Financial Accounting > TEST BANK > Test Bank for South-Western Federal Taxation Comprehensive Volume (All)

Test Bank for South-Western Federal Taxation Comprehensive Volume

Document Content and Description Below

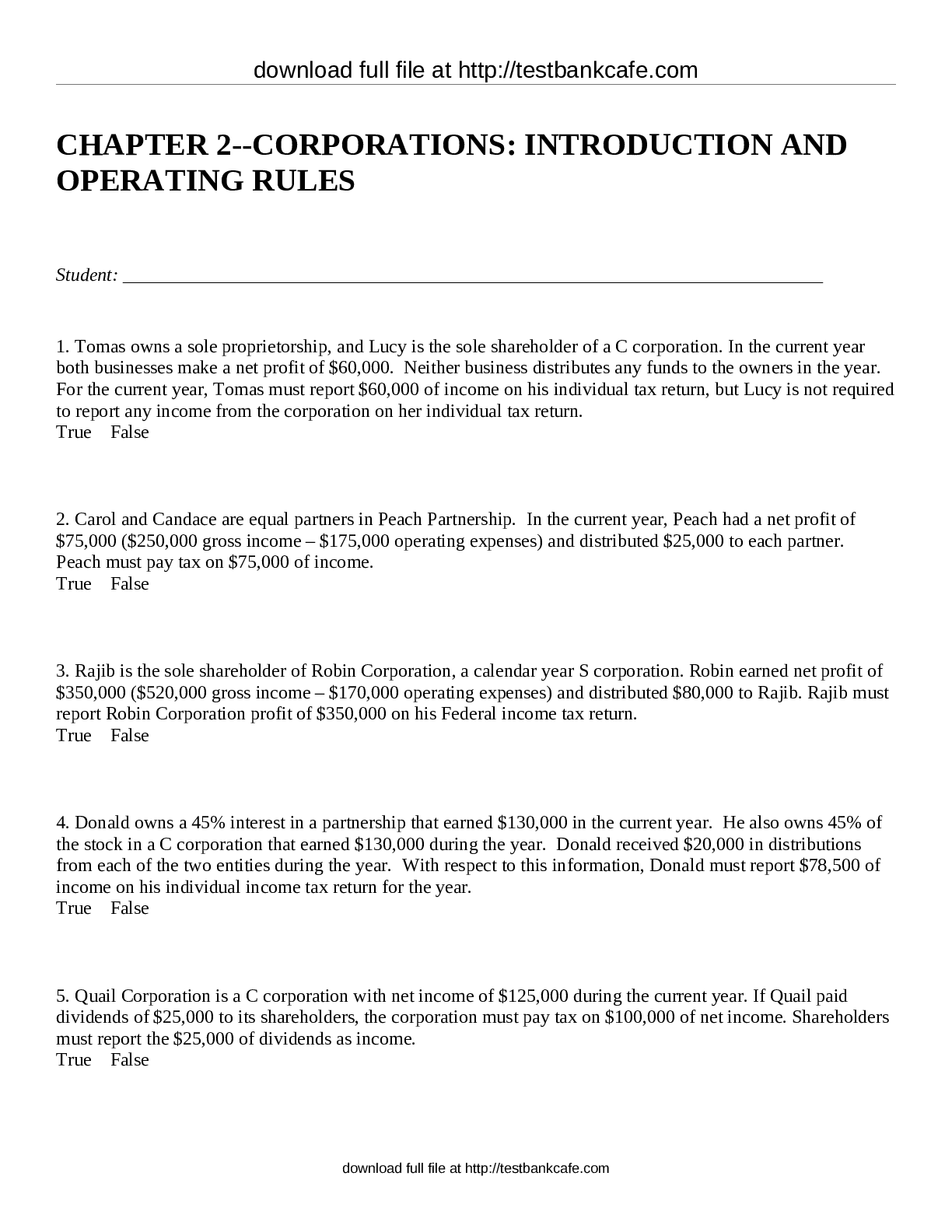

CHAPTER 1: AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW 1. The ratification of the Sixteenth Amendment to the U.S. Constitution was necessary to validate the Federal income tax ... on corporations. a. True b. False ANSWER: False RATIONALE: The Sixteenth Amendment validated only the tax on individuals. The income tax on corporations had been previously sanctioned by the courts. 2. Before the Sixteenth Amendment to the Constitution was ratified, there was no valid Federal income tax on individuals. a. True b. False ANSWER: False RATIONALE: There existed a Federal income tax during the Civil War that was sanctioned by the U.S. Supreme Court. 3. The first income tax on individuals (after the ratification of the Sixteenth Amendment to the Constitution) levied tax rates from a low of 2% to a high of 6%. a. True b. False ANSWER: True 4. The Federal income tax on individuals generates more revenue than the Federal income tax on corporations. 1 a. True b. False ANSWER: True 5. The payasyougo feature of the Federal income tax on individuals conforms to Adam Smith’s canon of certainty. a. True b. False ANSWER: False RATIONALE: Pay-as-you-go refers to the withholding provisions applicable to wages and other types of income and adds convenience to the tax system. 6. Because the law is complicated, most individual taxpayers are not able to complete their Federal income tax returns without outside assistance. a. True b. False ANSWER: True RATIONALE: Approximately 60% use tax return preparers, while slightly more than 32% purchase tax return software. 7. The FICA tax (Medicare component) on wages is progressive since the tax due increases as wages increase. a. True b. False ANSWER: False RATIONALE: The FICA tax (Medicare component) is proportional because the rate is constant regardless of the wages earned. 2 8. The Federal estate and gift taxes are examples of progressive taxes. a. True b. False ANSWER: True 9. The Federal excise tax on cigarettes is an example of a proportional tax. a. True b. False ANSWER: True RATIONALE: The tax is a flat $1.01 per pack. 10. Currently, the Federal income tax is less progressive than it ever has been in the past. a. True b. False ANSWER: False RATIONALE: Currently, the Federal income tax has six rates. At one time, it had two rates. 11. Mona inherits her mother’s personal residence, which she converts to a furnished rent house. These changes should affect the amount of ad valorem property taxes levied on the properties. a. True b. False ANSWER: True RATIONALE: Conversion from residential to rental use will increase the taxes. Furthermore, Mona’s mother may have had a senior citizen exemption on the property, which will no longer be appropriate. Lastly, the furnishings in the rent house could now be subject to an ad valorem tax on personalty. 3 12. A fixture will be subject to the ad valorem tax on personalty rather than the ad valorem tax on realty. a. True b. False ANSWER: False RATIONALE: By definition, a fixture becomes part of the real estate to which it is attached. 13. Even if property tax rates are not changed, the amount of ad valorem taxes imposed on realty may not remain the same. a. True b. False ANSWER: True RATIONALE: Property taxes will vary in accordance with changes in the assessed value of the property. 