Business > QUESTIONS & ANSWERS > Tax-QA _ Tentative Answers for Assignment No 2. (All)

Tax-QA _ Tentative Answers for Assignment No 2.

Document Content and Description Below

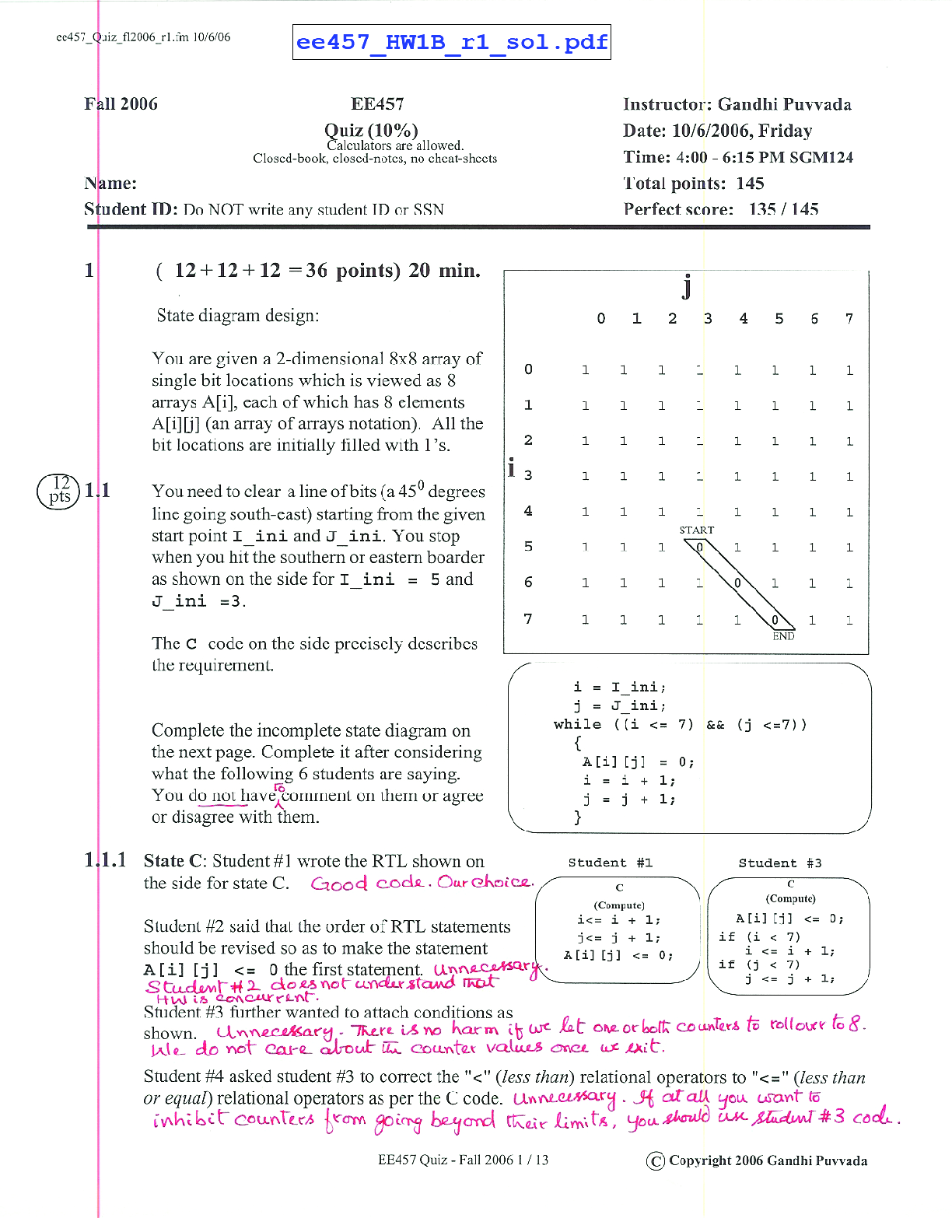

Tentative Answers for Assignment No 2. 1. No. 1. Non resident alien donor who donated shares of stocks of a Foreign Corp, to a qualified done, is subject to donor’s tax when there is no reciprocit... y. No. 2. Non resident alien donor who donated shares of stocks of a Foreign Corp, to a qualified done, is subject to donor’s tax regardless of reciprocity. • True True • False False • True False • False True 2.No.1 H and W donated a conjugal property to X worth 1M. H must declare a gross gift of 500,000 only because ½ of the property is deemed a donation of his spouse to another person. So, his spouse must file a separate donor’s tax return with gross gift of 500,000 also. No. 2. Resident alien donor is subject to reciprocity. However, RA donor is subject to donor’s tax for donation made within and without the Philippines. • True True • False False • True False • False True 3.No 1. If the gift (donation) involves conjugal/community property, each spouse shall file separate return corresponding to his/her respective share in the conjugal/community property donated. This rule shall likewise apply in the case of co-ownership over the property being donated. No 2. The interest rate to be imposed for late filing of 2018 donor’s tax return will be 20%. • True True • False False • True False • False True 4. In 2019: A, a lessee, donated the leased land to B worth 1M. What is the donor’s tax due? • 40,000 • 45,000 • 60,000 • 44,000 • None of the above 5. No 1. Non resident alien not engaged in business in the Philippines donated property worth P 15,000 located in USA to a resident citizen of Philippines; thus, the donation is subject to donors tax per NIRC. No 2. . If gift involves conjugal or community property, the spouse shall file one tax return to be filed in BIR for a calendar year. • True True • False False • True False • False True 6. No 1. . If there are different gifts made by donor within the calendar year or in several calendar years, computation of donor tax is based upon the entire gift, on cumulative basis, over a period of one calendar year. No 2. Donations in form of services such as labor and skills, are covered by Donor s tax and shall not be included in tax return based on the fair value of the services donated. • True True • False False • True False • False True 7. No 1. Property gifts in Phil and abroad are included in gross gift in computation of donor tax due if the donor is a Non resident citizen. No 2. A donated to B a land subject to a condition that title passes to B only upon death of A. The donation is subject to transfer taxes. • True True • False False • True False • False True 8. Keisha, a non resident citizen, living in Canada, donated properties worth P 10,000 that is located in USA to Pululu (Donee) , resident citizen . Where will Keisha file the Donor's tax return? • BIR Commissioner • Philippine Embassy in Canada • Philippine embassy in USA • a