Finance > QUESTIONS & ANSWERS > University of Economics - FIN 201CF Final. All Answers Verified (All)

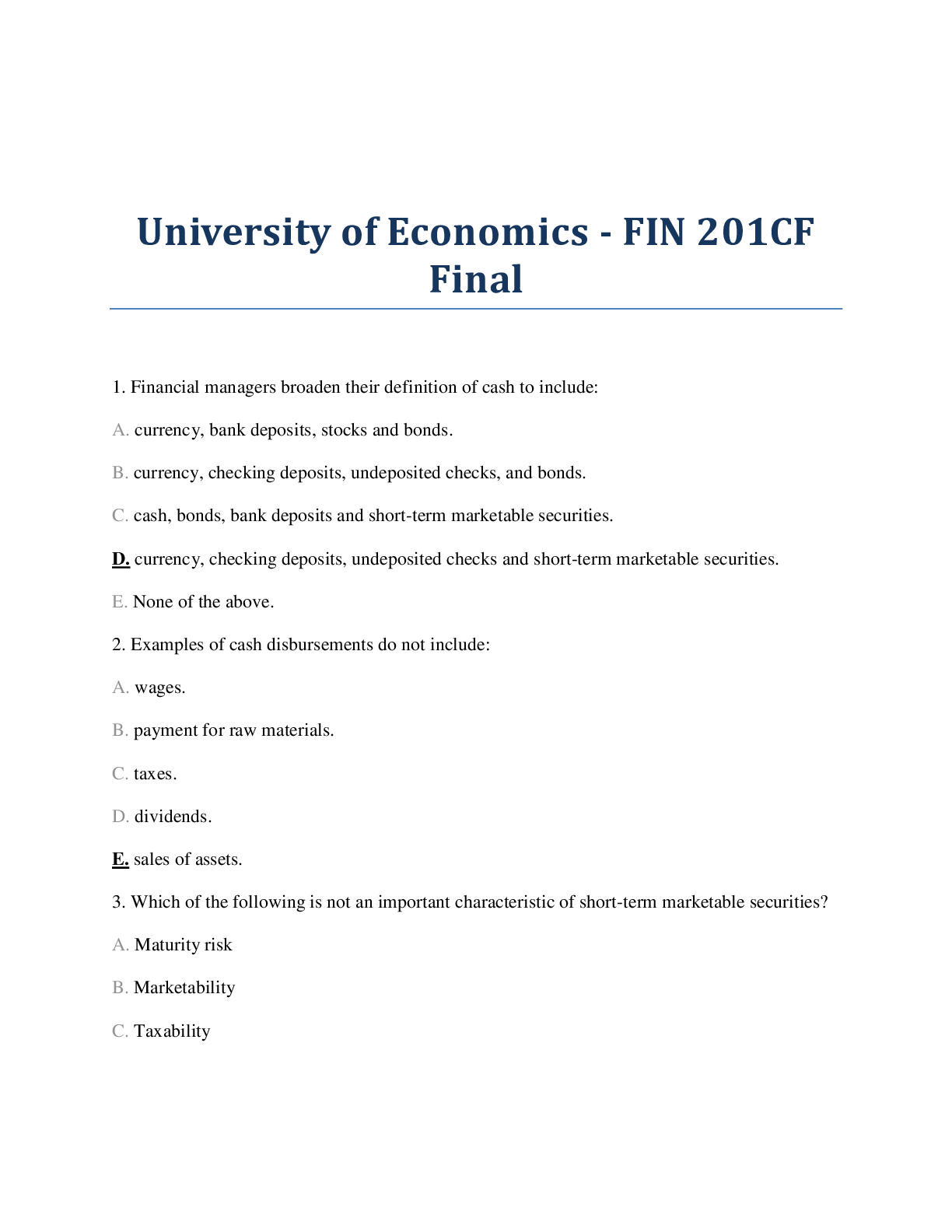

University of Economics - FIN 201CF Final. All Answers Verified

Document Content and Description Below

University of Economics - FIN 201CF Final 1. Financial managers broaden their definition of cash to include: A. currency, bank deposits, stocks and bonds. B. currency, checking deposits, undepo... sited checks, and bonds. C. cash, bonds, bank deposits and short-term marketable securities. D. currency, checking deposits, undeposited checks and short-term marketable securities. E. None of the above. 2. Examples of cash disbursements do not include: A. wages. B. payment for raw materials. C. taxes. D. dividends. E. sales of assets. 3. Which of the following is not an important characteristic of short-term marketable securities? A. Maturity risk B. Marketability C. Taxability D. Default risk E. All of the above are important. 4. Marketability risk is synonymous with: A. maturity risk. B. default risk. C. liquidity risk. D. interest rate risk. E. None of the above. 5. Which of the following money-market securities has no active secondary market? A. Certificates of deposit (CD's) B. Commercial paper C. Banker's acceptances D. Treasury bills E. All money-market securities have active secondary markets. 6. If a firm has achieved its target cash balance the net present value is: A. positive because the cash balance is positive. B. zero because increasing the cash balance increases the interest cost. C. negative because the cash balance has a financing cost. D. positive because decreasing the cash decreases the cost of illiquidity. E. None of the above. 7. Determining the appropriate target cash balance involves assessing the trade-off between: A. income and diversification. B. the benefit and cost of liquidity. C. balance sheet strength and transaction needs. D. All of the above. E. None of the above. 8. The target cash balance is reached when: A. the interest on any marketable security throw-off is maximized. B. the interest foregone from not investing in an equivalent amount of Treasury bills is minimized. C. the value of cash liquidity equals interest foregone on an equivalent amount of Treasury bills. D. the liquidity value is greater than interest foregone on an equivalent amount of Treasury bills. E. None of the above. 9. Firms would need to hold zero cash when transactions related needs are: A. greater than cash inflows. B. less than cash inflows. C. not perfectly synchronized with cash inflows. D. perfectly synchronized with cash inflows. E. None of the above. 10. Firms hold cash to satisfy the transaction motive. This means that cash is held: A. to meet disbursements for normal operations. B. to balance the flow between cash inflows and outflows. C. to make unexpected payments such as special price discounts. D. Both A and B. E. None of the above. 11. Firms hold cash, in part, to satisfy compensating balances. Compensating balances are: A. cash balances held at the firm in excess of its transactions needs. B. cash balances held at the firm that are below that of its transactions needs. C. cash balances held at the firm in excess of its cash inflows. D. cash balances held at commercial banks to pay implicitly for bank services. E. None of the above. 12. In determining the firm's target cash balance, trading costs: A. tend to fall when cash balances are large. B. tend to rise when cash balances are large. C. tend to rise when cash balances are low. D. Both A and B. E. Both A and C. 13. The cost of holding cash: A. is the opportunity cost of lost return. B. is zero because it is the most liquid and desirable asset. C. increases as cash holdings increase. D. Both A and B. E. Both A and C. 14. A firm with low cash balances will need to borrow to cover an unexpected cash outflow: A. if it has high cash flow variability. B. if COGS decrease. C. if the firm maintains a zero lower control limit. D. Both A and B. E. Both A and C. 15. Most large firms hold a cash balance greater than most models imply because: A. it is too difficult to estimate the costs of security transactions. B. banks are compensated by account balances for payment of services. C. corporations have few bank accounts and it is difficult to manage their cash. D. cash is costless and need not be managed closely. E. None of the above. 16. The difference between bank cash and book cash is called: A. float. B. disbursement float. C. net float. D. collection float. E. None of the above. 17. Checks written by the firm are said to generate: A. collection float. B. ledger float. C. disbursement float. D. book float. E. None of the above. 18. When a firm writes a check, there is an immediate decrease in _____ cash, but no immediate change in _____ cash. A. bank; collected B. ledger; book C. bank; ledger D. book; bank E. None of the above 19. Collection float increases: A. disbursement float. B. bank cash. C. book cash. D. gross float times net float. E. None of the above. 20. A financial manager should be concerned about bank cash and net float, which is the sum of: A. collection and book cash. B. collection float and disbursement float. C. disbursement float and book cash. D. disbursement float and bank credit. E. None of the above. 21. Which of the following is not true of float management? A. Float management involves controlling the collection and disbursement of cash. B. An objective of float management is to speed up the collection float. C. An objective of float management is to slow down disbursement float. D. Float management will succeed if the firm can collect late and pay early. E. All of the above are true of float management. 22. By getting closer to the source of payment, lockboxes can be used to reduce: A. availability or clearing float. B. mail float. C. in-house processing float. D. disbursement float. E. None of the above. 23. The most common cash management technique used to speed up collections is: A. concentration banking. B. wire transfers. C. lockboxes. D. in-house processing. E. None of the above. 24. The fastest but most expensive way to transfer surplus funds from the local deposit bank to the concentration bank is: A. a lockbox system. B. a mail float system. C. a wire transfer. D. an in-house processing float system. E. an availability float system. 