Business > TEST BANK > Test bank for Fundamentals of Futures and Options Markets 7e by John Hull (Test Bank) (All)

Test bank for Fundamentals of Futures and Options Markets 7e by John Hull (Test Bank)

Document Content and Description Below

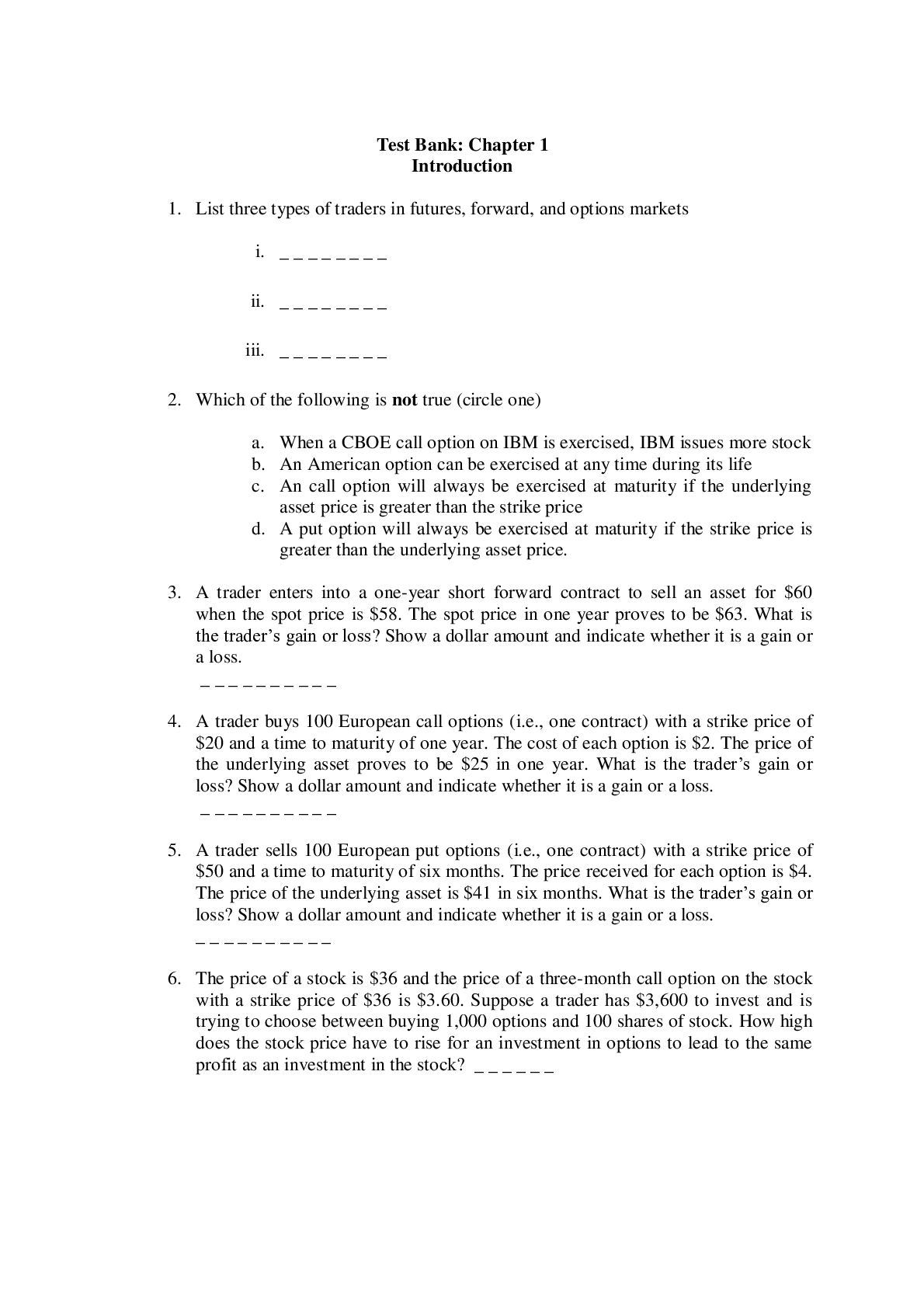

Test Bank: Chapter 1 Introduction 1. List three types of traders in futures, forward, and options markets i. _ _ _ _ _ _ _ _ ii. _ _ _ _ _ _ _ _ iii. _ _ _ _ _ _ _ _ 2. Which of the following is... not true (circle one) a. When a CBOE call option on IBM is exercised, IBM issues more stock b. An American option can be exercised at any time during its life c. An call option will always be exercised at maturity if the underlying asset price is greater than the strike price d. A put option will always be exercised at maturity if the strike price is greater than the underlying asset price. 3. A trader enters into a one-year short forward contract to sell an asset for $60 when the spot price is $58. The spot price in one year proves to be $63. What is the trader’s gain or loss? Show a dollar amount and indicate whether it is a gain or a loss. _ _ _ _ _ _ _ _ _ _ 4. A trader buys 100 European call options (i.e., one contract) with a strike price of $20 and a time to maturity of one year. The cost of each option is $2. The price of the underlying asset proves to be $25 in one year. What is the trader’s gain or loss? Show a dollar amount and indicate whether it is a gain or a loss. _ _ _ _ _ _ _ _ _ _ 5. A trader sells 100 European put options (i.e., one contract) with a strike price of $50 and a time to maturity of six months. The price received for each option is $4. The price of the underlying asset is $41 in six months. What is the trader’s gain or loss? Show a dollar amount and indicate whether it is a gain or a loss. _ _ _ _ _ _ _ _ _ _ 6. The price of a stock is $36 and the price of a three-month call option on the stock with a strike price of $36 is $3.60. Suppose a trader has $3,600 to invest and is trying to choose between buying 1,000 options and 100 shares of stock. How high does the stock price have to rise for an investment in options to lead to the same profit as an investment in the stock? _ _ _ _ _ _ 7. A one-year call option on a stock with a strike price of $30 costs $3; a one-year put option on the stock with a strike price of $30 costs $4. Suppose that a trader buys two call options and one put