Accounting > QUESTIONS & ANSWERS > CHAPTER 21 ACCOUNTING FOR LEASES IFRS questions are available at the end of this chapter WITH CORREC (All)

CHAPTER 21 ACCOUNTING FOR LEASES IFRS questions are available at the end of this chapter WITH CORRECT ANSWERS

Document Content and Description Below

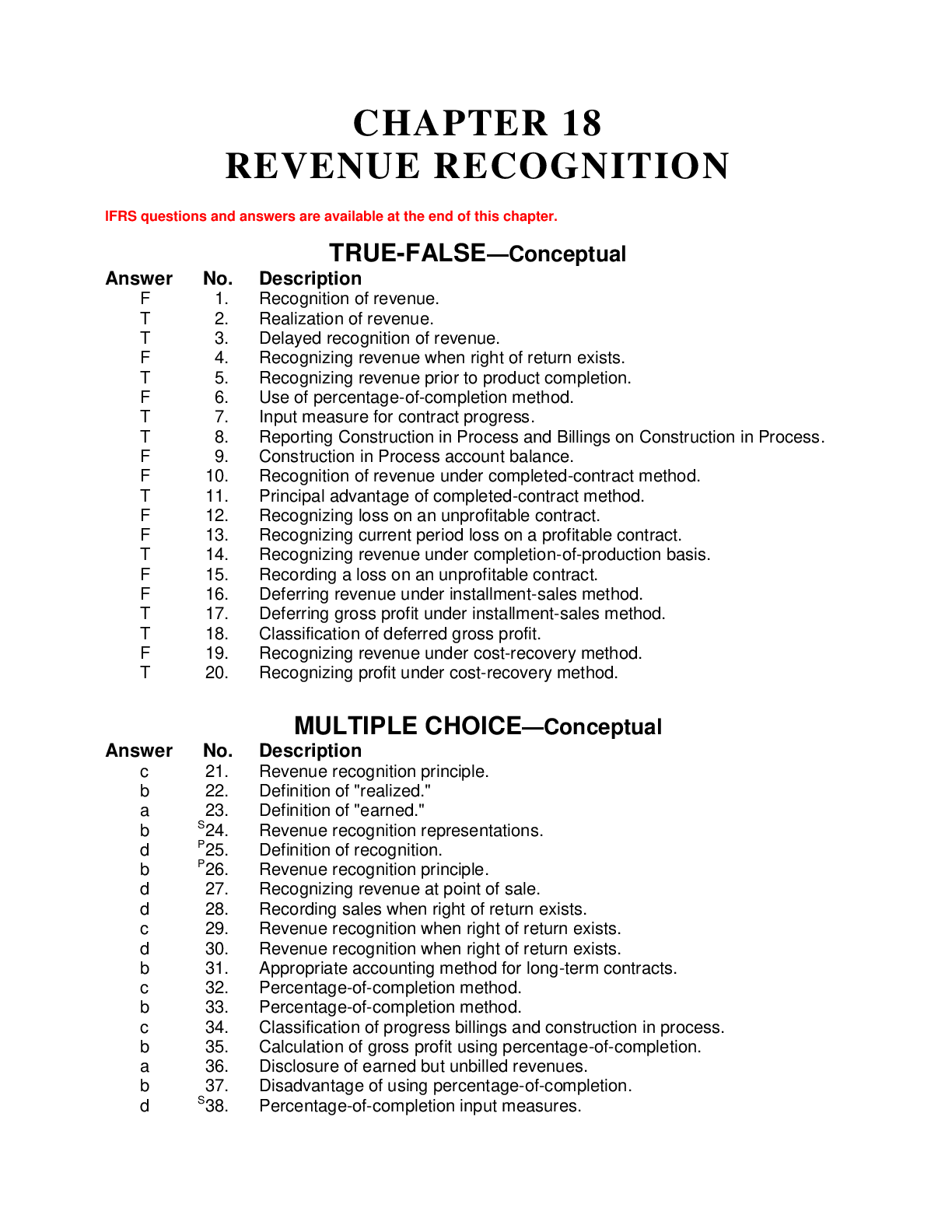

54. What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar.) a. $272,703 b. $872,703 c. $887,703 d. $902,703 Ans: C, LO: 2, Bloom: AP, Difficulty: Moderate, Min: ... 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 55. What is the amount of the total annual lease payment? a. $272,703 b. $872,703 c. $887,703 d. $902,703 Ans: D, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 56. From the lessee’s viewpoint, what type of lease exists in this case? a. Sales-type lease b. Sale-leaseback c. Capital lease d. Operating lease Ans: C, LO: 2, Bloom: C, Difficulty: Easy, Min: 2, AACSB: None, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 57. From the lessor’s viewpoint, what type of lease is involved? a. Sales-type lease b. Sale-leaseback c. Direct-financing lease d. Operating lease Ans: A, LO: 3, Bloom: K, Difficulty: Easy, Min: 2, AACSB: None, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 21 - 15 Test Bank for Intermediate Accounting, Sixteenth Edition 58. Yancey, Inc. would record depreciation expense on this storage building in 2018 of (Rounded to the nearest dollar.) a. $0. b. $495,000. c. $600,000. d. $976,471. Ans: C, LO: 2, Bloom: AP, Difficulty: Easy, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 59. If the lease was nonrenewable, there was no bargain purchase option, title to the building does not pass to the lessee at termination of the lease and the lease term was only for eight years, what type of lease would this be for the lessee? a. Sales-type lease b. Direct-financing lease c. Operating lease d. Capital lease Ans: D, LO: 2, Bloom: K, Difficulty: Moderate, Min: 2, AACSB: None, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 60. Metcalf Company leases a machine from Vollmer Corp. under an agreement which meets the criteria to be a capital lease for Metcalf. The six-year lease requires payment of $170,000 at the beginning of each year, including $25,000 per year for maintenance, insurance, and taxes. The incremental borrowing rate for the lessee is 10%; the lessor’s implicit rate is 8% and is known by the lessee. The present value of an annuity due of 1 for six years at 10% is 4.79079. The present value of an annuity due of 1 for six years at 8% is 4.99271. Metcalf should record the leased asset at a. $848,761. b. $814,435. c. $723,943. d. $694,665. Ans: C, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 61. On December 31, 2018, Lang Corporation leased a ship from Fort Company for an eightyear period expiring December 30, 2026. Equal annual payments of $500,000 are due on December 31 of each year, beginning with December 31, 2018. The lease is properly classified as a capital lease on Lang ‘s books. The present value at December 31, 2018 of the eight lease payments over the lease term discounted at 10% is $2,934,213. Assuming all payments are