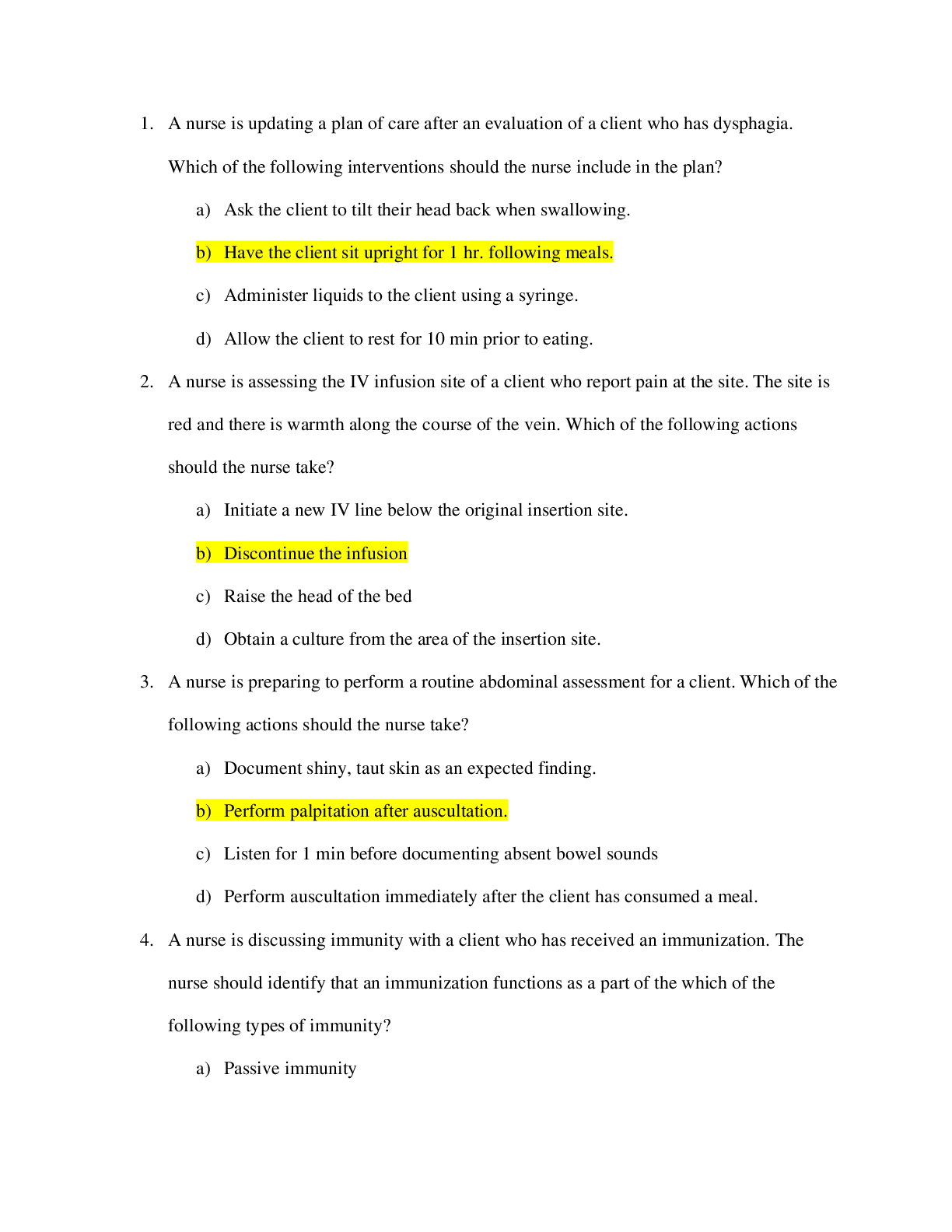

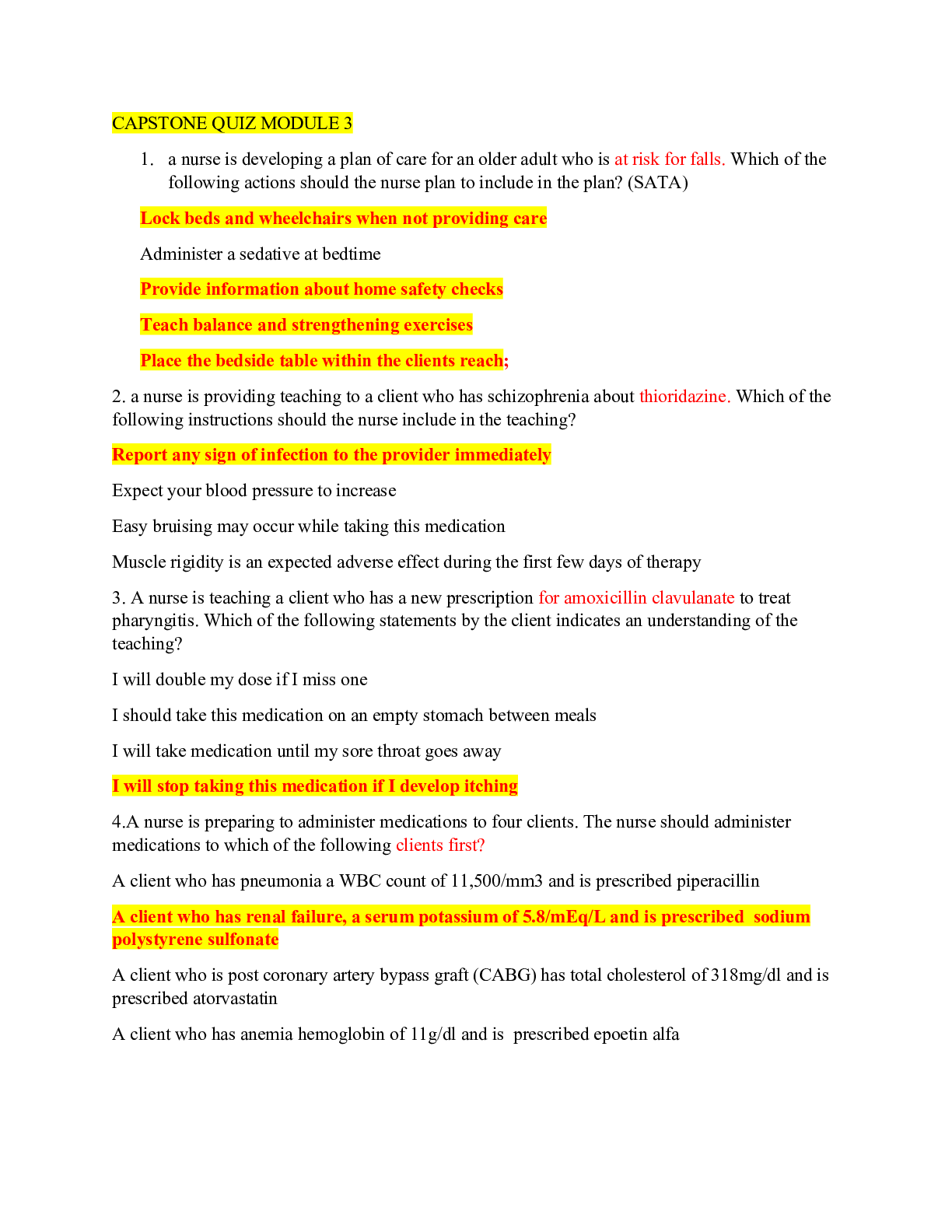

Management > CAPSTONE SIMULATION > MGMT 4300 >CAPSTONE EXAM | University of Texas | Download To Score An A (All)

