Finance > QUESTIONS & ANSWERS > Harvard University FIN 090 Assessment Review - Corporate Finance Institute Building a 3 Statement Fi (All)

Harvard University FIN 090 Assessment Review - Corporate Finance Institute Building a 3 Statement Financial Model

Document Content and Description Below

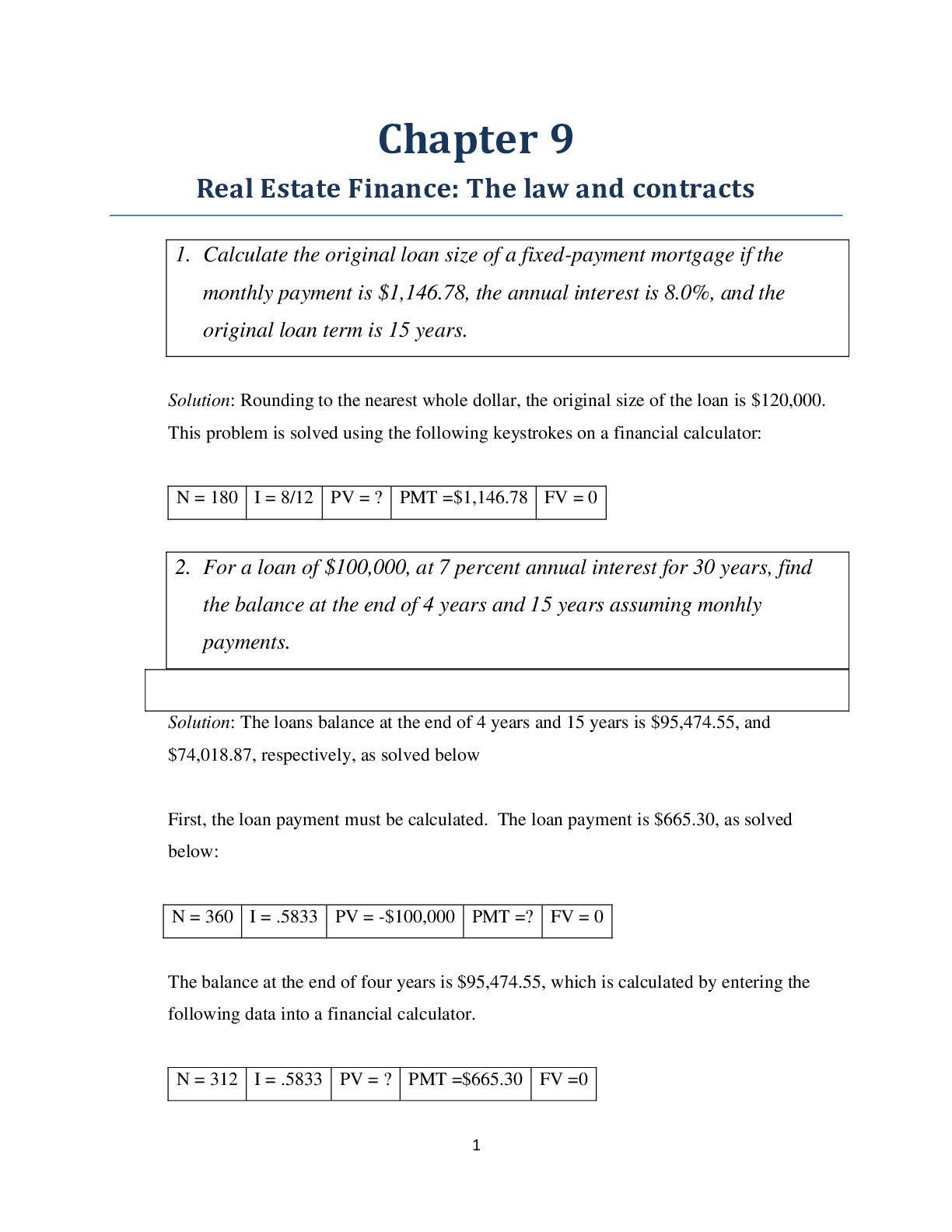

Harvard University FIN 090 Assessment Review - Corporate Finance Institute Building a 3 Statement Financial Model 1 Which of the following is NOT a best practice for Ònancial model inputs? 2 C... omplex Ònancial models are all of the following EXCEPT: Imported Questions - 10/12/2017 12:44 PM 3 Forecast the 2019 Cost of goods sold on the previous year’s number and the assumptions 2018 Actual 2019 Estimate Sales Growth 6% 8% Gross Margin 40% 40% Revenues 50,000 Cost of Goods Sold 30,000 4 Forecast the accounts receivable for Company XYZ using the following annual information. Receivable days assumption = 55 days Payable days assumption = 69 days Forecasted revenue = $263,500 Forecasted cost of goods sold = $114,780 Forecast accounts receivable = Receivable days / 365 x Sales = 55 / 365 x $263,500 = $39,705 5 What formula below can be used to forecast inventory? 6 Which of the following items can be found in a published cash Óow statement under "operating activities"? Select ALL correct answers. https://cfi.brillium.com/Assess.aspx?guid=565B87AA3A6C4F5C8D3998411BBCF4C1&a=R1 4/9 7 What is the total cash from operating activities based on the information below? Net income: 500 Depreciation: 80 Increase in receivables: 100 Increase in inventory: 50 Increase in payables: 60 8 Calculate the end of the year cash balance based on the information below: Beginning of the year cash balance: 2,000 Net income: 300 Depreciation: 140 Increase in accounts payable: 60 Acquisitions of PP&E: 580 Dividends paid in the current year: 130 Increase in long-term debt: 200 9 Which Excel function or tool will you use to display the cells that are referred to by a formula in the selected 10 What is the forecasted value of property, plan and equipment (PP&E) based on the following information: Capital asset turnover ratio: 2.5 Forecasted revenues: $120 Forecasted costs of goods sold: $80 11 p p y g p g assets and liabilities listed below? 12 What’s the forecasted capital expenditure based on the information below? Net PP&E beginning of period: 15,000 Net PP&E end of period: 17,500 Depreciation expenses: 2,400 13 What’s the retained earnings end of period based on the information below? Retained earnings beginning of period: 7,500 Net income: 2,300 Dividends paid: 1,700 14 What’s the depreciation expense based on the information below? Depreciation (percent of sales): 4% Revenues: 60,000 Gross proÒt: 25,000 PP&E: 40,000 15 What’s the forecasted EBIT based on the information below? Revenues: 56,000 Cost of goods sold: 32,000 SG&A: 8,500 Depreciation: 2,700 Interest: 1,200 Taxes: 3,800 [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$9.00

Document information

Connected school, study & course

About the document

Uploaded On

Aug 17, 2022

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Aug 17, 2022

Downloads

0

Views

57