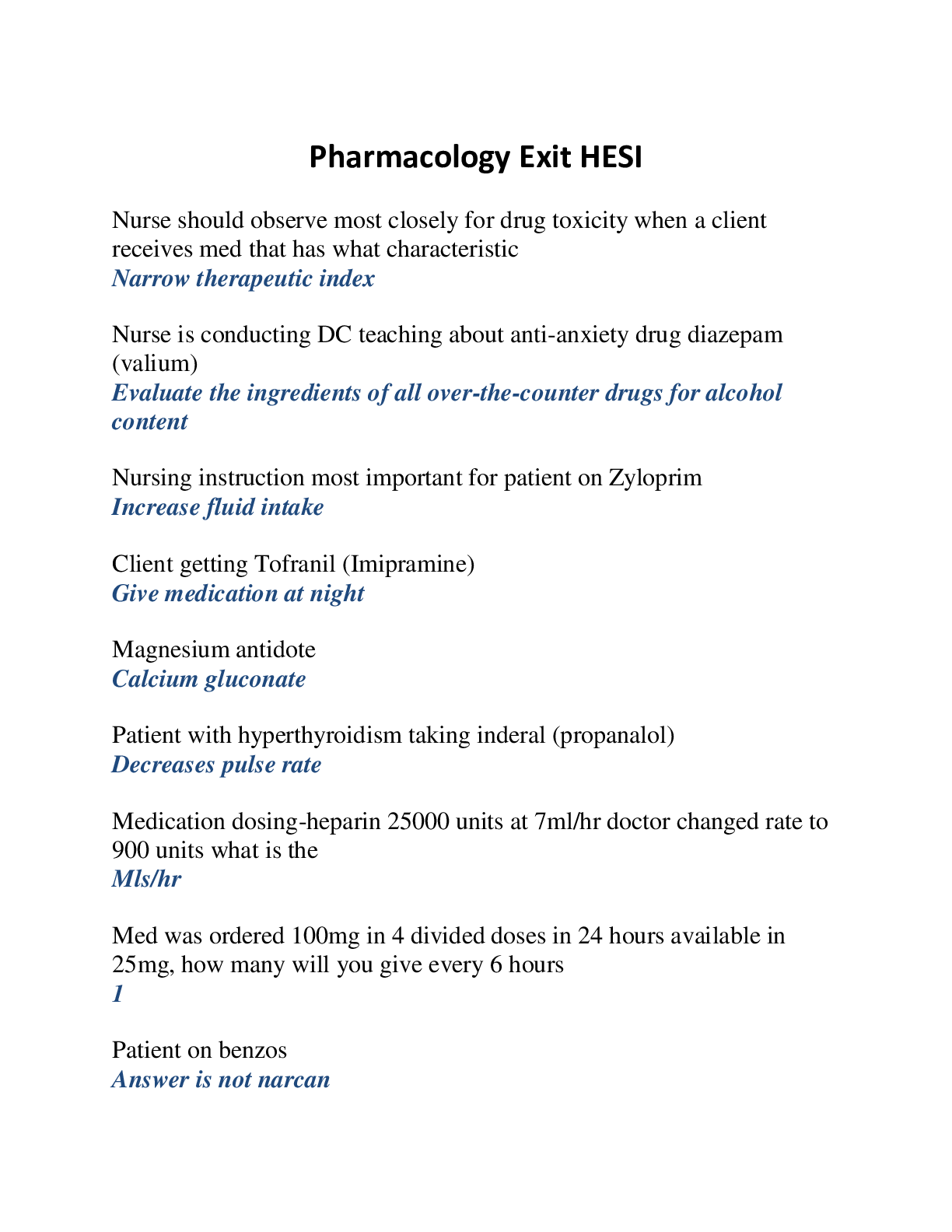

Accounting > QUESTIONS & ANSWERS > Accounting 1 Milestone 3 test question with answers updated 2020 (All)