25. Which of the following statements concerning zero balance accounts is not correct? A. They are set up to handle disbursement activity. B. The account has a minimum amount at all times. C. Checks are automatically transferred into the account as checks are presented for payment. D. The transfer is automatic and involves an accounting entry only. E. The master and the zero balance accounts are located at the same bank. 26. Efficient funds management attempts to reduce mailing and clearing time. Two methods do this by: A. moving collections and deposits closer together in concentration banks; and moving surplus funds quickly by wire transfers. B. moving mailing points to cross country locations and using depository drafts to transfer funds. C. drawing checks against zero balance accounts and using cross country mailing. D. wiring funds to zero balance accounts and using lockboxes in many cities. E. None of the above. 27. The major difference between a check and a draft is that: A. the draft is not drawn on the bank but on the issuer. B. the bank must present the draft to the firm for acceptance. C. after acceptance of the draft the firm must deposit the funds to make payment. D. All of the above. E. None of the above. 28. If the total long term financing of the firm is greater than the total financing needs for part of the year, and less than the needs for some of the year due to seasonal fluctuations, the company will most likely: A. hold excess cash. B. borrow short term and hold excess cash. C. hold excess cash and reduce business activities. D. invest in marketable securities and borrow short term. E. None of the above. 29. Adjustable rate preferred stock (ARPS) offer competitive rates of return with traditional money-market instruments but: A. are not rated by Moody's or Standard & Poor's. B. still provide the corporate investor with the tax exclusion on dividend income. C. have a fixed rate of dividend income. D. offers a highly competitive trading market. E. None of the above. 30. Even though the dividend rate on an Adjustable-Rate Preferred Stock (ARPS) is floating to keep in line with interest rates, the instrument still suffers from risk such as: A. a thin market causing potential principal risk and liquidity concerns. B. the risk of downgrades from the narrow range of issuers. C. the impact of tax law changes, which may reduce the after-tax value of the instrument. D. All of the above. E. None of the above. 31. Auction-Rate Preferred Stock is similar to Adjustable-Rate Preferred Stock (ARPS) in that they: A. are both issued for 90 days. B. have a dividend rate set by the issuer. C. both have a floating rate and a dividend tax exclusion. D. are equally accessible to the corporate investor directly. E. are not similar in any manner. 32. Auction-Rate Preferred Stock has less risk factors than Adjustable-Rate Preferred Stock (ARPS) because: A. the reset period is 49 days instead of 90. B. the market sets the dividend level reducing principle volatility. C. better liquidity allows corporate investors to control their investments individually. D. All of the above. E. None of the above. 33. Floating rate CDs differ from regular CDs in that: A. they have longer maturity. B. they differ substantially in default risk. C. they are not taxed. D. they have coupons that are frequently reset. E. All of the above describe differences. 34. A sensible cash management policy would be to: A. have enough cash on hand to meet ordinary course of business and some excess cash to invest in marketable securities as a precautionary measure. B. have nearly enough cash on hand to meet ordinary course of business. C. have enough cash on hand to meet any potential demand for cash. D. have a zero cash balance and charge all expenditures. E. None of the above. The Timberline firm expects a total cash need of $12,500 over the next 3 months. They have a beginning cash balance of $1,500, and cash is replenished when it hits zero. The fixed cost of selling securities to replenish cash balances is $3.50. The interest rate on marketable securities is 8% per annum. There is a constant rate of cash disbursement and no cash receipts during the month. 35. Based on the firm's current practice, what is the average daily cash balance (a month has 30 days)? A. $50.00 B. $69.44 C. $94.44 D. $138.89 E. None of the above. Average daily cash balance = [(($12,500/3) + $1,500)/2]/30 = $94.44 36. Based on the firm's current practice, how many times during the next 3 months will the cash balance be replenished? A. 3.33 times B. 4.42 times C. 8.33 times D. 13.35 times E. None of the above. Replenish Times = Cash Needs/Cash Balance = $12,500/$1,500 = 8.33 times 37. What is the total opportunity cost for a month based on the firm's current practice? A. $5.00 B. $18.98 C. $27.92 D. $60.00 E. None of the above. Opportunity cost = (C/2)(K) = ($1,500/2)(.006667) = $5.00 38. What is the total fixed order cost for the next three months based on the firm's current practice? A. $29.17 B. $37.80 C. $55.60 D. $75.60 E. None of the above. Total Fixed Order Cost = ($12,500/$1,500)(3.5) = $29.17 On an average day, a company writes checks totaling $1,500. These checks take 7 days to clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The cost of debt is 9%. 39. What is the firm's disbursement float? A. $-10,500 B. $-8,700 C. $1,800 D. $10,500 E. None of the above. DF = number of days times amount per day = 7 ($1,500) = $10,500 40. What is the firm's collection float? A. $-7,200 B. $-1,800 C. $1,800 D. $10,500 E. None of the above. CF = Days x Amount/Day = 4 ($-1,800) = $-7,200 41. What is the firm's net float? A. $-3,300 B. $-300 C. $300 D. $3,300 E. None of the above. DF + CF = $10,500 - $7,200 = $3,300 42. If the average daily float is $3,300, what is the net present value per day? A. $-0.81 B. $-79.41 C. $-282.48 D. $-297.00 E. None of the above. NPV = $3,300/(1 + .09/365) - $3,300 = $3,299.19 - $3,300 = $-0.81 43. Your firm has average daily receipts of $2,500. These receipts are available after 6 days on average. The interest rate that could be earned is .02% (.0002) per day. What is the approximate cost of the float per day? A. $2.50 B. $3.00 C. $30.00 D. $50.00 E. None of the above. Present value of delayed float = $2,500/(1 + .0002(6)) = $2,497 Cost = $2,500 - $2,497 = $3 44. Your firm receives 40 checks per month. Of these, 10 are for $1,200 and 30 are for $500. The delay for the $1,200 checks is 4 days; the $500 checks are delayed 6 days. What is the weighted average delay? A. 4 days B. 4.5 days C. 5 days D. 5.5 days E. 6 days (.25)(4 days) + (.75)(6 days) = 5.5 days 45. Your firm receives 10 checks per month. Of these, 6 are for $1,000 and 4 are for $500. The delay for the $1,000 checks is 5 days, and the $500 checks are delayed 8 days. Calculate the average daily float. A. $1,533.33 B. $1,486.87 C. $1,500.00 D. $1,530.35 E. $1,590.04 Total Float = $1,000 (6) (5) + $500 (4) (8) = $46,000 Average Daily Float = $46,000/30 = $1,533.33 On an average day, Tennis R Us writes checks totaling $2,000. These checks take 3 days to clear. The company receives checks totaling $1,800. These checks take 2 days to clear. The cost of debt is 8%. 