MGMT 4300 >CAPSTONE EXAM | University of Texas | Download To Score An A

Document Content and Description Below

1. At the beginning of the CAPSTONE simulation, firms have weaknesses in the following area(s): 2. In the CAPSTONE simulation, accurate sales forecasting is not a key element to achieve company succe... ss 3. In the CAPSTONE simulation, an economic threat and an opportunity include the potential entry of competitors products into market segments and growing market segments respectively 4. In general, technological change creates opportunities, but not threats FALSE Resources in the resource based view are defined as the tangible and intangible assets that a firm controls, which it can use to conceive and implement its strategies 5. The threat of direct competition tends to be high when 6. Increasing total debt will positively impact return on equity, holding other factors constant 7. P/E Ratio is defined as 8. When a firm earns above average accounting performance, it is said to enjoy competitive parity 9. A firm can increase its asset turnover by increasing total assets such as inventory, holding other factors constant 10. Holding other factors constant, a firm can increase its return on sales by 11. In the CAPSTONE simulation, the contribution margin is defined as [Price – (Material Cost + Labor Cost + Inventory Cost)] / Price 12. In the CAPSTONE simulation, proforma financial analyses include Balance Sheet, Income Statement, and 10-K report 13. Liquidity ratios that focus on the firm’s ability to meet its short-term financial obligations 14. In the CAPSTONE simulation, leverage is defined as 22. Capital can be acquired through 23. In the CAPSTONE simulation, market capitalization, a measure of firm value, is the stock price divided by the number of shares outstanding FALSE 24. In the CAPSTONE simulation, higher bond ratings (A vs B) lead to lower interest paid to bondholders 25. Economic measures of performance are compared to a firm’s own to determine if that firm has a competitive advantage 26. In order for corporate diversification to be economically valuable there must either be some valuable economy of scope among the multiple businesses in which a firm is operating or it must be less costly for managers in a firm to realize these economies of scope than for an outside equity holder on his or her own 27. The businesses within a diversified firm always gain-cost-of-capital advantages by being part of diversified firm’s portfolio 28. Key competitive data found in the CAPSTONE courier include competitors’ sales, profits, contribution margins, market share, product characteristics, unit labor costs, unit material costs, automation levels, first-shift capacity, and future plant utilization 29. The different use of the same information system by two competing firms can lead to differences in competitive advantage 30. If a firm’s information system is valuable and rare but not costly to imitate, exploiting this resource will generate a sustainable competitive advantage for a firm 31. In the CAPSTONE simulation’s Annual Report, the income statement can be used to diagnose problems on a product-by-product basis 32. In the CAPSTONE simulation, the value of proformas The lists the dollar value of what the company owns (assets), what it owes to creditors (liabilities) and the amount contributed by investors (equity) 33. In the CAPSTONE simulation, increases in automation levels have no impact on product redesigns 34. Economies of scale are said to exist when the increase in a firm size ( measured in terms of volume of production) are associated with lower costs (measured in terms of average costs per unit of production) levels of production are associated with levels of employees specialization In the CAPSTONE simulation, if a team decides to introduce a new product, when should its assembly line be purchased? 35. Large transportation costs can offset cost reductions attributable to the exploitation of economies of scale manufacturing 36. In the CAPSTONE simulation, an assembly line can produce more than twice its first shift capacity if automation reaches its maximum level The value chain model developed by McKinsey and Company divides value-creating activities into two large categories: primary activities and secondary activities 37. In the CAPSTONE simulation, stock price is driven by book value, the last two years’ earnings per share (EPS) and the last two years’ 38. Studying a firms value chain forces us to think about firm resources in an aggregated way 22. In the CAPSTONE simulation, the production function tells the finance function if it needs money for additional equipment. If the finance function cannot raise enogh money, it can tell the production function to scale back its requests or prhaps sell idle capacity 23. In the CAPSTONE simulation, the marketing function works with the R&D function to make sure manufacturing quantities are in line with forecasts 24. In order for corporate diversification to be economically valuable [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 17, 2021

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Mar 17, 2021

Downloads

0

Views

79

.png)