Accounting 1 Milestone 3 test question with answers updated 2020

Document Content and Description Below

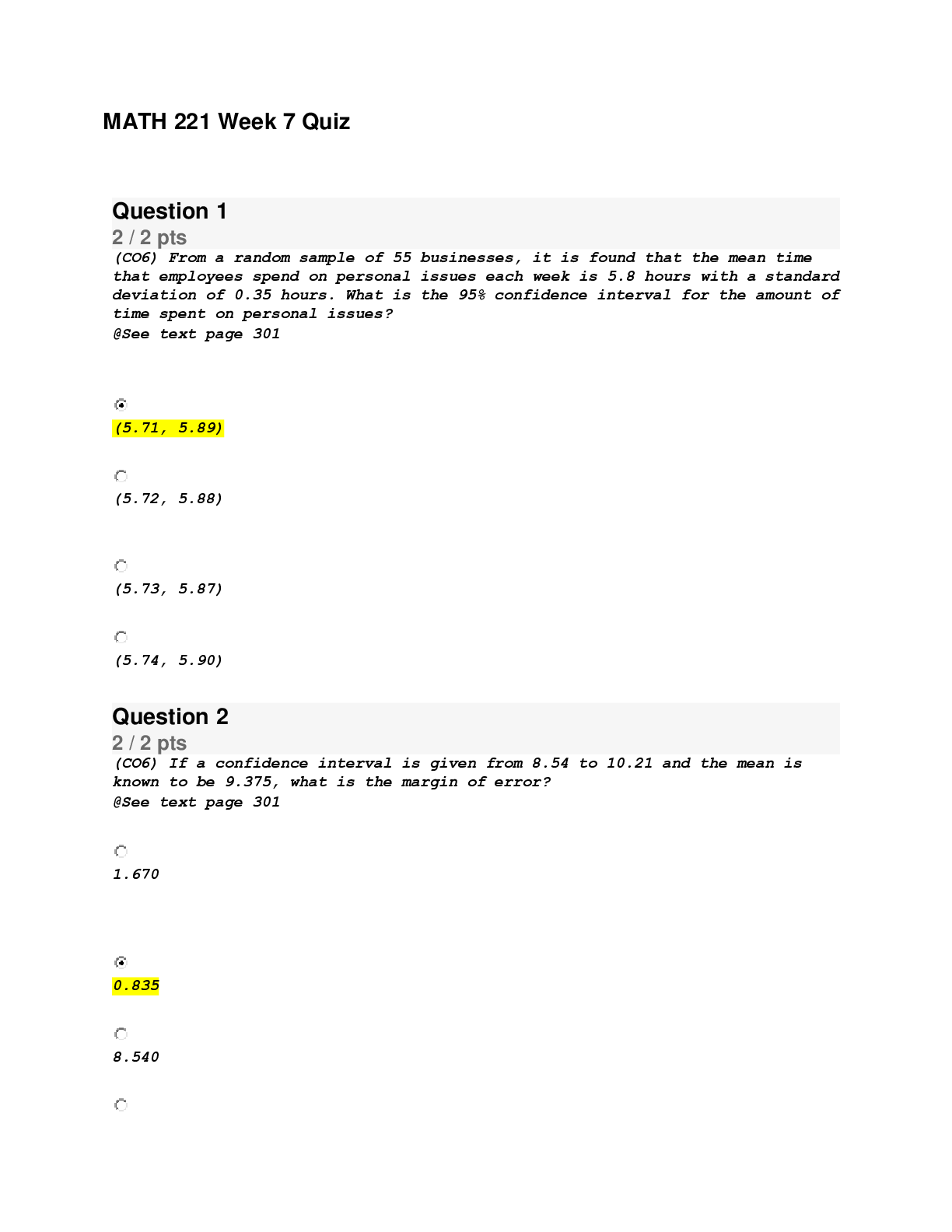

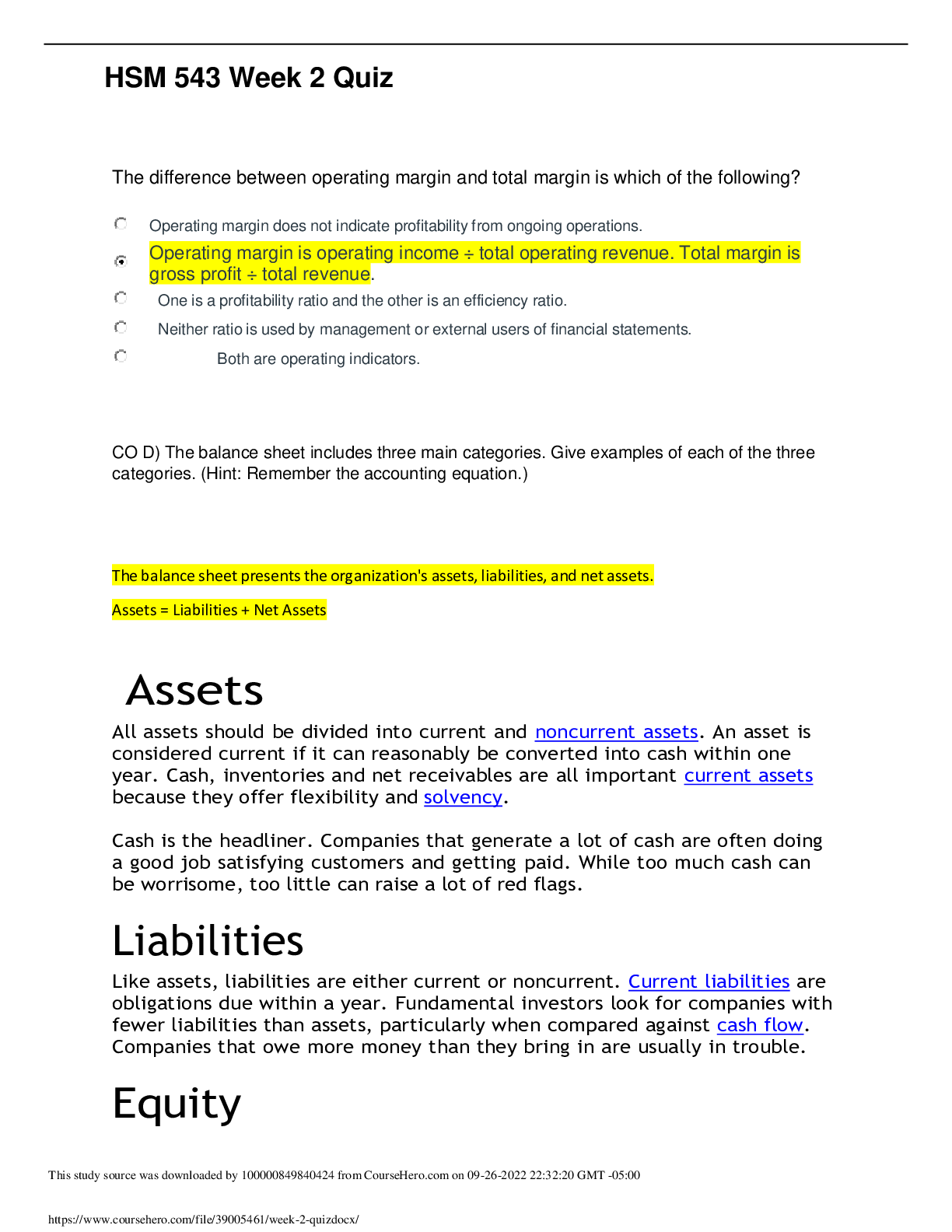

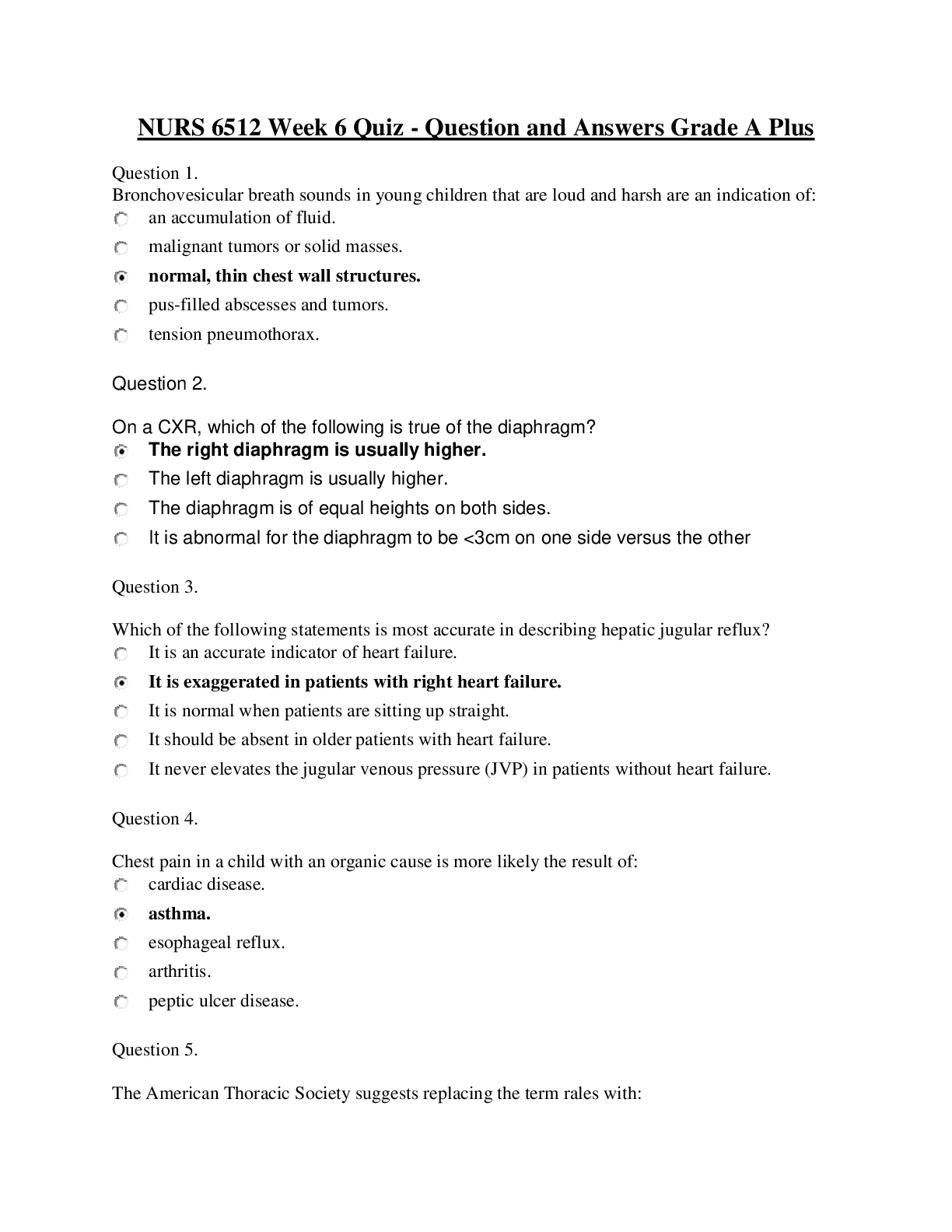

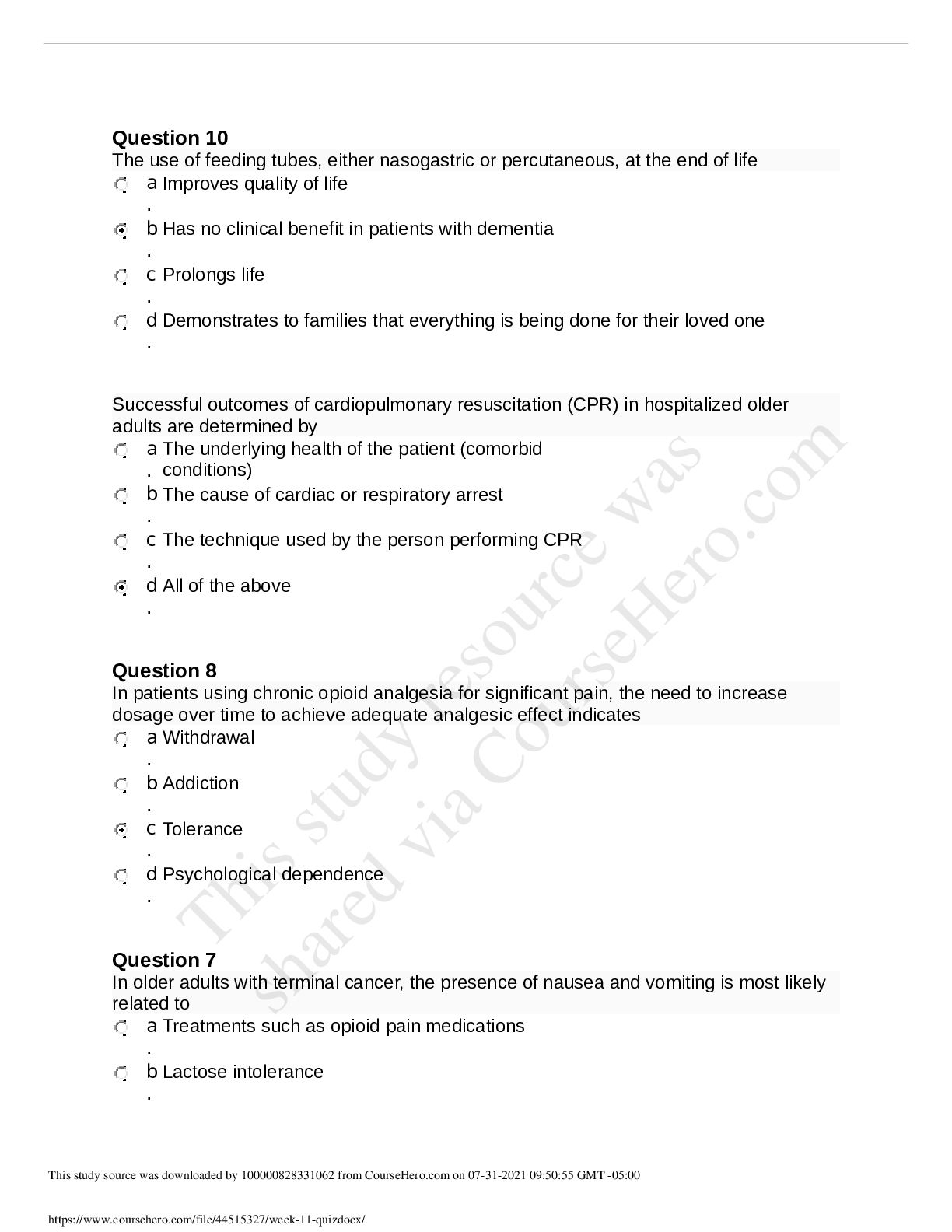

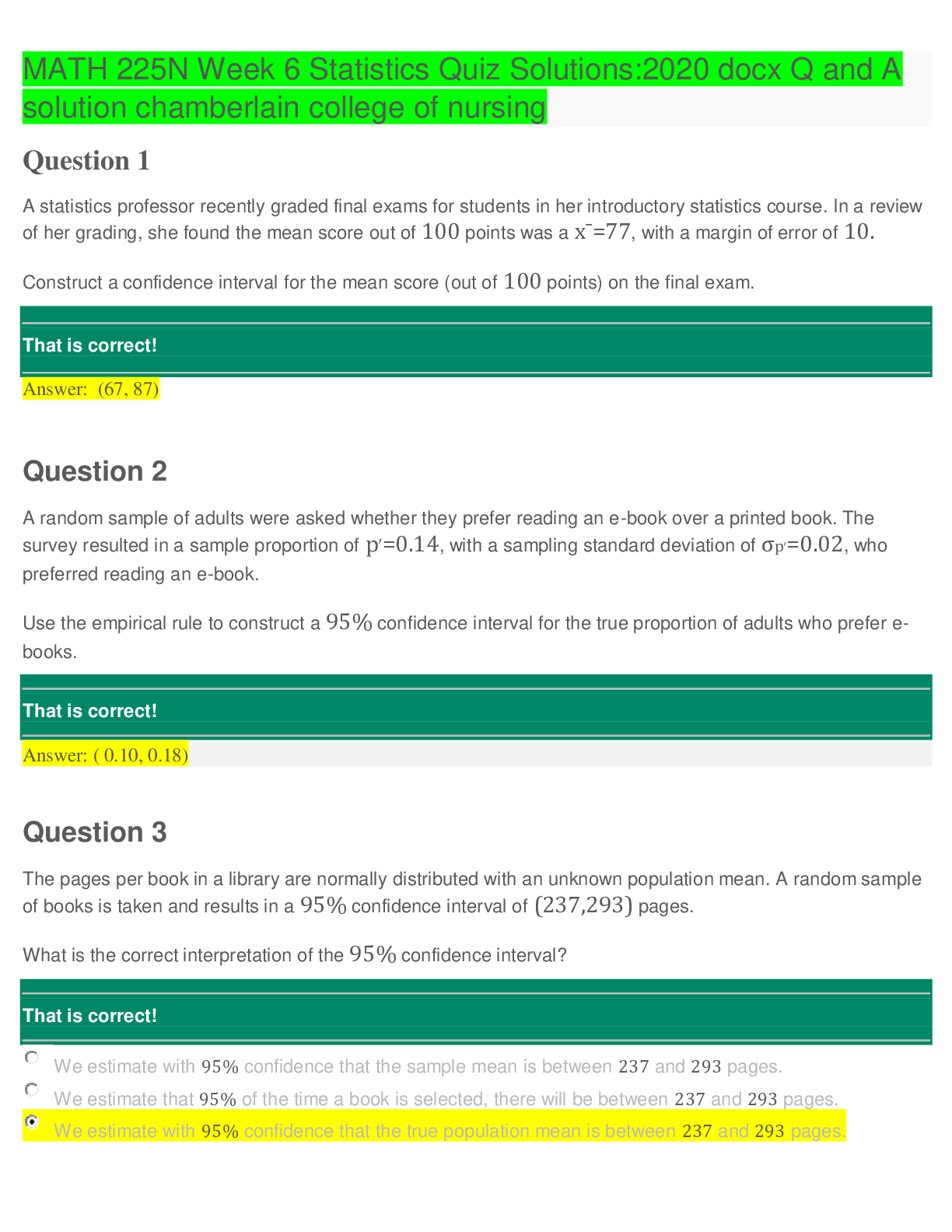

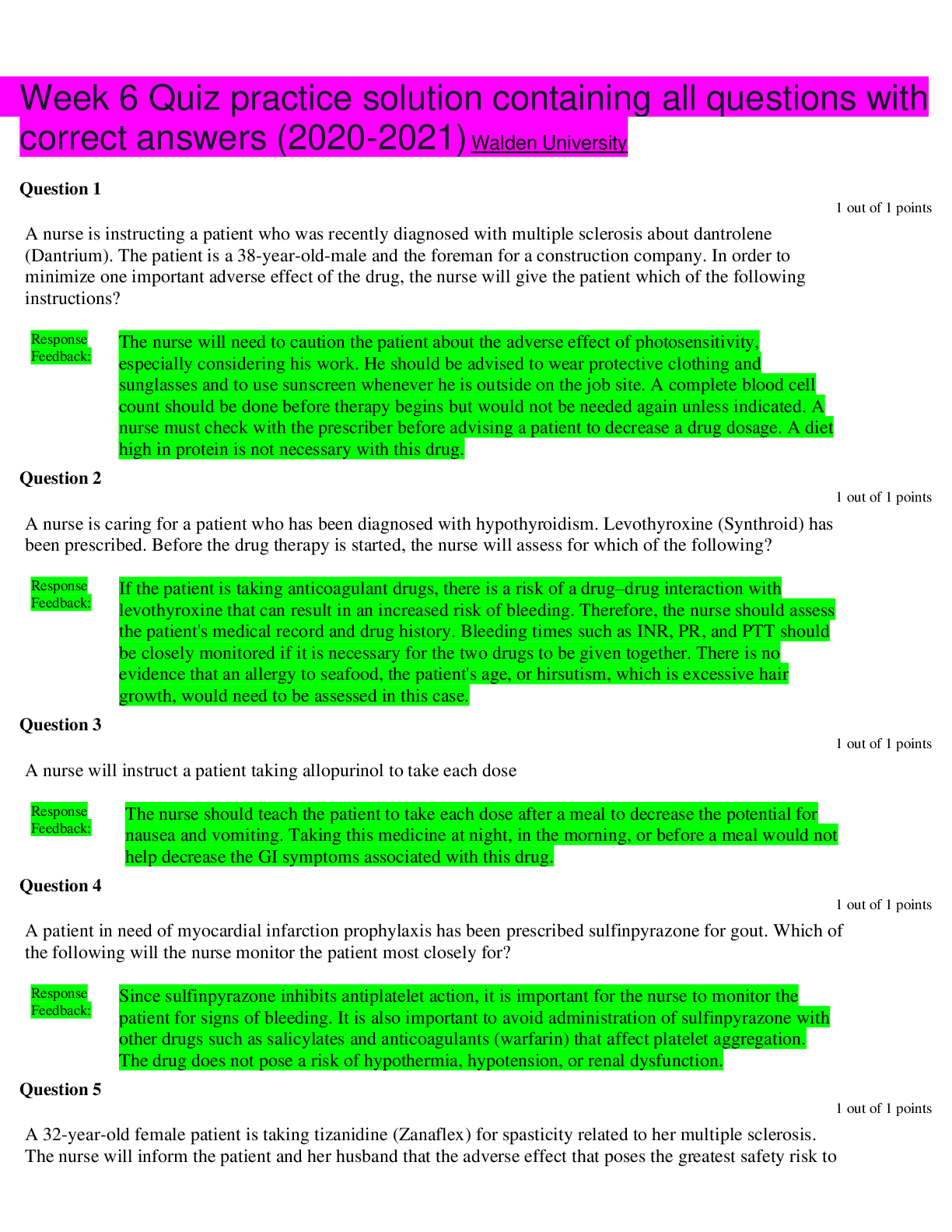

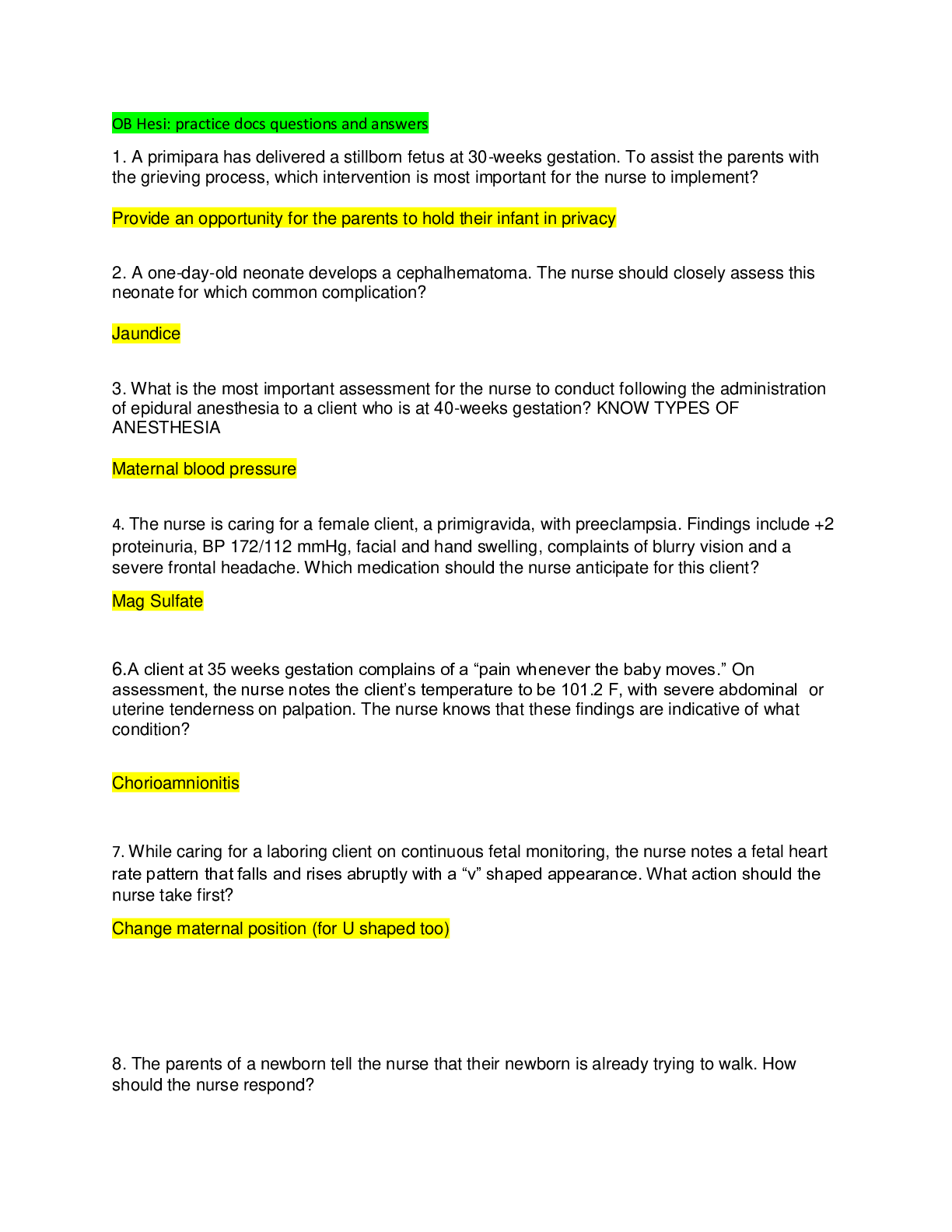

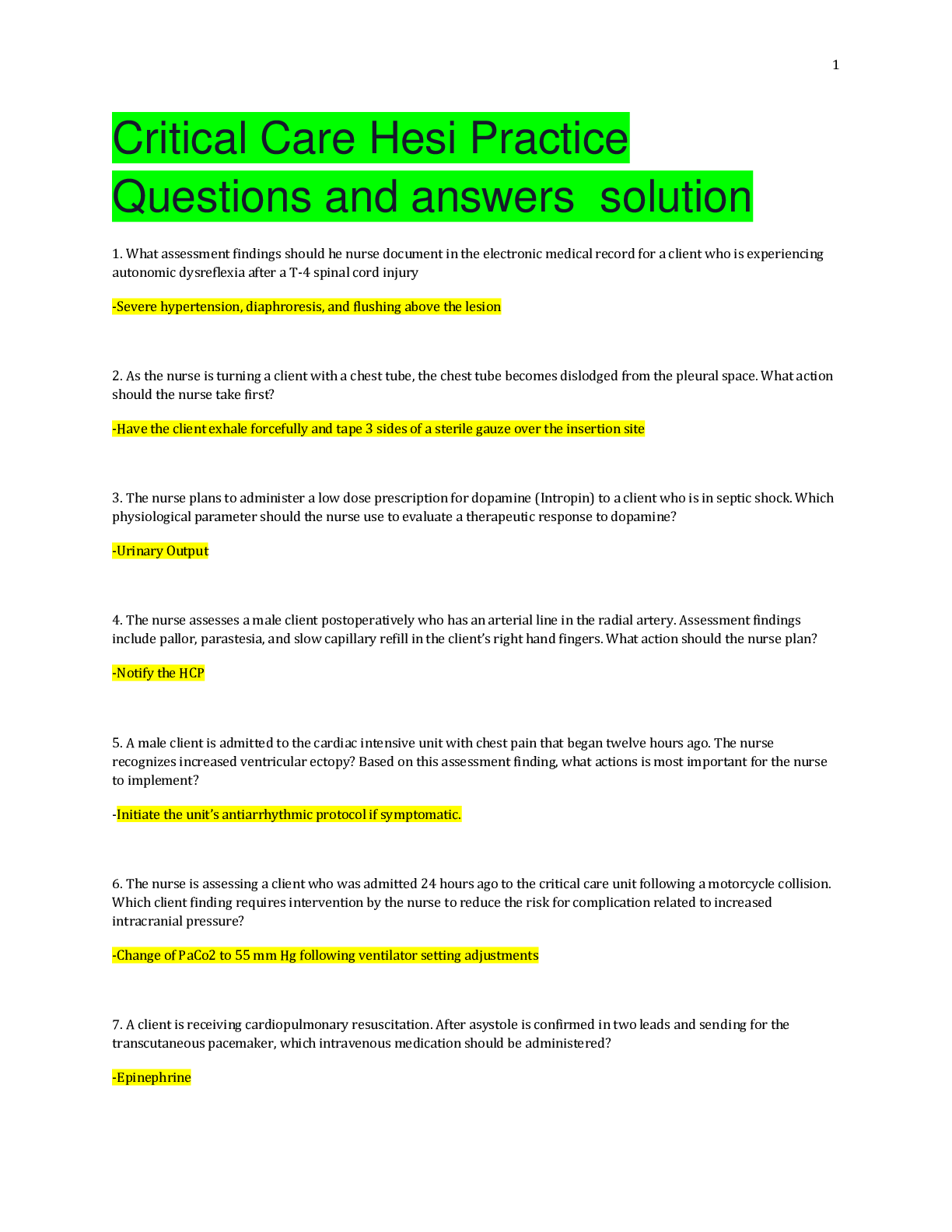

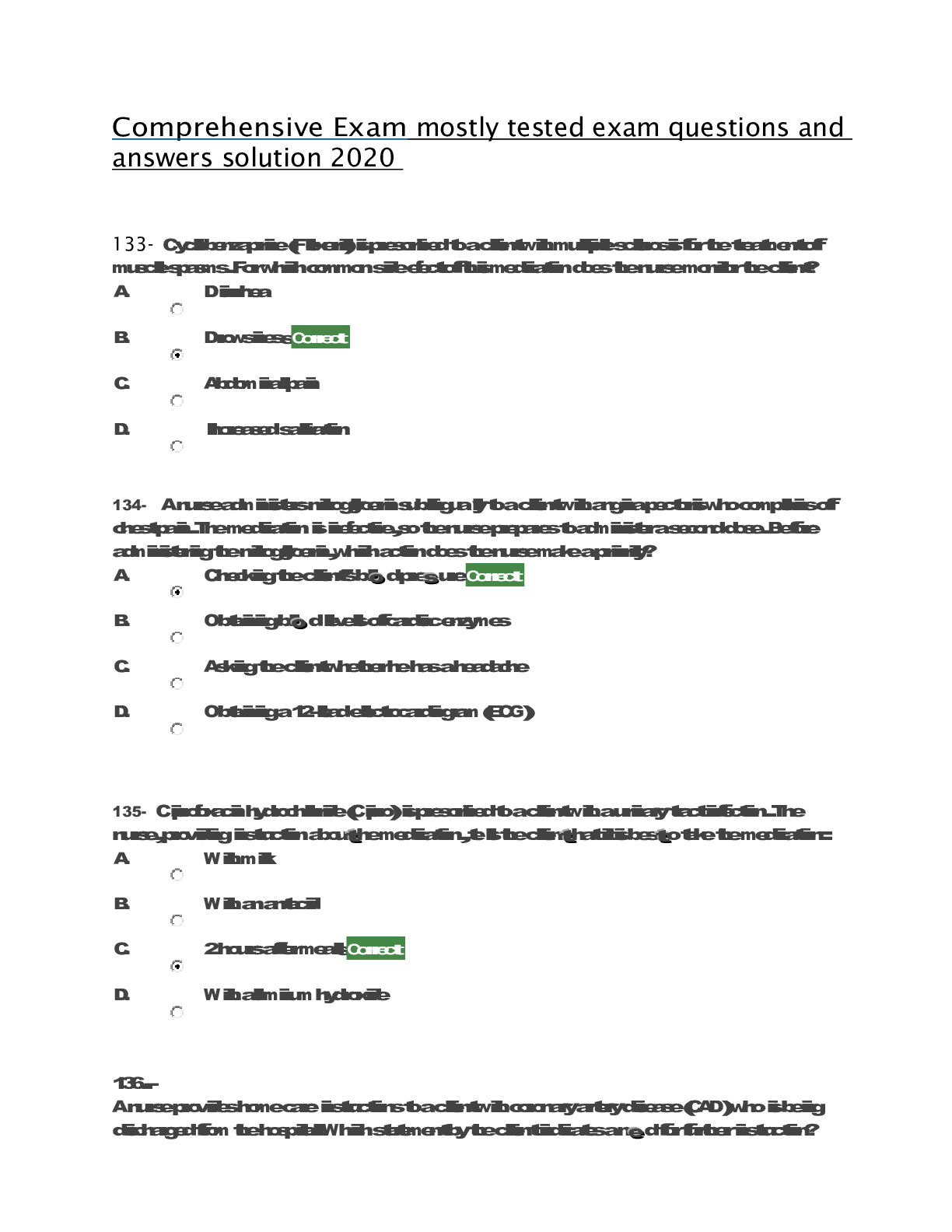

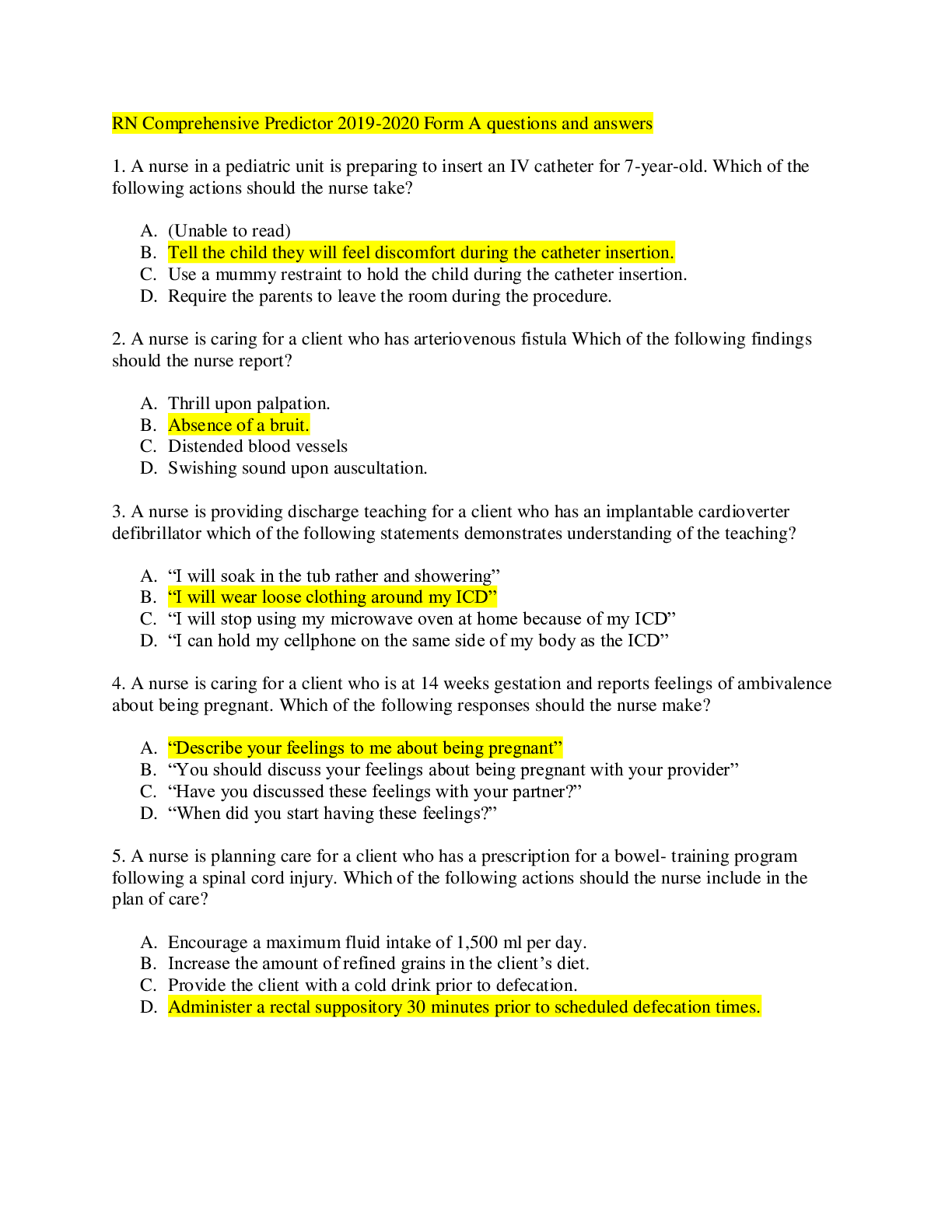

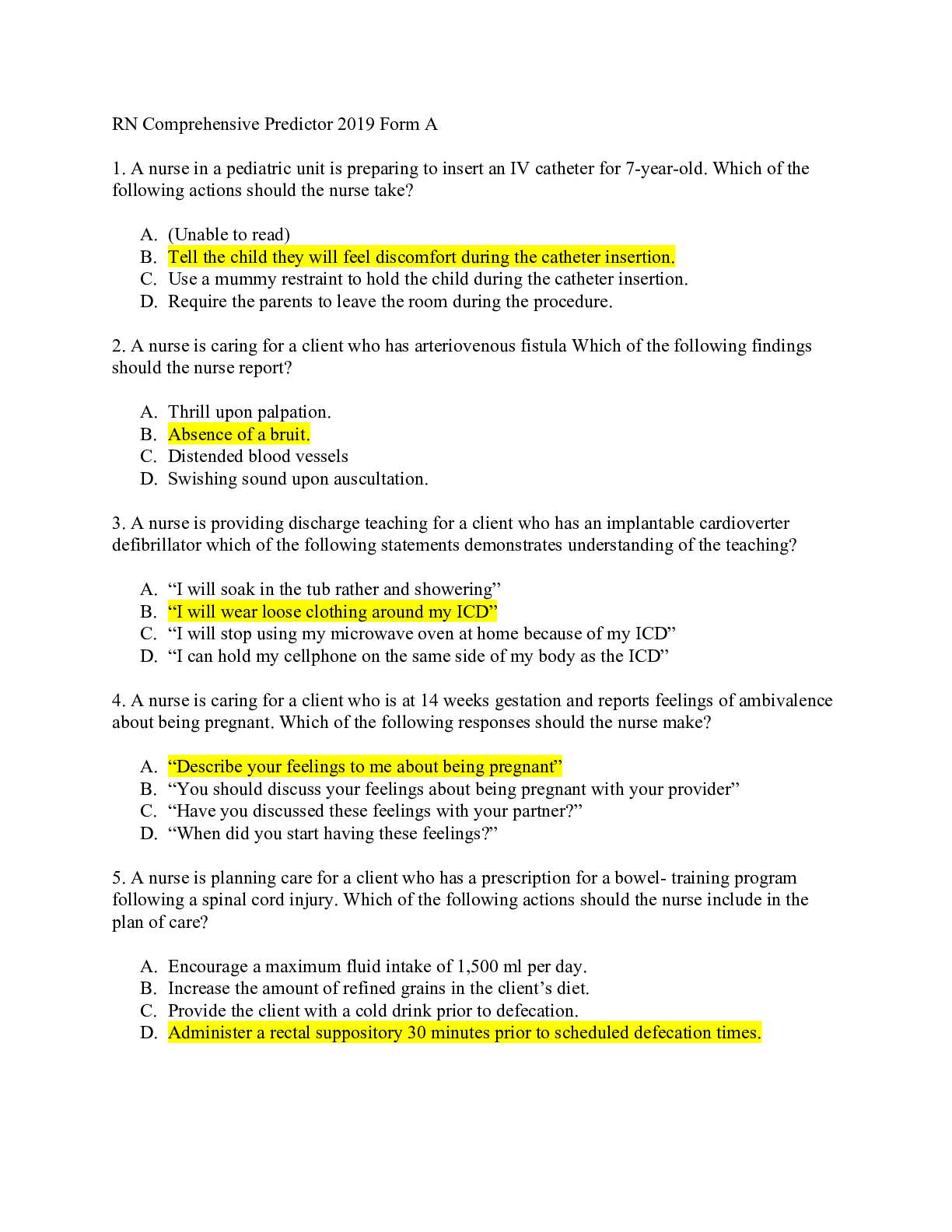

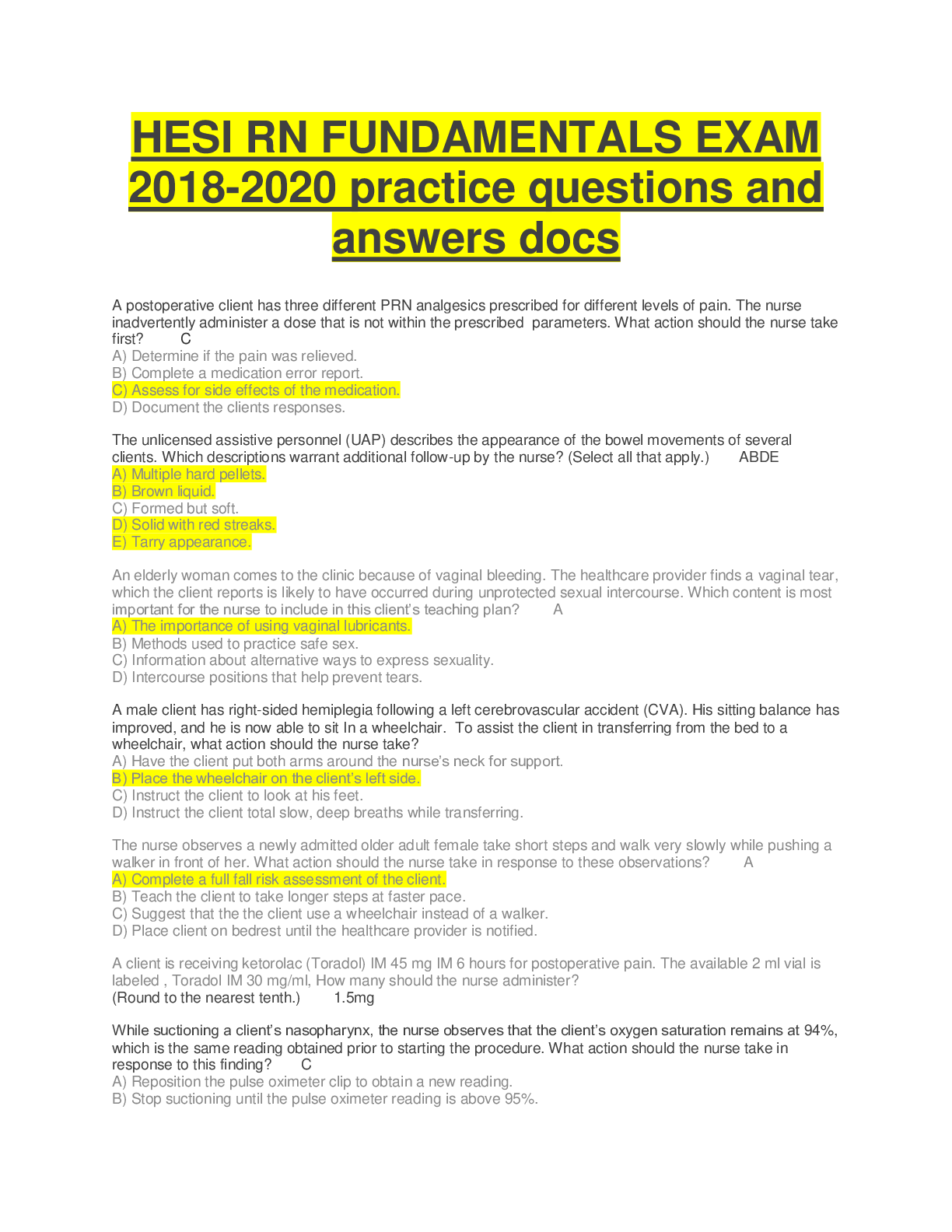

Accounting 1 Milestone 3 test question with answers updated 2020 1 Compute the correct Cost of Goods Sold in September using the FIFO method, based on the information in the table above. $3,... 