Financial Accounting > EXAM > MODERN ADVANCED ACCOUNTING IN CANADA 6TH EDITION HILTON TEST BANK QUESTIONS WITH ANSWERS LATEST UPDA (All)

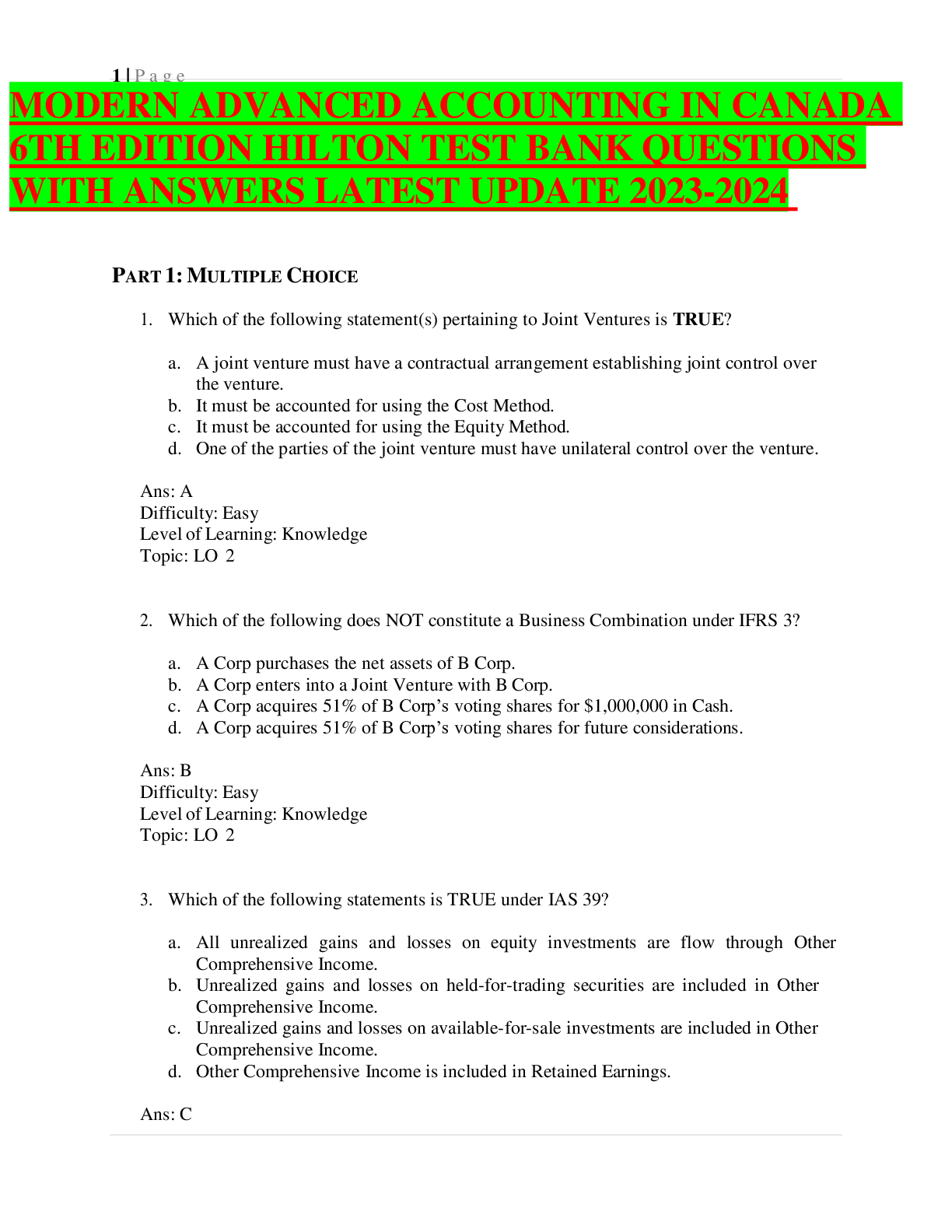

MODERN ADVANCED ACCOUNTING IN CANADA 6TH EDITION HILTON TEST BANK QUESTIONS WITH ANSWERS LATEST UPDATE 2023-2024

Document Content and Description Below

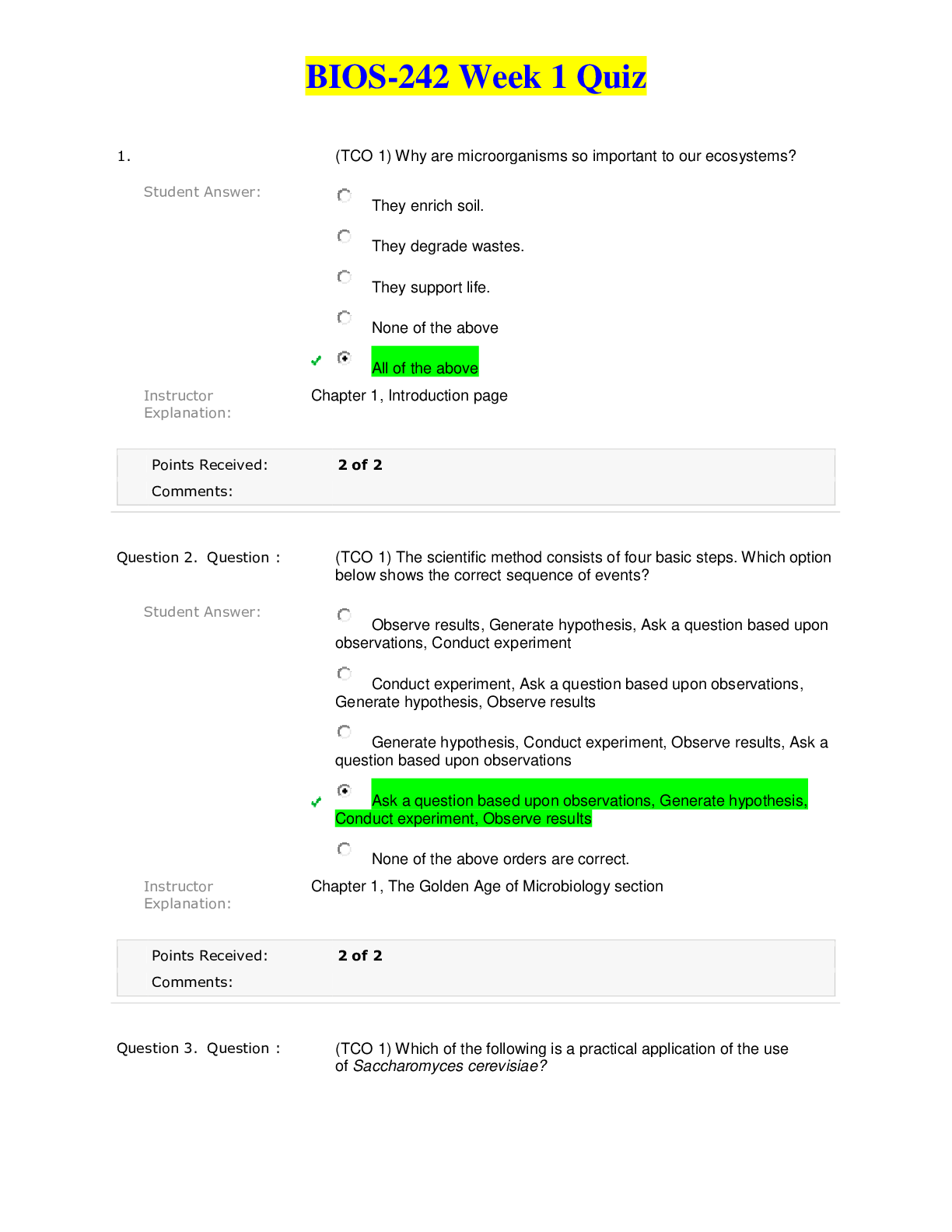

MODERN ADVANCED ACCOUNTING IN CANADA 6TH EDITION HILTON TEST BANK QUESTIONS WITH ANSWERS LATEST UPDATE 2023-2024 PART 1: MULTIPLE CHOICE 1. Which of the following statement(s) pertaining to J... oint Ventures is TRUE? a. A joint venture must have a contractual arrangement establishing joint control over the venture. b. It must be accounted for using the Cost Method. c. It must be accounted for using the Equity Method. d. One of the parties of the joint venture must have unilateral control over the venture. Ans: A Difficulty: Easy Level of Learning: Knowledge Topic: LO 2 2. Which of the following does NOT constitute a Business Combination under IFRS 3? a. A Corp purchases the net assets of B Corp. b. A Corp enters into a Joint Venture with B Corp. c. A Corp acquires 51% of B Corp’s voting shares for $1,000,000 in Cash. d. A Corp acquires 51% of B Corp’s voting shares for future considerations. Ans: B Difficulty: Easy Level of Learning: Knowledge Topic: LO 2 3. Which of the following statements is TRUE under IAS 39? a. All unrealized gains and losses on equity investments are flow through Other Comprehensive Income. b. Unrealized gains and losses on held-for-trading securities are