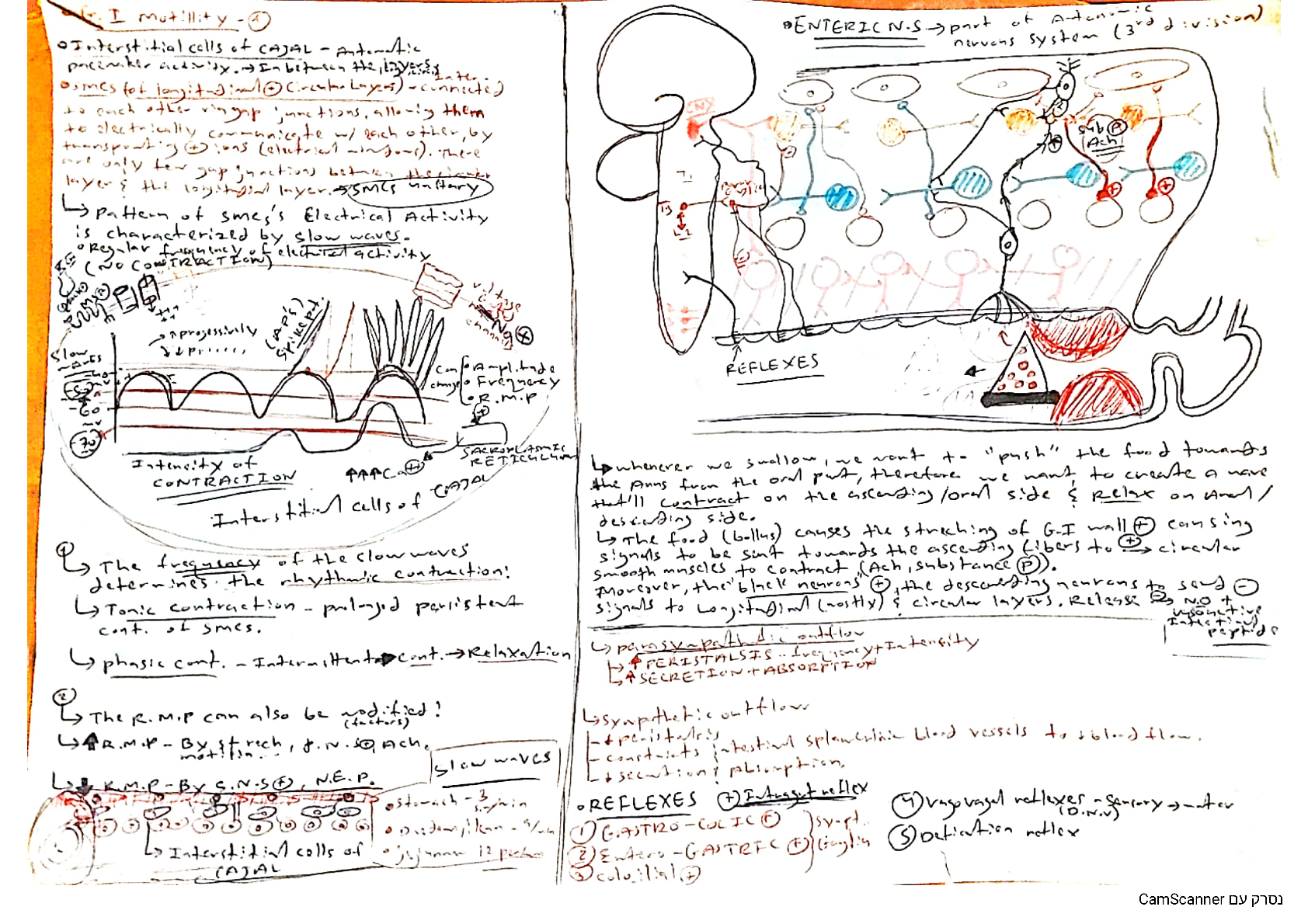

Physiology> LECTURE NOTES > Gastrointestinal physiology- GI motility (All)

Gastrointestinal physiology- GI motility

This document is regarding gastrointestinal physiology- stomach, small intestinal, large intestinal and enteric nervous system. GI motility is defined by the movements of the digestive system, and...