14. The ad valorem tax on personal use personalty is more often avoided by taxpayers than the ad valorem tax on business use personalty. a. True b. False ANSWER: True 15. A Federal excise tax is no longer imposed on admission to theaters. a. True b. False ANSWER: True RATIONALE: Such tax has been rescinded. 16. There is a Federal excise tax on hotel occupancy. 4 a. True b. False ANSWER: False 17. The Federal gas-guzzler tax applies only to automobiles manufactured overseas and imported into the U.S. a. True b. False ANSWER: False RATIONALE: No such restriction is imposed. Although many of the European luxury and sports car manufacturers were initially hit hard by the tax, the law is silent on this matter. 18. Like the Federal counterpart, the amount of the state excise taxes on gasoline varies from state to state. a. True b. False ANSWER: False RATIONALE: The Federal excise tax rate on gasoline remains constant. 19. Not all of the states that impose a general sales tax also have a use tax. a. True b. False ANSWER: False RATIONALE: Every state that has a general sales tax also has a use tax. There are no states with only a sales or use tax. 20. Sales made by mail order are not exempt from the application of a general sales (or use) tax. a. True 5 b. False ANSWER: True RATIONALE: They are not exempt but compliance is sporadic. 21. Two persons who live in the same state but in different counties may not be subject to the same general sales tax rate. a. True b. False ANSWER: True RATIONALE: This possibility could exist if local jurisdictions exact additional sales taxes. 22. States impose either a state income tax or a general sales tax, but not both types of taxes. a. True b. False ANSWER: False RATIONALE: Many states impose both. 23. A safe and easy way for a taxpayer to avoid local and state sales taxes is to make the purchase in a state that levies no such taxes. a. True b. False ANSWER: False RATIONALE: A review of the Example 5 discussion shows that this may not always be successful. 24. On transfers by death, the Federal government relies on an estate tax, while states impose an estate tax, an inheritance tax, both taxes, or neither tax. 6 a. True b. False ANSWER: True RATIONALE: The Federal government relies on an estate tax while states impose an estate tax, an inheritance tax, both taxes, or neither tax. 25. An inheritance tax is a tax on a decedent’s right to pass property at death. a. True b. False ANSWER: False RATIONALE: What is described is an estate tax. An inheritance tax is a tax on an heir’s right to receive property from a decedent. 26. One of the major reasons for the enactment of the Federal estate tax was to prevent large amounts of wealth from being accumulated within the family unit. a. True b. False ANSWER: True 27. Under Clint’s will, all of his property passes to either the Lutheran Church or to his wife. No Federal estate tax will be due on Clint’s death in 2014. a. True b. False ANSWER: True RATIONALE: A combination of the charitable and marital deductions will eliminate Clint’s taxable estate. 7 28. Under the usual state inheritance tax, two heirs, a cousin and a son of the deceased, would not be taxed at the same rate. a. True b. False ANSWER: True RATIONALE: The more closely related the heir is to the decedent, the larger the exemption allowed and/or the lower the tax rate imposed [Show More]

Last updated: 1 year ago

Preview 1 out of 344 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 24, 2022

Number of pages

344

Written in

Additional information

This document has been written for:

Uploaded

Feb 24, 2022

Downloads

0

Views

62