Education > QUESTIONS & ANSWERS > Test Bank Chapter 10 Acquisition and Disposition of Property, Plant, and Equipment. (All)

Test Bank Chapter 10 Acquisition and Disposition of Property, Plant, and Equipment.

Document Content and Description Below

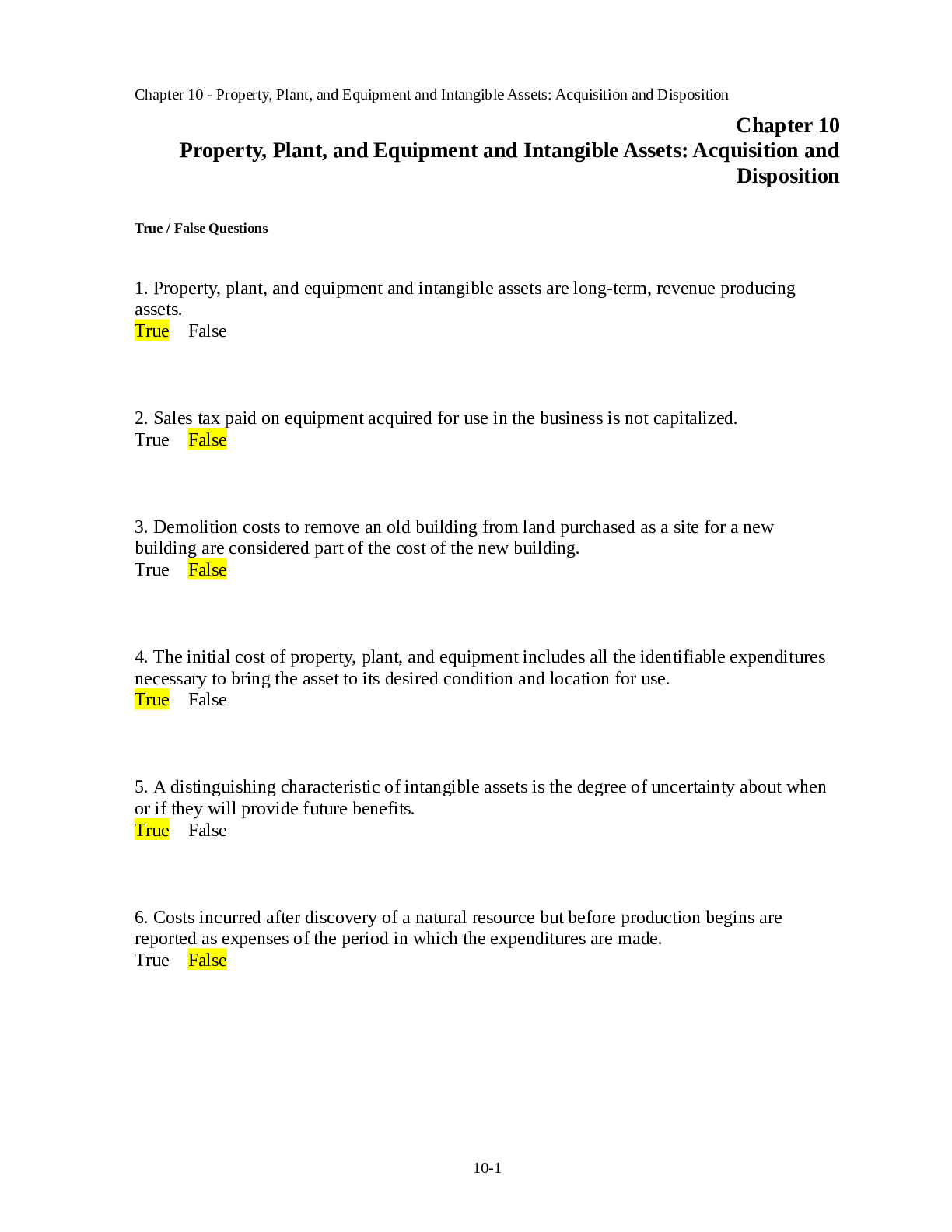

Test Bank Chapter 10 Acquisition and Disposition of Property, Plant, and Equipment. CHAPTER 10 ACQUISITION AND DISPOSITION OF PROPERTY, PLANT, AND EQUIPMENT IFRS questions are av... ailable at the end of this chapter. TRUE-FALSE—Conceptual Description F 1. Nature of property, plant, and equipment. T 2. Nature of property, plant, and equipment. F 3. Cost of removing old building. T 4. Insurance on equipment purchased. F 5. Accounting for special assessments. T 6. Overhead costs in self-constructed assets. F 7. Overhead costs in self-constructed assets. F 8. Interest capitalization. F 9. Qualifying assets for interest capitalization. T 10. Avoidable interest. T 11. Interest capitalization on land purchase. T 12. Deferred-payment contracts. T 13. Accounting for nonmonetary exchanges. F 14. Nonmonetary exchanges. F 15. Recognizing losses on nonmonetary exchanges. T 16. Costs subsequent to acquisition. T 17. Definition of improvements. F 18. Ordinary repairs benefit period. F 19. Involuntary conversion gains/losses. T 20 Loss from scrapped asset. MULTIPLE CHOICE—Conceptual Description d 21. Definition of plant assets. b 22. Characteristics of plant assets. d 23. Characteristics of plant assets. c 24. Composition of land cost. c 25. Composition of land cost. c 26. Determination of land cost. d 27. Determine cost of land used as a parking lot. a 28. Determine cost of machinery. b 29. Classification of fences and parking lots. b S30. Recording plant assets at historical cost. d S31. Accounting for overhead costs. d 32. Determine costs capitalized for self-constructed assets. d 33. Assets which qualify for interest capitalization. a 34. Assets which qualify for interest capitalization. c 35. Definition of "avoidable interest." a 36. Period of time over which interest may be capitalized. b 37. Maximum amount of annual interest that may be capitalized. MULTIPLE CHOICE—Conceptual (cont.) Description b 38. Interest capitalization—weighted-average factor. d 39. Classification of interest earned on securities purchased with borrowed funds. d 40. Write-off of capitalized interest costs. c S41. Conditions for interest capitalization. a S42. Capitalization of interest on constructed assets. c S43. Nonmonetary exchanges and culmination of earning process. a S44. Recognizing gains/losses in exchange having commercial substance. a S45. Valuation of nonmonetary asset. b P46. Gain recognition on plant asset exchange. c 47. Valuation of plant assets. d 48. Plant asset acquired by issuance of stock. d 49. Valuation of nonmonetary exchanges. a 50. Gain recognition on a nonmonetary exchange. c 51. Gain recognition on a nonmonetary exchange. b 52. Accounting for