*NURSING > QUESTIONS & ANSWERS > Globus- Quiz 2 - Part 2. 20 Questions and Answers (All)

Globus- Quiz 2 - Part 2. 20 Questions and Answers

Document Content and Description Below

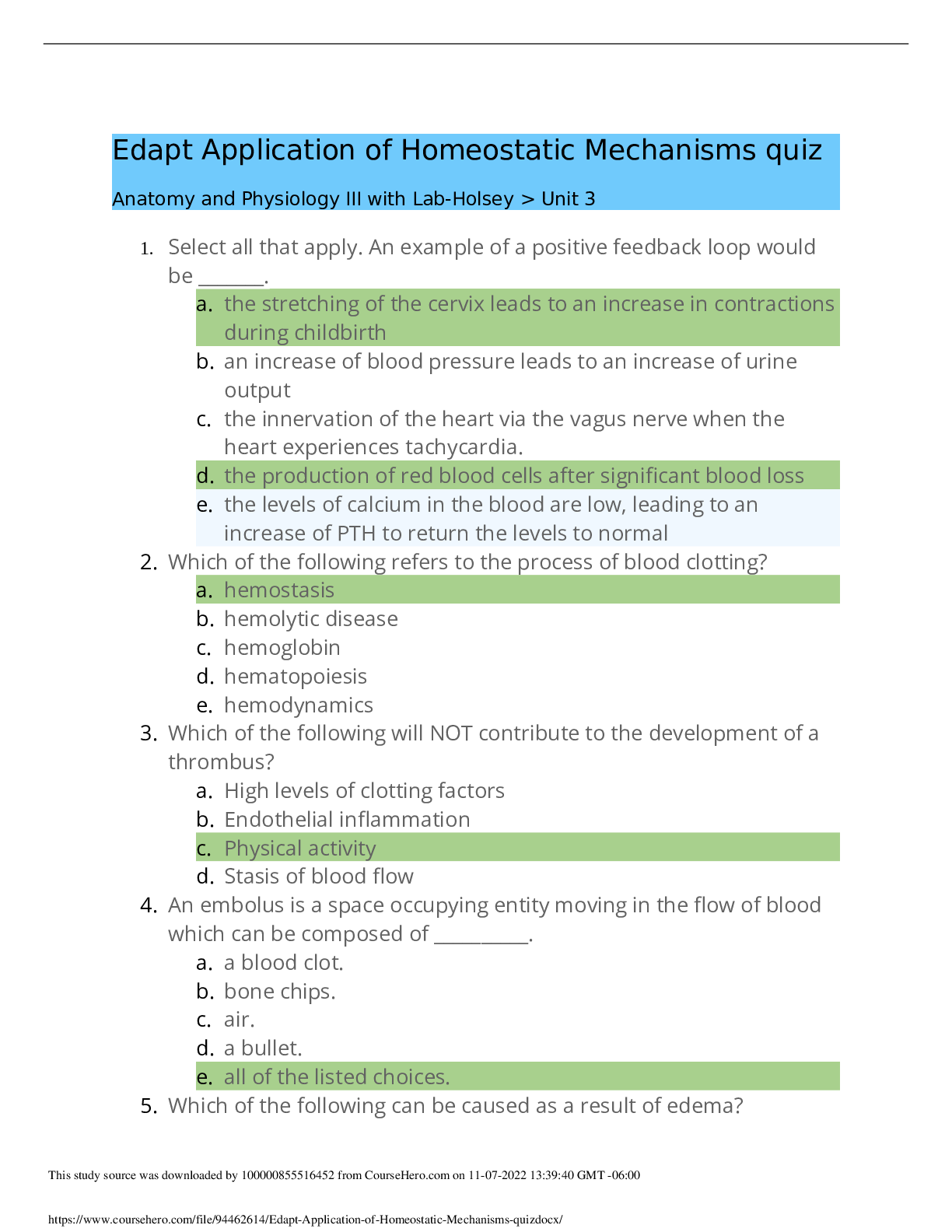

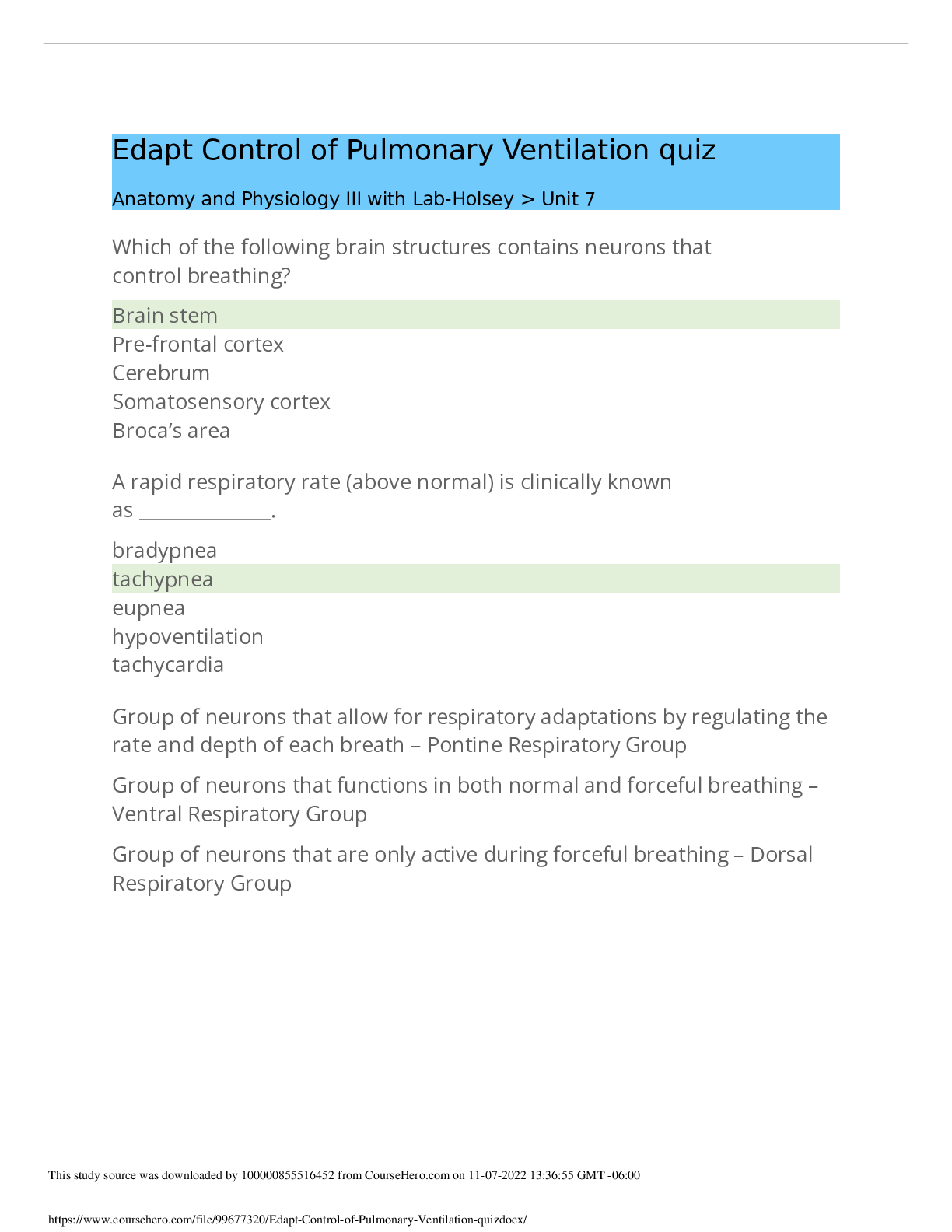

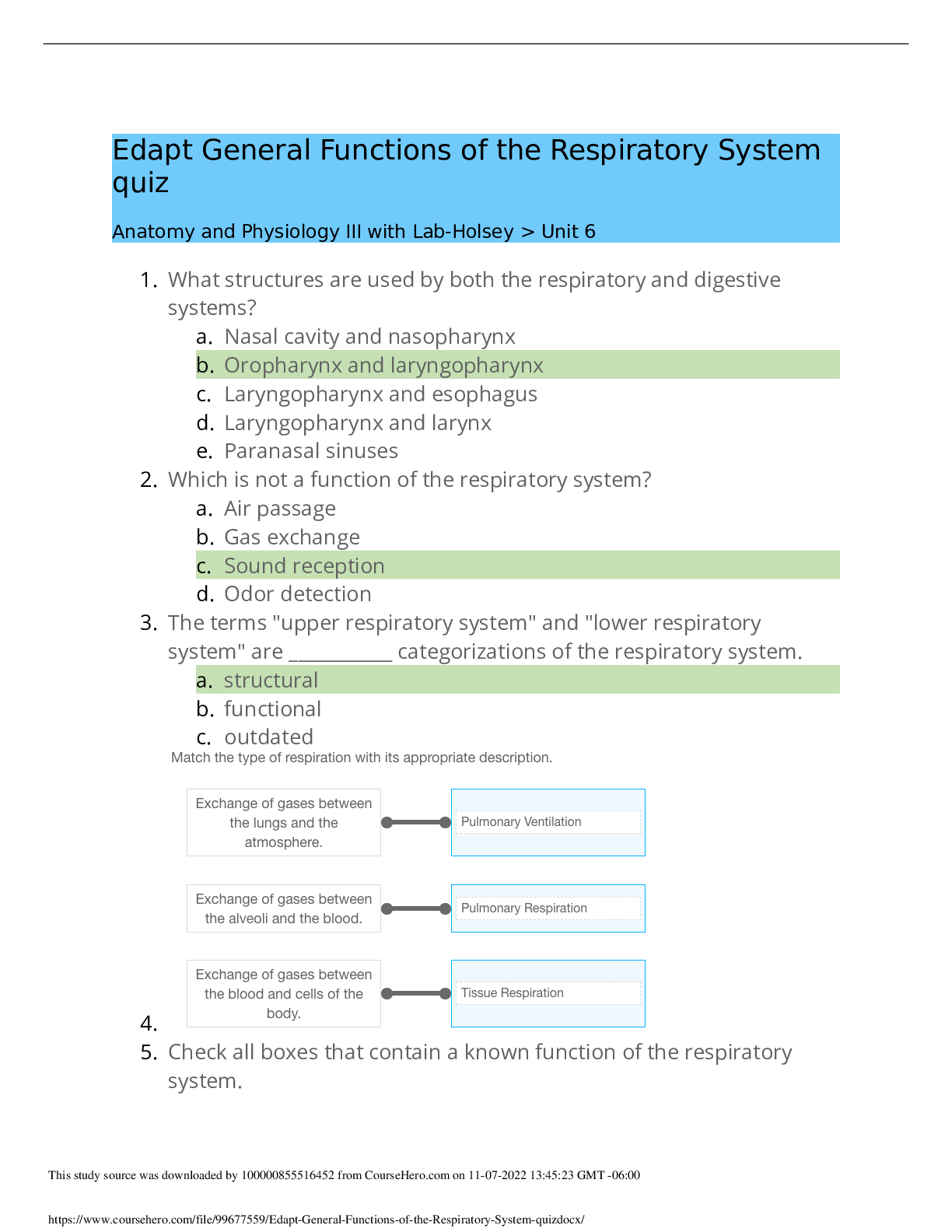

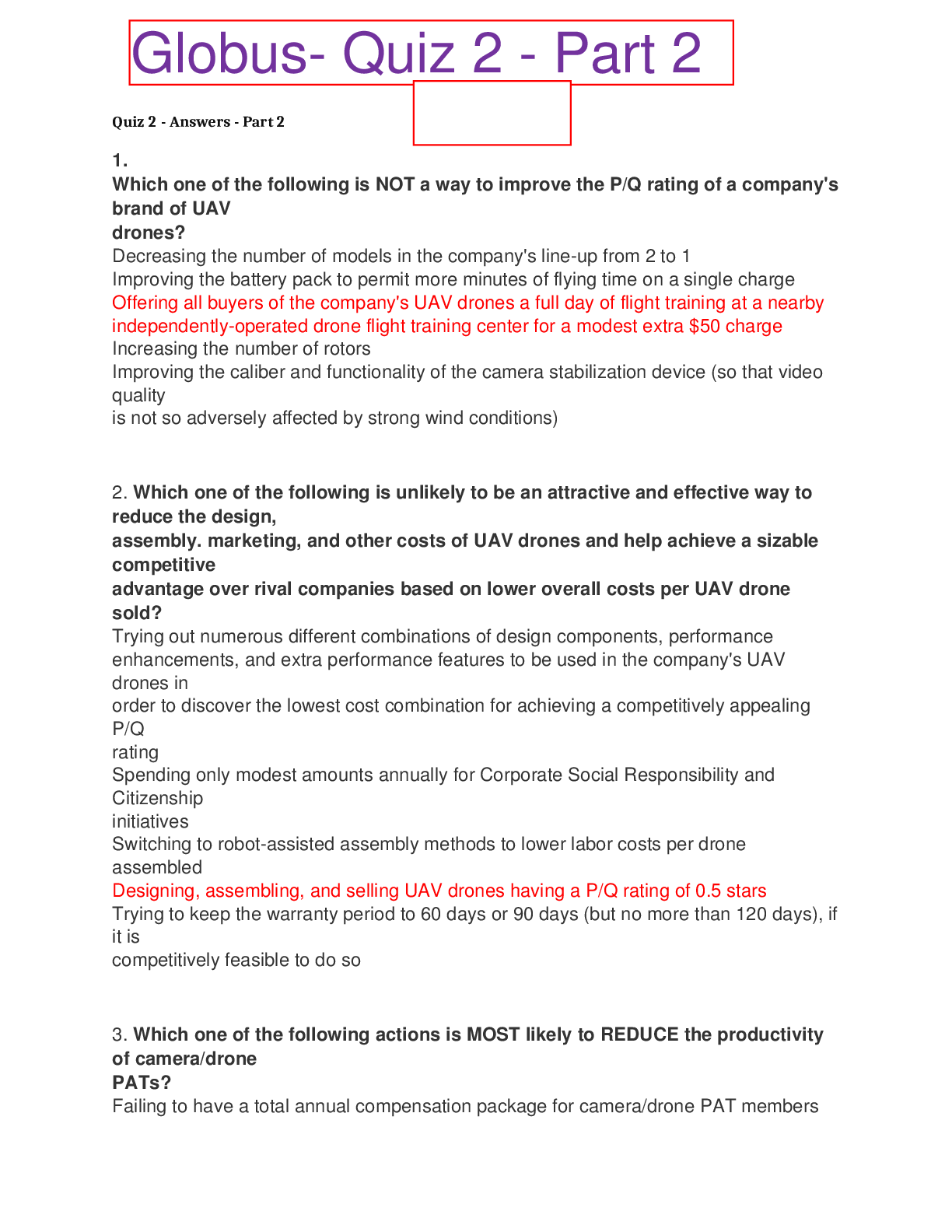

Quiz 2 - Answers - Part 2 1. Which one of the following is NOT a way to improve the P/Q rating of a company's brand of UAV drones? Decreasing the number of models in the company's lineup from 2... to 1 Improving the battery pack to permit more minutes of flying time on a single charge Offering all buyers of the company's UAV drones a full day of flight training at a nearby independentlyoperated drone flight training center for a modest extra $50 charge Increasing the number of rotors Improving the caliber and functionality of the camera stabilization device (so that video quality is not so adversely affected by strong wind conditions) 2. Which one of the following is unlikely to be an attractive and effective way to reduce the design, assembly. marketing, and other costs of UAV drones and help achieve a sizable competitive advantage over rival companies based on lower overall costs per UAV drone sold? Trying out numerous different combinations of design components, performance enhancements, and extra performance features to be used in the company's UAV drones in order to discover the lowest cost combination for achieving a competitively appealing P/Q rating Spending only modest amounts annually for Corporate Social Responsibility and Citizenship initiatives Switching to robotassisted assembly methods to lower labor costs per drone assembled Designing, assembling, and selling UAV drones having a P/Q rating of 0.5 stars Trying to keep the warranty period to 60 days or 90 days (but no more than 120 days), if it is competitively feasible to do so 3. Which one of the following actions is MOST likely to REDUCE the productivity of camera/drone PATs? Failing to have a total annual compensation package for camera/drone PAT membersthat is at least equal to the prioryear industryaverage compensation level Boosting the annual base wage of camera/drone PAT members by only 2% in any given year Not raising the annual bonus for perfect attendance for a period of 3 years Cutting the number of camera models being assembled from 4 models to 3 models and the number of drone models being assembled from 3 models to 2 models Decreasing the size of the assembly quality incentive for cameras to a maximum of $0.40 and the assembly quality incentive for drones to a maximum of $1.00 4. 