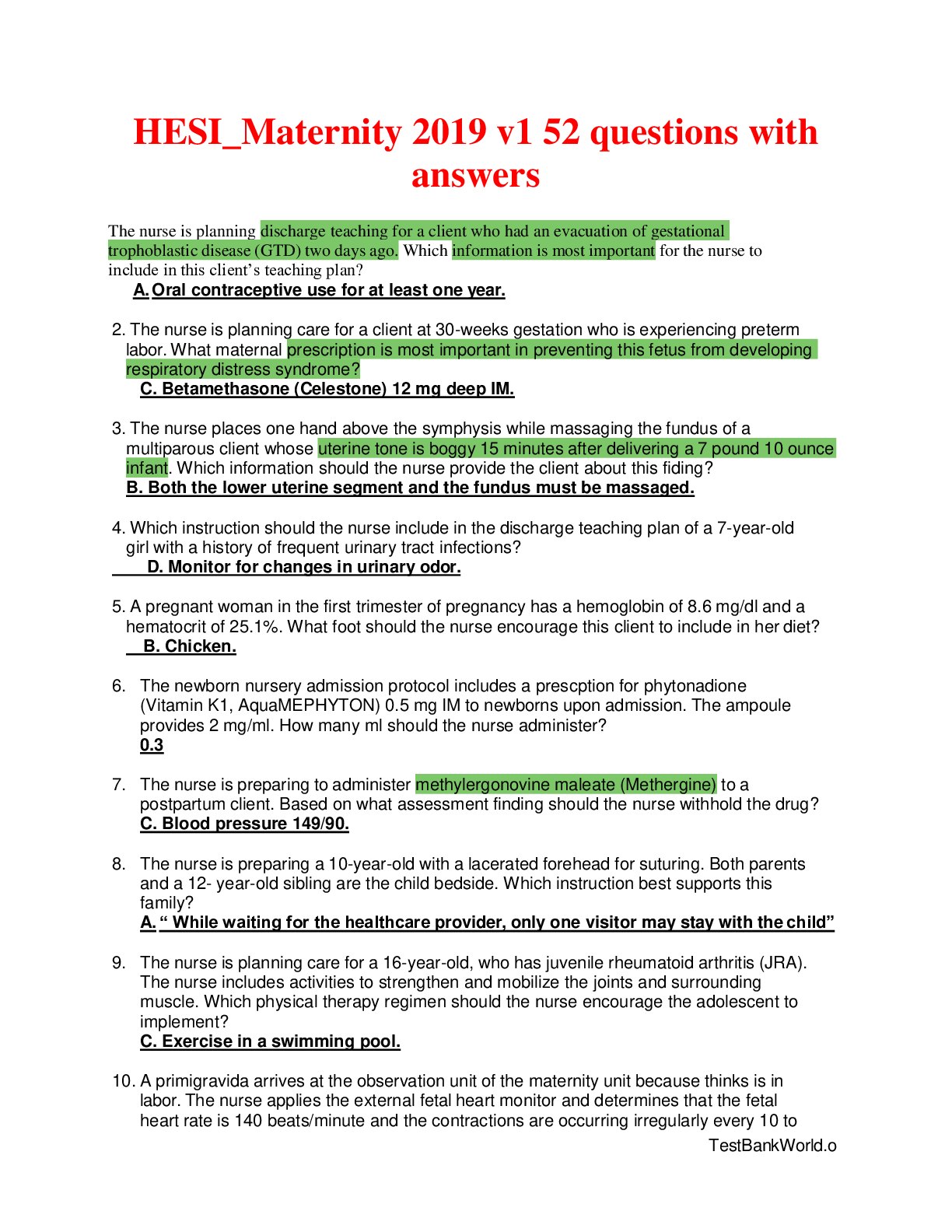

Accounting > QUESTIONS & ANSWERS > ACCT 304 WEEK 8 FINAL EXAM, RATED A, COMPLETE SOLUTIONS (all correct) Verified by expert tutors. (All)