donated assets. b 53. Valuation of donated assets. d 54. Identify conditions for capital expenditures. c 55. Capital expenditure. d 56. Identification of a capital expenditure. a 57. Identification of a capital expenditure. c P58. Accounting for revenue expenditures. d S59. Accounting for capital expenditures. a S60. Gain or loss on plant asset disposal. d 61. Determine loss on sale of depreciable asset. c 62. Knowledge of involuntary conversions. P These questions also appear in the Problem-Solving Survival Guide. S These questions also appear in the Study Guide. MULTIPLE CHOICE—Computational Description b 63. Determine cost of land. d 64. Determine cost of building. d 65. Calculate cost of land and building. c 66. Calculate cost of equipment. c 67. Calculate cost of equipment. d 68. Overhead included in self-constructed asset. d 69. Overhead included in self-constructed asset. a 70. Calculate interest to be capitalized. b 71. Calculate average accumulated expenditures. a 72. Calculate interest to be capitalized. b 73. Calculate average accumulated expenditures. a 74. Calculate average accumulated expenditures. c 75. Calculate amount of interest to be capitalized. b 76. Calculate weighted-average accumulated expenditures. a 77. Calculate weighted-average accumulated expenditures. d 78. Calculate weighted-average accumulated expenditures. a 79. Calculate actual interest cost incurred during year. MULTIPLE CHOICE—Computational (cont.) Description b 80. Calculate amount of interest to be capitalized. c 81. Calculate amount of interest to be capitalized. c 82. Calculate weighted-average accumulated expenditures. b 83. Calculate interest to be capitalized. d 84. Calculate weighted-average accumulated expenditures. b 85. Calculate interest to be capitalized. b 86. Calculate weighted-average accumulated expenditures. d 87. Calculate weighted-average interest rate. d 88. Calculate amount of avoidable interest. a 89. Calculate amount of actual interest. c 90. Calculate amount of interest expense. a 91. Exchange of nonmonetary assets. a 92. Exchange lacking commercial substance. c 93. Exchange lacking commercial substance. b 94. Valuation of a nonmonetary exchange. a 95. Valuation of a nonmonetary exchange. c 96. Calculate gain on exchange lacking commercial substance. a 97. Allocation of cost in a lump sum purchase. d 98. Allocation of cost in a lump sum purchase. c 99. Calculate cost of land acquired. c 100. Determine cost of purchased machine. c 101. Calculate cost of truck purchased. b 102. Calculate cost of machine purchased. d 103. Allocation of cost of a lump sum purchase. b 104. Calculate cost of equipment. d 105. Acquisition of equipment by exchange of stock held as an investment. b 106. Exchange lacking commercial substance. c 107. Exchange lacking commercial substance /gain. b 108. Exchange lacking commercial substance /gain. d 109. Valuation of a nonmonetary exchange. a 110. Exchange lacking commercial substance/gain. d 