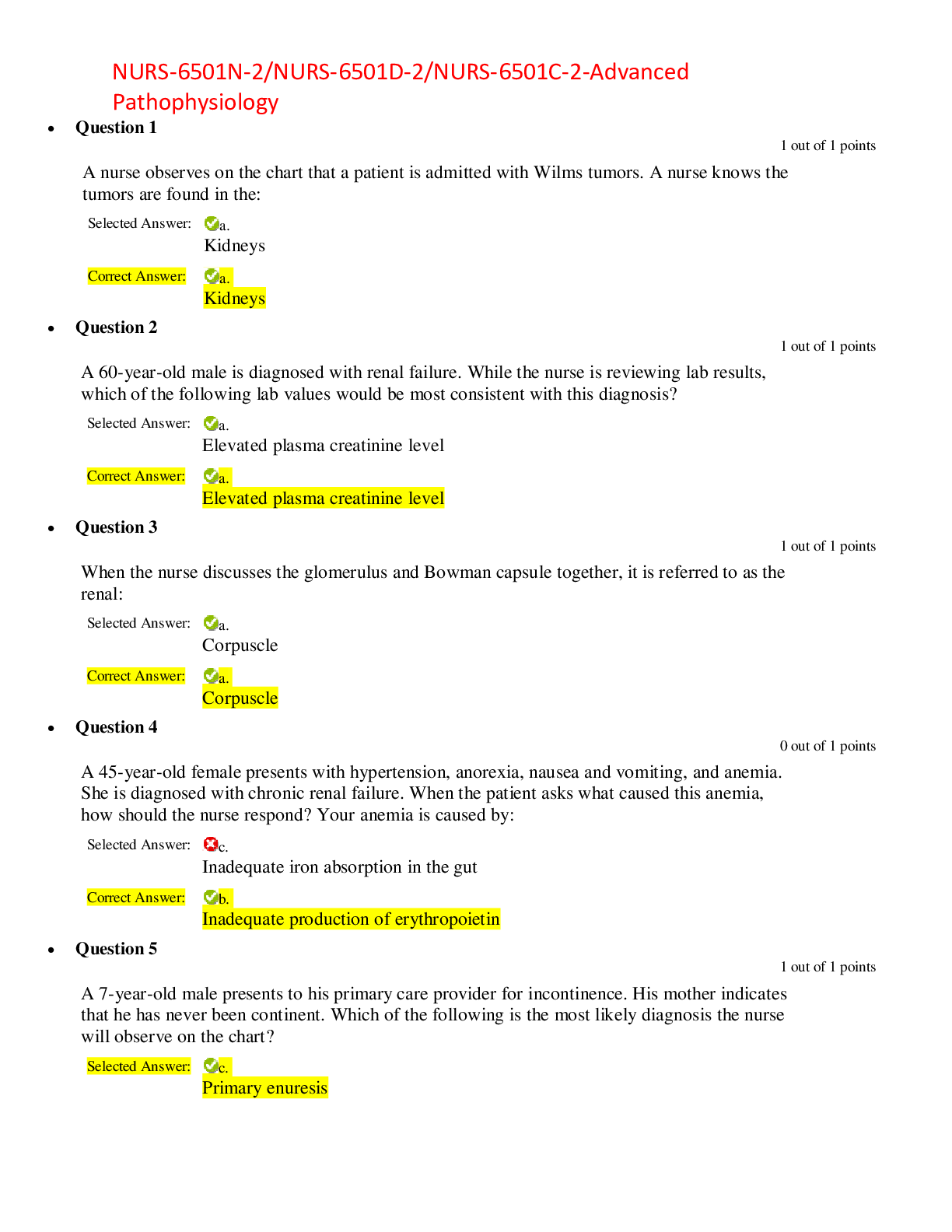

WGU C214 Financial Management > EXAM > WGU C214 Concepts Only Multi Choice Version (GRADED A) (All)

WGU C214 Concepts Only Multi Choice Version (GRADED A)

