Accounting > STUDY GUIDE > Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis (All)

Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis

Document Content and Description Below

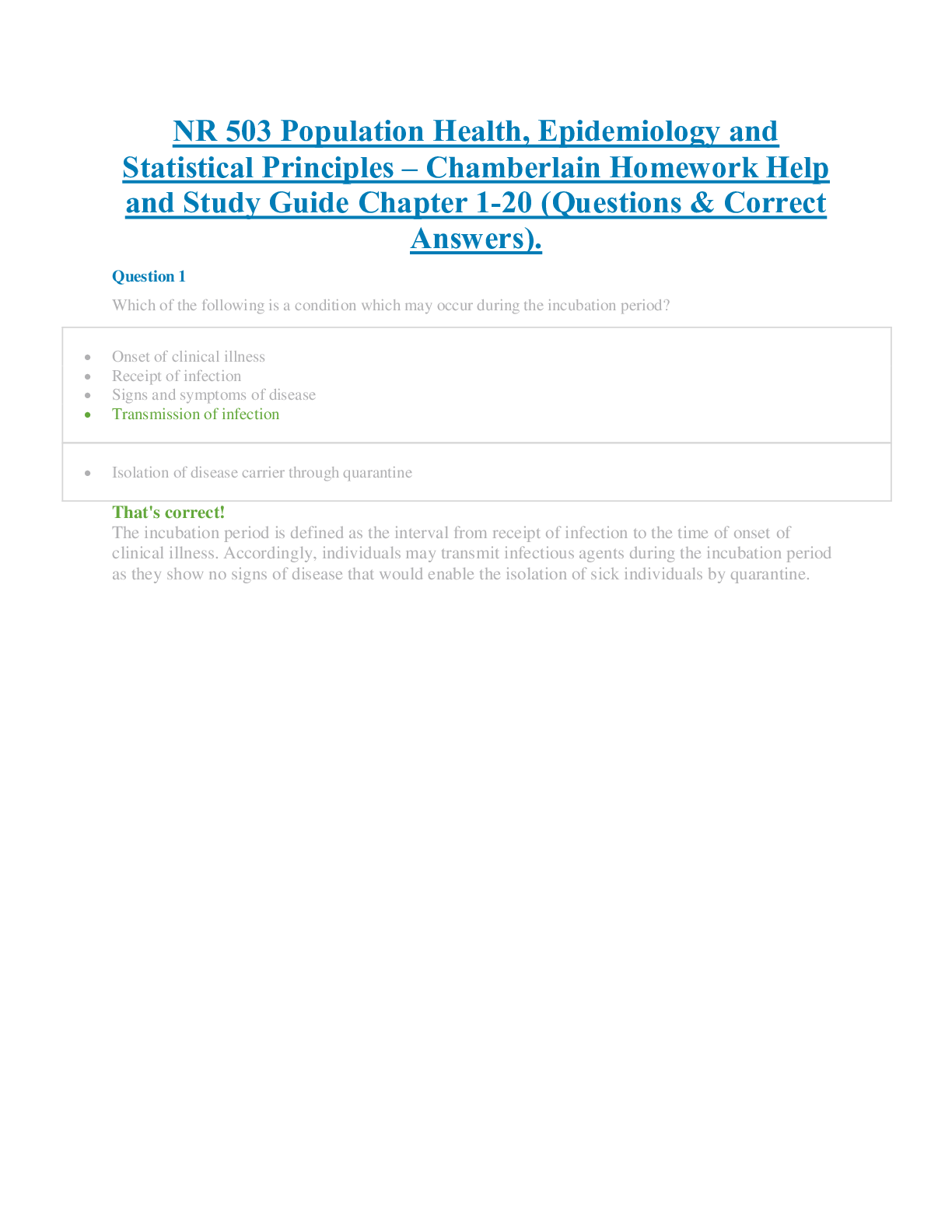

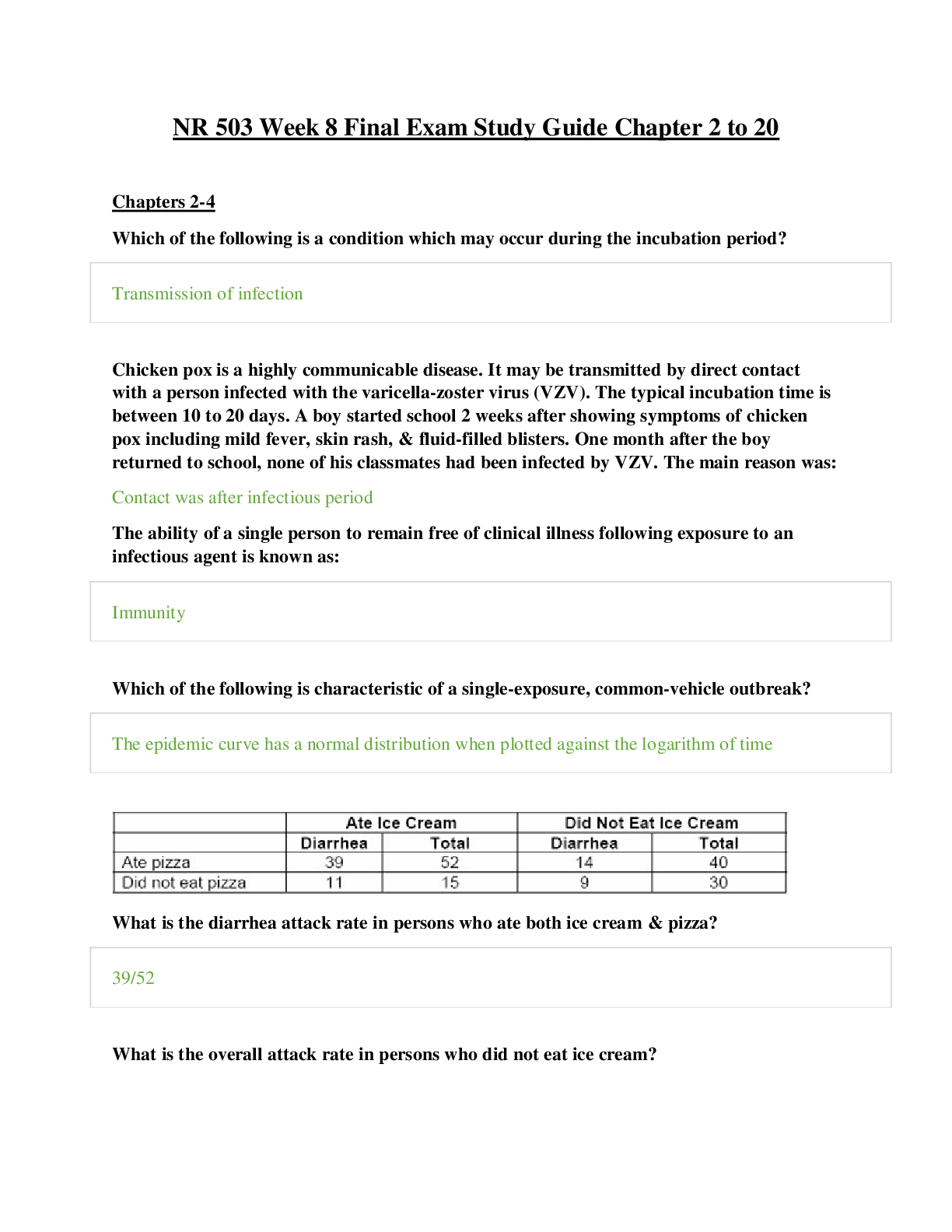

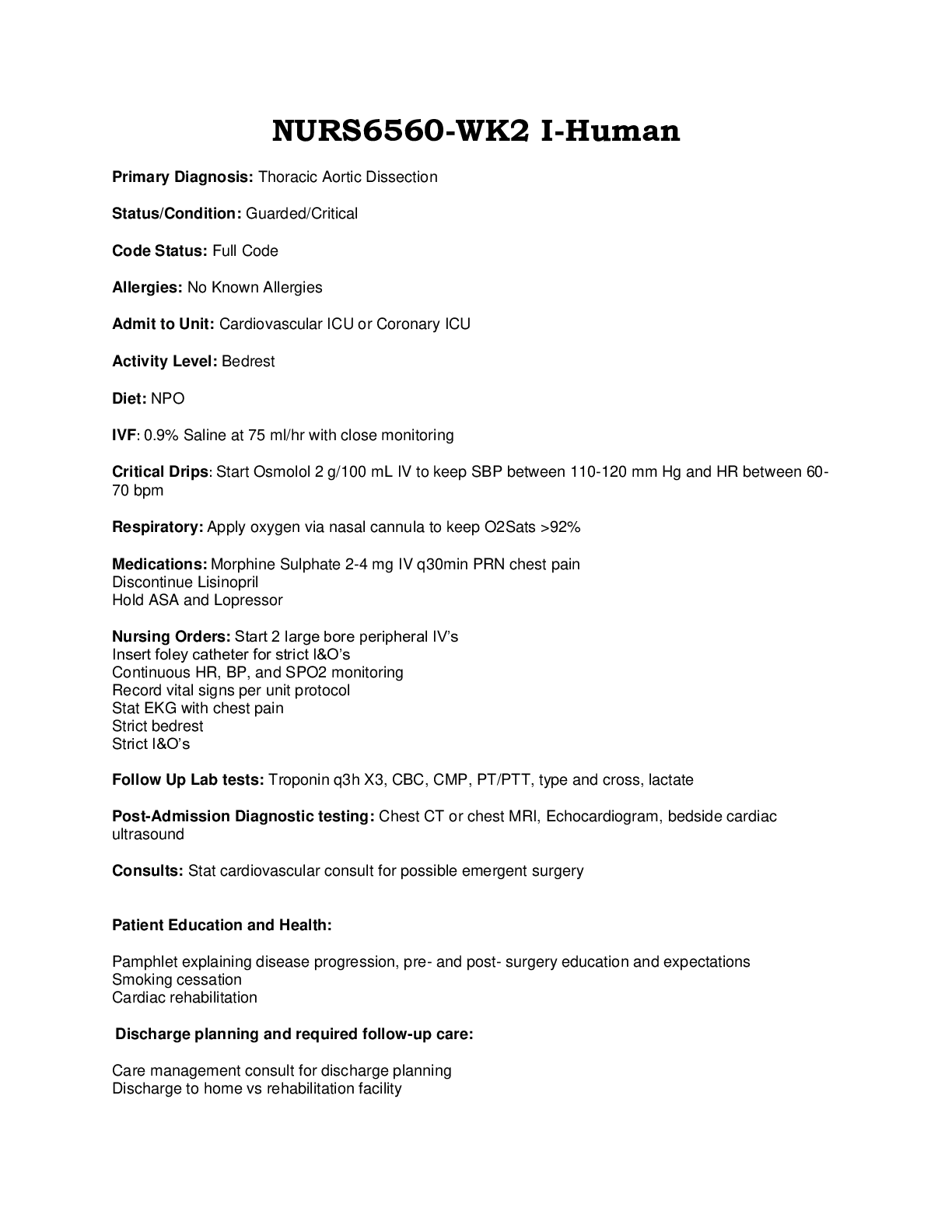

Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 1 of 11 ... Key Concepts LO 3-1 Use cost-volume-profit (CVP) analysis to analyze decisions. ♦ Cost-volume-profit (CVP) analysis studies the relations among revenues, costs, and volume and their effect on profit to help managers make decisions. • Managers make decisions on volume, pricing, or incurring a cost that will impact profit. • Profit equation: Operating profit (Profit) = Total revenues (TR) – Total costs (TC). • Total revenues (TR) = Price (P) × Units of output produced and sold (X). • Total costs (TC) = Variable cost per unit (V) × Units of output (X) + Fixed costs (F). • The expanded version of the profit equation becomes Profit = TR - TC = PX – (VX + F) = PX – VX – F = (P – V)X – F, where (P – V)X is the total contribution margin, the difference between total revenues (PX) and total variable costs (VX). Contribution margin should be large enough to cover the fixed costs and still provide for operating profit. • Unit contribution margin = P – V. • Alternatively, in CVP income statement format, Total Unit Percentage Sales revenue PX P 100% - Variable costs VX V V / P = Contribution margin (P – V)X P - V (P – V) / P - Fixed costs F = Profit (P – V)X - F • In financial accounting, costs are classified as either manufacturing or administrative.Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 2 of 11 • In cost accounting, the concern is over cost behavior, where V represents the sum of variable manufacturing cost per unit and variable marketing and administrative cost per unit, and F the sum of total fixed manufacturing costs and fixed marketing and administrative costs. • The operating profit can be derived (1) algebraically from the profit equation, or (2) from the company’s income statement. Exhibit 3.1 demonstrates the process in a CVP income statement. ♦ CVP analysis helps answer the following questions: (1) What volume is required to just break even (earning zero profit)? (2) What volume is required to achieve a target