Finance > QUESTIONS & ANSWERS > FIN 515 FINAL EXAM solved solution newly updated docs (All)

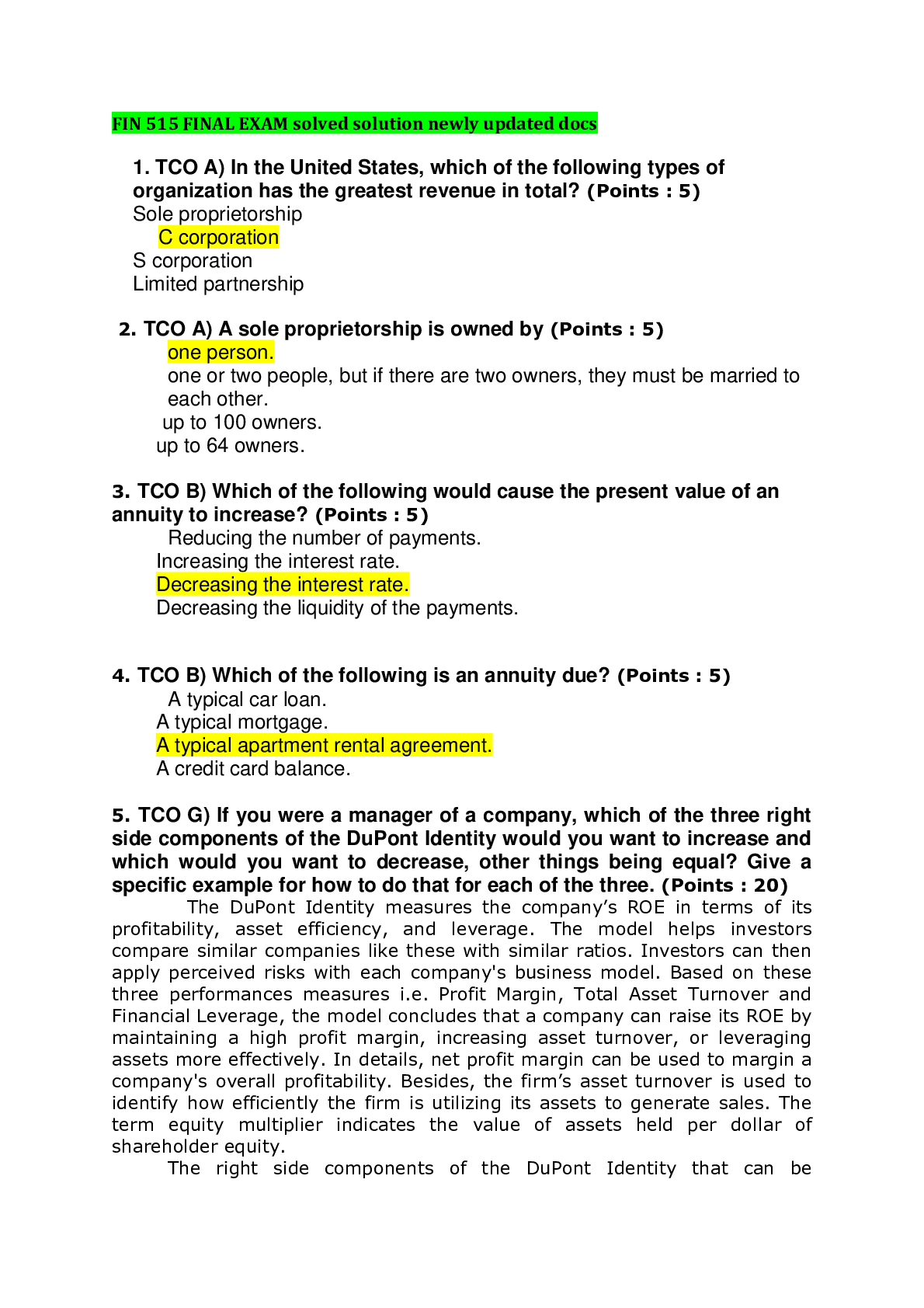

FIN 515 FINAL EXAM solved solution newly updated docs

Document Content and Description Below

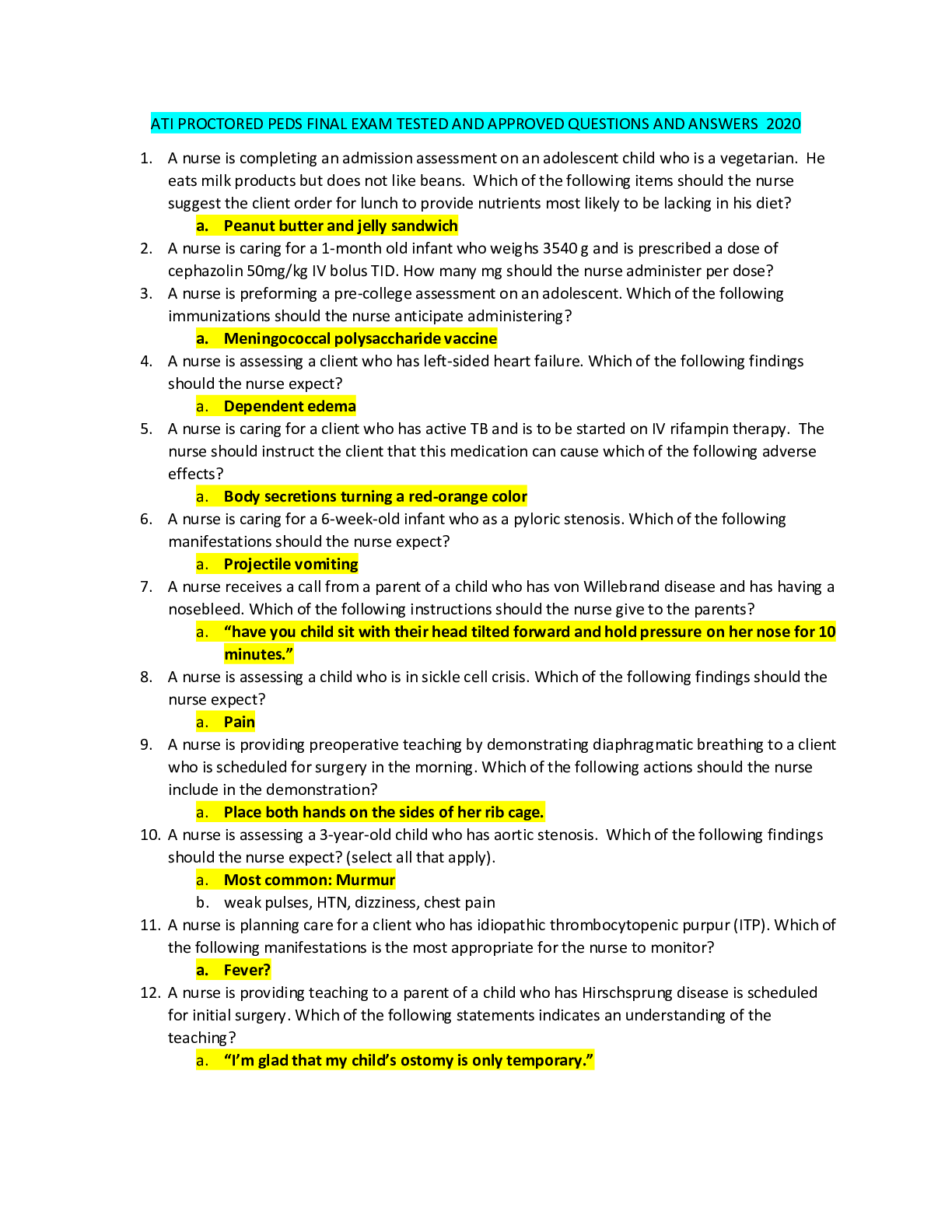

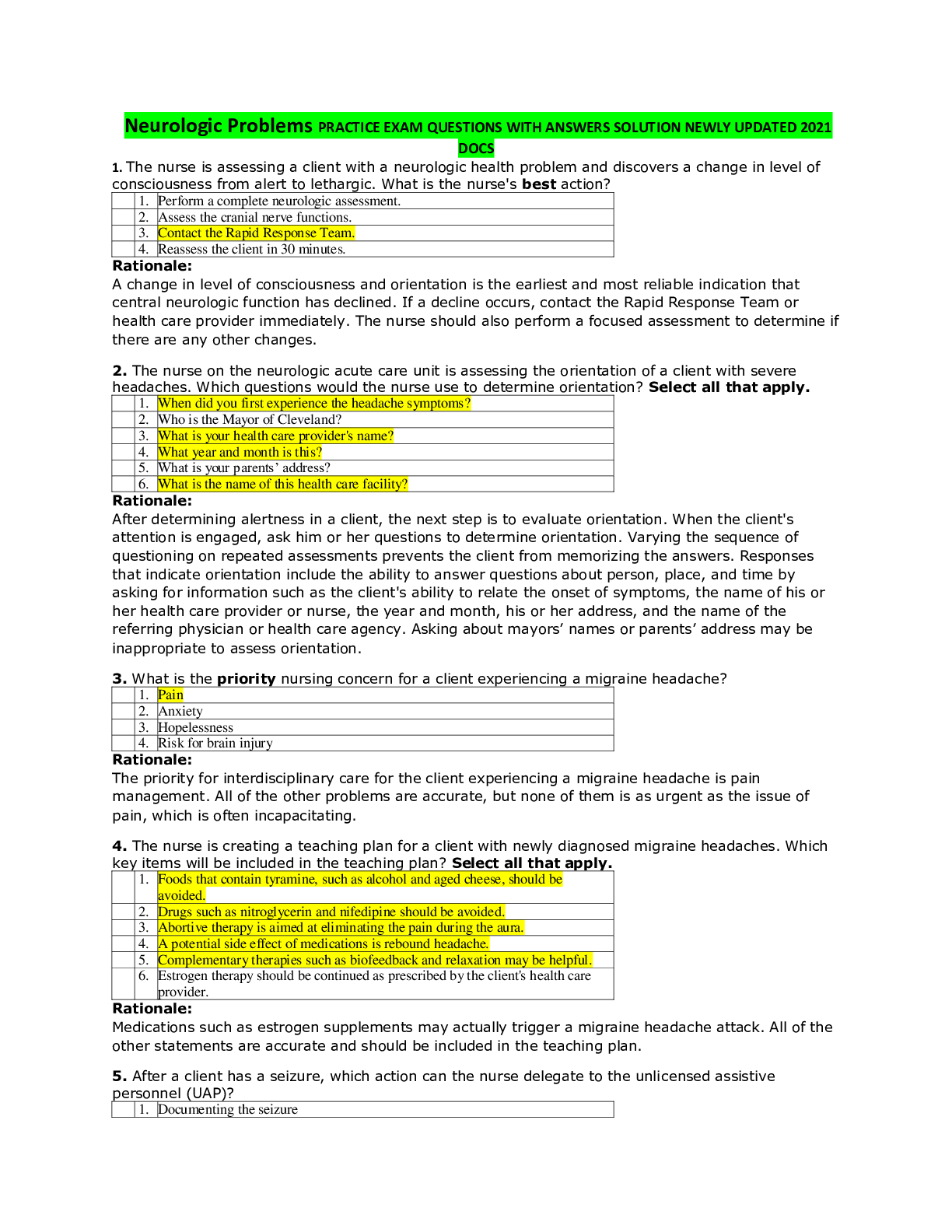

FIN 515 FINAL EXAM solved solution newly updated docs 1. TCO A) In the United States, which of the following types of organization has the greatest revenue in total? (Points : 5) 2. TCO A) A s... ole proprietorship is owned by (Points : 5) 3. TCO B) Which of the following would cause the present value of an annuity to increase? (Points : 5) 4. TCO B) Which of the following is an annuity due? (Points : 5) 5. TCO G) If you were a manager of a company, which of the three right side components of the DuPont Identity would you want to increase and which would you want to decrease, other things being equal? Give a specific example for how to do that for each of the three. (Points : 20) 6. TCO