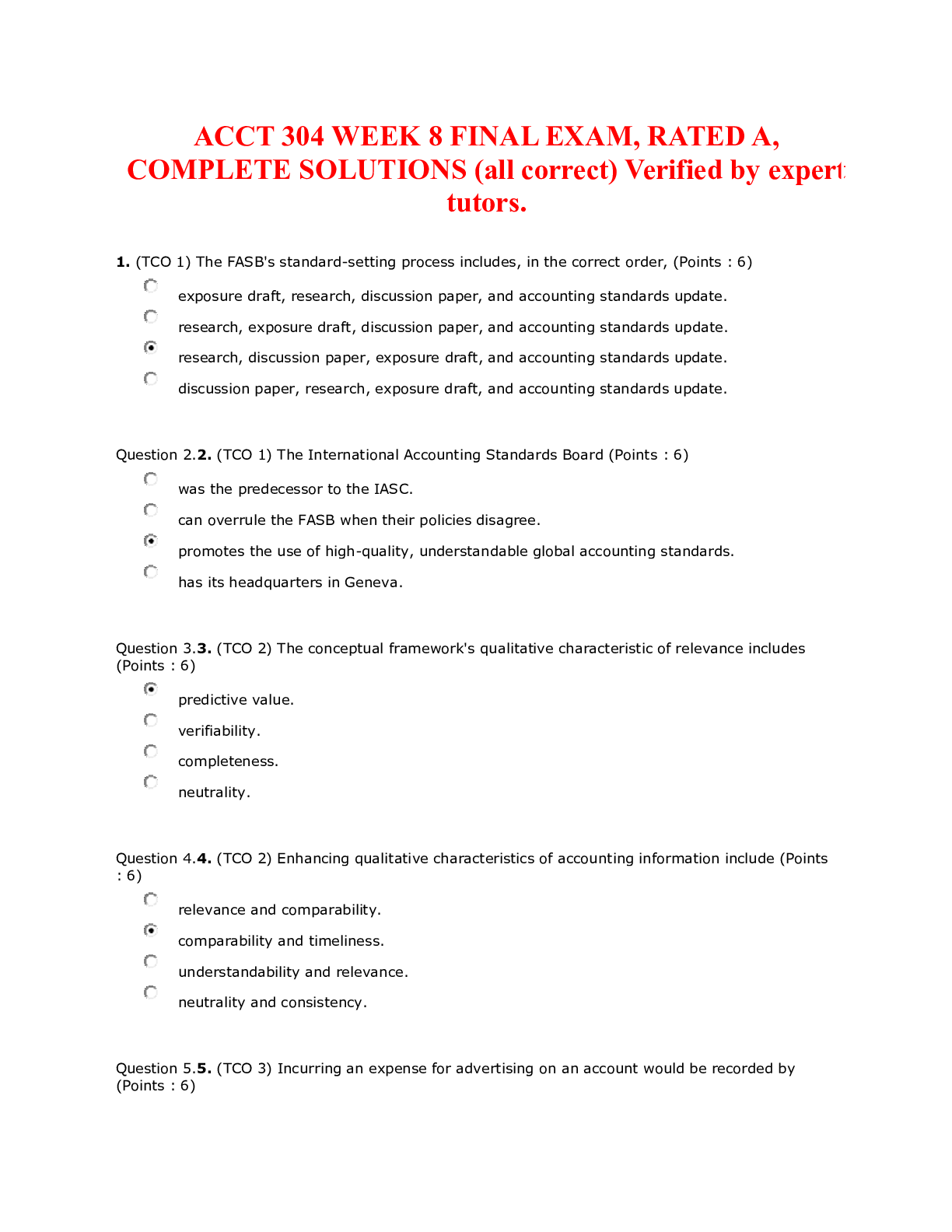

ACCT 304 WEEK 8 FINAL EXAM, RATED A, COMPLETE SOLUTIONS (all correct) Verified by expert tutors.

