Business Administration > CASE STUDY > 5BUSS001W: BUSINESS DECISION MAKING: EXAMINATION PAPER SEMESTER ONE JANUARY 2019: All Solutions (All)

5BUSS001W: BUSINESS DECISION MAKING: EXAMINATION PAPER SEMESTER ONE JANUARY 2019: All Solutions

Document Content and Description Below

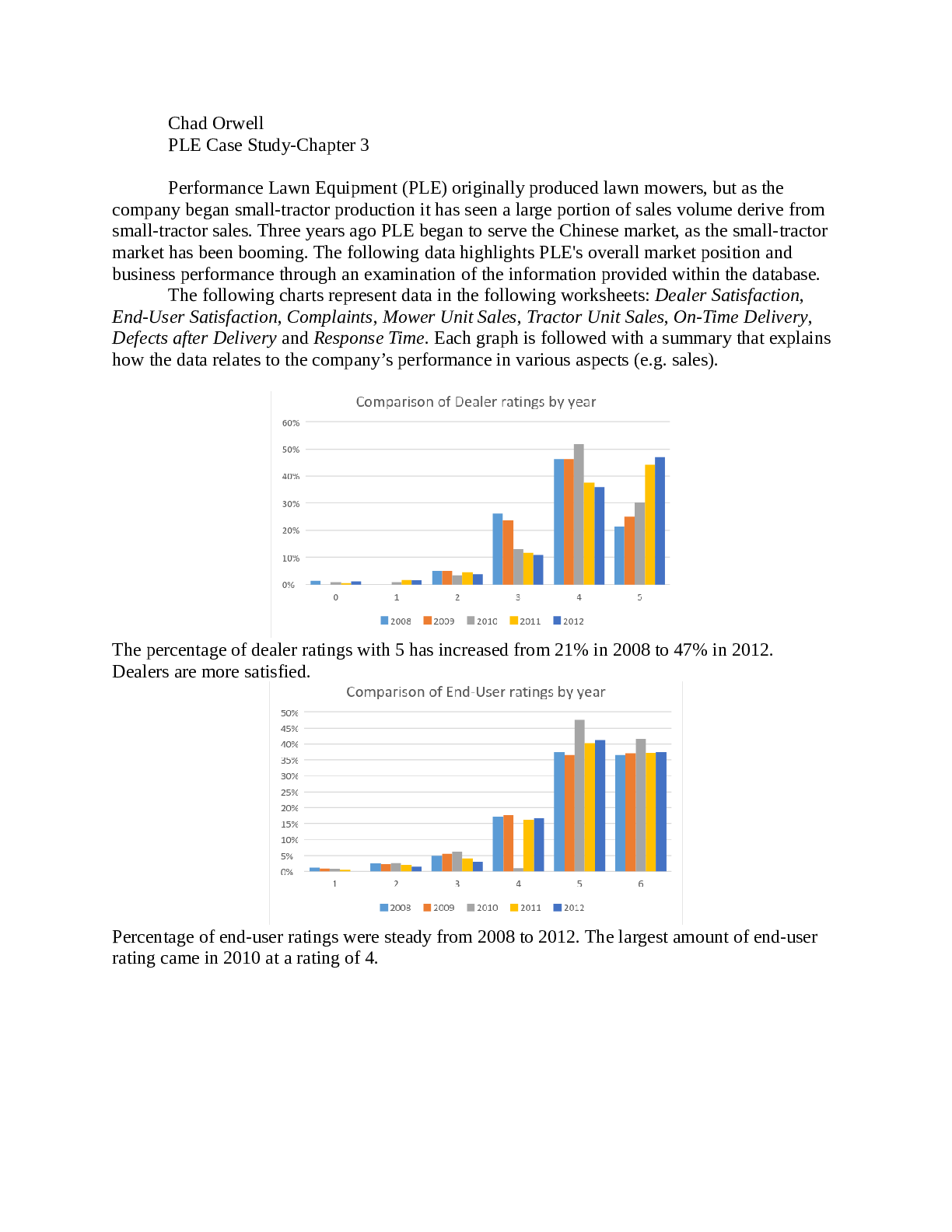

SECTION A Answer all THREE questions in this section. Question 1 Zenith Sporting Goods Company (ZSGC) is trying to decide which of four possible locations it should select for its new ‘mega-st... ore’; the choice is between Aldershot, Brighton, Canterbury and Dover. It has asked you, as one of new business analysts, to undertake a multi-criteria analysis (MCA). The company has identified three key criteria: Average Incomes, Transport Links and Investment Cost. You have used a range of sources to help determine the weighting given to each criterion, together with the rating assigned to each option (where 5 indicates the best and 1 the worst). The information that have provided is summarised in the decision matrix, below: Location Average Incomes (Weight = 0.35) Score Transport Links (Weight = 0.35) Score Investment Cost (Weight = 0.3) Score Aldershot 2 4 4 Brighton 5 1 2 Canterbury 4 2 1 Dover 2 3 3 Required: a) Copy the decision matrix above. Use a MCA to advise ZSGC on the location it should choose, based on the information provided. Location Average Incomes (Weight = 0.35) Score Transport Links (Weight = 0.35) Score Investment Cost (Weight = 0.3) Score Weighted score Aldershot 2*0.35 4*0.35 4*0.3 3.3* Brighton 5*0.35 1*0.35 2*0.3 2.7 Canterbury 4*0.35 2*0.35 1*0.3 2.4 Dover 2*0.35 3*0.35 3*0.3 2.65 Aldershot is the preferred location. Up to 6 marks for workings; 2 marks for correct choice. (8 marks) b) Give two limitations of multi-criteria analysis as a decision-making technique. (2 marks) (10 marks) Question 2 ZSGC is considering two possible marketing campaigns to increase company turnover (celebrity endorsement or social media adverts). Celebrity endorsement would cost £100,000 (whether the company decides to go with Lewis Hamilton or Johanna Konta), while social media adverts would cost the company £50,000. The decision tree, below, sets out the probabilities and payoffs (profit contribution in £000s) associated with the two marketing options under conditions of high and low growth, but it is incomplete: Required: Copy and complete the decision tree (shown over page) by adding any missing elements. Use it to advise ZSGC which option to choose, assuming the company wishes to maximize expected profits from the marketing campaigns. (10 marks) Question 3 The management team at ZSGC has been offered a new credit control system and would like you to determine whether it will generate an accounting rate of return (ARR) that exceeds the company’s benchmark of 25%. The system costs £180,000 and has a 10-year life. The system is expected to generate incremental revenues of £120,000 and will have incremental expenses of £66,000 including depreciation. Required: a) Calculate the accounting rate of return (ARR) on the investment project. (8 marks) b) For the benefit of the ZSGC management team highlight two limitations of ARR as an investment appraisal technique. (2 marks) (10 marks) Section B starts on the next page SECTION B Answer only TWO questions from this section. Question 4 ZSGC has long believed that demand for its sporting goods is sensitive to the overall weather conditions in any year. In 2018, for instance, the hot, dry spring and summer weather in the UK boosted sales of water sports wear and equipment, while reducing sales of its hiking gear. The market research consultancy hired by ZSGC has produced forecasts of sales of four of the company’s best-selling