910 $2,630 $1,865 $1,805 CONCEPT FIFO 2 Which one of the businesses below would most likely use the FIFO method of inventory valuation? Stone and brick company Petroleum company Luxury car dealership Produce stand CONCEPT Inventory Cost Flow Assumptions 3 Acme Furniture purchased 10 desks for $100 each and paid the invoice in full within 20 days, which reduced the price of each desk to $90. Which of the following amounts would be recorded in the purchases account of Acme Furniture? $100 $1,000 $200 $900 CONCEPT Merchandising: Purchases, Sales, Discounts, Returns and Allowance 4 Brett agreed to the freight on board (FOB) destination method for an order of t-shirts that is ready to ship. The freight is in New York, at the port of distribution, to be delivered to Brett's clothing store in Pennsylvania. Who owns the freight at the loading docks in New York? Brett The supplier The shipping company Brett's customer CONCEPT Merchandising 5 If Kevin purchased 175 candles at $3 each and sold 90 candles for $7 each, which of the following is his cost of goods sold? $270 $630 $735 $525 CONCEPT Merchandising 6 In 2011, Matt's hunting store sold goods that cost $89,000, and had expenses that totaled $12,000. His average stock of goods during 2011 was $45,000. Which of the following is Matt’s hunting store inventory turnover ratio in 2011? 