11Which of the following is an action that merits serious consideration in trying to improve a company's credit rating? In answering this question, you may wish to consult the Help section for page 5 of the Camera & Drone Journal and read the discussion pertaining to The Credit Rating Measures." Avoid all use of overtime in assembling cameras and drones Do not increase the compensation paid to PAT members (until the desired credit rating is achieved)this will help keep production costs for both cameras and drones from rising Issue additional shares of common stock and use the proceeds to pay off bank loans, thereby immediately improving the company's debtequity percentages Cut the prices the company charges for both cameras and drones in all four geographic regions by at least 10% in order to improve the company's EPS, ROE, and stock price Increase the size of the company's dividend payments to stockholdersthis helps reduce the amount of retained earnings on the company's balance sheet (which in turn helps increase the company's interest coverage ratio) 5. As a general rule, it is important for company managers to be aware of the regions where the company's UAV drone business was most profitable and least profitable in the justcompleted decision round (so they can pursue corrective actions in the underperforming regions in the upcoming decision round); the best information, then the best place(s) to look for thisinformation is page 1 of the Company Operating Report showing "Assembly and Facilities Operations." the top section of page 5 of the Camera & Drone Journal. the benchmarking data for operating profits and operating profit margins on p. 7 of the Camera & Drone Journal and the regionbyregion breakdowns of drone net sales revenues, costs, total operating profits, and operating profit margins displayed on page 3 of the Company Operating Report. on page 3 of the Company Operating Report there are page 4 of the Company Operating Report showing the company's financial statements and selected financial statistics. in the 4page section of the Competitive Intelligence Report that shows the comparative competitive efforts of rival companies for each region. 6. A company's managers should almost always give serious consideration to making significant adjustments in its camera/drone strategies and competitive approaches when the company has been unsuccessful in achieving the investorexpected targets for EPS, ROE, and stock price appreciation in the prior decision round and certainly if it has been unsuccessful for the past two decision rounds. the number of camera and drone workstations the company has installed is NOT well above the industryaverages (as reported on pages 6 and 7 of the most recent Camera & Drone Journal). several rival companies are charging prices below the