Document Content and Description Below

Trading on the NYSE is executed without a specialist (i.e. a market maker). (T/F) F Stocks and bonds are two types of financial instruments (T/F) T The matching principle in accrual accoun... ting requires that: a. Revenues be recognized when the earnings process is complete and matches expenses to revenues recognized. b. Expenses are matched to the year in which they are incurred c. Revenues are matched to the year in which they are booked d. Revenues should be large enough to match expenses a A basic equation for the balance sheet is: a. Equity = Assets - Liabilities b. Liabilities = Equity + Assets c. Assets = Liabilities - Equity d. Assets = Equity - Liabilities a Why is the Balance Sheet known as a permanent statement? a. Because the statement is sent to the SEC. b. Because the other statements are reset at the end of the fiscal year c. Because it is printed out and archived d. Because it persists in the minds of the shareholders. b How do you calculate the change in Retained Earnings? a. Ending Retained Earnings - Change in Cash b. EBIT divided by Total Assets + Dividends c. EBIT - Change in Cash - Dividends d. Net Income - Dividends d Which of the following is generally true? a. Gross Profit and Operating Income are the same b. Cost of Goods Sold + Operating Expenses = Net Income c. Operating Income and EBIT are the same d. EBIT + Income Taxes = Net income c Which components are part of total assets? a. Cash, Accounts Receivable, Short Term Debt b. Cash Accounts Receivable, Inventory, Long Term Assets c. Accounts Payable, Long Term Assets, Long Term Debt d. Accounts Payable, Net Income, Equity b Which components are part of current assets? a. Cash, Accounts Receivable, Property Plant & Equipment b. Accounts Receivable, Accounts Payable, Inventory c. Long Term Debt, Property Plant & Equipment, Common Stock d. Inventory, Cash, Accounts Receivable, Short Term Investments d Which components are part of Total Liabilities? a. Accounts Payable, Accounts Receivable, Short Term Debt b. Long Term Debt, Common Stock, Retained Earnings c. Bonds, Accounts Payable, Mortgage d. Common Stock, Long Term Debt, Short Term Investments c When Fixed Assets increase what happens to Cash? a. Cash stays the same b. Cash increases c. Cash decreases d. Assets decrease c Which is the purpose of the statement of cash flows? a. serves as the replacement for the income statement and balance sheet b. explains the change in cash balance at one point in time c. explains the change in cash balance for one period of time d. both (a) and (b) above c The OIROI (Operating Income Return on Investment) uses what elements on the income statement? a. Operating Income, EBIT, Total Liabilities b. EBIT, Total Assets c. Sales, Total Assets, Equity d. Net Margin, Total Current Assets b Why would a company be interested in the TAT(Total Asset Turnover) ratio? a. How efficient assets are at producing income b. What the turnover of sales is to liabilities c. How efficient assets are at producing sales d. How efficient assets are to liabilities and equity c Which of the following gives the largest effective rate (APY) a. 18.6% compounded monthly b. 18.6% compounded daily c. 18.6% compounded weekly d. 18.6% compounded yearly b What does the beta coefficient represent? a. It is a statistically-derived measure of volatility b. It is the Expected Return minus the Growth Rate c. It is the volatility of the Risk Free Return d. It is the expected return for a basket of preferred stocks a Why is depreciation expense taken out of the net income calculation, yet added back at the end? a. Because fixed assets should remain on the balance sheet b. Because depreciation is not a current asset c. Because depreciation is a non-cash liability d. Because depreciation expense is tax deductible d Why is the NPV preferred over the IRR? Pick Two a. It has a higher dollar value b. It measures the dollar value c. It is more reliable d. It is harder to calculate b, c What does the Degree of Financial Leverage indicate? a. The firms cash balance b. The cost of financed assets c. The reliance on debt d. The reliance on assets c If a company has a high degree of financial leverage, what does that tell us about the firm's risk profile? a. Low Risk b. Appropriate Risk c. Higher ability to pay debt d. Higher profits to shareholders d What is the cash cycle? a. The speed of collecting cash from customers b. The amount of cash kept in banks c. The comparison of debt to cash d.The amount of time to regenerate cash d Why is float important to understand? a. To know how to keep the company profitable b. To know why the company needs cash c. To determine when to buy fixed assets d. To time cash expenditures e. None of the above d What should a company do to manage its working capital? a. Collect quickly and pay slowly b. Keep a large cash balance c. Maximize the use of long term investment d. Depreciate assets more slowly a What would be a source of information to determine Replacement Cost? a. Building Appraisal b. Accumulated Depreciation Expense c. Stock price d. Statement of Cash Flows a What does the Sarbanes-Oxley Act require companies to do? a. Have a board of directors b. Register all foreign sales c. Make estimated tax payments d. Have internal control audits d FINRA (Financial Industry Regulatory Authority) does the following: (pick one) a. No foreign bribery by corporations b. Regulates bond prices c. Establishes Credit Unions d. Prosecutes naughty stock brokers e. Regulates Hedge Funds d If a product is made 100% domestically, what can affect its domestic market? a. International exchange rates b. International competition c. Product tariffs d. International political regulations b If a company makes its product in a foreign country where labor costs are much lower, what happens? a. Profits and domestic employment goes up b. Costs go up and domestic employment goes down c. Costs stay the same and domestic employment increases d. Profits go up and domestic employment decreases. d If the value of a dollar increases, the price of imports: a. Increases b. Decreases c. Stays the same d. Fluctuates b Why would a farmer buy a hedge when he signs a contract to sell produce overseas? a. To avoid tariffs b. To reduce currency risk c. To increase profits d. To avoid competition b A basic equation for the balance sheet is: a. Equity = Assets - Liabilities b. Liabilities = Equity + Assets c. Assets = Liabilities - Equity d. Assets = Equity - Liabilities a Why is the Balance Sheet known as a permanent statement? a. Because the statement is sent to the SEC. b. Because the other statements are reset at the end of the fiscal year c. Because it is printed out and archived d. Because it persists in the minds of the shareholders. b How do you calculate the change in Retained Earnings? a. Ending Retained Earnings - Change in Cash b. EBIT divided by Total Assets + Dividends c. EBIT - Change in Cash - Dividends d. Net Income - Dividends d Which of the following is generally true? a. Gross Profit and Operating Income are the same b. Cost of Goods Sold + Operating Expenses = Net Income c. Operating Income and EBIT are the same d. EBIT + Income Taxes = Net income c Which components are part of total assets? a. Cash, Accounts Receivable, Short Term Debt b. Cash