products over the next year, based on three alternative weather forecasts for 2019 (relative to long term average conditions). It has summarised these as: Cool & Wet, Warm & Variable or Hot & Dry. This information is summarised in the following pay-off matrix (with sales volumes in £000s). Weather Conditions Sporting Good Cool & Wet Warm & Dry Hot & Dry Mountain Bikes 400 330 200 Surfboards -150 150 550 Tennis racquets -100 300 450 Running shoes 300 300 300 a) Explain the difference between a situation of risk and one of uncertainty. (3 marks) b) What is the preferred option according to each of the following criteria and what attitude to risk do they represent? c) Construct a potential regret matrix and use it to determine the best choice of sporting good according to the minimax regret criterion. (8 marks) Opp Loss Matrix Weather Conditions Sporting Good Cool & Wet Warm & Dry Hot & Dry MAX Mountain Bikes 0 0 350 350 Surfboards 550 180 0 550 Tennis racquets 500 30 100 500 Running shoes 100 30 250 250* d) The market research consultancy has obtained weather forecasts from the Meteorological Office for the coming year and using these has estimated the following probabilities for the different weather conditions: Cool & Wet (25%), Warm & Dry (55%), and Hot & Dry (20%). Which sporting good looks the best choice according to the expected monetary value (EMV) criterion? EV Weather Conditions Sporting Good Cool & Wet (0.25) Warm & Dry (0.55) Hot & Dry (0.20) EV Mountain Bikes 400*0.25 330*0.55 200*0.2 321.5* Surfboards -150 150 550 155 Tennis racquets -100 300 450 230 Running shoes 300 300 300 300 (8 marks) e) ZSGC has now been contacted by a private weather agency that has offered to provide infallible forecasts of next year’s weather conditions. What is the maximum that ZSGC should be prepared to pay the weather agency for this information (in other words what is the value of perfect information concerning next year’s weather conditions in the UK)? . (8 marks) (Total: 35 marks) Question 5 ZSGC has so far operated as a merchandising company, but would like to move into the manufacture of some ‘own-brand’ sporting goods in its own workshop. Initially, it has plans to produce a high quality badminton racquet made from lightweight, high performance materials. The fixed costs of operating the workshop for a month amount to £16,000. Each racquet will require £120 of material and will take 2 hours of direct labour at an hourly rate of £20. The racquet will be sold at its stores for £240. The company expects to sell 300 racquets each month. a) Calculate the company’s annual profit. (6 marks) b) Calculate the break-even point both in terms of number of racquets and in terms of sales revenue. (6 marks) c) Calculate the ‘margin of safety’ as a percentage of the expected level of sales and briefly explain what the ‘margin of safety’ means. (5 marks) d) Would it be worthwhile to increase the selling price of each racquet by £40 from its current level if it leads to a decrease of 20% in demand for the racquet? Estimate the new annual profit if the price reduction was implemented. (6 marks) e) Use the information from d) to calculate the price elasticity of demand for the racquet and the optimal mark-up (on variable costs). (6 marks) f) What price should the company sell each racquet for if it wishes to make an annual profit of £120,000? (6 marks) (Total: 35 marks) Question 6 ZSGC would like you to appraise two possible designs for its new workshop, which it has code-named Alpha and Omega. The following table presents the annual net cash flows of these two designs; assume that both would have an eight-year life, at the end of which there would be no scrap value. Year Alpha Omega £ £ Initial