regional averages in all four regions for cameras and drones with a fourstar or lower P/Q rating. the company's total production/assembly costs for both action cameras and UAV drones are above the industry averages (as reported on pages 6 and 7 of the latest issue of the Camera & Drone Journal). its sales and market shares for cameras and drones are below the industry averages in as many as two geographic regions. 7. The makers of actioncapture cameras have good reason to sell their camera models to cameraretailers in EuropeAfrica at lower average wholesale prices than the average wholesale prices charged to camera retailers in Latin America because the costs of shipping AC cameras from Taiwan to camera retailers in EuropeAfrica are $2 lower per camera than the costs of shipping AC cameras from Taiwan to retailers in Latin America. annual interest rates on bank loans in the EuropeAfrica region are 1%2% lower than interest rates on bank loans in Latin America. the administrative costs per camera sold that cameramakers incur on sales to camera retailers in EuropeAfrica are about S4 lower than those incurred on sales to camera retailers in Latin America. the warranty repair costs for cameras all companies have to pay in the EuropeAfrica region are $10 lower than in Latin America. they incur lower import duties per action camera sold/shipped to camera retailers in EuropeAfrica than the import duties they have to pay on each action camera sold/ shipped to camera retailers in Latin America. 8. Which of the following actions does NOT help improve a company's image rating/brand reputation? Successfully increasing its global market share of worldwide actioncapture camera sales Building a widely recognized reputation for paying camera/drone PAT members the biggest total annual compensation package of any company in the industry Increasing the company's P/Q ratings of both action cameras and UAV drones Successfully increasing its global market share of worldwide UAV drone sales Spending sizable sums of money for multiple social responsibility initiatives and good corporate citizenship over a multiyear period 9. If a company adds 40 new workstations at a cost of $75,000 each and also spends $14 million for addition space in its camera/drone assembly facilities to accommodate more workstations, then its annual depreciation costs will rise by 10% of the capital cost or $1.700,000. 5% of the capital cost or $850,000.4% of the capital cost or $680,000. S560,000. S17 million. 