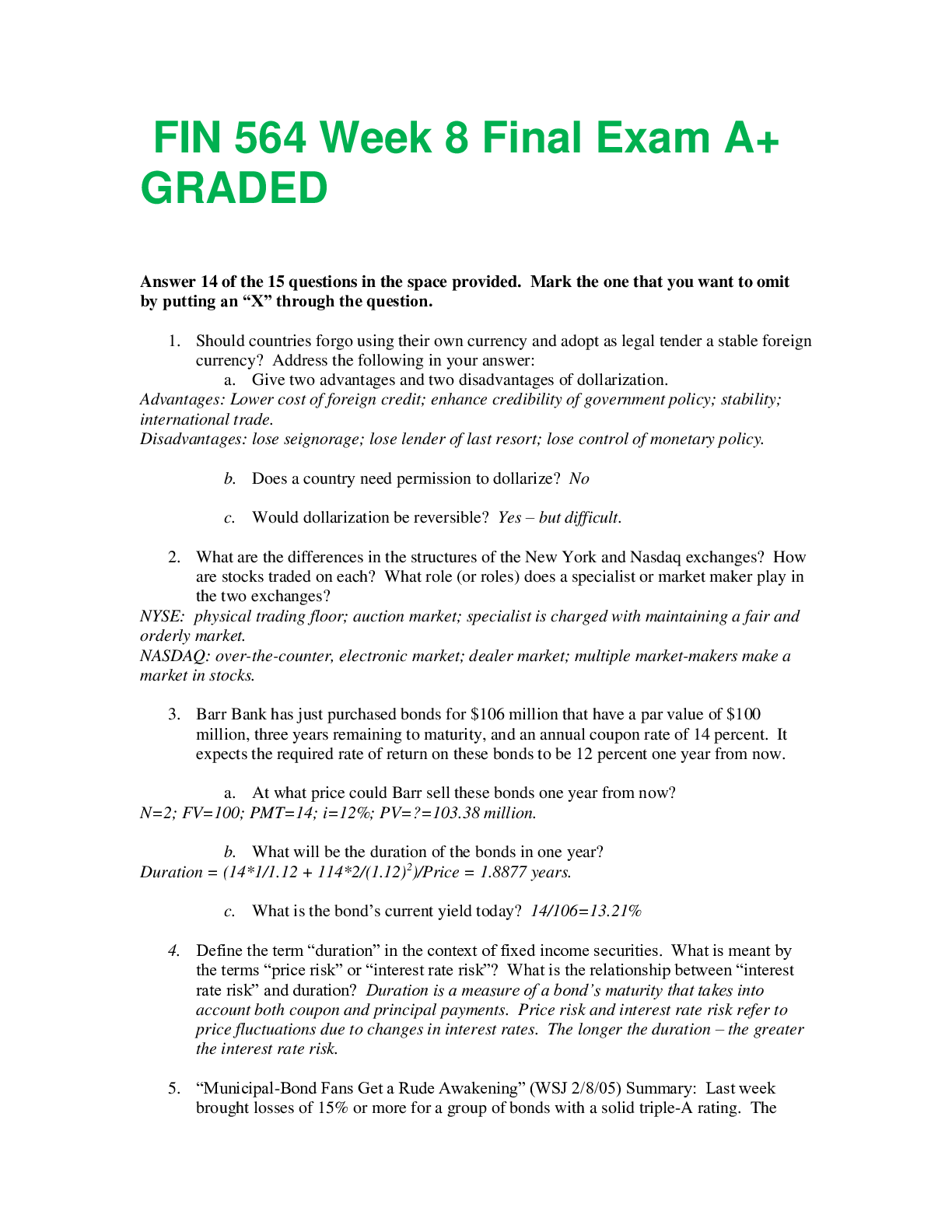

FIN 564 Week 8 Final Exam 2021 100% Guaranteed A Score

Document Content and Description Below

1. Should countries forgo using their own currency and adopt as legal tender a stable foreign currency? Address the following in your answer: a. Give two advantages and two disadvantages of dollariz... ation. Advantages: Lower cost of foreign credit; enhance credibility of government policy; stability; international trade. Disadvantages: lose seignorage; lose lender of last resort; lose control of monetary policy. b. Does a country need permission to dollarize? No c. Would dollarization be reversible? Yes – but difficult. 2. What are the differences in the structures of the New York and Nasdaq exchanges? How are stocks traded on each? What role (or roles) does a specialist or market maker play in the two exchanges? NYSE: physical trading floor; auction market; specialist is charged with maintaining a fair and orderly market. NASDAQ: over-the-counter, electronic market; dealer market; multiple market-makers make a market in stocks. 3. Barr Bank has just purchased bonds for $106 million that have a par value of $100 million, three years remaining to maturity, and an annual coupon rate of 14 percent. It expects the required rate of return on these bonds to be 12 percent one year from now. a. At what price could Barr sell these bonds one year from now? N=2; FV=100; PMT=14; i=12%; PV=?=103.38 million. b. What will be the duration of the bonds in one year? Duration = (14*1/1.12 + 114*2/(1.12)2)/Price = 1.8877 years. c. What is the bond’s current yield today? 14/106=13.21% 4. Define the term “duration” in the context of fixed income securities. What is meant by the terms “price risk” or “interest rate risk”? What is the relationship between “interest rate risk” and duration? Duration is a measure of a bond’s maturity that takes into account both coupon and principal payments. Price risk and interest rate risk refer to price fluctuations due to changes in interest rates. The longer the duration – the greater the interest rate risk. 5. “Municipal-Bond Fans Get a Rude Awakening” (WSJ 2/8/05) Summary: Last week brought losses of 15% or more for a group of bonds with a solid triple-A rating. The losses occurred when New York City exercised the call feature on some of their municipal bonds. A call feature allows the issuer to redeem the bond early at a set price (usually a few percentage points above par value). a. What is a municipal bond? Why would an investor prefer a municipal bond to a non-municipal one? Municipal bonds are issued by state and local governments and are exempt from federal taxes. b. What is a “call option”? How does a callable bond differ from a non-callable bond? Who holds the call option in a callable bond? The call option gives the issuer the right to pay-off the bond early. Non-callable bonds cannot be paid off early. The issuer holds the option. c. All else equal, should a callable bond have a higher or lower yield to maturity than an otherwise equivalent non-callable bond? Support your answer. The callable bond should have a higher yield to maturity. The call feature is undesirable to the holder of the bond. Therefore he demands a higher yield. 