investment (100,000) (180,000) 1 10,000 10,000 2 20,000 20,000 3 20,000 20,000 4 30,000 30,000 5 40,000 40,000 6 30,000 50,000 7 30,000 60,000 8 20,000 70,000 a) Calculate the payback period for each of the designs and suggest which of them (if any) is worthwhile if it is the company’s policy not to take on a project with a payback period longer than 4 years. (8 marks) b) Briefly discuss the main reasons why, despite its numerous drawbacks, payback still remains a widely used technique for investment appraisal. (5 marks) c) Calculate the Net Present Value (NPV) for both Alpha and Omega, using a cost of capital of 9%. Recommend which design should be chosen (if any). 14 marks) d) You are told that at a discount rate of 20% the NPV of Alpha is –£12,593 and that of Omega is –£65,900. Using this information calculate the internal rate of return (IRR) of each option and indicate which should be preferred according to this criterion. (8 marks) (Total: 35 marks) Question 7 ZSGC buys the component parts for two types of bicycle, a road bike and a mountain bike, which it them assembles, tests and packs under its own brand name. It has a small facility attached to its mega-store in Slough which it uses for this operation. The table, below, shows the hours required for each stage of the operation and the total hours available each month. Road Bike Mountain Bike Total hours available Assembly 2 10 8,000 Testing 4 5 5,500 Packing 6 5 6,000 Profit Contribution £400/unit £250/unit Required: a) Formulate as a linear programming problem, where the objective is to maximise the total profit from the two products. (6 marks) b) Solve the problem graphically to determine the optimal number of Road Bikes and Mountain Bikes to produce each month. Confirm the solution algebraically. So the optimum solution should be: X1=250; X2=900 And 7c: £325,000? (14 marks) c) What is the maximum achievable monthly profit? (4 marks) d) What is meant by the shadow price of a constraint? Using the information provided in the Excel Sensitivity Report shown below, advise ZSGC on the benefits to be gained from increasing the hours available at each stage (Assembly, Testing and Packing). (5 marks) Microsoft Excel Sensitivity Report ADJUSTABLE CELLS Objective Allowable Allowable Cell Name Coefficient Increase Decrease $D$5 Quantity produced Road Bike 400 100 200 $E$5 Quantity produced Mountain 250 250 50 CONSTRAINTS Shadow Constraint Allowable Allowable Cell Name Price R.H. Side Increase Decrease $C$8 Assembly Amount used 0 8000 Infinity 1500 $C$9 Testing Amount used 1.67 5500 500 1500 $C$10 Packing Amount used 5.56 6000 2250 900 e) Briefly explain how Scenario Analysis and the Monte Carlo Simulation technique differ from Sensitivity Analysis. How could they could be helpful to ZSGC when dealing with risky decisions? (6 marks) (Total: 35 marks) End of Examination Present Value of £1 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% (after n years) 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 4 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 6 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 7 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 8 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 10 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 16 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 18 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 19 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 20 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 21 0.8114 0.6598 0.5375 0.4388 0.3589 0.2942 0.2415 0.1987 0.1637 0.1351 [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 24, 2020

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Apr 24, 2020

Downloads

0

Views

124