Accounts Receivable, Inventory, Long Term Assets c. Accounts Payable, Long Term Assets, Long Term Debt d. Accounts Payable, Net Income, Equity b Which components are part of current assets? a. Cash, Accounts Receivable, Property Plant & Equipment b. Accounts Receivable, Accounts Payable, Inventory c. Long Term Debt, Property Plant & Equipment, Common Stock d. Inventory, Cash, Accounts Receivable, Short Term Investments d Suppose the inventory turnover of a company is higher than the industry. Based on this observation, which of the following is most likely? a. The firm has lower liquidity than the industry average. b. The firm has too much inventory thus impairing overall liquidity. c. The firm has too little inventory resulting in lost sales or stock-outs. d. The firm has low sales volume. c If a company wishes to obtain a bank loan, will it want to have a higher current ratio or a lower current ratio? a. higher b. lower c. the same d. it doesn't matter a If an investor knows the idiosyncratic risk, the investor knows the: a. Profit Margin percentage b. Beta Coefficient c. Operating Leverage d. Free Cash Flow b Why would we reject a project based on the NPV? a. The NPV is lower than the IRR b. The NPV is lower than investment c. The NPV is a negative number d. The IRR is positive. c Why would we reject a project based on the IRR? a. The IRR is higher than the sum of the cash flows b. The discount rate is lower than the IRR c. The IRR is higher than the NPV d. The discount rate is higher than the IRR d Company A wishes to keep 20% of its assets as cash. Company B keeps its cash balance at 5% of assets. Which of the following statements apply? a. Company A is less liquid than Company B b. Company B invests in more working current assets c. Company A uses better working capital management d. Company B has a more conservative cash policy b Company A offers trade credit of 2% 10 / net 30 and Company B offers trade credit at net 30. What can be said about the credit policies of each company? a. Company B has a looser credit policy b. Company A keeps more of its Accounts Receivable c. Company A can attract more customers d. Company B can attract more customer c Which of the following characterizes collection float a. Longer float indicates good financial practices b. Increased float indicates slower processing time c. Accounts receivable increase with shorter float d. Liquidity is enhanced with longer float b Company A's inventory is larger than Company B. Both companies are competitors and are about the same size. What does this difference mean from a working capital management standpoint? a. Company B has lower inventory float b. Company A has more cash in hand c. Company B might have higher inventory turnover d. Company A has tighter credit. c In regards to Accounts Payable balances, which of the following is true: a. Higher Accounts Payable is better than a lower balance b. Paying off A/P as soon as possible is good policy c. Increased Accounts Payable means faster collections d. Paying off A/P on the last day due is good policy d If two companies have earnings of $2,000,000, and Company X has a multiple of 1.2 and Company Z has a multiple of 2.0, what can we estimate about the value of each company? a. The value is the same b. The value of Company X is higher c. The value of Company Z is higher d. The relative value can't be determined c Dodd-Frank regulates which segment of the U.S. Economy? a. Fannie Mae and Freddie Mac (Housing financing) b. Banking Industry c. Multi-level Marketing Industry d. Automobile Industry b The SEC Securities & Exchange Commission requires companies to do the following: (pick two) a. Register all public offerings b. Change CEOs on a regular basis c. Regulates stock sales d. Prohibits foreign bribery e. Regulates the Money Supply a, c Economics is a subfield of Finance (T/F) F Capital is defined as a financial asset. (T/F) T Stocks and bonds are two types of financial instruments (T/F) T Primary financial markets are markets where issuers place new securities with investors. (T/F) T An IPO occurs on the primary market (T/F) T An IPO is a seasoned equity offering (T/F) F Syndicates are generally made up of investment banks and other institutional investors (T/F) T While competitive sales allow underwriters to submit bids to purchase bonds, negotiated sales do not. (T/F) F NASDAQ is the world's largest secondary financial market. (T/F) F Auction markets have a physical location. (T/F) T Dealer markets have a physical location. F Nasdaq is an example of an auction market. F Stocks that are listed on dealer markets generally have a single dealer for each stock. F Markets are where prices are determined (T/F) T The NYSE specialist has an objective to provide liquidity to the market. (T/F) T The NYSE specialist will charge a higher price to sellers of the stock and a lower price to the buyer of the stock F The bid-ask spread is compensation to the specialist for providing liquidity to the market. (T/F) T A market order to buy a stock would execute at the current ask price (T/F) T A market order to sell a stock would execute at the current ask price (T/F) T A limit order to buy a stock at $101.55 would execute at the current ask price (T/F) F A limit order to buy a stock at $101.55 would execute when the ask price is at or below $101.55 (T/F) T Efficient markets are those in which prices are volatile F Efficient markets will often have mispriced securities F Inefficient markets are those in which prices will respond quickly to new information F Inefficient markets will often have mispriced securities. T Because in an efficient market all available information is built into the price of a stock - investment patterns and trends to "get rich quickly" are not easily discernable and it is difficult to predict the price T In an inefficient market, prices will slowly respond to new information. T In an efficient market, new information will move prices almost immediately (T/F) T What is the relationship between WACC and IRR? a. Just 2 different numbers b. IRR must exceed WACC to accept investment c. WACC must exceed IRR to accept investment d. WACC and IRR are the same thing b What is the relationship between NPV and IRR? a. Both must exceed WACC to accept investment b. If discount rate equals IRR, NPV is equal to zero. c. NPV must exceed WACC to accept investment d. If discount rate equals IRR, should accept investment b If a firm's financial and operating leverage is high, what is the implication? a. The firm is more profitable b. Profits are more volatile as sales fluctuate c. The firm is less profitable d. The two leverages offset each other - - neutral impact b If an industry, such as autos, has very high fixed costs and very cyclical sales, what is the implication for financial leverage? a. Use high financial leverage to offset high fixed costs b. Use low financial leverage to offset high operating leverage c. It has no implication at all d. None of the above b The SGR measures: a. Historical dividend growth rate b. Sales growth rate c. Potential sales growth with internal funding d. None of the above c The SEC Securities & Exchange Commission requires public companies to do the following: a. File audited financial statements with SEC b. Change CEOs on a regular basis e. Regulates