profit? • Break-even point is the volume level at which profits equal zero. That is, Profit = 0 = (P – V)X – F. • If the company makes many products, the volume is usually expressed in terms of sales dollars; if only one product is available, units would be the measure of volume. • Break-even volume in units (X*) = Fixed cost (F) Unit contribution margin (P- V) . • Contribution margin ratio = Unit contribution margin (P-V) Sales price per unit (P) , the contribution margin expressed as a percentage of sales revenue. Since P-V P = (P-V)X PX , the contribution margin ratio remains the same at any level of activity. • Break-even volume in sales dollars (PX*) = P Fixed cost (F) Unit Contribution margin (P V) = Fixed cost (F) Contribution margin ratio ((P V) / P) . • The volume to achieve a target profit may also be expressed either in units or in sales dollars.Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 3 of 11 • Target volume in units (X**) = Fixed cost (F) + Target profit Unit contribution margin (P- V) . • Target volume in sales dollars (PX**) = P Fixed cost (F) Target profit Unit Contribution margin (P V) = Fixed cost (F) + Target profit Contribution margin ratio ((P V) / P) . • Exhibit 3.2 provides a summary of target volume and break-even formulas. ♦ There are two ways to present the CVP relations graphically: (1) CVP graph, and (2) PV analysis. • CVP graph (Exhibit 3.3) plots total revenues against total costs at various activity levels (volumes). • The total revenue line (TR) starts at the origin (0, 0) with slope P, the price per unit. The total cost line (TC) starts at intercept F with slope V, the variable cost per unit. The two lines intersect at the break-even volume where TR = TC. • Volumes lower than breakeven result in an operating loss (TR < TC); volumes higher than breakeven result in an operating profit (TR > TC). The vertical distance between TR and TC determines the amount of operating profit or loss. • Profit-volume (PV) analysis is a version of the CVP analysis using a single profit line. In Exhibit 3.4, the differences between TR and TC at various volumes are reduced to a single profit line that starts at –F (the loss at zero volume, which equals fixed costs) with slope the unit contribution margin. The vertical axis shows the amount of operating profit or loss.Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 4 of 11 Example 1: The relation between CVP graph and PV graph is presented below. ====================== Demonstration Problem 1 The Power Tool Division of ABC Hardware sells one product, Jig Saw, and has the following data for the second quarter: Units of output 1,200 units Price per unit $150 Variable cost per unit 90 Total fixed costs 48,000 Volume $ Volume $ -F F 0 TR = PX TC = F + VX Break-even volume TR = TC Operating profit Operating loss CVP graph TR - TC PV graphAcct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 5 of 11 Required: Determine 1. Quarterly operating profit when 1,200 units are sold. 2. Break-even volume in units and sales dollars. 3. Contribution margin ratio. 4. Sales dollars and units needed to generate an operating profit of $57,000. 5. Number of units sold that would produce an operating profit of 15% of sales dollars. Solution: 1. Operating profit = (P – V)X – F = ($150 - $90) × 1,200 - $48,000 = $24,000. 2. Break-even volume in units (X*) = P - V F = $150 $90 $48,000 = 800 units. Break-even volume in sales dollars (PX*) = $150 × 800 units = $120,000. 3. Contribution margin ratio = P P - V = $150 $90 $150 × 100% = 40%. 4. Target profit = $57,000, TCAcct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 8 of 11 Example 2: Margin of safety is presented below. LO 3-3 Use Microsoft Excel to perform CVP analysis. ♦ Spreadsheet programs such as Excel® will help analyze CVP relations. Analysis tools such as Goal Seek can even accommodate alternative estimates of P, V, F, and target profits to conduct so called “what-if” analyses. Exhibits 3.6 and 3.7 illustrate an example. LO 3-4 Incorporate taxes, multiple products, and alternative cost structures into the CVP analysis. ♦ In addition to the “what-if” analyses, more complications may be incorporated into the basic CVP analysis to consider, for example, the fixed costs required to achieve a certain profit for a given volume. • Assuming t is the tax rate, then After-tax profit = [(P – V)X – F] × (1 – t). Volume $ F TR = PX TC = F + VX Break-even volume Projected or actual sales Margin of safety (in units)Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 9 of 11 Target volume in units = Fixed cost (F) + [After-tax target profit / (1 - t)] Unit contribution margin (P- V) , where [After-tax target profit / (1 - t)] determines the required before-tax operating profit. ====================== Demonstration Problem 2 (Continued from Demonstration Problem 1) The Power Tool Division of ABC Hardware now faces a tax rate of 30 percent. Required: Determine the number of Jig Saws required to generate the after-tax operating profit of $16,800. Solution: After-tax profit = [(P – V)X – F] × (1 – t), or $16,800 = [($150 - $90)X - $48,000] × (1 – 30%). X = 1,200 units ====================== • For firms that make multiple products, managers often assume a particular product mix and compute break-even or target volumes using (1) fixed product mix method, or (2) weighted-average contribution margin method. • Using the fixed product mix method, managers define a package or bundle of products in the typical product mix and then compute the break-even or target volume for the package. Once the break-even point is calculated for the number of packages required, the product mix in the package will be multiplied to determine the required units for each product. • Assuming a constant product mix, the second method calculates a weighted-average contribution margin per unit for all of the products considered. The break-even formula determines the required total number of units for all products involved. Multiplying the total by the respective “weights” in the product mix determines the required units for each product.Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 10 of 11 Demonstration Problem 3 (Continued from Demonstration Problem 1) The Power Tool Division of ABC Hardware introduces a second product, Circular Saw, whose unit price and unit variable cost are $200 and $120, respectively. The total fixed cost is increased to $68,000. The manager of ABC Hardware estimates that Jig Saws and Circular Saws will sell in a 3:2 ratio. Required: Calculate the break-even volume in units using 1. fixed product mix method, and 2. weighted-average contribution margin method. Solution: 1. According to the product mix, out of every 5 units sold, three will be Jig Saws and two will be Circular Saws. Let X be the number of such 5-unit packages to break even. Then the contribution margin from this package will be $60 × 3 + $80 × 2 = $340. The breakeven point (X) = $68,000 $340 = 200 packages. This