Financial Accounting > TEST BANK > Chapter 08 Accounting for Receivables. Test Bank for Accounting Principles, Eleventh Edition. This d (All)

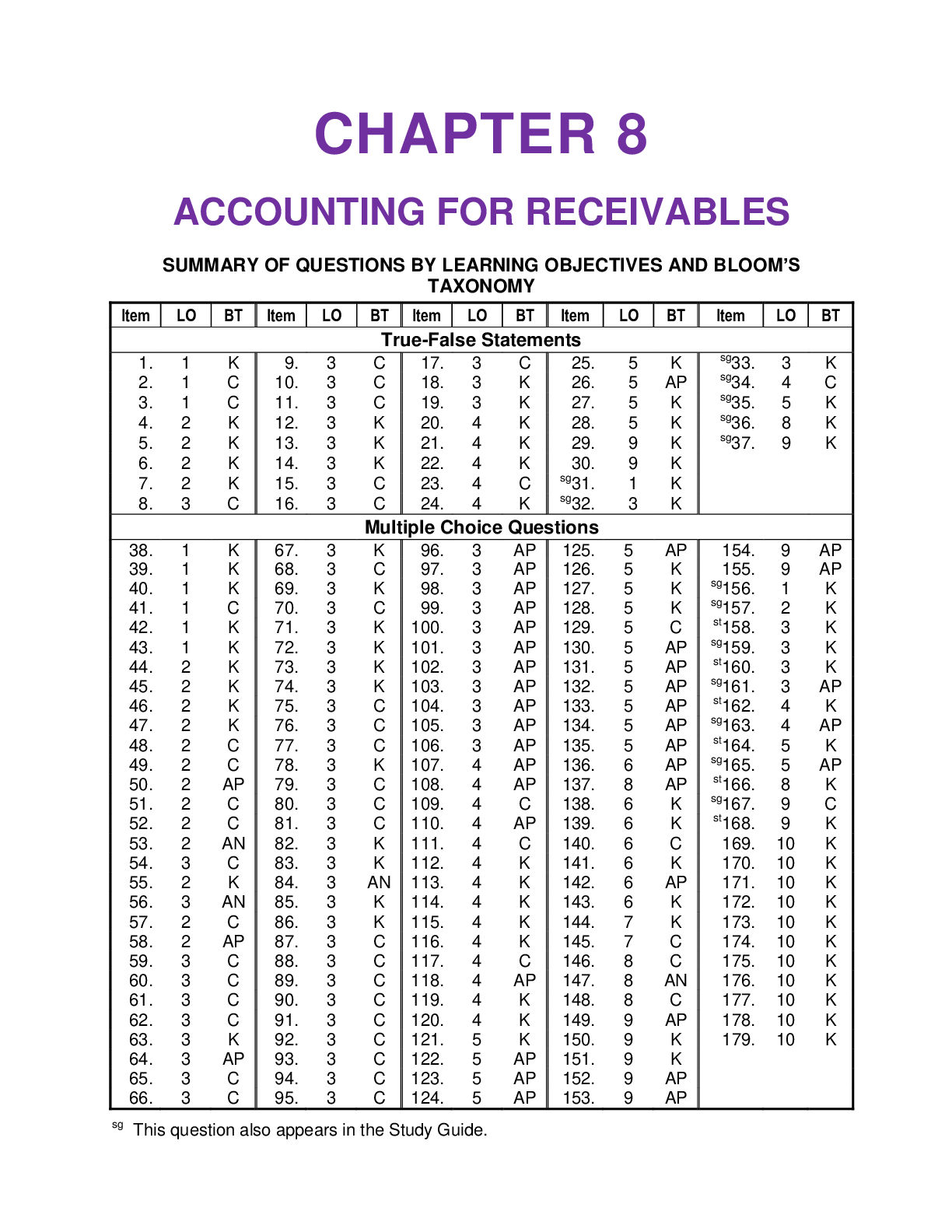

Chapter 08 Accounting for Receivables. Test Bank for Accounting Principles, Eleventh Edition. This document/TEST BANK Contains 241 Questions With Answers, Worked Solutions and Essay Explanations

Document Content and Description Below