the Money Supply d. Prohibits foreign bribery a What does the Sarbanes-Oxley Act require companies to do? a. Have a board of directors b. Register all foreign sales c. Make estimated tax payments d. Have internal control audits d If a company produces and sells a product only in the U.S., what international developments may affect its sales? a. Fluctuating exchange rates b. Imports of competing products c. Immigration policy d. Inflation in Europe b The SEC requires the following to file audited financial statements: a. All companies b. All for-profit companies c. All publicly-traded corporations d. There is no such requirement c Which best describes conceptually the valuation of all financial assets in financial markets? a. Based on opinions of Wall Street analysts b. The NPV of anticipated cash flows c. Based on the book value of assets and liabilities d. None of the above b Which accurately describes an "efficient" market? a. Prices are low b. Prices do not fluctuate c. Deviations from "fair value" are quickly eliminated d. "Hot stocks" are the best investment c If a firm's goal is to maximize stockholder wealth, which would the firm avoid? a. Stock buybacks b. Risky long-term investments c. Investments with negative NPV d. Transparency in financial statements c If you wanted to evaluate a non-public company, what sources would you use? a. The financial statements filed with the SEC b. The latest stock price quoted in the Wall Street Journal c. The PE of a comparable public company d. The book value of equity in its balance sheet c Which section of the Statement of Cash Flows describes the production and sales of the firm's product? a. Cash Flow Operations b. Cash Flow Investing c. Cash Flow Financing. d. Cash Flow Securities a For calculating cash flows, why is depreciation added to Net Income? a. To offset taxes b. Depreciation is a non-cash deduction c. To determine pre-tax income d. None of the above b The fundamental concept underlying the valuation of all financial assets is: a. The application of the PE ratio b. Use of the Gordon Model c. The present value of anticipated cash flows. d. The future value of cash flows c What explains the size of the yield spread of junk bonds over Treasury? a. It is the value of the expected default loss b. It depends the firm'a profit c. It is the probability of default d. It is a "psychological' reaction of investors. a What does Beta measure? a. The default risk of a stock b. The relative riskiness of an individual stock c. Indicates the market value of the stock d. Stocks to avoid purchasing b What is the most effective use of financial statements in valuing a stock? a. Use the book value of equity on the balance sheet b. Use GAAP earnnings c. Use data to estimate future earnings d. Read the footnotes c If market interest rates rise, what impact does it have on a given bond? a. Its price decreases b. It will have a discount price c. No impact since the coupon rate is fixed d. Its price increases a What impact did the recent corporate tax cut have on a firm's WACC? a. It decreased WACC b. It increased WACC c. No impact since WACC depend on firm risk d. None of the above b Why do firms often use "sensitivity" tests in analyzing investment projects a. Required by the SEC b. Uncertainty of forecast assumptions c. Auditors require it. d. Required section of financial statements b If debt is less costly than equity, why don't firms maximize debt use? a. Excessive debt inceases risk of banruptcy b. Restricted by Federal tax regulations c. It reduces the benfits of financial leverage d. It increases operating leverage a Why does a firm's investment opportunities affect it dividend payout ratio? a. Maximization of shareholder wealth strategy b. Limited access to market financing c. Attempts to increase stock price d. All of the above d If two annuities have the same payments and term, why is an Annuity Due more valuable than an Ordinary Annuity? a. The have equal value b. Annuity Due payments occur earlier c. Annuity Due uses a lower discount rate d. Ordinary annuities are consider more risky b What is the impact of rising interest rates on foreign exchange? a. Makes USD decline in value b. Has no impact on USD c. Increases the value of USD d. Increases the value of EUR c In cash flow statements, which section reflects so-called "spontaneous" accounts which vary with sales? a. Cash flow operations b. Cash flow investing c. Cash flow financing d. Cash flow Sales a What are the practical disadvantages of the Gordon model for equity valuation? a. How to use if no dividends are paid b. Must project dividends "forever" into the future. c. Does not address the appropriate discount rate d. All of the above d What factor determines the "market risk premium" on stocks? a. The level of Treasury yields b. The investor-perceived riskiness of stocks c. Seasonality d. Projected future earnings b Why would a company buy back outstanding stock? a. To boost the price of the stock b. To increase financial leverage c. Lack of investment opportunities d. All of the above d Which factor does NOT affect a firm's WACC? a. The market risk premium b. The tax rate c. Treasury yields d. The exchange rate d Why should an investor diversify the portfolio? a. To achieve a better combination of risk and return b. To avoid putting "all eggs in one basket" c. Stock returns are a function of systematic risk d. All of the above d Which statement about a PE ratio is false? a. High PE ratios reflect higher expected growth rates b. Low PE stocks are cheap c. PE is the ratio of price to earnings d. High Beta stocks have lower PE ratios b If a firm cannot access markets sufficiently to meet their DFN, what strategies might they use? a. Slow sales growth b. Lower dividend payout c. Increase the net margin d. All of the above. d Dodd-Frank regulates which segment of the U.S. Economy? a. Fannie Mae and Freddie Mac (Housing financing) b. Banking Industry c. Multi-level Marketing Industry d. Automobile Industry b Which is not true of both stocks and bonds a. Market value derived from expected cash flows b. Market value varies over time c. Have voting rights d. Trade in both primary and secondary markets c The value of a corporation is best measured by a. Equity on the Balance Sheet b. Assets minus Liabilities on the Balance Sheet c. Market capitalization d. Its book value c Which is not a component of the DuPont formula? a. Net Income to Sales b. Debt to Equity Ratio c. Sales to Asset Ratio d. Assets to Equity Ratio b What metric converts FV to PV? a. The discount rate b. Time c. The PE ratio d. None of the above a The interest rate on a corporate bond does not reflect a. Risk b. Inflation c. Face Value d. U.S. Treasury rates c PV ordinarily is less than FV. What would cause the opposite? a. Compounding b. Negative interest rates c. The exchange rate d. The Federal Reserve b Which would likely have the lowest price? a. 3-month commercial paper b. Zero coupon bond c. 5-year Treasury note d. AAA corporate note b Junk bonds are those whose rating is below a. AAA b. AA c. A d. BBB d Diversification protects against a. Systematic risk b. Market risk c. Idiosyncratic risk d. Inflation risk c Which is the best diversification for stock investment? a. Auto company and grocery chain b. Walmart and Costco c. Home buider and