Finance > QUESTIONS & ANSWERS > Deakin University: MAF302 CORPORATE FINANCE Trimester 2, 2016 Department of Finance 1 Seminar 4 Real (All)

Deakin University: MAF302 CORPORATE FINANCE Trimester 2, 2016 Department of Finance 1 Seminar 4 Real options and their valuation Week 4 (1 August 2016) SOLUTIONS

Document Content and Description Below

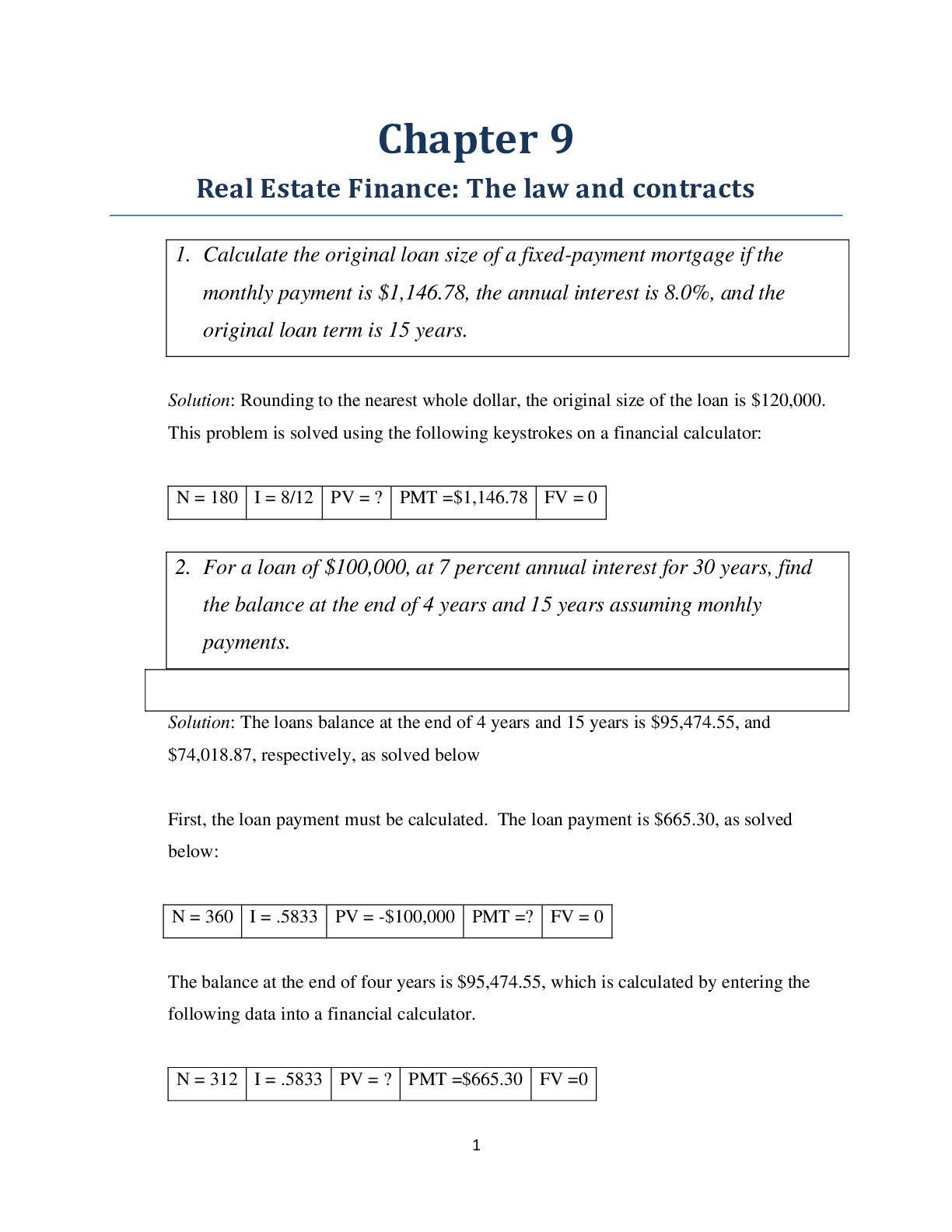

MAF302 CORPORATE FINANCE Trimester 2, 2016 Department of Finance 1 Seminar 4 Real options and their valuation Week 4 (1 August 2016) SOLUTIONS Question 1 (Brealey et. al., Chapter 22, Proble... m Sets: Question 2, p 580) A start-up company is moving into its first offices and needs desks, chairs, filing cabinets, and other furniture. It can buy the furniture for $25,000 or rent it for $1,500 per month. The founders are of course confident in their new venture, but nevertheless they rent. Why? What's the option? Question 2 (Brealey et. al., Chapter 22, Problem Sets: Question 9, p 581) Describe each of the following situations in the language of options: a. Drilling rights to undeveloped heavy crude oil in Northern Alberta. Development and production of the oil is a negative-NPV endeavor. (Assume a break-even oil price is C$90 per barrel, versus a spot price of C$80.) However, the decision to develop can be put off for up to five years. Development costs are expected to increase by 5% per year. b. A restaurant is producing net cash flows, after all out-of-pocket expenses, of $700,000 per year. There is no upward or downward trend in the cash flows, but they fluctuate as a random walk, with an annual standard deviation of 15%. The real estate occupied by the restaurant is owned, not leased, and could be sold for $5 million. Ignore taxes. c. A variation on part (b): Assume the restaurant faces known fixed costs of $300,000 per year, incurred as long as the restaurant is operating. Thus, The annual standard deviation of the forecast error of revenue less variable costs is 10.5%. The interest rate is 10%. Ignore taxes. MAF302 CORPORATE FINANCE Trimester 2, 2016 Department of Finance 2 d. A paper mill can be shut down in periods of low demand and restarted if demand improves sufficiently. The costs of closing and reopening the mill are fixed. e. A real estate developer uses a parcel of urban land as a parking lot, although construction of either a hotel or an apartment building on the land would be a positiveNPV investment. f. Air France negotiates a purchase option for 10 Boeing 787s. Air France must confirm the order by 2014. Otherwise Boeing will be free to sell the aircraft to other airlines. Question 3 (Brealey et. al., Chapter 21, Problem Sets: Question 6, p 556) Use the Black-Scholes formula to value the following options: a. A call option written on a stock selling for $60 per share with a $60 exercise price. The stock’s standard deviation is 6% per month. The options matures in three months. The risk-free interest rate is 1% per month b. A put option written on the same stock at the same time, with the same exercise price and expiration date Question 4 (Brealey et. al., Chapter 21, Problem Sets: Question 1, p 555) The stock price of Heavy Metal (HM) changes only once a month: either it goes up by 20% or it falls by 16.7%. Its price now is $40. The interest rate is 12.7% per year, or about 1% per month. a. What is the value of a one-month call option with an exercise price of $40? b. What is the option delta? c. Show how the payoffs of this call option can be replicated by buying HM’s stock and borrowing. Question 5 (Brealey et. al., Chapter 22, Problem Sets: Question 16, p 582) In Section 10-4 we considered two production technologies for a new Wankel-engined outboard motor. Technology A was the most efficient but had no salvage value if the new outboards failed to sell. Technology B was less efficient but offered a salvage value of $17 million. Figure 10.5 shows the present value of the project as either $24 or $16 million in year 1 if Technology A is used. Assume that the present value of these payoffs is $18 million at year 0. a. With Technology B, the payoffs at year 1 are $22.5 or $15 million. What is the present value of these payoffs in year 0 if Technology B is used? (Hint: The payoffs with Technology B are 93.75% of the payoffs from Technology A.) b. Technology B allows abandonment in year 1 for $17 million salvage value. You also get cash flow of $1.5 million, for a total of $18.5 million. Calculate abandonment value, assuming a risk-free rate of 7%. Question 6 (Brealey et. al., Chapter 20, Problem Sets: Question 30, p 533) Some years ago the Australian firm Bond Corporation sold a share in some land that it owned near Rome for $110 million and as a result boosted its annual earnings by $74 million. A television program subsequently revealed that the buyer was given a put option to sell its share in the land back to Bond for $110 million and that Bond had paid $20 million for a call option to repurchase the share in the land for the same price. a. What happens if the land is worth more than $110 million when the options expire? What if it is worth less than $110 million? b. Use position diagrams to show the net effect of the land sale and the option transactions. c. Assume a one-year maturity on the options. Can you deduce the interest rate? d. The television program argued that it was misleading to record a profit on the sale of land. What do you think? Additional Questions (Homework) Additional question 1 (Brealey et. al., Chapter 22, Problem Sets: Question 11, p 581) You own a one-year call option to buy one acre of Los Angeles real estate. The exercise price is $2 million, and the current, appraised market value of the land is $1.7 million. The land is currently used as a parking lot, generating just enough money to cover real estate taxes. The annual standard deviation is 15% and the interest rate 12%. How much is your call worth? Use the Black–Scholes formula. You may find it helpful to go to the spreadsheet for Chapter 21, which calculates Black–Scholes values (visit this book's website, www.mhhe.com/bma) [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$13.00

Document information

Connected school, study & course

About the document

Uploaded On

Jan 05, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jan 05, 2021

Downloads

0

Views

74