10. Which of the following actions are most likely to catch the eye of action camera shoppers, generate the biggest boost in overall buyer appeal for a company's camera models versus rival brands. and cause the biggest number of additional camera shoppers to purchase its brand instead of rival brands? Boosting merchandising support to camera retailers stocking the company's brand by 15% Reducing average wholesale prices to camera retailers by $5 in all four geographic regions Increasing the annual number of weekly sales promotion campaigns from 2 to 3 and also increasing the discount to camera retailers during these weekly promotions by 1% Boosting the number of camera models from 3 to 4 while also keeping the company P/Q rating at the same star rating Raising the P/Q rating on the company's camera models from 4.2 stars to 4.9 stars and only increasing the average wholesale prices to retailers by $4 in all four regions 11. Which of the following results from the latest decision round are LEAST important in providing guidance to company managers in making their strategic moves and decisions to improve their company's competitiveness and rank among the topperforming companies in the upcoming decision round? The information concerning the company's market segment performance for both action cameras and UAV drones found on pages 2 and 3 of the Company Operating Report The comparative competitive efforts of rival companies in each geographic region that are found in Competitive Intelligence Report Each company's performance on EPS, ROE. stock price. credit rating. and image rating displayed on the pp. 2 and 3 of the Camera & Drone Journal The industrylow, industryaverage, and industryhigh benchmarks on pp. 67 of each issue of the Camera & Drone Journal The balance sheet data in the middle section of page 5 of the Camera & Drone Journal12. If your company earns $3.00 per share of common stock (in a year when the investorexpected EPS target is $3.60), if another company has an industryleading EPS of S5.00, and if EPS has a scoring weight of 20 points, then your company's EPS score on the BestinIndustry scoring standard will be 11 points 17 points (83.3% of the 20 points awarded for meeting the EPS target) 10 points 12 points 15 points 13. The industrylow. industryaverage. and industryhigh benchmarks on pp. 67 of each issue of the Camera & Drone Journal are of little value to company managers in making decisions to improve company performance in the upcoming decision round because the benchmarking data do not identify which particular companies have the lowest/highest costs and operating profits in each geographic region. are most valuable to the managers of companies whose costs are close to the industrylow values and to the managers of companies whose operating profits and operating profit margins are at or close to the industryhigh benchmarks. are worth careful scrutiny by the managers of all companies because when