included in Other Comprehensive Income. c. Unrealized gains and losses on available-for-sale investments are included in Other Comprehensive Income. d. Other Comprehensive Income is included in Retained Earnings. Ans: C Difficulty: Easy Level of Learning: Knowledge Topic: LO 4 4. Which of the following statements is CORRECT? 1 | P a g e a. A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control. b. A Comprehensive Revaluation of Assets and Liabilities is optional when there has been a change in control. c. A Comprehensive Revaluation of Assets and Liabilities is optional when the company was subject to a Financial Reorganization. d. A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control and/or the company has been subject to a Financial Reorganization. Ans: B Difficulty: Moderate Level of Learning: Knowledge Topic: LO 2 5. Under which of the following scenarios would Foreign Currency translation of an Associate NOT be required? a. The Associate is located in a different country. b. The Associate prepares its financial statements in a foreign currency. c. The investing Company has borrowings denominated in a Foreign Currency. d. The Associate prepares its financial statements using the same currency as the Investing Company. Ans: D Difficulty: Easy Level of Learning: Knowledge Topic: LO 4 6. Since its inception Company X has had earnings of $800,000 and paid out dividends of $900,000. Which of the following statements is correct with respect to Company X? a. The Company has been subject to a hostile takeover. b. The Company’s share price will likely increase when investors become aware of this. c. A liquidating dividend has occurred. d. Company X’s total Shareholder Equity has increased since its inception. Ans: C Difficulty: Easy Level of Learning: Knowledge Topic: LO 4 7. Private enterprise gap is permitted in certain instances for: a. all privately held companies. b. all publicly held companies. c. all Canadian companies. d. Canadian companies consolidating its foreign subsidiaries. Ans: A Difficulty: Easy Level of Learning: Knowledge Topic: LO 2 8. Which of the following types of share investment does not qualify as a strategic investment? a. Significant influence investments. b. Joint Control investments. c. Held for Trading. d. Control investments. Ans: C Difficulty: Easy Level of Learning: Knowledge Topic: LO 2 9. What percentage of ownership is used as a guideline to determine that significant influence exists under IAS 28? a. 20% or less. b. Less than 20%. c. Between 20% and 50%. d. 25% or more. Ans: C Difficulty: Easy Level of Learning: Knowledge Topic: LO 3 10. Gains and losses on fair-value-through-profit-or-loss securities: a. are included in net income, regardless of whether they are realized or not. b. are included in net income only when the investment has become permanently impaired. [Show More]

Last updated: 2 months ago

Preview 1 out of 29 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$17.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2024

Number of pages

29

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2024

Downloads

0

Views

3