option. (i) What is the breakeven stock price, above which the trader makes a profit? _ _ _ _ _ _ (ii) What is the breakeven stock price below which the trader makes a profit? _ _ _ _ _ _ Test Bank: Chapter 2 Mechanics of Futures and Forward Markets 1. Which of the following is true (circle one) (a) Both forward and futures contracts are traded on exchanges. (b) Forward contracts are traded on exchanges, but futures contracts are not. (c) Futures contracts are traded on exchanges, but forward contracts are not. (d) Neither futures contracts nor forward contracts are traded on exchanges. 2. Which of the following is not true (circle one) (a) Futures contracts nearly always last longer than forward contracts (b) Futures contracts are standardized; forward contracts are not. (c) Delivery or final cash settlement usually takes place with forward contracts; the same is not true of futures contracts. (d) Forward contract usually have one specified delivery date; futures contract often have a range of delivery dates. 3. In the corn futures contract a number of different types of corn can be delivered (with price adjustments specified by the exchange) and there are a number of different delivery locations. Which of the following is true (circle one) (a) This flexibility tends increase the futures price. (b) This flexibility tends decrease the futures price. (c) This flexibility may increase and may decrease the futures price. (d) This has no effect on the futures price 4. A company enters into a short futures contract to sell 50,000 units of a commodity for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call? _ _ _ _ _ _ 5. A company enters into a long futures contract to buy 1,000 barrels of oil for $60 per barrel. The initial margin is $6,000 and the maintenance margin is $4,000. What oil futures price will allow $2,000 to be withdrawn from the margin account? … 6. On the floor of a futures exchange one futures contract is traded where both the long and short parties are closing out existing positions. What is the resultant change in the open interest? Circle one. (a) No change (b) Decrease by one (c) Decrease by two (d) Increase by one [Show More]

Last updated: 2 months ago

Preview 1 out of 46 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 18, 2024

Number of pages

46

Written in

Additional information

This document has been written for:

Uploaded

Feb 18, 2024

Downloads

0

Views

25