111. Valuation of a nonmonetary exchange. b 112. Gain recognition of a nonmonetary exchange. a 113. Valuation of a nonmonetary exchange. b 114. Valuation of a nonmonetary exchange. b 115. Calculate gain on nonmonetary exchange. d 116. Calculate loss on nonmonetary exchange. b 117. Calculate gain on nonmonetary exchange. d 118. Calculate loss on nonmonetary exchange. c 119. Calculate cash received from sale of machinery. c 120. Calculate cash received from sale of machinery. b 121. Calculate loss on sale of machine. b 122. Calculate gain on sale of equipment. MULTIPLE CHOICE—CPA Adapted Description c 123. Determine cost of land. b 124. Classification of sale of building. b 125. Determine interest cost to be capitalized. a 126. Valuation of a nonmonetary exchange. a 127. Exchange lacking commercial substance. b 128. Accounting for donated assets. d 129. Costs subsequent to acquisition. a 130. Valuation of replacement equipment. EXERCISES Item Description E10-131 Plant asset accounting. E10-132 Weighted-average accumulated expenditures. E10-133 Capitalization of interest. E10-134 Nonmonetary exchange. E10-135 Nonmonetary exchange. E10-136 Donated assets. E10-137 Capitalizing vs. expensing. PROBLEMS Item Description P10-138 Capitalizing acquisition costs. P10-139 Capitalization of interest. P10-140 Capitalization of interest. P10-141 Asset acquisition P10-142 Nonmonetary exchange. P10-143 Nonmonetary exchange. P10-144 Nonmonetary exchange. P10-145 Nonmonetary exchange. P10-146 Nonmonetary exchange. CHAPTER LEARNING OBJECTIVES 1. Describe property, plant, and equipment. 2. Identify the costs to include in the initial valuation of property, plant, and equipment. 3. Describe the accounting problems associated with self-constructed assets. 4. Describe the accounting problems associated with interest capitalization. 5. Understand accounting issues related to acquiring and valuing plant assets. 6. Describe the accounting treatment for costs subsequent to acquisition. 7. Describe the accounting treatment for the disposal of property, plant, and equipment. SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS Item Type Item Type Item Type Item Type Item Type Item Type Item Type Learning Objective 1 1. TF 2. TF 21. MC 22. MC 23. MC Learning Objective 2 3. TF 24. MC 27. MC 30. MC 65. MC 123. MC 137. E 4. TF 25. MC 28. MC 63. MC 66. MC 124. MC 138. P 5. TF 26. MC 29. MC 64. MC 67. MC 131. E Learning Objective 3 6. TF S31. MC 68. MC 132. E 7. TF S32. MC 69. MC 133. E Learning Objective 4 8. TF 35. MC S41. MC 74. MC 80. MC 86. MC 131. E 9. TF 36. MC S42. MC 75. MC 81. MC 87. MC [Show More]

Last updated: 1 year ago

Preview 1 out of 39 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$14.00

Document information

Connected school, study & course

About the document

Uploaded On

Nov 04, 2020

Number of pages

39

Written in

Additional information

This document has been written for:

Uploaded

Nov 04, 2020

Downloads

0

Views

55

.png)