Finance > QUESTION PAPER (QP) > CMA Part 1 – Financial Reporting, Planning, Performance, and Control Examination Practice Question (All)

CMA Part 1 – Financial Reporting, Planning, Performance, and Control Examination Practice Questions

Document Content and Description Below

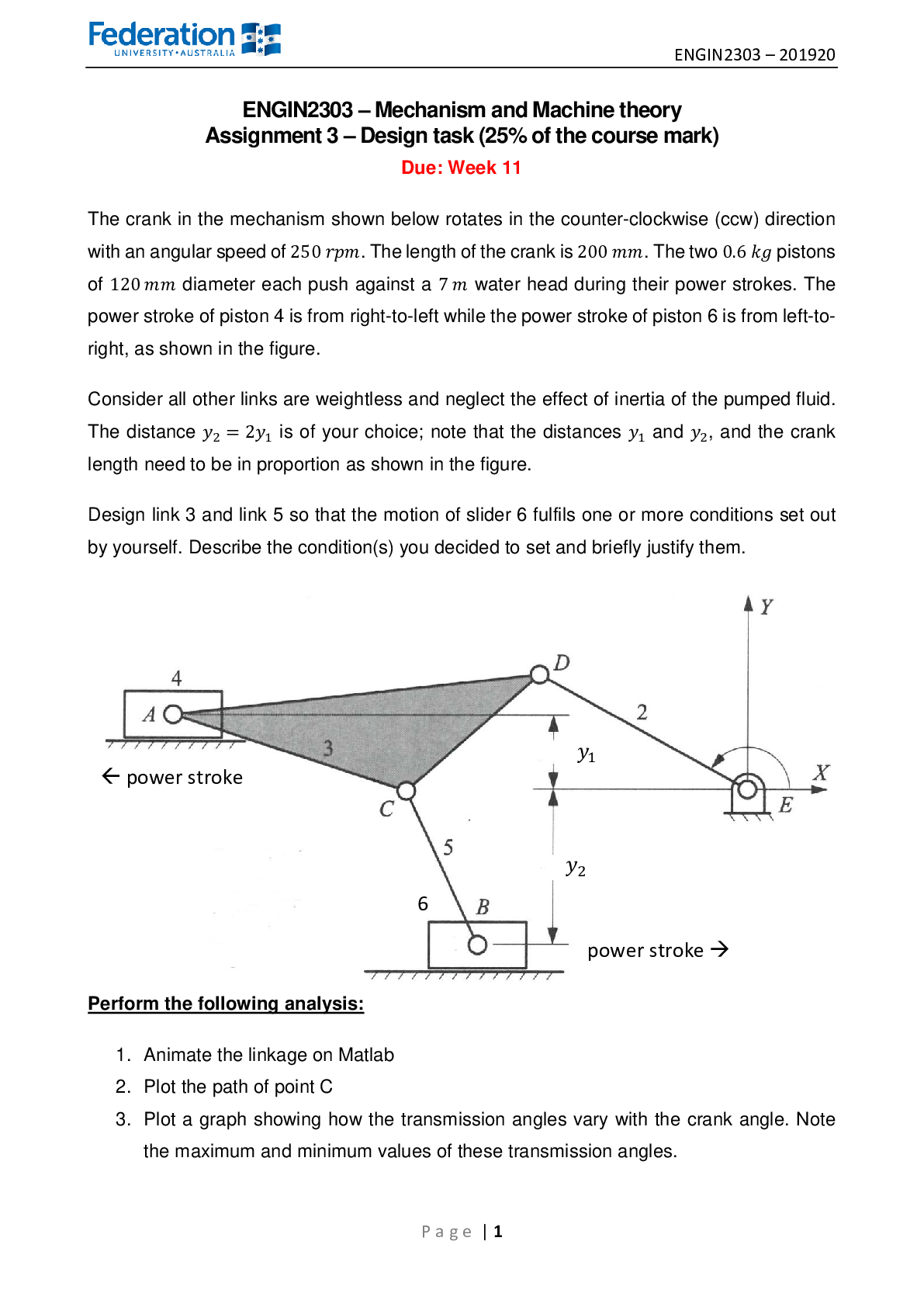

CMA Part 1 – Financial Reporting, Planning, Performance, and Control Examination Practice Questions © Copyright 2017 Institute of Certified Management Accountants3 CMA Part 1 – Financial Repor... ting, Planning, Performance, and Control Examination Practice Questions Section A: External Financial Reporting Decisions 1. CSO: 1A1a LOS: 1A1a The financial statements included in the annual report to the shareholders are least useful to which one of the following? a. Stockbrokers. b. Bankers preparing to lend money. c. Competing businesses. d. Managers in charge of operating activities. 2. CSO: 1A1d LOS: 1A1e Which one of the following would result in a decrease to cash flow in the indirect method of preparing a statement of cash flows? a. Amortization expense. b. Decrease in income taxes payable. c. Proceeds from the issuance of common stock. d. Decrease in inventories. 3. CSO: 1A1c LOS: 1A1b The statement of shareholders’ equity shows a a. reconciliation of the beginning and ending balances in shareholders’ equity accounts. b. listing of all shareholders’ equity accounts and their corresponding dollar amounts. c. computation of the number of shares outstanding used for earnings per share calculations. d. reconciliation of the beginning and ending balances in the Retained Earnings account. 4. CSO: 1A1d LOS: 1A1b When using the statement of cash flows to evaluate a company’s continuing solvency, the most important factor to consider is the cash a. balance at the end of the period. b. flows from (used for) operating activities. c. flows from (used for) investing activities. d. flows from (used for) financing activities.4 5. CSO: 1A1a LOS: 1A1b A statement of financial position provides a basis for all of the following except a. computing rates of return. b. evaluating capital structure. c. assessing liquidity and financial flexibility. d. determining profitability and assessing past performance. 