3.75 1.98 6.42 1.71 CONCEPT Merchandising Financial Statement Analysis 7 Which inventory method was used to calculate cost of goods sold, based on the information above? Weighted average Specific ID FIFO LIFO CONCEPT Inventory Cost Flow Assumptions 8 Based on the information above, calculate the Cost of Goods Purchased. $13,450 $9,475 $13,375 $9,550 CONCEPT Expanded Income Statement 9 Which of the businesses below uses a periodic inventory method? A grocery store A bookstore An auto parts store An art gallery CONCEPT Inventory Accounting Methods 10 Ann bought three sweaters online. Each of the sweaters was normally priced at $75. She received a sales discount for paying for her sweaters in full within 10 days. She ultimately paid $180 for all three. Which discount percentage did she receive? 5% 10% 20% 25% CONCEPT Merchandising: Purchases, Sales, Discounts, Returns and Allowance 11 Based on the information in this portion of an expanded income statement, what is the total of the Goods Available for Sale? $104,000 $92,000 $167,000 $138,000 CONCEPT Expanded Income Statement 12 What is calculated only at the end of a period in the periodic inventory method? Gross sales Current inventory Cost of goods purchased Sales returns and allowances CONCEPT Inventory Accounting Methods 13 An expanded income statement is generally divided by the different categories of expenses. The most common categories are __________. sales expenses and general and admin revenues sales revenues and general and admin expenses sales expenses and general expenses sales expenses and general and admin expenses