46. What is the firm's disbursement float? A. $-6,000 B. $-4,500 C. $4,500 D. $6,000 E. None of the above. DF = number of days times amount per day = 3 ($2,000) = $6,000 47. What is the firm's collection float? A. $-4,500 B. $-3,600 C. $3,600 D. $4,500 E. None of the above. CF = Days x Amount/Day = 2 ($-1,800) = $-3,600 48. What is the firm's net float? A. $-2,500 B. $-2,400 C. $2,400 D. $2,500 E. None of the above. DF + CF = $6,000 - $3,600 = $2,400 49. If the average daily float is $2,500, what is the net present value per day? A. $-0.55 B. $-5.55 C. $-252.66 D. $-197.00 E. None of the above. NPV = $2,500/(1 + .08/365) - $2,500 = $2,499.45 - $2,500 = $-.55 Chapter 28 Credit and Inventory Management Answer Key 1. Selling goods and services on credit is: A. an investment in a customer. B. never necessary unless customers cannot pay for the goods. C. a decision independent of customers. D. permissible if your bank lends the money. E. None of the above. 2. When credit is granted to another firm this gives rise to a(n): A. accounts receivable and is called a consumer credit. B. credit due and is called an installment note. C. accounts receivable and is called trade credit. D. trade receivable and is called an installment note. E. None of the above. 3. Cash discounts: A. conveniently separate the pricing of credit and cash customers. B. lower profit margins on sales. C. speed the collection of receivables. D. All of the above. E. Both A and B. 4. Which of the following is not one of the "five C's of Credit" for credit scoring? A. Capability B. Capacity C. Capital D. Character E. Conditions 5. The average collection period measures: A. the average time necessary to collect a credit sale. B. how long the companies money is invested in their customers. C. the days sales outstanding. D. All of the above. E. None of the above. 6. Factoring refers to: A. determining the aging schedule of the firm's accounts receivable. B. the sale of a firm's accounts receivable to a financial institution. C. the determination of the average collection period. D. scoring a customer based on the 5 C's of credit. E. All of the above. 7. Captive finance companies are: A. parent companies to the subsidiary. B. subsidiaries to the parent company. C. used by firms with good credit ratings. D. Both A and B. E. Both B and C. 8. When a firm sells its accounts receivables to a financial institution, it is called: A. captive financing. B. collateralization. C. securitization. D. legalization. E. None of the above. 9. The three components of credit policy are: A. collection policy, credit analysis, and interest rate determination. B. collection policy, credit analysis, and terms of the sale. C. collection policy, interest rate determination, and repayment analysis. D. credit analysis, repayment analysis, and terms of the sale. E. interest rate determination, repayment analysis and terms of sale. 10. On September 1, a firm grants credit with terms of 2/10 net 45. The creditor: A. must pay a penalty of 2% when payment is made later than September 1st. B. must pay a penalty of 10% when payment is made later than 2 days after September 1st. C. receives a discount of 2% when payment is made at least 10 days before September 1st. D. receives a discount of 2% when payment is made before September 1st and pays a penalty of 10% if payment is made after September 1st. E. receives a discount of 2% when payment is made within 10 days after the effective invoice date of September 1st. 11. The credit period offered is influenced by: A. the size of the account to receive credit. B. the collateral value of the goods sold. C. the probability that the customer will not pay. D. All of the above. E. None of the above. 12. Seasonal dating of accounts receivable: A. is used by all firms that grant credit. B. brings the receivable immediately due during the season of the product. C. makes the effective date of the invoice on a specific date in or around the relevant season of the product. D. All of the above. E. None of the above. 13. Which of the following is not true concerning considerations in setting a credit policy? A. A firm that supplies a perishable product will tend to offer restrictive credit terms. B. A firm whose customers are in a high-risk business will tend to offer restrictive credit terms. C. Lengthening the credit period effectively reduces the price paid by the customer. D. Small accounts, associated with firms that find it difficult to acquire a line of credit, tend to receive longer credit periods. E. None of the above. 14. Lengthening the credit period _____ the price paid by the customer. Generally, this acts to _____ sales. A. increases; increase B. increases; decrease C. decreases; decrease D. decreases; increase E. increases; have no effect on 15. When analyzing the NPV of a decision to change cash discounts, the firm would probably not consider: A. the size of the discount. B. the expected change in the order size. C. the firm's cost of debt. D. the expected change in sales due to the cash discount policy change. E. All of the above would probably be considered. 16. When analyzing the decision to change the cash discount policy, the firm should: A. choose the policy with the highest order size. B. choose the policy with the lowest variable cost. C. choose the policy with the lowest NPV. D. choose the policy with the highest NPV. E. choose the policy offering the lowest cash discount. 