Document Content and Description Below

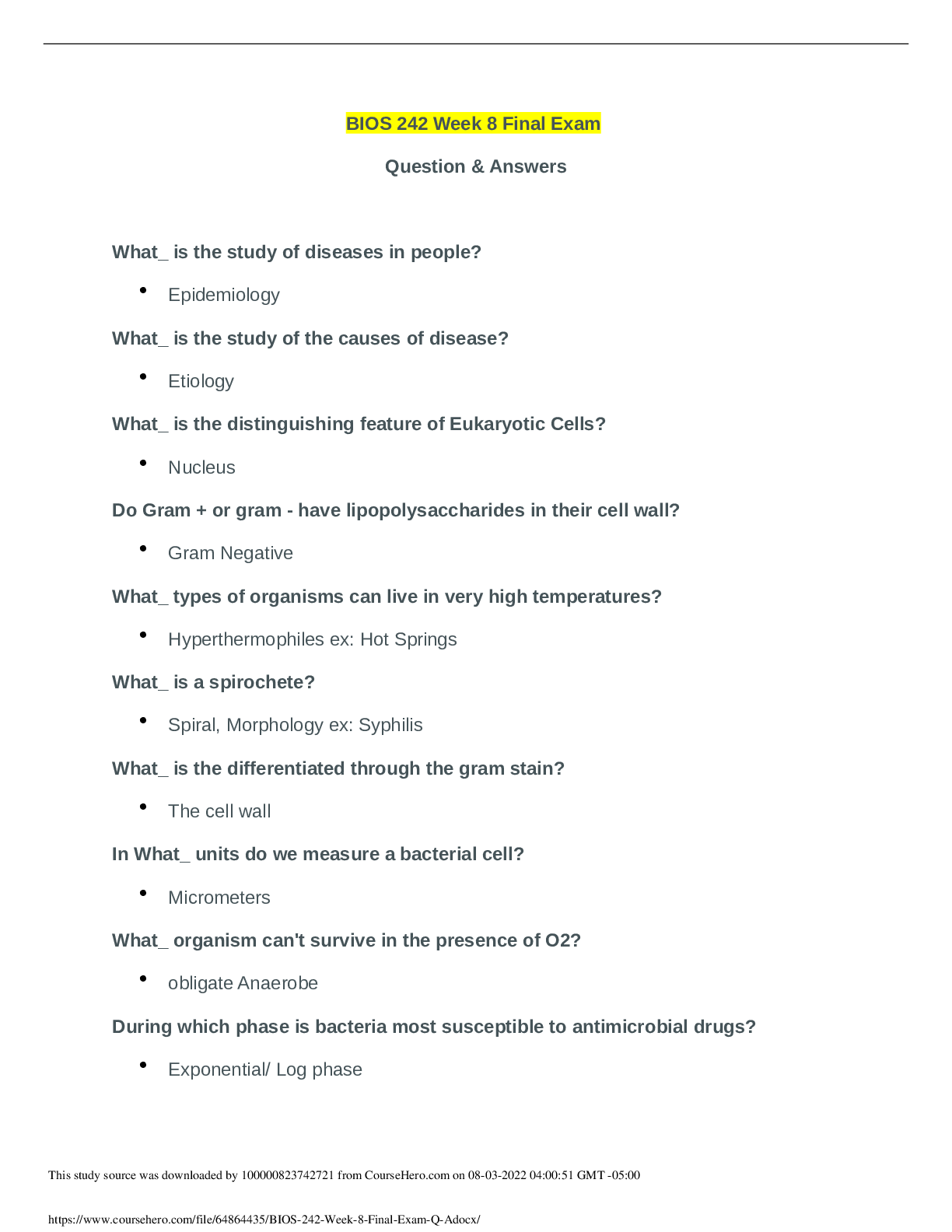

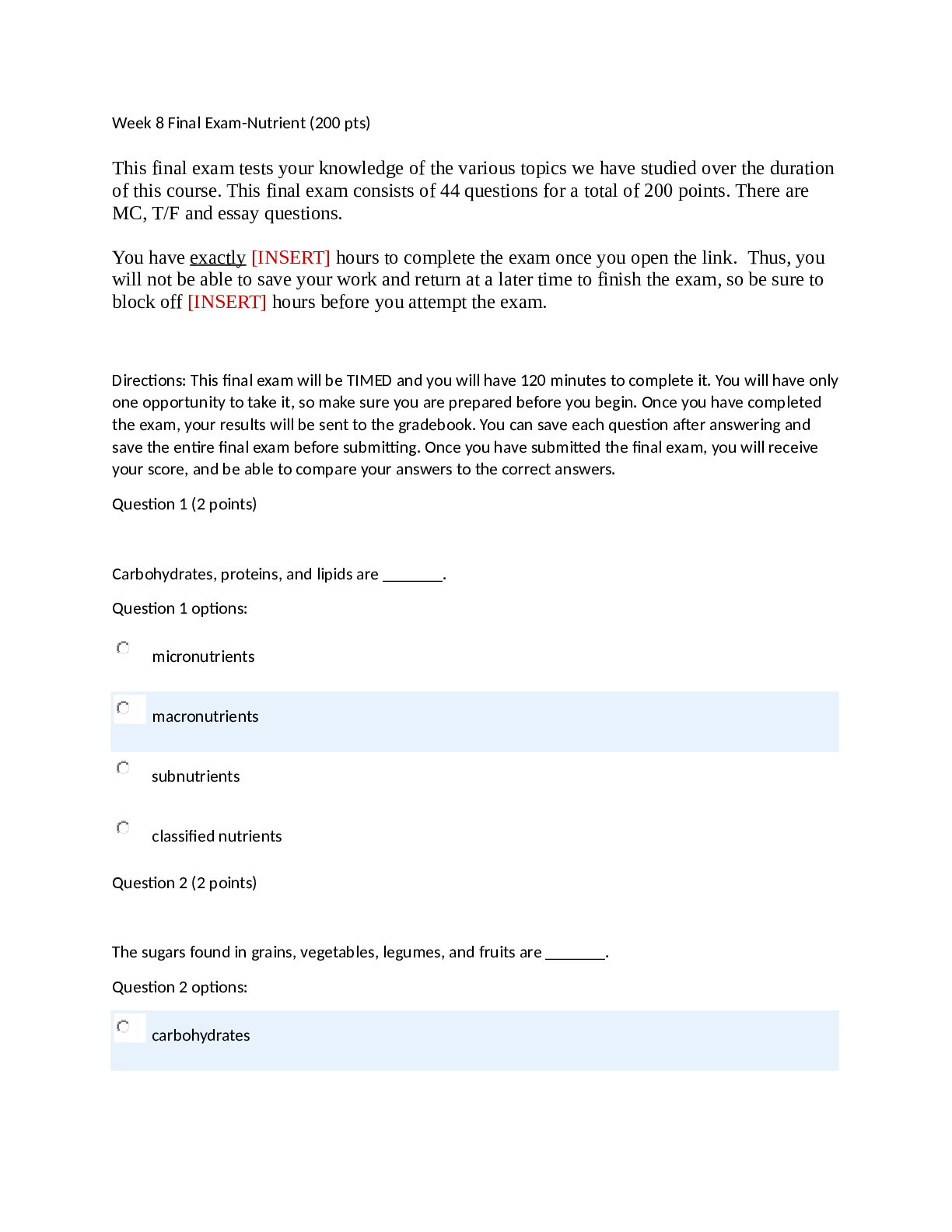

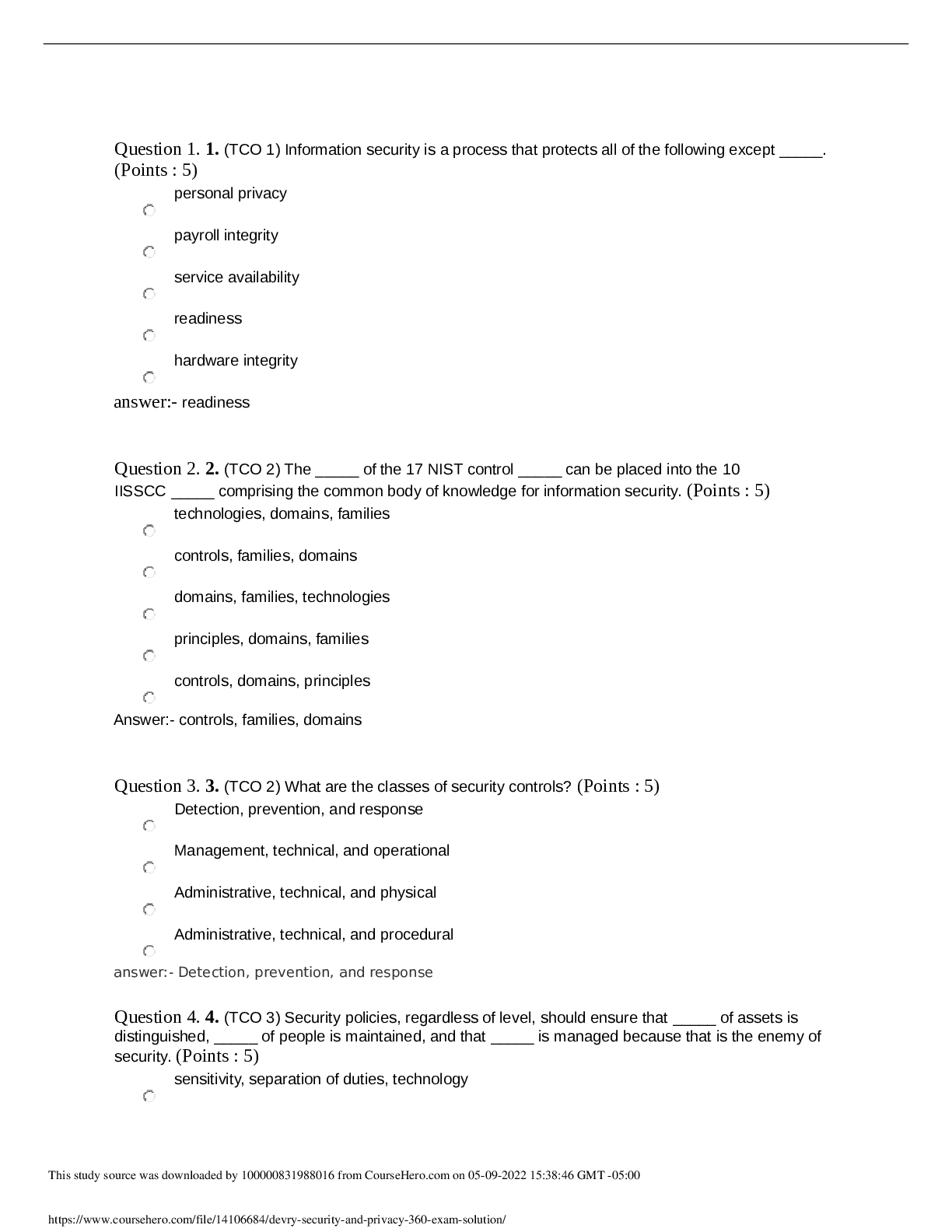

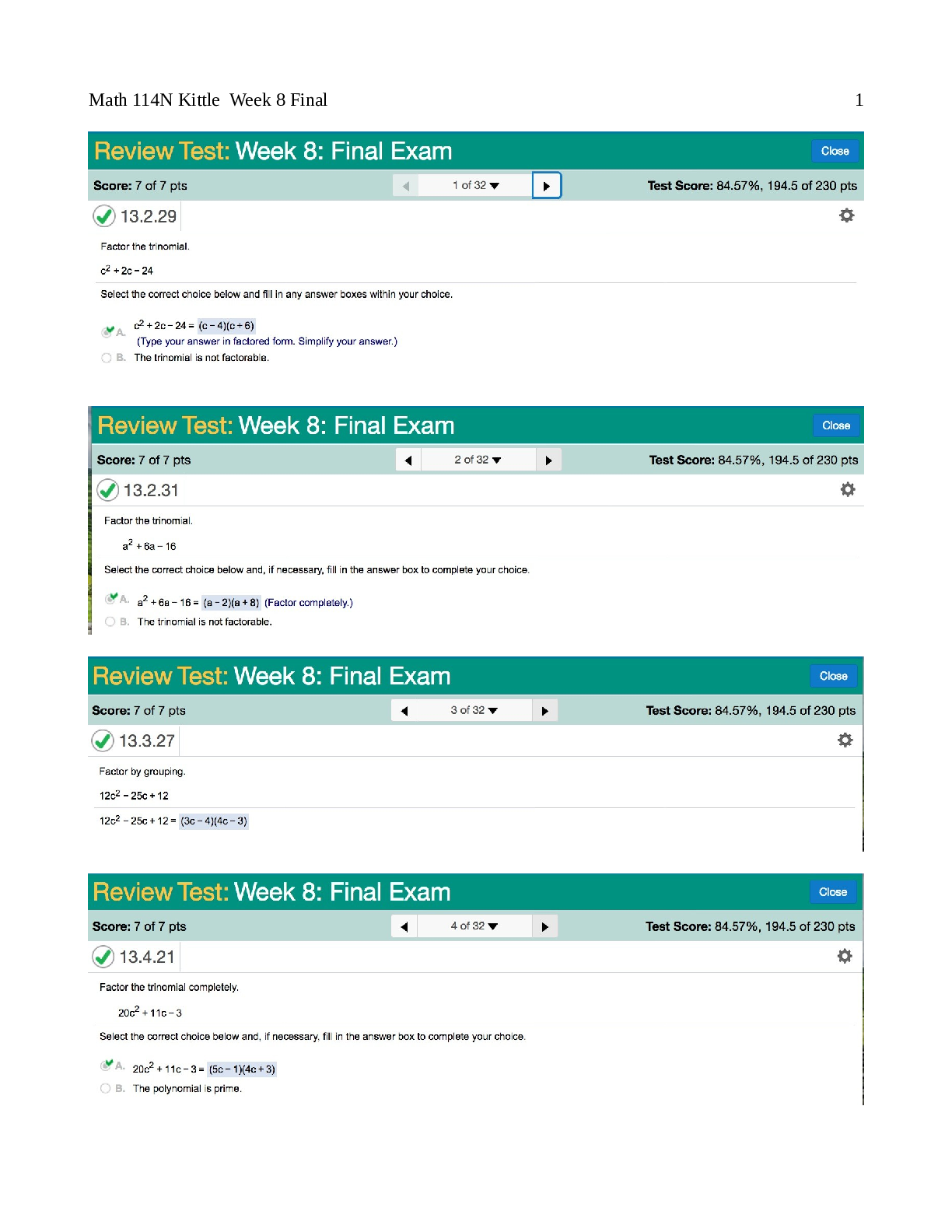

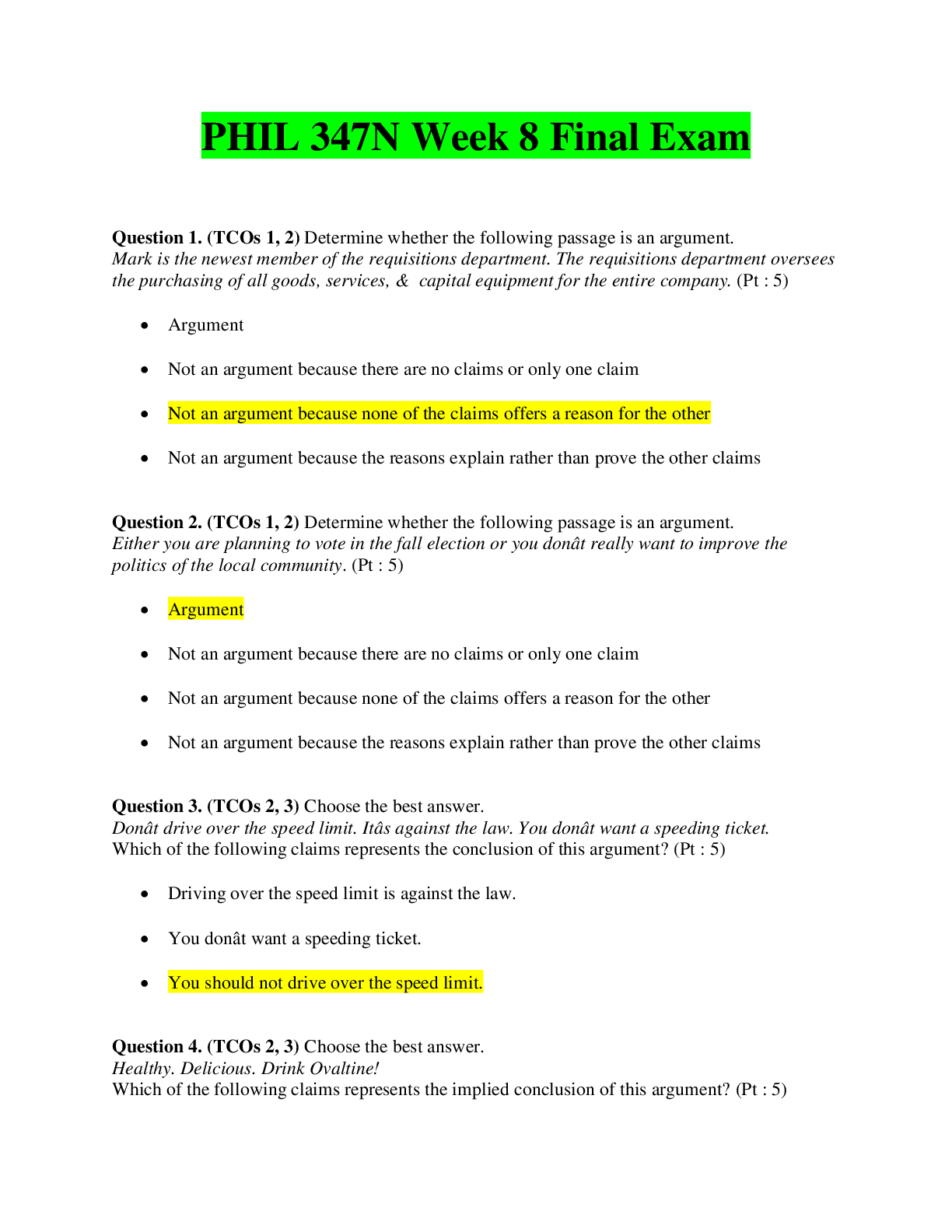

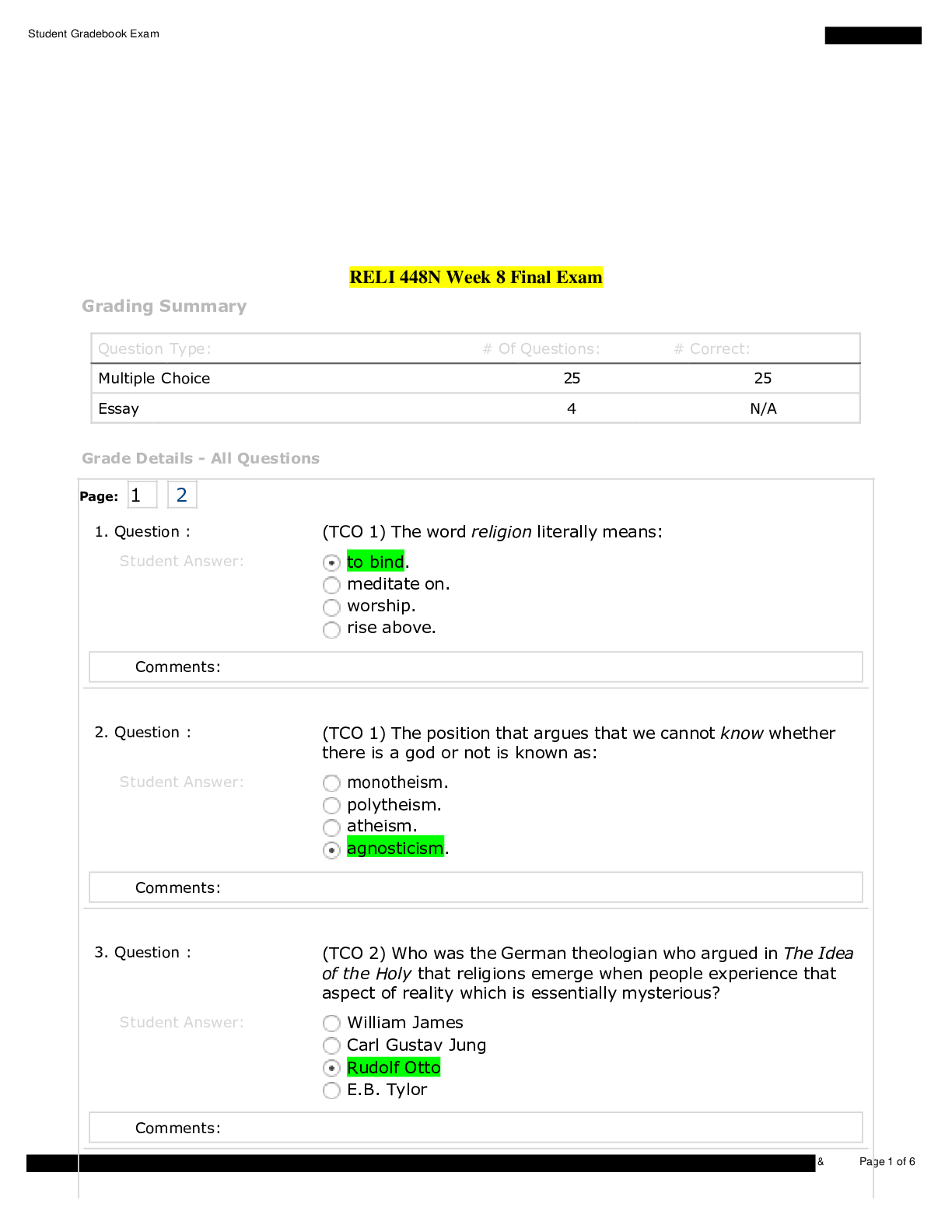

ACCT 304 WK 8 FINAL EXAM. 1. (TCO 1) The FASB's standard-setting process includes, in the correct order, (Points : 6) exposure draft, research, discussion paper, and accounting standards update. resea... rch, exposure draft, discussion paper, and accounting standards update. research, discussion paper, exposure draft, and accounting standards update. discussion paper, research, exposure draft, and accounting standards update. Question 2.2. (TCO 1) The International Accounting Standards Board (Points : 6) was the predecessor to the IASC. can overrule the FASB when their policies disagree. promotes the use of high-quality, understandable global accounting standards. has its headquarters in Geneva. Question 3.3. (TCO 2) The conceptual framework's qualitative characteristic of relevance includes (Points : 6) predictive