CONCEPT Expanded Income Statement 14 Given the information provided above, what is the gross margin percentage? 73% 79% 71% 83% CONCEPTMerchandising Financial Statement Analysis 15 Given the information in the partial income statement below, what is the cost of goods sold? $45,500 $53,500 $68,000 $50,000 CONCEPT Expanded Income Statement 16 Using the LIFO method and the information in this image, what is the Cost of Goods Sold during December? $60,000 $95,000 $105,000 $80,000 CONCEPT LIFO 17 Which of the following scenarios would use a purchases subsidiary ledger? Ann Marie wants to determine whether to extend more credit to a customer. Trudy wants to know which suppliers have raised their prices in the past year. John wants to identify his top 20 customers. Maybelle wants to know which customers have been late on their payments. CONCEPT Sales & Purchases Subsidiary Ledger 18 Troy has 75 fuses that he purchased for $4 each and 17 air filters that he purchased for $12 each on the floor of his auto repair shop. He has 80 of the same fuses and nine of the same air filters in his storeroom. Which of the following is the weighted average cost of the fuses and air filters being sold if Troy implements the weighted average method to inventory these supplies? $5.15 $5.48 $4.02 $4.09 CONCEPT Weighted Average Method [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 09, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Nov 09, 2020

Downloads

0

Views

156

2020 ans.png)

.png)