the camera/drone benchmarking data signals that a company's costs/operating profits for one or more of the benchmarks are clearly outofline (or unappealing), managers are well advised to take corrective action in the upcoming decision round. have the greatest value to the managers of companies that have negative operating profit per camera sold in one of more geographic regions because their marketing andlor administrative expenses per camera sold are too far above the industry averages. are of considerable value to the managers of companies pursuing a lowcost strategy but are of very limited value to managers of companies pursuing all other types of strategies to outcompete and outperform rival companies.14. Which of the following is an action company comanagers can take that will help the company meet or beat the investorexpected ROE targets in upcoming years? Making it standard practice to issue more shares of common stock to fund all capital expenditures for camera/drone workstation space, the installation of additional camera/drone workstations, and any robotics upgrades that company comanagers decide to undertake Not paying an annual dividend to shareholders or else paying only a small portion of net profits (say less than 15%) to shareholders in the form of an annual dividend because retaining more earnings in the business makes it easier to meet the higher ROE targets expected by investors Frequently increasing annual dividend payments to shareholders, perhaps reaching a dividend payout ratio of 30% to 50% (or more) in years 1115: retaining a smaller fraction of earnings for use in the company's camera/drone business makes it easier for the company to achieve the higher ROE targets expected by investors. Making it standard practice to use a combination of internal cash flows from operations and new issues of common stock to finance the company's growth and new capital investments in assembling action cameras and UAV drones. Financing the installation of additional camera/drone workstations, and any robotics upgrades that company comanagers decide to undertake with a combination of 50% debt (1 year, 5 year, and/or 10year bank loans) and 50% proceeds from the issue of additional shares of common stock 15. Which one of the following is NEITHER an advantage or disadvantage of shifting to roboticsassisted camera assembly methods? Installing robots at each camera workstation enables the size of PATs to be cut by one member. The capital cost of converting to robotassisted camera assembly results in higher annual depreciation costs in producing/assembling cameras. Roboticsassisted assembly increases workstation maintenance costs from $10,000 annually per camera workstation to $25,000 annually per camera workstation. Robotassisted camera assembly reduces total annual compensation costs per camera PAT. If borrowing is used to partly or wholly finance the cash outlays required to pay forrobotics upgrades, the company will incur higher interest costs until the borrowed funds are repaid. 