17. When credit is offered with only the invoice as a formal instrument of credit, the credit procedure is called: A. invoice account. B. open account. C. unsecured account. D. unsecured note. E. None of the above. 18. Which of the following statements is true? A. Most credit arrangements use promissory notes. B. Promissory notes are used when firms do not anticipate a problem with collections. C. Promissory notes usually involve no cash discount. D. All of the above. E. None of the above. 19. A commercial draft is useful to a seller because: A. a specific payment amount and time are set. B. the customer's bank has the buyer sign the draft before releasing the invoices. C. the seller gets a credit commitment from a customer before the goods are delivered. D. All of the above. E. None of the above. 20. Which of the following statements is not true? A. Commercial drafts represent a way to obtain a credit commitment from a customer before the goods are delivered. B. When a banker's acceptance is discounted in the secondary market it becomes a commercial note. C. Sight drafts require immediate payment. D. Banker's acceptances arise when a bank guarantees payment on a commercial draft. E. Both A and C. 21. A conditional sales contract is useful to the seller because: A. the firm retains legal ownership of the goods until they are completely paid for. B. the firm is compensated for their opportunity cost. C. there is a sequence of scheduled payments. D. All of the above. E. None of the above. 22. If a firm refuses to offer credit, the net present value of the transaction is: A. the cash revenues received minus the cost paid in time period 0. B. the discounted value of the revenues from time period 0. C. the net cash flow from the future payments to be received. D. determined by all of the above. E. always equal to zero. 23. Risk should be incorporated into the decision to grant credit by: A. decreasing the discount rate. B. increasing the credit period to allow for customers in financial distress to reorganize. C. decreasing the cash inflows, or the numerator of the NPV formula. D. increasing the cash inflows, or the numerator of the NPV formula. E. increasing costs per unit. 24. The decision to grant credit does not depend on: A. delayed revenues from granting credit. B. the immediate costs of granting credit. C. the probability of payment. D. the appropriate required rate of return for delayed cash flows. E. All of the above are considered in the decision to grant credit. 25. The credit decision usually includes riskier customers. The credit decision should adjust for this by: A. determining the probability that customers will pay and reducing the expected cash flow. B. discounting the net cash flows at a lower discount rate. C. discounting the cash inflow at a higher discount rate. D. delaying collections on these customers. E. speeding up deliveries to riskier customers. 26. The optimal credit amount is determined by: A. the point which minimizes the total credit cost curve. B. the point which maximizes the carrying costs associated with granting credit. C. the point which maximizes opportunity costs associated with granting credit. D. the point where the additional net cash flow from new customers equals the additional carrying costs of the investment in receivables. E. Both A and D. 27. Businesses, in deciding to extend credit to new customers, try to reduce defaults by: A. determining the probability of non-payment. B. gathering independent credit checks. C. determining if it is profitable to extend credit. D. All of the above. E. None of the above. 28. Determining the optimal credit policy is based on a trade-off of: A. carrying costs of granting credit and making an investment in receivables. B. stock out costs of losing sales from not offering credit. C. the opportunity cost of lost sales from not offering credit. D. Both A and C. E. Both B and C. 29. Which of the following statements is true? A. Customers in high tax brackets would be more likely to take cash discounts and corporations in high tax brackets would be more likely to offer credit. B. Customers in high tax brackets would be more likely to take cash discounts and corporations in low tax brackets would be more likely to offer credit. C. Customers in low tax brackets would be more likely to take cash discounts and corporations in high tax brackets would be more likely to offer credit. D. Customers in low tax brackets would be more likely to take cash discounts and corporations in low tax brackets would be more likely to offer credit. E. Taxes have an effect on the propensity to grant credit, but no effect on the propensity to use credit. 30. Companies will frequently use information from which of the following sources when conducting their credit analysis? A. Financial statements supplied by the customer. B. Payment history supplied by other firms. C. Payment history supplied by banks. D. All of the above. E. None of the above. 31. Which of the following statements is not true? A. An aging schedule shows only overdue accounts. B. An aging schedule shows the probability that a 67-day account will be unpaid when it is a 68-day account. C. Average collection period data is somewhat flawed if sales are seasonal. D. Collection efforts may involve legal action. E. Investments in accounts receivable equal average daily sales times average collection period. 32. Aging schedules are flawed because they: A. do not identify specific customers. B. show the percent of accounts that are past due. C. only give the yearly or periodic average of account age. D. All of the above. E. None of the above. 33. To collect on the accounts receivable due to the firm, a firm can: A. send a delinquency letter of past due status to the customer. B. make personal contact by telephone. C. employ a collection agency. D. take legal action against the customer as necessary. E. All of the above. 