By Dan18268 , Uploaded: Jan 17, 2024

$7

BioChemistry> LECTURE NOTES > C785 BIOCHEMISTRY NOTES (WESTERN GOVERNORS UNIVERSITY) (All)

C785 BIOCHEMISTRY NOTES (WESTERN GOVERNORS UNIVERSITY)

Amino acid structure Amino acid types • Hydrophobic: ending in CHs • Polar: ending OH, NH, or SH • Charged: ending in a charge • Flow Chart: Is there a charge? → Is there S, N, or O? → Hydrophob...

By Professor Marjorie Barker , Uploaded: Sep 25, 2022

$5.5

Management> LECTURE NOTES > Mnb1601 Summarise - Lecture Notes Unisa (All)

Mnb1601 Summarise - Lecture Notes Unisa

MNB1601 NOTES OPERATIONS MANAGEMENT The operations function is that function of the business aimed at executing the transformation process. The importance of operations management: It can reduce the...

By ACADEMICTUTORIAL , Uploaded: Nov 29, 2021

$1.5

*NURSING> LECTURE NOTES > Mark Klimek Lecture Notes NCLEX REVIEW (All)

Mark Klimek Lecture Notes NCLEX REVIEW

Mark Klimek Lecture Notes NCLEX REVIEW

By ACADEMICTUTORIAL , Uploaded: Nov 30, 2021

$3

Psychology> LECTURE NOTES > PSYCH 104 Lecture Notes Chapters-1-7 & 11 (All)

PSYCH 104 Lecture Notes Chapters-1-7 & 11

PSYCH 104 Lecture Notes Chapters-1-7 & 11

By ACADEMICTUTORIAL , Uploaded: Nov 30, 2021

$2.5

*NURSING> LECTURE NOTES > NR 283 Pathophysiology notes ch 1,2, 21 (All)

NR 283 Pathophysiology notes ch 1,2, 21

NR 283 Pathophysiology notes ch 1,2, 21

By ACADEMICTUTORIAL , Uploaded: Mar 16, 2022

$3.5

*NURSING> LECTURE NOTES > NR 509 Adv Physical Assessment- Midterm Notes (All)

NR 509 Adv Physical Assessment- Midterm Notes

NR 509 Adv Physical Assessment- Midterm Notes Soap note example for the patient. This is a great start to your learning and practice.

By ACADEMICTUTORIAL , Uploaded: Mar 20, 2022

$4

*NURSING> LECTURE NOTES > Mark klimek lecture 1-12 notes (All)

Mark klimek lecture 1-12 notes

Mark Klimek 1-12 notes for NCLEX test review.

By ACADEMICTUTORIAL , Uploaded: Mar 16, 2023

$4.5

*NURSING> LECTURE NOTES > Mark Klimek Test taking strategies (All)

.png)

Mark Klimek Test taking strategies

Mark Klimek Test taking strategies Lab Values: DEADLY DANGEROUS: Elevated K+ ( >6) - Hold K+, Assess heart, Prepare Kayexalate/D5W, Call Dr. Elevated pH ( >6) - Assess Vitals, Call doctor ...