or b • No need to file Donor's tax return 9. Mr. A, married and a nonresident citizen, has the following donation in July 2018 to a stranger: Conjugal property in Philippines worth 300,000; Exclusive property in USA worth 500,000; Another conjugal property in Philippines of 400,000; Exclusive property in Philippines of 600,000. Last January 2018, Mr. A donated cash amounting to 1,000,000 to his brother and paid the required taxes thereon. What is the donor tax payable / still due of Mr. A on July 2018? • 132,000 • 72,000 • 114,000 • 87,000 • None of the above 10.Mr. A, married and a nonresident alien, has the following donation in July 2018 to a stranger: Conjugal property in Philippines worth 300,000; Exclusive property in USA worth 500,000; Another conjugal property in Philippines of 400,000; Exclusive property in Philippines of 600,000. Last January 2018, Mr. A donated cash amounting to 1,000,000 to his brother in the Philippines and paid the required taxes thereon. What is the donor tax payable / still due of Mrs. A on July 2018? • 6,000 • 102,000 • 57,000 • 67,000 • None of the above Q1.In 2017; A, resident alien, donated the following properties: net gift in Phil amounting to P 600,000; net gift in Japan amounting to P 250,000 and net gift in USA amounting to 150,000. The receiver of donations are as follows: Phil= 2nd cousin; USA= best friend and Japan= friend. Taxes paid in USA and Japan are 37,500 and P 68,500, respectively. What is the donor’s tax still due? Answer: 1. 194,000 • 184,000 • 194,000 • 300,000 • 176,000 • None of the above Q2. A, is a Filipino donor living in America. In July 2016, he donated to his relatives properties located therein amounting to 475,000 with related deduction of 175,000 (includes 12,500 donor’s tax paid in USA. In February of same year, there was 250,000 net gift n Phil given to his sister. What is the donor’s tax still due of A in July? Answer: 3,889 None of the above • 7,889 • 17,750 • 3,727 • 7,727 • None of the above (3,889. Donor tax is NOT allowed deduction. must be excluded in 175,000) Q3. A. resident alien, has the following donations in 2018: rendered services gratuitously to a friend and his effort is worth 150,000; personal computer worth 50,000 to International rice research institute; Residential house and lot worth 1M was transferred to a friend for 200,000 only and cash contributions to Mr X for his political campaign in local election of 60,000. What is the gross gift? Answer: None of the above 50,000 • 850,000 • 800,000 • 910,000 • 750,000 • None of the above (50,000) Q4.On same date of 2016, A, non resident alien, donated a property in Philippines worth 1M to his daughter and her husband. He also donated property to victims of earthquake in 2016 worth 1M. What is the donor’s tax due of A? Answer: 464,000 5. 99,000 • 194,000 • 464,000 • 463,600 [Show More]

Last updated: 1 year ago

Preview 1 out of 21 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 12, 2022

Number of pages

21

Written in

Additional information

This document has been written for:

Uploaded

Dec 12, 2022

Downloads

0

Views

27

.png)

.png)

.png)