16. As explained in the Help section for the Workforce Compensation, Training, and Product Assembly decision screen, if (1) a company pays a drone PAT member an annual base wage of $25.000, an $800 yearend bonus for perfect attendance, and provides a companypaid annual fringe benefits package worth $3,600 and (2) a PAT is paid a $4 assembly quality incentive per UAV drone assembled that is equally divided among 4 PAT members, then if a drone PAT's productivity is 1500 drones per year the total compensation cost per drone assembled would be $82.40. the total compensation cost per drone assembled would be $41.20. the total compensation cost per drone assembled would be $37.33. the total compensation cost per drone assembled would be $78.67. the total compensation cost per drone assembled would be $42.00 17. One of the benefits of pursuing a strategy of social responsibility and corporate citizenship that involves spending sizable sums of money for social responsibility initiatives and good corporate citizenship over a multiyear period is greater ease in achieving the investorexpected performance targets for EPS, ROE, and stock price, provided a company wins one or more Gold Star Awards for Corporate Citizenship. a higher image rating. increased power and effectiveness of a company's advertising expenditures for action cameras in all four regions in those years when the company's total annual spending for socially responsible activities exceeds the industry average (as reported on p. 3 of the Camera & Drone Journal. increased company ability to charge higher prices for its action cameras and UAV drones (because of widespread public enthusiasm for the company's social responsibility initiatives). increased global sales volume and global market share of action cameras. provided as muchas 20% of company's advertising expenditures in each geographic region are devoted to media ads informing the general public about all of the socially responsible activities being undertaken. 18. If a company earns net income of S55 million in Year 8, has 10 million shares of common stock outstanding, pays a dividend of $1.50 per share, and has annual interest costs of $15 million, then the company's credit rating would be at least a B+ because dividend payments are equal to annual interest costs. the company's EPS for Year 8 would be $2 50 (net income of $55 million less dividend payments of $15 million less S15 