6. CSO: 1A1b LOS: 1A1b The financial statement that provides a summary of the firm’s operations for a period of time is the a. income statement. b. statement of financial position. c. statement of shareholders’ equity. d. statement of retained earnings. 7. CSO: 1A1b LOS: 1A1e Bertram Company had a balance of $100,000 in Retained Earnings at the beginning of the year and $125,000 at the end of the year. Net income for this time period was $40,000. Bertram’s Statement of Financial Position indicated that Dividends Payable had decreased by $5,000 throughout the year, despite the fact that both cash dividends and a stock dividend were declared. The amount of the stock dividend was $8,000. When preparing its Statement of Cash Flows for the year, Bertram should show Cash Paid for Dividends as a. $20,000. b. $15,000. c. $12,000. d. $5,000. 8. CSO: 1A1b LOS: 1A1c All of the following are elements of an income statement except a. expenses. b. shareholders’ equity. c. gains and losses. d. revenue.5 9. CSO: 1A1d LOS: 1A1c Dividends paid to company shareholders would be shown on the statement of cash flows as a. operating cash inflows. b. operating cash outflows. c. cash flows from investing activities. d. cash flows from financing activities. 10. CSO: 1A1d LOS: 1A1c All of the following are classifications on the statement of cash flows except a. operating activities. b. equity activities. c. investing activities. d. financing activities. 11. CSO: 1A1d LOS: 1A1c The sale of available-for-sale securities should be accounted for on the statement of cash flows as a(n) a. operating activity. b. investing activity. c. financing activity. d. noncash investing and financing activity. 12. CSO: 1A1d LOS: 1A1c A statement of cash flows prepared using the indirect method would have cash activities listed in which one of the following orders? a. Financing, investing, operating. b. Investing, financing, operating. c. Operating, financing, investing. d. Operating, investing, financing. 13. CSO: 1A1d LOS: 1A1e Kelli Company acquired land by assuming a mortgage for the full acquisition cost. This transaction should be disclosed on Kelli’s Statement of Cash Flows a [Show More]

Last updated: 1 year ago

Preview 1 out of 491 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 28, 2022

Number of pages

491

Written in

Additional information

This document has been written for:

Uploaded

Jul 28, 2022

Downloads

0

Views

57

.png)