D) A stock has just paid a dividend and will pay a dividend of $3.00 in a year. The dividend will stay constant for the rest of time. The return on equity for similar stocks is 14%. What is P0? (Points : 20) A stock has just paid a dividend and will pay a dividend of $3.00 in a year, so Dividend for Year 0 and coming years will be $3 7. TCO D) A stock has just paid a dividend and has declared an annual dividend of $2.00 to be paid one year from today. The dividend is expected to grow at a 5% annual rate. The return on equity for similar stocks is 12%. What is P0? (Points : 20) 8. (TCO D) A particular bond has 8 years to maturity. It has a face value of $1,000. It has a YTM of 7% and the coupons are paid semiannually at a 10% annual rate. What does the bond currently sell for? (Points : 10) 9. (TCO D) A bond currently sells for $1,000 and has a par of $1,000. It was issued two years ago and had a maturity of 10 years. The coupon rate is 7% and the interest payments are made semiannually. What is its YTM? (Points : 10) 10. (TCO D) What is β and why is it important to investors and issuers of stock? Describe the behavior of stocks with βs of greater than one, less than one, and less than zero. (Points : 30) 11. TCO E) A company has 100 million shares outstanding trading for $8 per share. It also has $900 million in outstanding debt. If its equity cost of capital is 15%, and its debt cost of capital is 12%, and its effective corporate tax rate is 40%, what is its weighted average cost of capital? (Points : 30) 12. TCO A) What is the difference between capital structure and capital budgeting? Explain and give an example of a capital structure decision and an example of a capital budgeting decision. (Points : 25) 13. TCO H) What is the difference between the cash cycle and the operating cycle? Under what condition would they be the same? (Points : 30) [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 09, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Nov 09, 2020

Downloads

0

Views

36