auto company d. Boeing and Lockheed a If you are assessing a firm's ability to meet short term obligations, you would use which ratio? a. Debt ratio b. Quick ratio c. Gross margin d. Financial leverage b To assess firm efficiency, which ratio would you use? a. Asset turnover b. Operating margin c. Debt ratio d. None of the above a Which would have the highest value? a. Gross margin b. Operating margin c. Net margin d. All are equal a Which is the most important profit ratio? a. Gross Margin b. Net Margin c. Return on Equity d. Return on Assets c If the debt ratio increases, what effect does that have on ROE? a. ROE increases b. ROE decreases c. ROE is unchanged d. Cannot be determined a What is one way a firm maximizes shareholder value? A. By switching inventory methods B. By reducing the firm's labor force C. By outsourcing the production of the firm's core product D. By avoiding investments that cost more money than they bring in d What is one of the two basic types of financial instruments? A. Money Markets B. Mutual Funds C. Stocks D. Options c Why is it a challenge for a fund manager to review financial statements from other countries? A. Because the U.S. Financial Accounting Standards Board is in the beginning stages of working with the International Accounting Standards Board on converging reporting standards. B. Because the U.S. Generally Accepted Accounting Principles and the International Financial Reporting Standards vary. C. Because the U.S. Financial Accounting Standards and the International Accounting Standards Board abandoned the project to converge financial reporting rules. D. Because the U.S. Financial Accounting Standards Board does not work with the International Accounting Standards Board on mitigating differences in reporting standards. b What is true about the content and structure of an income statement? A. It reports the expenses and liabilities at a point in time. B. It reports the revenues and expenses for a period of time. C. It reports the assets and expenses for a period of time. D. It reports the assets, liabilities, and equity at a point in time. b What is true when income for tax purposes is higher than accounting income A. Accounting income tax expenses is the same as actual income tax payable. B. Actual income taxes payable will be lower than accounting income tax expense. C. Actual income taxes payable will be the same as accounting income tax expense. D. Actual income taxes payable will be higher than accounting income tax expense. d What does the statement of cash flows report? A. A firm's cash balance at a point in time B. A firm's cash net income for a point in time C. A firm's cash balance and changes for a period of time D. A firm's cash net income for a period of time c What does net income measure that the cash flow from operating activities does not? A. Credit sales to customers B. Payments made to suppliers of goods and services C. Depreciation expenses D. Payments to employees or other expenses b Which measure of cash flow is commonly used to evaluate the change in revenue and costs? A. Cash flow from operating activities B. Free cash flow to the firm C. Cash flow from financing activities D. Free cash flow to equity a An analyst is comparing the ratios of two firms and needs to address accounting differences. What would be considered an accounting difference between the two firms? A. The firms have different auditors B. The firms use different inventory methods C. The firms have different fiscal years D. The firms are in different industries b For the year 2013, a firm has a return on equity (ROE) that is greater than return on assets (ROA). Which conclusion would an analyst draw from these numbers? A. The firm is ineffectively using debt. B. The firm is ineffectively managing their inventory C. The firm is effectively managing their inventory D. The firm is effectively using debt d What is an example of an estimate used in recording transactions? A. Deciding whether to expense or depreciate a fixed asset B. Deciding the cost of fixed asset when calculating depreciation expense C. Deciding the salvage value of a fixed asset when calculating depreciation expense D. Deciding whether to sell a fixed asset c What is the coupon rate (yield) of a bond? A. The interest accrued on the bond through expiration B. The interest rate of the bond that can be changed at any time during the life of the bond C. The sum of money that the corporation promises to pay upon expiration of the bond D. The interest rate of the bond that is contractually set upon issuance d If the coupon rate on a particular bond is higher than the market rate of return, at what will the bond sell? A. At a premium B. A the risk-free rate C. At par D. At a discount a Which securities are issued by the U.S. Federal government and are taxable at the federal level? A. Eurobonds B. Municipal bonds C. Corporate bonds D. Treasury bonds d What is the current price of the bond, if the required rate of return on a bond is the same as the coupon rate? A. Greater than the par value of the bond B. Equal to the par value of the bond C. The current prevailing market price of the bond D. Less than the par value of the bond b If the current coupon rate on a bond is 6% and the bond is selling at a 5% discount, what is the yield to maturity on the bond? A. Equal to 5% B. Equal to 6% C. Less than 6% D. Greater than 6% b How is a short-term receivable, with the maturity of less than one year, carried on the balance sheet? A. As a current asset B. As a current liability C. As owner's equity D. As a long-term liability a When is a company that has strong operating revenues and competent management a good investment? A. When the intrinsic value of the price per share is higher than the current stock price B. When the intrinsic value of the price per share is lower than the current stock price C. When the current stock price is currently equal to the intrinsic value D. When the current stock price is overvalued relative to the intrinsic value a Thinking about levels of market efficiency quadrants. Which investment option should be selected assuming a prudent investor wants to maximize their expected return E(R)? Quad 1; Quad 2; Quad 3; Quad 4 A. A B. B C. C D. D E. E a Which security type includes the right to vote for a board of directors? A. Preferred stock B. Money market funds C. Bonds D. Common stock d Economists forecast the probability of recession at 22%. During periods of recession, returns for a company have been -2%. Returns for the company have been 18% during an expansionary period. What is the forecast probability of an expansionary period? A. 80% B. 78% C. 76% D. 82% b What makes the "efficient frontier" efficient? A. It always produces the minimum risk B. It disregards risk to produce the maximum return C. It provides the highest level of risk for a given return D. It maximizes the ratio of expected return to risk d What are 3 components required in calculating weighted average cost of capital (WACC)? A. The market cap of the company B. The desired growth rate C. The amount and required return for common equity, preferred equity and debt D. The marginal tax rate E. The value of preferred stock and debt F. The firm's market value G. The combined total expected growth rate d, e, f What advantage does the