6. Explain the government bond quotes below. If you wanted to buy the 2nd bond listed, what price would you pay? Why are the bonds selling at different prices? What is the asked yield? Why do the bonds have the same asked yield when their prices are different? Rate Maturity Mo/Yr Bid Asked Asked Yield 3 1/2 Feb 10 n 98:09 98:10 3.87 6 1/2 Feb 10 n 111:24 111:25 3.87 Price = 11125/32% of par value = $111,781.30. The bonds are selling at different prices because of the very different coupon rates. The asked yield is the yield to maturity. Yield to maturity is made up of current yield and capital gains yield. The first bond has a low current yield and a positive capital gains yield. The second bond has a high current yield and a negative capital gains yield. They end up with the same asked yield since they mature at the same time. 7. You have taken a long position in a call option on IBM common stock. The option has an exercise price of $136 and IBM’s stock currently trades at $140. The option premium is $5 per contract. a. What is your net profit on the option if IBM’s stock price increases to $150 at the expiration of the option and you exercise the option? 150-136 = $14 -$5 =$9 b. What is your net profit if IBM’s stock price decreases to $130? -$5 8. What is an ECN? Give two advantages of ECNs in the U.S. equity markets. What is a limit order? An Electronic communications network brings buyers and sellers together for electronic execution of trades. Advantages: less expensive trades; swift execution; more price information; provide trader anonymity. A limit order is a prearranged order to buy or sell at a specific price. 9. Given the options data below, answer the following questions. AppleC ( AAPL ) Underlying stock price*: 85.29 Expiration Strike Call Put Last Volume Open Interest Last Volume Open Interest Apr 65.00 22.30 40 14016 0.55 36 12377 Apr 85.00 6.90 1530 39417 6.00 145 4165 Apr 105.00 1.50 50 1482 19.80 455 19 a. If you bought the Apr put with a strike price of 65, to what does this entitle you? Why would you buy this put? The right to sell at $65 before expiration in April. You would buy this put if you thought the price were going to go down. It gives you some downside protection. b. Why do the three April call options sell at such different prices? They sell at different prices because they have different exercise prices – some are in the money and some out of the money. c. Which of the call options are “out-of-the-money”? Apr 105 d. What is meant by “Open Interest”? It is the number of contracts outstanding. 