By Kirsch , Uploaded: Mar 14, 2023

$9

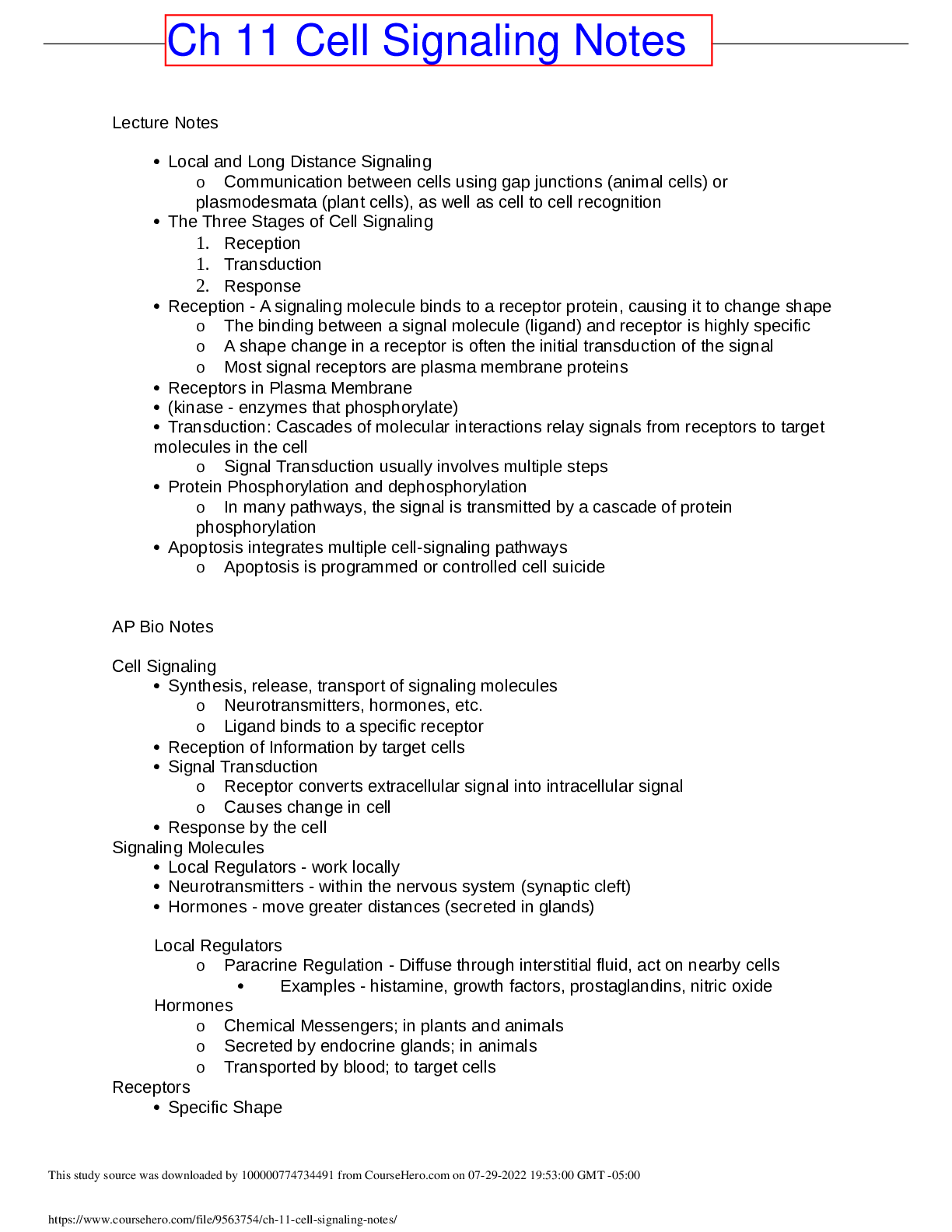

Biology> LECTURE NOTES > Lecture Materials > University of Louisville BIO 240 Ch 11 Cell Signaling Notes (All)

Lecture Materials > University of Louisville BIO 240 Ch 11 Cell Signaling Notes

University of Louisville BIO 240 Ch 11 Cell Signaling Notes Lecture Notes Local and Long Distance Signaling o Communication between cells using gap junctions (animal cells) or plasmodesmata (p...

By QuizMaster , Uploaded: Aug 02, 2022

$4

Document information

Connected school, study & course

About the document

Uploaded On

Nov 28, 2019

Number of pages

110

Written in

Additional information

This document has been written for:

Uploaded

Nov 28, 2019

Downloads

0

Views

100