value. verifiability. completeness. neutrality. Question 4.4. (TCO 2) Enhancing qualitative characteristics of accounting information include (Points : 6) relevance and comparability. comparability and timeliness. understandability and relevance. neutrality and consistency. Question 5.5. (TCO 3) Incurring an expense for advertising on an account would be recorded by (Points : 6) debiting liabilities. crediting assets. debiting an expense. debiting assets. Question 6.6. (TCO 3) Accruals occur when cash flows (Points : 6) occur before expense recognition. occur after revenue or expense recognition. are uncertain. may be substituted for goods or services. Question 7.7. (TCO 4) Which of the following accounts is not a current asset account? (Points : 6) Cash in a checking account Savings account Six-month treasury bills Money orders Question 8.8. (TCO 4) Rent collected in advance is (Points : 6) an asset account in the balance sheet. a liability account in the balance sheet. a shareholders' equity account in the balance sheet. a temporary account that is not in the balance sheet at all. Question 9.9. (TCO 5) Popson Inc. incurred a material loss that was not unusual in character but was clearly an infrequent occurrence. This loss should be reported as (Points : 6) an extraordinary loss. a separate line item between income from continuing operations and income from discontinued operations. a separate line item within income from continuing operations. a separate line item in the retained earnings statement. Question 10.10. (TCO 5) On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2012. The following additional facts pertain to the transaction: •The Footwear Division qualifies as a component of the entity according to GAAP regarding discontinued operations. •The book value of Footwear's assets totaled $48 million on the date of the sale. •Footwear's operating income was a pre-tax loss of $10 million in 2012. •Foxtrot's income tax rate is 40%. In the 2012 income statement for Foxtrot Co., which of the following would it would report? (Points : 6) All income taxes would be combined into one line item. Income taxes would be separated for continuing and discontinued operations. Income taxes would be reported for income and gains only. None of the above Question 11.11. (TCO 8) An argument against the use of LCM is its lack of (Points : 6) relevance. reliability. consistency. objectivity. 