34. In credit analysis of a customer, commonly used information includes the customer's: A. financial statements. B. credit report. C. payment history with the firm. D. All of the above. E. Both B and C. 35. The carrying value of a firm's account receivable is $700,000 and the average collection period is 45 days. The firm's credit sales per day are: A. $15,555.56 B. $23,333.33 C. $700,000.00 D. $4,666,666.67 E. None of the above. Credit sales = Accounts Receivable/Average Collection Period $700,000/45 = $15,555.56 36. The Ault Company made a credit sale of $15,000. The invoice was sent today with the terms, 3/15 net 60. This customer normally pays at the net date. If your opportunity cost of funds is 9% the expected payment is worth how much today? A. $13,761 B. $14,789 C. $15,000 D. $15,214 E. None of the above. $15,000/(1.09)60/365 = $14,789 37. Edgeworth Heating is selling a commercial heating unit at the price of $100,000 per unit. The variable cost of producing this unit is $75,000. Edgeworth is considering offering credit terms to their customers, which would allow payment to be delayed one month. Edgeworth predicts that offering these terms will increase monthly sales from 50 units to 60 units. Edgeworth does not expect the increased production to change its variable cost and Edgeworth does not expect to charge a higher price. The default rate on credit customers is predicted to be 2.25%. Which of the following statements is true? A. At a monthly interest rate of 1%, Edgeworth is indifferent between extending credit and continuing current policies. At higher interest rates Edgeworth would prefer granting credit. B. At a monthly interest rate of 1%, Edgeworth is indifferent between extending credit and continuing current policies. At lower interest rates Edgeworth would prefer granting credit. C. At a monthly interest rate of 2%, Edgeworth is indifferent between extending credit and continuing current policies. At higher interest rates Edgeworth would prefer granting credit. D. At a monthly interest rate of 2%, Edgeworth is indifferent between extending credit and continuing current policies. At lower interest rates Edgeworth would prefer granting credit. E. At a monthly interest rate of 3%, Edgeworth is indifferent between extending credit and continuing current policies. At lower or higher interest rates Edgeworth would prefer granting credit. NPV0 = PQ - CQ = 50($100,000 - $75,000) = $1,250,000 $1,250,000 = NPV1 = (hPQ/(1 + rB )) - CQ = (0.9775(60)($100,000))/1 + rB - 60($75,000) $5,865,000/1 + rB = $5,750,000 1 + rB = 1.02 rB = 2% 38. Collegiate Tuxedo rents apparel throughout the year. They have experienced non-payment by about 15% of their customers with an average loss of $200. Collegiate wants to stem their losses by using an instant electronic credit check on the customer. These checks will cost them $7 on each of the 1,000 customers. The opportunity cost is 1.5% for the credit period. Should they pursue the credit check? A. No, because the $7000 cost is too high. B. No, because a $200 loss is minor. C. Yes, because the net gain is $30,000. D. Yes, because the net gain is $23,000. E. Yes, because the net gain is $193,000. NPV of the defaulting customers = 0 - [(200)(.15)(1000)] = $-30,000 Net Gain = gain from not granting - cost of credit check = $30,000 - $7(1000) = $23,000 39. Delta Distributors has an investment in accounts receivable of $2,750,000. Daily credit sales are $118,280. If 30% of Delta's credit customers receive a discount by paying within 10 days, what is the net period that Delta maintains? A. 10 days B. 23 days C. 38 days D. 45 days E. There is not enough information to tell. Rationale: E, Actual terms not given. 40. Delta Distributors has an investment in accounts receivable of $2,750,000. Daily credit sales are $118,280. If 30% of Delta's credit customers receive a discount by paying within 10 days and the remainder of Delta's customers pay in 40 days, what is the net period that Delta maintains? A. 19 days B. 31 days C. 37 days D. 40 days E. None of the above. .3(10) + .7(40) = 31 days 41. Delta Distributors has total credit sales of $2,750,000 for the year. Delta's credit sales represent 75% of total sales. What are total sales? A. $1,925,000 B. $2,062,500 C. $2,750,000 D. $3,666,667 E. None of the above. $2,750,000/.75 = $3,666,667 42. The net credit period for a company with terms of 3/10, net 60 is: A. 10 days B. 50 days C. 57 days D. 60 days E. None of the above. 60 -10 = 50 days 43. If 25% of the customers pay on day 10 and 75% pay on day 30, the average collection period is: A. 15 days. B. 20 days. C. 25 days. D. 30 days. E. 40 days. (.25)(10) + (.75)(30) = 25 days 44. The carrying value of a firm's account receivable is $1,000,000 and the average collection period is 55 days. The firm's credit sales per day are: A. $33,333.33 B. $18,181.82 C. $1,000,000.00 D. $1,333,333.33 E. None of the above. Credit sales = Accounts Receivable/Average Collection Period $1,000,000/55 = $18,181.82 45. The Lemon Company made a credit sale of $20,000. The invoice was sent today with the terms, 3/10 net 30. This customer normally pays at the net date. If your opportunity cost of funds is 10% the expected payment is worth how much today? A. $15,000 B. $15,657 C. $19,843 D. $20,000 E. None of the above. $20,000/(1.10)30/365 = $19,843 46. Collegiate Tuxedo rents apparel throughout the year. They have experienced non-payment by about 20% of their customers with an average loss of $300. Collegiate wants to stem their losses by using an instant electronic credit check on the customer. These checks will cost them $12 on each of the 1,000 customers. The opportunity cost is 2.0% for the credit period. Should they pursue the credit check? A. No, because the $24,000 cost is too high. B. No, because a $300 loss is minor. C. Yes, because the net gain is $30,000. D. Yes, because the net gain is $48,000. E. Yes, because the net gain is $60,000. NPV of the defaulting customers = 0 - [(300)(.20)(1000)] = $-60,000 Net Gain = gain from not granting - cost of credit check = $60,000 - $12(1000) = $48,000 47. Quattro Incorporated has an investment in accounts receivable of $3,500,000. Daily credit sales are $120,000. If 20% of Quattro's credit customers receive a discount by paying within 10 days, what is the net period that Quattro maintains? A. 10 days B. 23 days C. 38 days D. 45 days E. There is not enough information to tell. Rationale: E, Actual terms not given. 48. If 20% of the customers pay on day 10 and 80% pay on day 30, the average collection period is: A. 10 days. B. 15 days. C. 22.5 days. D. 24 days. E. 26 days. (.20)(10) + (.80)(30) = 26 days [Show More]