means that a total of 600 Jig Saws (= 3 × 200 units) and 400 Circular Saws (= 2 × 200 units) have to be sold to break even. 2. Since 60 percent Jig Saws and 40 percent Circular Saws constitute the product mix, the weighted-average contribution margin per unit = .60 × $60 + .40 × $80 = $68. The breakeven point for both products = $68,000 $68 = 1,000 units. Jig Saws must be sold 600 units (= .60 × 1,000 units) and Circular Saws 400 units (= .40 × 1,000 units) to break even. ♦ When more complicated cost structures are considered, the basic setup developed so far must be adapted to deliver relevant information for decision making. Example 3: Consider the fixed cost that follows a step-cost pattern over the relevant range as machine capacity is limited. If the break-even calculation results in a required volume that is within the existing capacity, no further consideration is needed. If, on the other hand, the required volume exceeds the existing capacity, then additional fixed cost must be incurred to bring up the capacity, and a new break-even volume will be calculated. The new volume must be within the now higher capacity to be viable, or another iteration of calculations ensues.Acct 111 – Cost Accounting Study Guide Chapter 03 Fundamentals of Cost-Volume-Profit Analysis Also refer to the chapter material, lecture material and exercises for additional help Page 11 of 11 LO 3-5 Understand the assumptions and limitations of CVP analysis. ♦ CVP analysis relies on certain assumptions that may limit the applicability of the results for decision making. • The limitations are due to the assumptions made, not inherent to the method of CVP analysis itself. • It is usually assumed that unit variable cost and unit price are constant for all levels of volume. • Simplifying assumptions are easier to deal with, but can be relaxed to incorporate more realistic situations. • The more important the decision, the more the manager will want to ensure that the assumptions made are suitable. • The degree of sensitivity of the decisions to the assumptions made dictates caution about the results and the need for considering alternative assumptions. [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 16, 2021

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Mar 16, 2021

Downloads

0

Views

46

.png)

.png)