million in interest payments = $25 million divided by 10 million shares). the company's credit rating would be no less than an A because net income is more than three times higher than annual interest costs. the company's EPS for Year 8 would be $4.00 (net income of $55 million less dividend payments of $15 million = $40 million divided by 10 million shares). the company's EPS for Year 8 would be $5.50 and Its retained earnings for Year 8 would be $40 million (net income of $55 million less dividend payments of $15 million). 19. If company comanagers wish :o pursue efforts aimed specifically at helping the company meet or beat the investorexpected stock price appreciation targets in upcoming years, then comanagers should consider issuing new shares of common stock to help fund needed capital investment expenditures in those decision rounds when internal cash flows are insufficient to cover all the expenditures on capital investment projects management has decided to undertake. actions to boost the company's net income and EPS, increase annual dividend payments to shareholders, and regularly allocate a portion of internal cash flows to repurchasing shares of the company's common stock. outspending rivals on corporate social responsibility initiatives and charitable contributions, soas to convince civicminded investors to purchase shares of the company's stock and thus help drive up the stock price. boosting the amount of earnings retained in the business, thereby increasing the hoard of cash held in the company's retained earnings account on its Balance Sheet. issuing additional shares of common stock and using the proceeds to pay off all bank loans and then further issuing shares of stock as may be needed to help finance capital expenditures for additional workstation space, new workstations, and possibly robotics upgrades so as to completely avoid the use of debtfinancing. 20. A company's EPS can most always be bolstered by managerial actions to offer more camera/drone models to buyers than rivals: 7 models is ideal. spend at least $1 million to $3 million more on various kinds of marketing efforts than any other company in all four regions: the resulting annual increases in camera/drone sales volumes, revenues, and profits will normally boost the company's EPS. offer 1year warranties on the company's cameras/drones. achieve an A+ credit ratingthe resulting lower interest rates on borrowings help drive increases in EPS allocate significant cash flows from operations to repurchasing shares of common stock, ideally most every year. [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 10, 2022

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Mar 10, 2022

Downloads

0

Views

118