Last updated: 1 year ago

Preview 1 out of 32 pages

Reviews( 0 )

Recommended For You

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 9 Urinary System[ ALL ANSWERS VERIFIED 100%] (All)

Topic 9 Urinary System[ ALL ANSWERS VERIFIED 100%]

BIO202_MH_V3 Topic 9: Urinary System Started on Friday, October 22, 2021, 6:52 PM State Finished Completed on Friday, October 22, 2021, 7:15 PM Time taken 23 mins 23 secs Grade 40.00 out of...

By QuizMaster82 , Uploaded: Dec 04, 2022

$9

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 8 Nutrition, Metabolism and Temperature Regulation[ ALL ANSWERS VERIFIED 100%] (All)

Topic 8 Nutrition, Metabolism and Temperature Regulation[ ALL ANSWERS VERIFIED 100%]

BIO202_MH_V3 Topic 8: Nutrition, Metabolism and Temperature Regulation Started on Friday, October 22, 2021, 6:26 PM State Finished Completed on Friday, October 22, 2021, 6:48 PM Time taken 22...

By QuizMaster82 , Uploaded: Dec 04, 2022

$9

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 7 Digestive System[ALL ANSWERS VERIFIED 100%] (All)

Topic 7 Digestive System[ALL ANSWERS VERIFIED 100%]

Page path BIO202_MH_V3 Topic 7: Digestive System Started on Friday, October 22, 2021, 4:55 PM State Finished Completed on Friday, October 22, 2021, 5:24 PM Time taken 29 mins 1 sec Grade 40...

By QuizMaster82 , Uploaded: Dec 04, 2022

$9

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 6 Respiratory System[ALL ANSWERS VERIFIED 100%] (All)

Topic 6 Respiratory System[ALL ANSWERS VERIFIED 100%]

BIO202_MH_V3 Topic 5: Immunity Started on Friday, October 22, 2021, 4:02 PM State Finished Completed on Friday, October 22, 2021, 4:21 PM Time taken 19 mins 8 secs Grade 40.00 out of 40.00 (...

By QuizMaster82 , Uploaded: Dec 04, 2022

$8

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 5 Immunity[ ALL ANSWERS VERIFIED 100%] (All)