Gordon growth model have compared to the capital asset pricing model (CAPM)? A. It requires assumptions about growth that benefit fast growing companies B. It provides an easier to understand and relatively accurate forecast when growth rates are stable C. It is highly accurate in predicting future growth D. It requires the use of accurate known factors, such as future growth rates b How does the weighted average cost of capital affect a company's growth opportunities? A. The higher the cost of capital, the greater the growth opportunities B. Only the cost of debit will affect growth opportunities C. The lower the cost of capital, the lower the growth opportunities D. The lower the cost of capital, the greater the growth opportunities d Under which three conditions would a firm decide to reduce the growth rate? A. When investors are dissatisfied with the dividend payout ratio B. When additional investor capital is not available C. When capacity has been reached D. When customers are dissatisfied with the company's products E. When the company's borrowing limits have reached the maximum allowed by the lender b, c, d Which three changes would affect an estimate of differential cash flows? A. An increase in the marginal tax rate of a company B. An increase in the estimated value of the new machine at the end of the project C. A revision in the depreciation schedule D. A decrease in projected annual revenue E. An increase in the overhead allocation b, c, e Why is it important to prepare an accurate fixed asset financing forecast? A. The method used to finance fixed assets will drive product demand. B. Firms producing above capacity may not require additional fixed asset investment to increase sales. C. Accurate forecasting of fixed assets requirements ensures the complete discretion of management in budgeting. D. Firms producing below capacity may not require additional fixed asset investment to increase sales. b How is the value of a project determined in the capital budgeting process? A. The net present value of the incremental before-tax cash flows B. The future value of the incremental tax cash flows C. The net present value of the incremental tax cash flows D. The future value of the incremental before-tax cash flows c Company A has a high degree of business risk. What will be the effect on the company's EBIT if the company suffers a slight decrease in sales? A. Large increase in EBIT B. Large decrease in EBIT C. Small decrease in EBIT D. Small increase in EBIT b What effect does the method of financing investments have on the value of the firm? A. The method of financing investments alters the weighted average of the cost of capital. B. Financing through tax-advantage debt has no effect on the value of the firm C. Issuing more costly (ie risker) bonds for financing investments has no effect on the value of the firm D. Any mehod of financing investments has the same effect on the value of the firm a Why would a company prefer equity financing over debt financing? A. Too much debt can lead to a greater risk of possible insolvency B. Equity financing has tax benefits C. Issuing new debt diminishes the existing control of shareholders D. Using equity to finance a capital investment project is less costly d Which hybrid security has some elements that resemble equity and others that resemble debt? A. Derivative stock B. Preferred stock C. Common stock D. Treasury stock b How do increases in market interest rates affect a firm's cost of capital? A. The cost of debt decreases B. The cost of equity decreases C. The cost of debt increases D. The cost of equity increases c Which two ratios are used to evaluate a company's working capital management? A. Receivable turnover B. Earnings per share C. Return on equity D. Cash ratio E Profit Margin a, d Why should a company carry cash A. The opportunity cost of holding cash is low B. The shortage cost of holding cash is high C. Cash is needed for day to day operations D. Cash is needed to meet the customers demands c What is commonly used method that limits the time it takes between payment and the receipt of cash? A. Automated data processing B. Payment by mail processing C. Disbursement float processing D. Electronic check processing d Some companies offer discounts to customers in order to give incentive for paying earlier than the due date. What two terms incentivize customers to accept trade discounts? A. Cash cycle B. Length of the credit period C. Sales commission D. Amount of discount E. Days sales in receivables b, d Which three costs are associated with holding inventory? A. Variable costs B. Opportunity costs C. Storage costs D. Product costs E. Fixed costs b, c, d Which ratio is used in the comparable multiples method? A. Quick ratio B. Current ratio C. Price earnings ratio D. Debt to equity ratio c Investors will often sell a stock that has gains rather than a stock that is suffering losses in their portfolio, despite subsidized tax relief when selling at a loss. What the logic-defying behavioral implications of such a decision. A. Selling a stock at a gain results in dollar cost average benefits B. Maintaining winning positions in the portfolio enhances future portfolio growth rate C. Investors hate taking a loss, especially when they can realize a gain D. Selling an equity position at any point results in a favorable tax benefit b How are the Security and Exchange Commissions' Regulation S and Rule 144A similar? A. Both use incentives and penalties to ensure fair dealings between large financial institutions and small investors. B. Both allow firms to raise capital without registering with the SEC if certain conditions are met C. Both are intended to increase transparency of financial markets D. Both encourage specialized training by individuals designated to sell securities b What is the primary intent of the Sarbanes-Oxley Act? A. To impose requirements on stockholders of public companies B. To reduce the fees associated with financial transactions C. To control the rise in the rate of executive compensation D. To ensure honest audit and accounting procedures d Which element is a required disclosure in the prospectus, according to the Securities Act of 1933? A. Internal control reports B. Tax returns C. Audited financial statements D. Budgets c Which condition must be met for a firm that trades in equities to be in compliance with the Securities and Exchange (SEC) regulations? Securities and Exchange (SEC) regulations? A. Payments pursuant to the Sarbanes-Oxley Act B. Participation in the MSRB (Municipal Securities Rulemaking Board) C. Certification under the Dodd-Frank Act D. Membership in FINRA (Financial Industry Regulatory Authority) d Which practice is limited by the Volcker rule of the Dodd-Frank Act? A. The role of inside directors B. Issuance of limited prospectuses C. Bank investments in hedge funds D. Conflicts of interests by bank board members c What is beta? A. An absolute measure of idiosyncratic risk B. A measure of market value relative to the market risk C. An absolute measure of systematic risk D. A measure of systematic risk, relative to the market risk c What do investors, entrepreneurs and other market participants rely on the SEC to do? A. Determine safety and efficiency of investment by US and foreign investors B. Regulate the