St. Johns University - ACC 624 Chapter 16 Connect Home Work

Document Content and Description Below

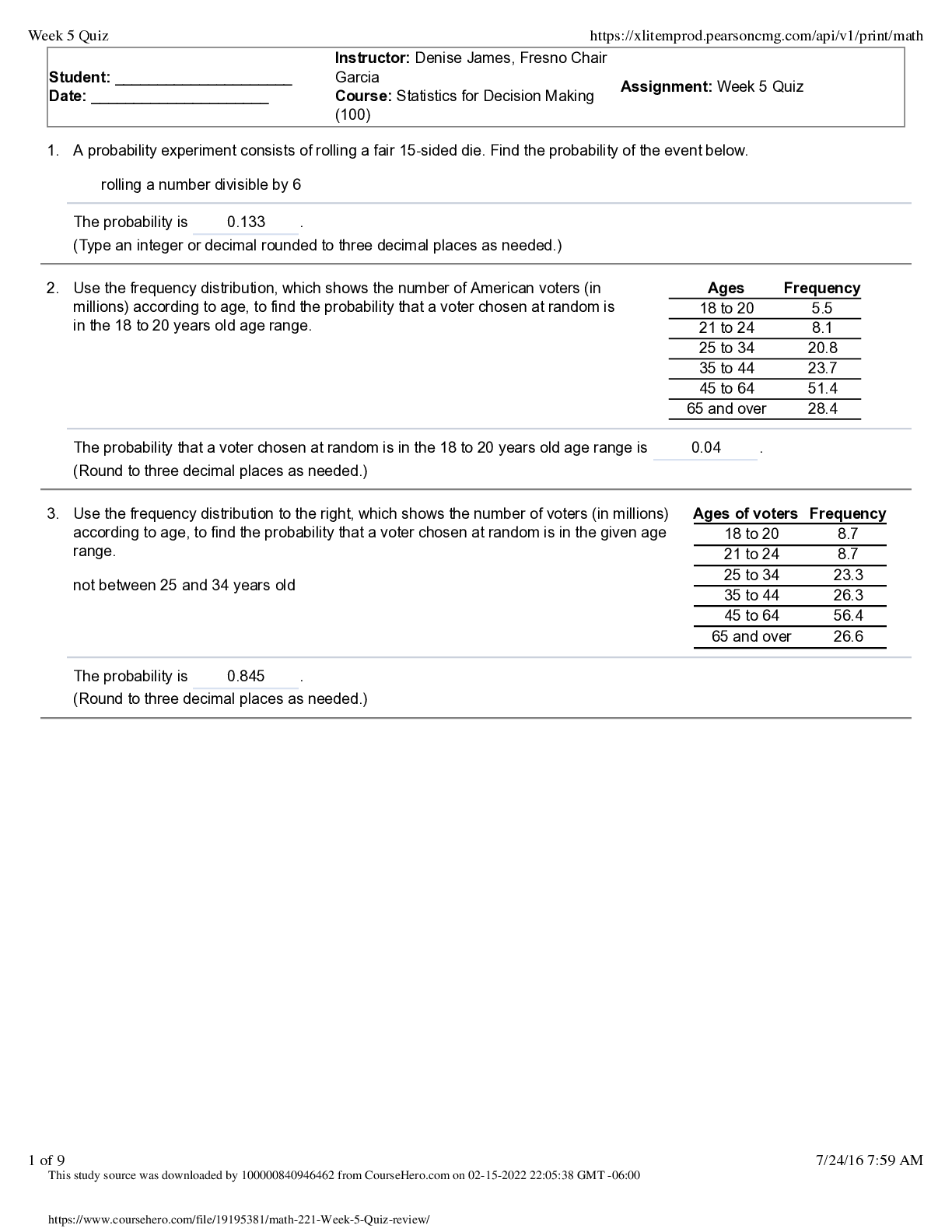

St. Johns University - ACC 624 Chapter 16 Connect Home Work Chapter 16 Homework 1. A company reports pretax accounting income of $10 million, but because of a single temporary difference... ,taxable income is $12 million. No temporary differences existed at the beginning of the year, and the tax rate is 40%. Prepare the appropriate journal entry to record income taxes. 2. At the end of the year, the deferred tax asset account had a balance of $12 million attributable to a cumulative temporary difference of $30 million in a liability for estimated expenses. Taxable income is $35 million. No temporary differences existed at the beginning of the year, and the tax rate is 40%. Prepare the journal entry(s) to record income taxes assuming it is more likely than not that one-fourth of the deferred tax asset will not ultimately be realized. 3. Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when collected. In the prior year, income recognized for financial reporting purposes for lots sold this way was $20 million, which would be collected equally over the next two years. The enacted tax rate was 40%. This year, a new tax law was enacted, revising the tax rate from 40% to 35% beginning next year. Calculate the amount by which Superior should reduce its deferred tax liability this year. 4. AirParts Corporation reported a net operating loss of $25 million for financial reporting and tax purposes. Taxable income last year and the previous year, respectively, was $20 million and $15 million. The enacted tax rate each year is 40%. Prepare the journal entry to recognize the income tax benefit of the net operating loss. AirParts elects the carryback option. 5. Sherrod, Inc., reported pretax accounting income of $76 million for 2016. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting income in 2016 exceeded that reported for tax purposes by $3 million. The installment receivable account at year-end had a balance of $4 million (representing portions of 2015 and 2016 installment sales), expected to be collected equally in 2017 and 2018. b. Sherrod was assessed a penalty of $2 million by the Environmental Protection Agency for violation of a federal law in 2016. The fine is to be paid in equal amounts in 2016 and 2017. c. Sherrod rents its operating facilities but owns one asset acquired in 2015 at a cost of $80 million. Depreciation is reported by the straight-line method assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-line depreciation the first two years but less than straight-line depreciation the next two years ($ in millions): d. Warranty expense of $3 million is reported in 2016. For tax purposes, the expense is deducted when costs are incurred, $2 million in 2016. At December 31, 2016, the warranty liability was $2 million (after adjusting entries). The balance was $1 million at the end of 2015. e. In 2016, Sherrod accrued an expense and related liability for estimated paid future absences of $7 million relating to the company's new paid vacation program. Future compensation will be deductible on the tax return when actually paid during the next two years ($4 million in 2017; $3 million in 2018). f. During 2015, accounting income included an estimated loss of $2 million from having accrued a loss contingency. The loss is paid in 2016 at which time it is tax deductible. Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2016, were $1.2 million and $2.8 million, respectively. The enacted tax rate is 40% each year. Required: 1. Determine the amounts necessary to record income taxes for 2016 and prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. 6. Alvis Corporation reports pretax accounting income of $400,000, but due to a single temporary difference,taxable income is only $250,000. At the beginning of the year, no temporary differences existed. Required: 1. Assume a tax rate of 35%, what will be Alvis’s net income? 2. What will Alvis report in the balance sheet pertaining to income taxes? 7. Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T). 8. Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: ($ in thousands) Situation 1 2 3 4 Taxable income $ 85 $ 215 $ 195 $ 260 Future deductible amounts 15 20 20 Future taxable amounts 15 15 30 Balance(s) at beginning of the year: Deferred tax asset 2 9 4 Deferred tax liability 2 2 The enacted tax rate is 40%. Required: For each situation, determine the following: (Enter your answers in thousands. Negative amounts should be indicated by a minus sign. Leave no cell blank, enter "0" wherever applicable.) Situation 1 2 3 4 a. Income tax payable currently. $34 $86 $78 $104 b. Deferred tax asset—balance. $6 $0 $8 $8 c. Deferred tax asset—change $4 $0 $(1) $4 d. Deferred tax liability—balance. $0 $6 $6 $12 e. Deferred tax liability—change $0 $4 $4 $12 f. Income tax expense. $30 $90 $83 $112 At the end of 2015, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book–tax difference of $75 million in a liability for estimated expenses. At the end of 2016, the temporary difference is $70 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2016 is $180 million and the tax rate is 40%. Required: 1. Prepare the journal entry(s) to record Payne’s income taxes for 2016, assuming it is more likely than not that the deferred tax asset will be realized. 10. At the end of 2015, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book-tax difference of $75 million in a liability for estimated expenses. At the end of 2016, the temporary difference is $70 million. Payne has no other temporary differences. Taxable income for 2016 is $180 million and the tax rate is 40%. Payne has a valuation allowance of $10 million for the deferred tax asset at the beginning of 2016. Required: 1. Prepare the journal entry(s) to record Payne’s income taxes for 2016, assuming it is more likely than not that the deferred tax asset will be realized. 11. For the year ended December 31, 2016, Fidelity Engineering reported pretax accounting income of $977,000. Selected information for 2016 from Fidelity’s records follows: Interest income on municipal bonds $ 32,000 Depreciation claimed on the 2016 tax return in excess of depreciation on the income statement 55,000 Carrying amount of depreciable assets in excess of their tax basis at year-end 85,000 Warranty expense reported on the income statement 26,000 Actual warranty expenditures in 2016 16,000 Fidelity's income tax rate is 40%. At January 1, 2016, Fidelity's records indicated balances of zero and $12,000 in its deferred tax asset and deferred tax liability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2016 and prepare the appropriate journal entry. Arnold Industries has pretax accounting income of $33 million for the year ended December 31, 2016. The tax rate is 40%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2016. An $8 million advance rent payment at the inception of the lease is tax-deductible in 2016 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term. Required: 1. Complete the following table given below and prepare the appropriate journal entry to record Arnold’s income taxes for 2016. 