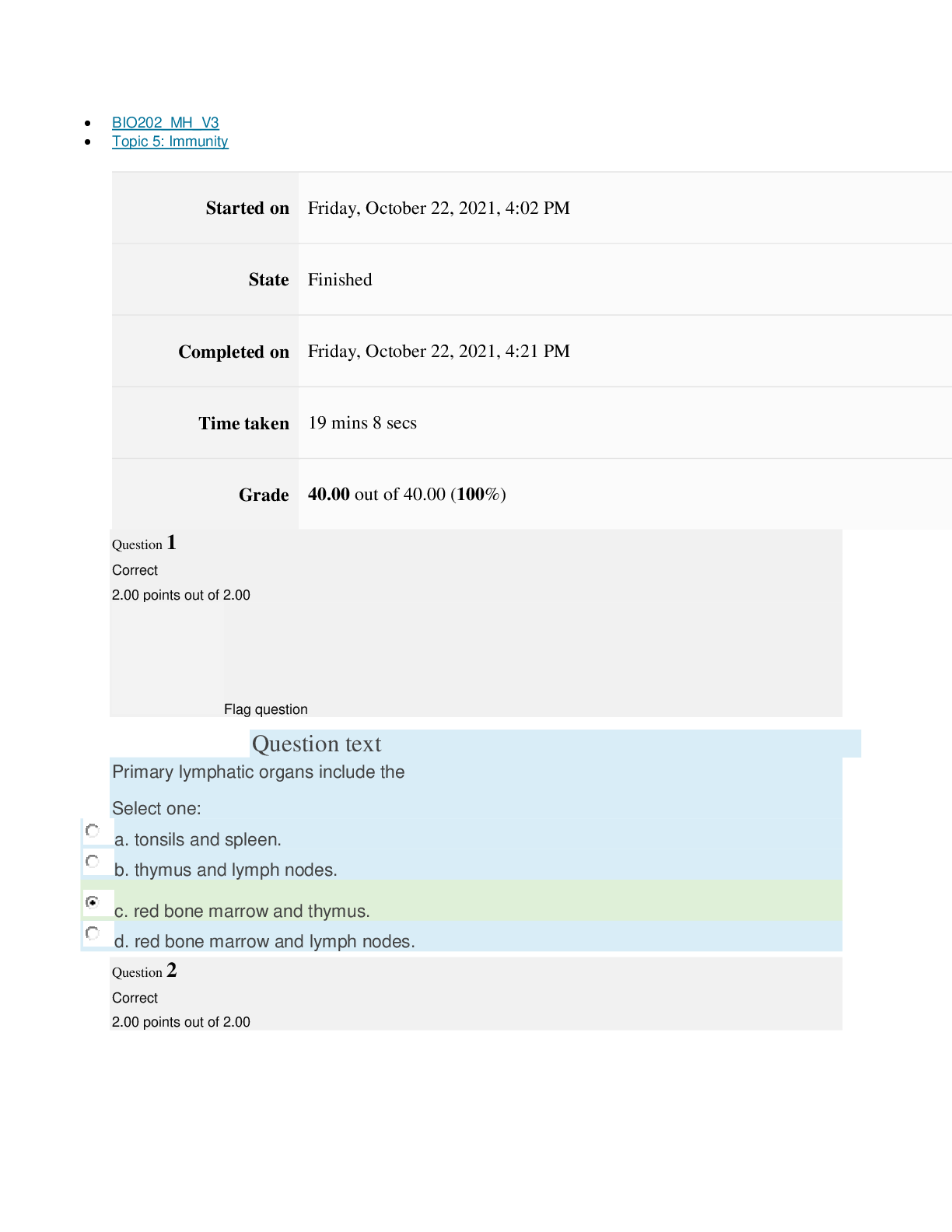

Topic 5 Immunity[ ALL ANSWERS VERIFIED 100%]

BIO202_MH_V3 Topic 5: Immunity Started on Friday, October 22, 2021, 4:02 PM State Finished Completed on Friday, October 22, 2021, 4:21 PM Time taken 19 mins 8 secs Grade 40.00 out of 40.00 (...

By QuizMaster82 , Uploaded: Dec 04, 2022

$8

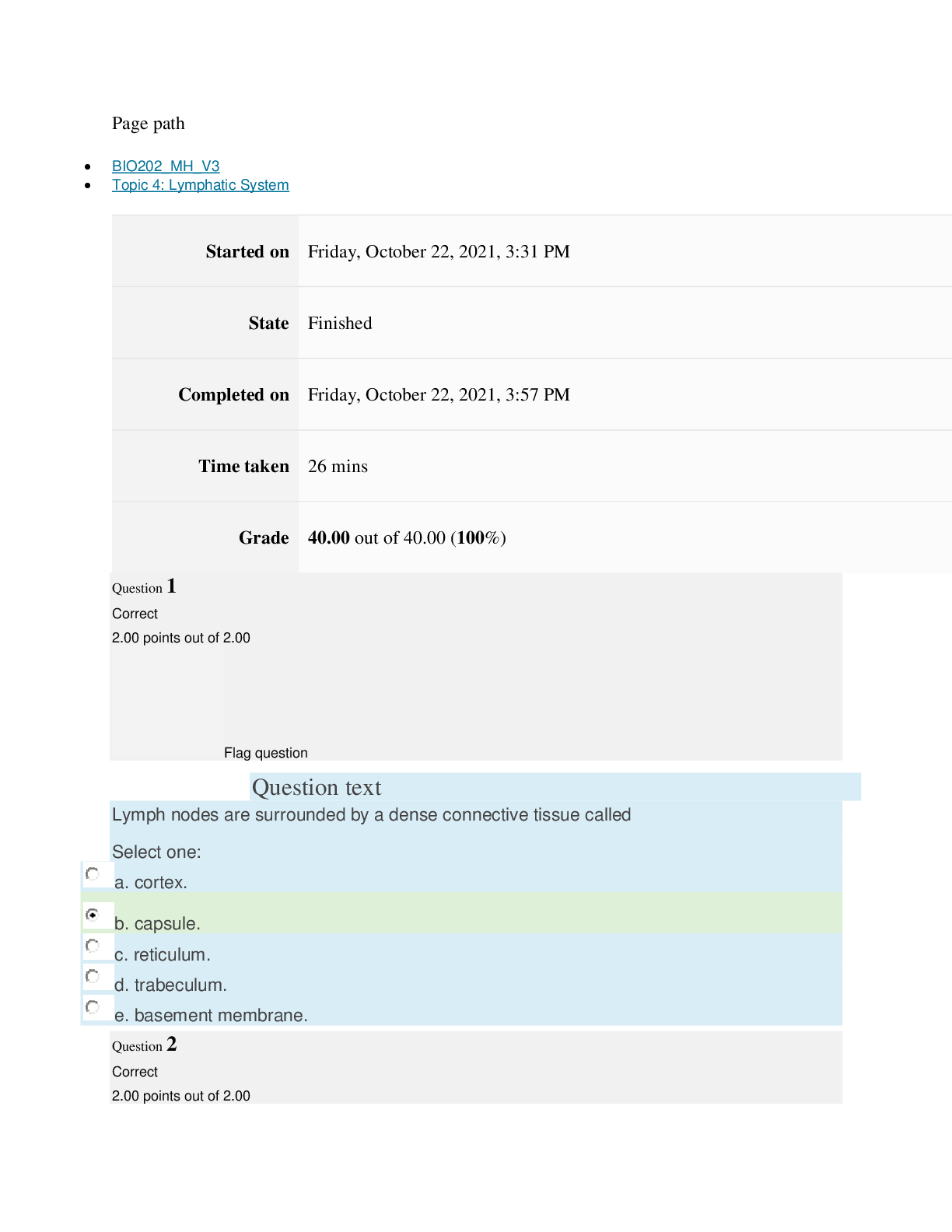

Anatomy and Physiology - A&P 2> QUESTIONS & ANSWERS > Topic 4 Lymphatic System[ALL ANSWERS VERIFIED 100%] (All)

Topic 4 Lymphatic System[ALL ANSWERS VERIFIED 100%]

Page path BIO202_MH_V3 Topic 4: Lymphatic System Started on Friday, October 22, 2021, 3:31 PM State Finished Completed on Friday, October 22, 2021, 3:57 PM Time taken 26 mins Grade 40.00 ou...