Money Supply C. Prohibit foreign bribery D. Require Private Firms to Register a What is one way a firm maximizes shareholder value? A. By switching inventory methods B. By reducing the firm's labor force C. By outsourcing the production of the firm's core product D. By avoiding investments that cost more money than they bring in d What is one of the two basic types of financial instruments? A. Money Markets B. Mutual Funds C. Stocks D. Options c The stock price of a company increases and the market is deemed efficient. What assumption can be made? A. A new, patented, product was introduced to the market. B. New machinery was purchased with a useful life of 20 years. C. Management is optimizing its resources and operating efficiently. D. Management hired new employees and invested in a training program. a Which statement is true about how the global market affects the U.S. A. A bad options trade executed by a foreign subsidiary of a Wall Street bank will affect layoffs overseas. B. A Bad derivatives trade executed by a foreign subsidiary of a Wall Street bank will affect layoffs overseas. C. American investors and fund managers make decisions based on financial reporting standards developed and financial statements audited overseas. D. Foreign investors and fund managers make decisions based on financial reporting standards developed and financial statements audited overseas. d What are secondary markets? A. Markets where securities are traded subsequent to the initial offering. B. Markets were securities are issued for the first time. C. Markets were securities are issued through a competitive sale. D. Markets where securities are issued through a negotiated sale. a A special interest group in the U.S. has been lobbying intensely for protectionism through increased tariffs and trade restrictions, with the argument that it will save jobs in the industry they represent. What is the most likely result if they are successful? A. Employees and shareholders of the domestic industry that produce the protective goods will be hurt and the nation will benefit. B. The overall economy will benefit from trade restrictions and tariffs. C. Removing the trade restrictions and tariffs will result in a net economic loss to the overall U.S. economy. D. Employees and shareholders of the domestic industry that produce the protected goods will benefit and the nation will be hurt. d What is true about the content of an income statement? A. It reports the assets, liabilities, and the equity at a point in time. B. It reports the assets and expenses for a period of time. C. It reports the expenses and liabilities at a point in time. D. It reports the revenues and expenses for a period of time. d What is the basis used to compute a company's income tax expense? A. Pretax accounting income. B. Taxable income. C. Net operating income. D. Taxes payable. d A company's trial balance shows $900 in long-term debt. On which financial statement should this be shown? A. The general ledger B. The statement of cash flows C. The income statement D. The balance sheet d What do cash flows from financing activities generally relate to? A. A firm's purchase and sale of long-term assets B. A firm's non-cash transactions C. A firms' debt and equity transactions D. A firms sale of goods and services c What is true about the cash flow from the operating activities section of the statement of cash flows? A. Increases in current liability accounts represents an inflow of cash and should be added to net income B. Decreases in current liability accounts represent an outflow of cash and should be added to net income C. Increases in current liability accounts represent an outflow of cash and should be subtracted from net income D. Decreases in current liability accounts represent an inflow of cash and should be added to net income a An analyst is comparing the ratios of two firms and needs to address accounting differences. What would be considered an accounting difference between two firms? A. The firms are in different industries B. The firms have different auditors C. The firms use different inventory methods D. The firms have different fiscal years c Firms A and B are in the same industry. For the year 2013, Firm A has a gross margin of .45 and Firm B has a gross margin of .36. Which conclusion would an analyst draw when comparing Firm A to Firm B? A. Firm A has a more efficient production process B. Firm A has higher depreciation expense C. Firm A has lower depreciation expense D. Firm A has less efficient production process a What is an example of an estimate used in recording transactions? A. Deciding the salvage value of fixed asset when calculating depreciation expense B. Deciding whether to expense or depreciate a fixed asset C. Deciding the cost of a fixed asset when calculating depreciation expense D. Deciding whether to sell a fixed asset a What is a subordinated debenture? A. A bond that is risk free B. A bond that is backed by collateral C. A bond that has a higher claim to the assets of the firm in the event of liquidation D. A bond that has a lower claim to the assets of the firm in the event of liquidation d If the coupon rate on a particular bond is higher than the market rate of return, at what will the bond sell? A. At a premium B. A par C. At the risk-free rate D. At a discount a Which securities are issued by the U.S. federal government and are taxable at the federal level? A. Municipal bonds B. Treasury bonds C. Corporate bonds D. Eurobonds b If the current coupon rate on a bond is 6% and the bond is selling at a 5% discount, what is the yield to maturity on the bond? A. Less than 6% B. Greater than 6% C. Equal to 6% D. Equal to 5% c What is the difference between a secured loan and an unsecured loan? A. Secured loans require some form of collateral. B. Unsecured loans typically have a lower interest rate C. Unsecured loans require some form of collateral. D. Secured loans typically have a higher interest rate a What is the intrinsic value of a stock? A. The future estimated market value B. The 100-day moving average of the stock price C. Net present value of expected future cash flows D. Past market value c Which investment option should be selected assuming a prudent investor wants to maximize their return E(R)? A. Quad 1 A B. Quad 2 B C. Quad 2 C D. Quad 3 D E. Quad 4 E a What is the relationship between annual percentage rate (APR) and annual percentage yield (APY)? A. The APR will be greater than the APY if compounding happens more frequently than annually B. The APR will equal the APY if compounding happens more frequently than annually C. The APR will be less than the APY if compounding happens more frequently than annually D. The APR will be less than the APY if compounding happens more frequently than annually a What is the priority order of repayment (first to last) to a company's investors and creditors? A. Creditors, common stockholders, preferred stockholders B. Preferred stockholders, creditors, common stockholders C. Creditors, preferred stockholders, common stockholders D. Common stockholders, preferred stockholders, creditors c Where on the "efficient frontier" is a young investor with a high risk tolerance likely to fall? A. A1 B. C1 C. D2 D. D3 d Supply and demand factors suggest the slope for an individual asset in