10. The treasurer of a major US firm has $5 million to invest for 3 months. The annual interest rate in the US is 12%. The annual interest rate in the UK is 9%. The spot exchange rate is $2/£. The 3-month forward rate is $2.015/£. Ignoring transactions costs, in which country would the treasurer want to invest the company’s capital. What would be his return? Convert $5 million to 2,500,000 pounds. At time 0: sell pounds on the futures market and invest in a U.K. CD. 2,500,000*(1.0225) = 2,556,250 pounds at time 1. Time 1 convert back to $ = $5,150,843.75. Return = [($5,150,843.75 – 5,000,000)/5,000,000]-1 = 12.62% 11. The price of Microsoft is $25.26 and the July 2005 call options with a strike price of 27.50 sell for $0.24. You have $1,000 to invest. Describe in words (you don’t need to do calculations) the risks and returns of buying the stock outright, buying the stock on margin or buying the call options. Buy the stock: risk is that the stock will go down. The worst thing that can happen is that the stock price goes to zero and you lose $1,000. Buy the stock on margin: You buy twice as much stock and have the potential for twice the gains. However, you also have the potential for twice the loss. Buy call options: call options are a wasting asset. If the stock price has not moved above 27.50 by July, your options will be worthless. Your potential for gains are unlimited. You have the highest risk and the chance for the most reward with this option. 12. If you wanted to buy the T-bill below, what is the price that you would pay? Assume a face value of $1,000. What would be the yield to maturity or coupon equivalent yield on the T-bill? Maturity Days to Mat. Bid Asked Jun 23 05 120 2.68 2.67 .0267 = [(1000-P)/1000]*360/120; Price = 991.10 YTM = [(1000-991.10)/991.10]*365/120; ytm = 2.73% 13. Given the data on the Euro futures contract ($/Euro quote), answer the questions below. Contract Month Last Volume OpenInt Exch Euro Mar '05 1.32170 155511 159575 IMM Euro Jun '05 1.32460 1221 3773 IMM Euro Sep '05 1.32750 258 560 IMM Euro Mar '06 1.33650 20 IMM a. Describe the rights and/or obligations of the buyer and the seller of the Sep ’05 contract. The buyer and the seller have the obligation to take delivery and deliver in September 2005 at the agreed upon price b. Based on the data above, what do you think is going to happen to the Euro/$ exchange rate in the future – is the dollar expected to appreciate or depreciate? It will depreciate. c. What is the difference between a forward market and a futures market? A futures contract is standardized and a forward contract is non-standardized. 14. “Japanese Officials Vow to Fight Any Excessive Surge in the Yen” (WSJ 1/7/04) a. Describe how Japanese officials intervene directly in foreign markets to stop the dollar’s fall. What specifically would they do? They sell yen and buy dollars. b. The March 2005 yen/dollar exchange rate is $1 to 104.04 yen. Has the dollar appreciated or depreciated since April 2, 2001, when $1 equaled 126.68 yen? Depreciated. 15. When the Federal Reserve raises interest rates, exactly which rate are they “raising”? How does the Fed cause rates to rise? What U.S. Government security do they use to change this rate? Be specific. They raise the target on the Fed funds rate. They cause the rate to rise by selling T-bills. [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 13, 2021

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Feb 13, 2021

Downloads

0

Views

49

.png)