13. Bronson Industries reported a deferred tax liability of $8 million for the year ended December 31, 2015, related to a temporary difference of $20 million. The tax rate was 40%. The temporary difference is expected to reverse in 2017 at which time the deferred tax liability will become payable. There are no other temporary differences in 2015–2017. Assume a new tax law is enacted in 2016 that causes the tax rate to change from 40% to 30% beginning in 2017. (The rate remains 40% for 2016 taxes.) Taxable income in 2016 is $30 million. Required: Prepare the appropriate journal entry to record Bronson’s income tax expense in 2016. What adjustment, if any, is needed to revise retained earnings as a result of the change? When a company revises a previous estimate, prior financial statements are not revised. No adjustment is made to existing accounts. A disclosure note should describe the effect of a change in estimate on income before extraordinary items, net income, and related per share amounts for the current period. 14. 15. Delta Catfish Company has taken a position in its tax return to claim a tax credit of $10 million (direct reduction in taxes payable) and has determined that its sustainability is “more likely than not,” based on its technical merits. Delta has developed the probability table shown below of all possible material outcomes: 16. In its December 31, 2016, balance sheet, Shin Co. had income taxes payable of $13,000 and a current deferred tax asset of $20,000 before determining the need for a valuation account. Shin had reported a current deferred tax asset of $15,000 at December 31, 2015. No estimated tax payments were made during 2016. At December 31, 2016, Shin determined that it was more likely than not that 10% of the deferred tax asset would not be realized. In its 2016 income statement, what amount should Shin report as total income tax expense? 17. Black Co. organized on January 2, 2016, had pretax financial statement income of $500,000 and taxable income of $800,000 for the year ended December 31, 2016. The only temporary differences are accrued product warranty costs, which Black expects to pay as follows: The enacted income tax rates are 25% for 2016, 30% for 2017 through 2019, and 35% for 2020. Black believes that future years’ operations will produce profits. In its December 31, 2016, balance sheet, what amount should Black report as deferred tax asset? 18. An example of intraperiod income tax allocation is Reporting a discontinued operation in the income statement, net of direct tax effects. 19. Which of the following items is treated differently under accounting for taxation guidance of U.S. GAAP and IFRS? Reporting an extraordinary item in the income statement, net of direct tax effects. 20. Which one of the following temporary differences will result in a deferred tax asset? Advance rental receipts accounted for on the accrual basis for financial statement purposes and on a cash basis for tax purposes. [Show More]

Last updated: 1 year ago

Preview 1 out of 19 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 08, 2021

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Mar 08, 2021

Downloads

0

Views

37

.png)