the portfolio will equal the slope of the market portfolio itself. What is the significance of this equalization? A. The entire risk-return slope will decrease over time B. Investors will be forced to frequently shift their portfolios C. Investors will be incentivized to hold the market portfolio D. The slope of the individual assets in a portfolio will diverge to increase diversification. c What are the components required in calculating weighted average cost of capital (WACC)? Choose 3 A. The market cap of the company B. The desired growth rate C. The value of the preferred stock and debt D. The firms market value E The marginal tax rate F The combined total expected growth rate The amount and required return for common equity, preferred equity and debt c,d, e What advantage does the Gordon Growth Model have compared to the capital asset pricing model (CAPM)? A. It is highly accurate in predicting future growth B. It requires assumptions about growth that benefit fast-growing companies C. It provides an easier to understand and relatively accurate forecast when growth rates are stable D. It requires the use of accurate known factors, such future as growth rates. c How does the weighted average cost of capital affect a company's growth opportunities? A. The lower the cost of capital, the greater the growth opportunities B. Only the cost of debt will affect growth opportunities C. The lower the cost of capital, the lower the growth opportunities D. The higher the cost of capital, the greater the growth opportunities a Under which three conditions would a firm decide to reduce the growth rate? Choose 3 A. When investors are dissatisfied with the dividend payout ratio B. When additional investor capital is not available C. When the company's borrowing limits have reached the maximum allowed by the lender D. When capacity has been reached E. When customers are dissatisfied with the company's products b, d, e What are discretionary accounts? A. Accounts that require management to deliberately increase or decrease B. Accounts that increase automatically with sales C. Accounts that include current assets D. Accounts that only appear on an income statement a What is the purpose of the capital budget process? A. Estimating the budget of a new project B. Estimating the cost to start a new project C. Budgeting a firm's monthly revenue and expenses D. Deciding which projects increase the firm's value d Firm A has a lower degree of business risk than Firm B. What will happen if there is a 1% increase in sales for both firms? A. It will result in a greater percentage in Firm A's operating income B. It will result in a greater percentage in Firm Bs operating income C. It will result in a greater percentage in Firm Bs operating income D. It will result in a greater percentage in Firm As operating income c Modigilani and Miller's initial capital structure theory suggested that in the absence of taxes, bankruptcy costs and transaction costs, the firm's capital structure would not affect the weighted average cost of capital (WACC). What has been proven by subsequent research and inclusion of factors omitted in the initial theory? A. A firm's capital structure does affect the weighted average costs of capital, and thus a firm's value. B. Modigliani and Miller's initial work has proven accurate in determining a firm's value. C. Financing decisions do not affect a firm's value D. Taxes are the only factor that impacts the weighted average cost of capital and a firm's value a Which strategy issues new debt within a company and takes the proceeds from the debt issuance to buy back some of the outstanding shares? A. Leverage recapitalization B. Leverage buyouts C. Reorganization D. Nationalization a Which type of bond gives an investor the right to trade each bond for a set number of shares of common stock whenever the investor chooses? A. Treasury bond B. Convertible bond C. Mortgage bond D. Foreign bond b A credit agency recently downgraded a company's debt. What is the impact on the cost of debt? A. The cost of capital will increase B. The cost of capital will decrease C. The cost of equity will decrease D. The cost of capital will remain the same a Which financial ratio measures a company's ability to meet its short term obligations with its most liquid assets? A. Quick ratio B. Equity ratio C. Debt ratio D. Current ratio a Why should a company carry cash? A. The opportunity cost of holding cash is low. B. Cash is needed to meet the customers' demand. C. Cash is needed for day to day operations D. The shortage cost of holding cash is high. c Which term describes the amount of cash that a firm must hold as a safety net to counter future unforeseen expenses? A. Reserve balance B. Budgetary balance C. Beginning balance D. Operating balance a Some companies offer discounts to customers in order to give incentive for paying earlier than the due date. Which two terms incentivize customers to accept trade discounts? Choose 2 A. Sales commission B. Amount of discount C. Cash cycle D. Day's sales in receivables E. Length of the credit period b, e Which three costs are associated with holding inventory? A. Fixed costs B. Storage costs C. Variable costs D. Product costs E. Opportunity costs b, d, e Which ratio is used in the comparable multiples method? A. Current ratio B. Debt to equity ratio C. Quick ratio D. Price earnings ratio d Investors will often sell as stock that has gains rather than a stock that is suffering losses in their portfolio, despite subsidized tax relief when selling at a loss. What are the logic defying behavioral implications of such a decision? A. Selling a stock at a gain results in dollar cost averaging benefits B. Maintaining winning positions in the portfolio enhances future portfolio growth rate C. Investors hate taking a loss, especially when they can realize a gain. D. Selling an equity position at any point results in a favorable tax benefit. b How are the Securities and Exchange Commissions Regulation S and Rule 144A similar? A. Both allow firms to raise capital without registering with the SEC if certain conditions are met B. Both encourage specialized training by individuals designated to sell securities. C. Both use incentives and penalties to ensure dealing between large financial institutions and small investors D. Both are intended to increase transparency of financial markets a Which element is a required disclosure in the prospectus, according to the Securities Act of 1933? A. Audited financial statements B. Tax returns C. Budgets D. Internal control reports a What must a firm have to be in compliance with Financial Industry Regulatory Authority (FINRA) rules? A. Significant cash reserves B. Diversity in board membership C. Public disclosure of personnel files D. Current and accurate books d Which organization was created by Dodd-Frank to monitor how systematic risk could impact the banking industry? A. Public Oversight Board B. Financial Stability Oversight Council C. Federal Insurance Office D. Financial Regulatory Agency b [Show More]

Last updated: 8 months ago

Preview 1 out of 79 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 25, 2023

Number of pages

79

Written in

Additional information

This document has been written for:

Uploaded

Aug 25, 2023

Downloads

0

Views

35

.png)