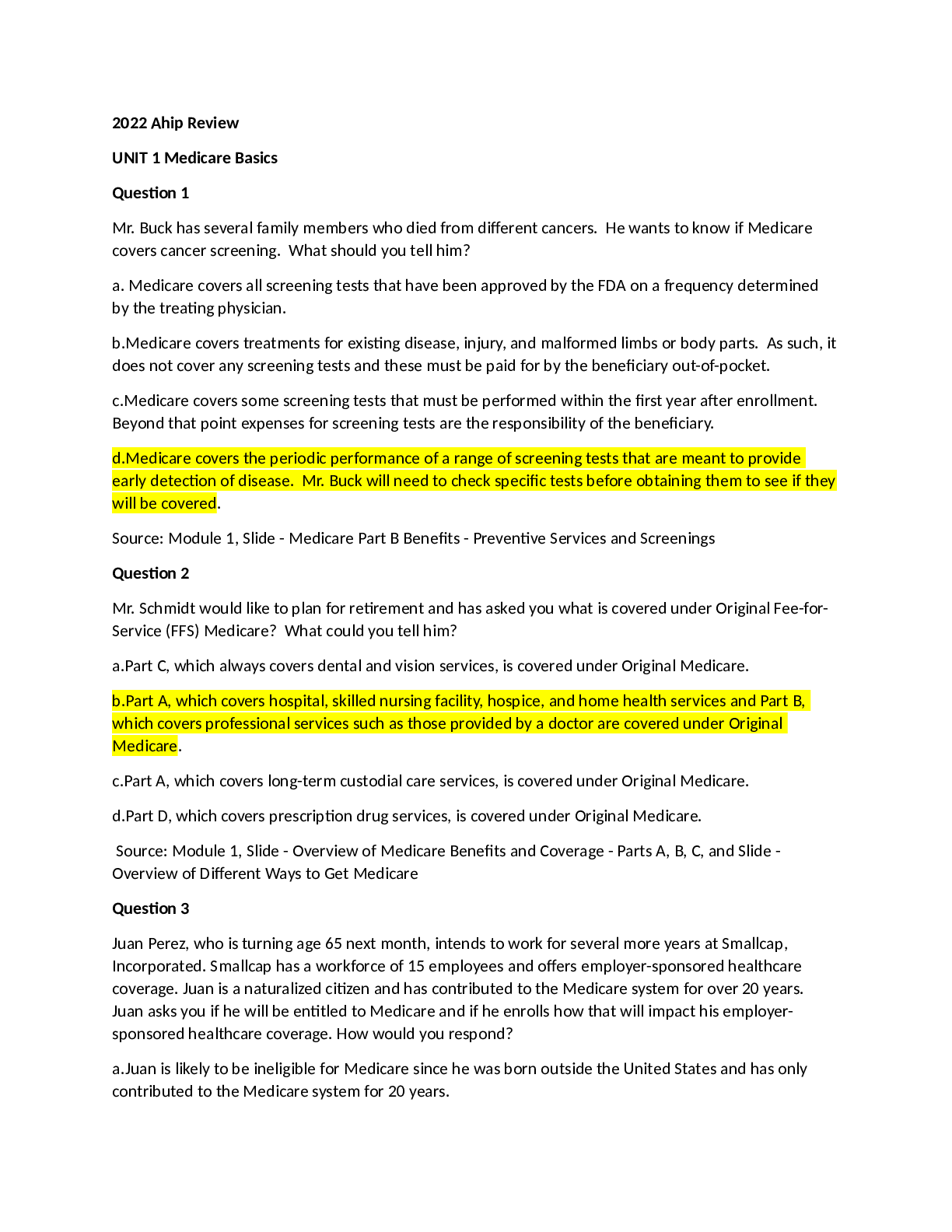

*NURSING > Feedback Log > 2022 AHIP Test Review Questions: UNIT 1 Medicare Basics, UNIT 2 Medicare Advantage (MA), UNIT 3 ME (All)

2022 AHIP Test Review Questions: UNIT 1 Medicare Basics, UNIT 2 Medicare Advantage (MA), UNIT 3 MEDICARE PDP, UNIT 4 MEDICARE ADVANTAGE AND PART D PLANS & UNIT 5 ENROLLMENT GUIDANCE MA AND PART D. Each 20 Q&A . 100 Exam Questions & Answers

Document Content and Description Below