made on time, the amount that should be reported by Lang Corporation as the total obligation under capital leases on its December 31, 2019 balance sheet is a. $2,727,635. b. $2,500,397. c. $2,177,634. d. $3,000,000. Ans: C, LO: 2, Bloom: AP, Difficulty: Difficult, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None On January 1, 2018, Sauder Corporation signed a five-year noncancelable lease for equipment. The terms of the lease called for Sauder to make annual payments of $200,000 at the beginning of each year for five years beginning on January 1, 2018 with the title passing to Sauder at the end of this period. The equipment has an estimated useful life of 7 years and no salvage value. Sauder uses the straight-line method of depreciation for all of its fixed assets. Sauder accordingly accounts for this lease transaction as a capital lease. The minimum lease payments were determined to have a present value of $833,972 at an effective interest rate of 10%. 21 - 16 Accounting for Leases 62. In 2018, Sauder should record interest expense of a. $63,397. b. $116,604. c. $83,396. d. $136,604. Ans: A, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None On January 1, 2018, Sauder Corporation signed a five-year noncancelable lease for equipment. The terms of the lease called for Sauder to make annual payments of $200,000 at the beginning of each year for five years beginning on January 1, 2018 with the title passing to Sauder at the end of this period. The equipment has an estimated useful life of 7 years and no salvage value. Sauder uses the straight-line method of depreciation for all of its fixed assets. Sauder accordingly accounts for this lease transaction as a capital lease. The minimum lease payments were determined to have a present value of $833,972 at an effective interest rate of 10%. 63. In 2019, Sauder should record interest expense of a. $43,397. b. $49,737. c. $69,737. d. $63,397. Ans: B, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 64. On December 31, 2018, Kuhn Corporation leased a plane from Bell Company for an seven-year period expiring December 31, 2025. Equal annual payments of $450,000 are due on December 31 of each year, beginning with December 31, 2018. The lease is properly classified as a capital lease on Kuhn’s books. The present value at December 31, 2018 of the eight lease payments over the lease term discounted at 10% is $2,640,792. Assuming the first payment is made on time, the amount that should be reported by Kuhn Corporation as the lease liability on its December 31, 2018 balance sheet is a. $2,640,792. b. $2,454,870. c. $2,376,714. d. $2,190,792. Ans: D, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None On January 1, 2018, Ogleby Corporation signed a five-year noncancelable lease for equipment. The terms of the lease called for Ogleby to make annual paym [Show More]

Last updated: 1 year ago

Preview 1 out of 52 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 04, 2022

Number of pages

52

Written in

Additional information

This document has been written for:

Uploaded

Sep 04, 2022

Downloads

0

Views

37

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)