By QuizMaster82 , Uploaded: Dec 04, 2022

$8

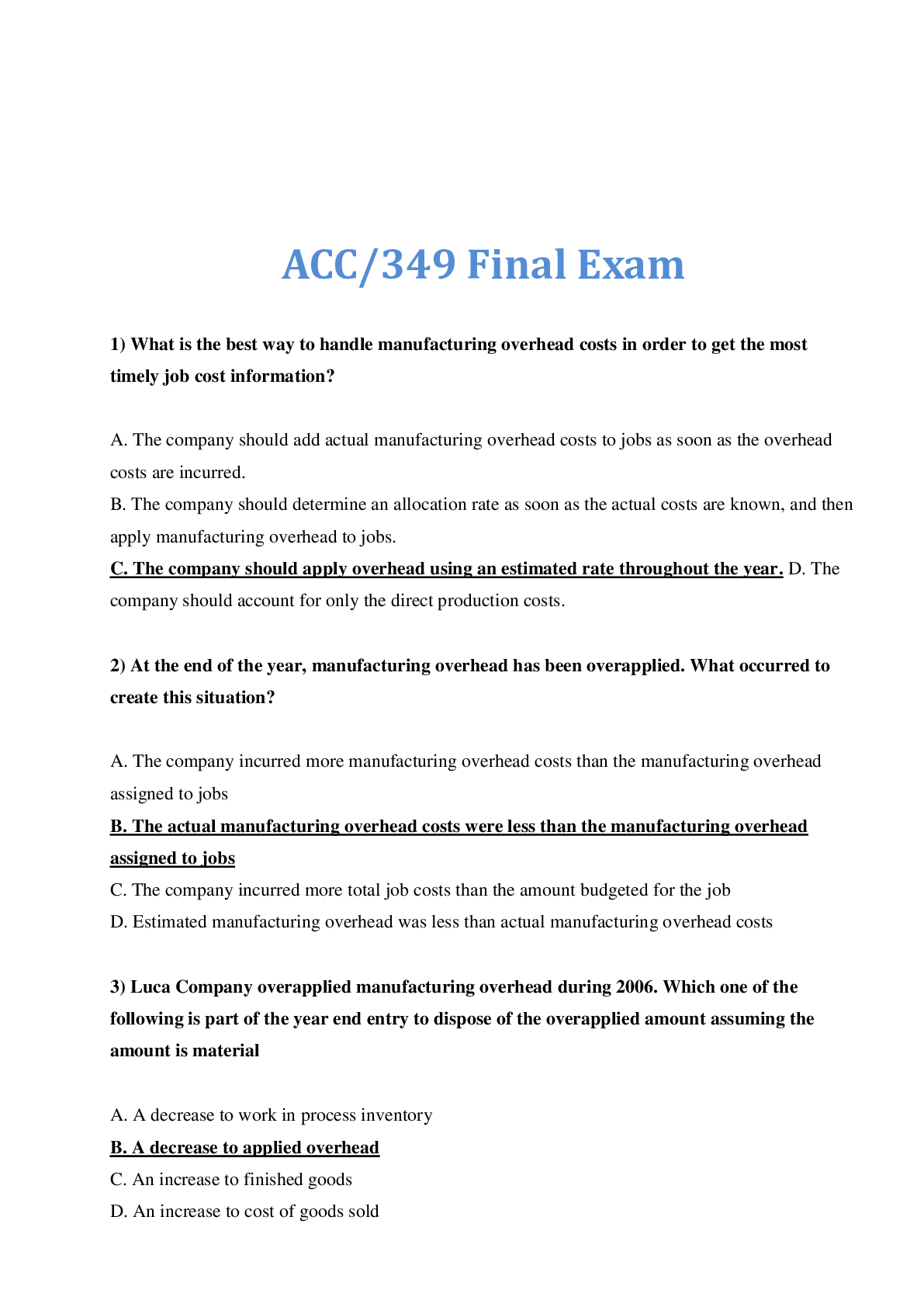

Financial Accounting> QUESTIONS & ANSWERS > ACC/349 Final Exam. All Answers Verified. (All)

ACC/349 Final Exam. All Answers Verified.

1) What is the best way to handle manufacturing overhead costs in order to get the most timely job cost information? A. The company should add actual manufacturing overhead costs to jobs as soon a...

By QuizMaster , Uploaded: Feb 20, 2020

$9.5

Management Information Systems (MIS)> QUESTIONS & ANSWERS > University of Management and Technology - MIL 101 > SEJPME II Latest Pres test Guide (2019/20) All Answers Verified Correct. A+ Graded. (All)

University of Management and Technology - MIL 101 > SEJPME II Latest Pres test Guide (2019/20) All Answers Verified Correct. A+ Graded.

Pre Test MIL 101 SEJPME II. Back to Status page contains 50 Questions (Correct) ________________________________________ 1) The non-operational chain of command runs directly from the President to the...

By Book Worm, Certified , Uploaded: Nov 20, 2021

$11.5

*NURSING> QUESTIONS & ANSWERS > ATI COMPREHENSIVE 2019 C|Latest 2019/2020 complete 100% all answers verified. (All)

ATI COMPREHENSIVE 2019 C|Latest 2019/2020 complete 100% all answers verified.

1. A nurse is caring for a client who has bipolar disorder and is experiencing acute mania. The nurse obtained a verbal prescription for restraints. Which of the following should the actions the nur...

By QuizGuider82 , Uploaded: Nov 13, 2021

$18

*NURSING> QUESTIONS & ANSWERS > ATI COMPREHENSIVE 2019 C|Latest 2019/2020 complete 100% all answers verified. (All)

ATI COMPREHENSIVE 2019 C|Latest 2019/2020 complete 100% all answers verified.

ATI COMPREHENSIVE C 1. A nurse is caring for a client who has bipolar disorder and is experiencing acute mania. The nurse obtained a verbal prescription for restraints. Which of the following should...

By Professor Lynne , Uploaded: Sep 28, 2021

$15

Document information

Connected school, study & course

About the document

Uploaded On

Feb 21, 2020

Number of pages

32

Written in

Additional information

This document has been written for:

Uploaded

Feb 21, 2020

Downloads

0

Views

240