1. Another name for the balance sheet is 2. The balance sheet heading will specify a 3. Which of the following is a category or element of the balance sheet? are an element 4. Which of the following is an asset account? 5. Which of the following is a contra account? 6. What is the normal balance for an asset account? 7. What is the normal balance for liability accounts? 8. What is the normal balance for stockholders’ equity and owner’s equity accounts? 9. What is the normal balance for contra assets accounts? 10. Client Jay pays ABC Co. $1000 in December for ABC to perform services for Jay in 45 days. ABC uses the accrual basis of accounting. In December ABC will debit Cash for $1,000. What will be the other account involved in the December accounting entry prepared by ABC (and what type of account is it)? 11. ABC Co. performed services for Client Kay in December and billed Kay $4,000 with terms of net 30 days. ABC follows the accrual basis of accounting. In January ABC received the $4,000 from Kay. In January ABC will debit Cash, since cash was received. What account should ABC credit in the January entry? 12. ABC Co. follows the accrual basis of accounting and performs a service on account (on credit) in December. The service was billed at the agreed upon amount of $3,500. ABC Co. debited Accounts Receivable for $3,500 and credited Service Revenue for $3,500. The effect of this entry on the balance sheet of ABC is to increase assets by $3,500 and to 13. Which of the following would not be a current asset? 14. Which of the following would normally be a current liability? 15. When an owner draws $5,000 from a sole proprietorship or when a corporation declares and pays a $5,000 dividend, the asset Cash decreases by $5,000. What is the other effect on the balance sheet? 16. ABC Co. incurs cleanup expense of $500 on December 30. The supplier's invoice states that the $500 is due by January 10 and ABC will pay the invoice on January 9. ABC follows the accrual basis of accounting and its accounting year ends on December 31. What is the effect of the cleanup service on the December balance sheet of ABC? 17. Deferred credits will appear on the balance sheet with the 18. Notes Payable could not appear as a line on the balance sheet in which classification? 19. On December 1, ABC Co. hired Juanita Perez to begin working on January 2 at a monthly salary of $4,000. ABC's balance sheet of December 31 will show a liability of 20. ABC Co. has current assets of $50,000 and total assets of $150,000. ABC has current liabilities of $30,000 and total liabilities of $80,000. What is the amount of ABC's owner's equity? 21. The amount reported on the balance sheet for Property, Plant and Equipment is the company's estimate of the fair market value as of the balance sheet date. 22. The total amount reported for stockholders' equity is the approximate fair value or net worth of the corporation as of the balance sheet date 23. The book value of a corporation is the total amount of stockholders' equity reported on the balance sheet. 24. The third line of the balance sheet at the end of the year should begin with "For the Year Ended". [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 13, 2020

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Dec 13, 2020

Downloads

0

Views

83

.png)

.png)