Economics > QUESTIONS & ANSWERS > Week 11 Quizzes 100% CORRECT ANSWERS AID GRADE A (All)

Week 11 Quizzes 100% CORRECT ANSWERS AID GRADE A

Document Content and Description Below

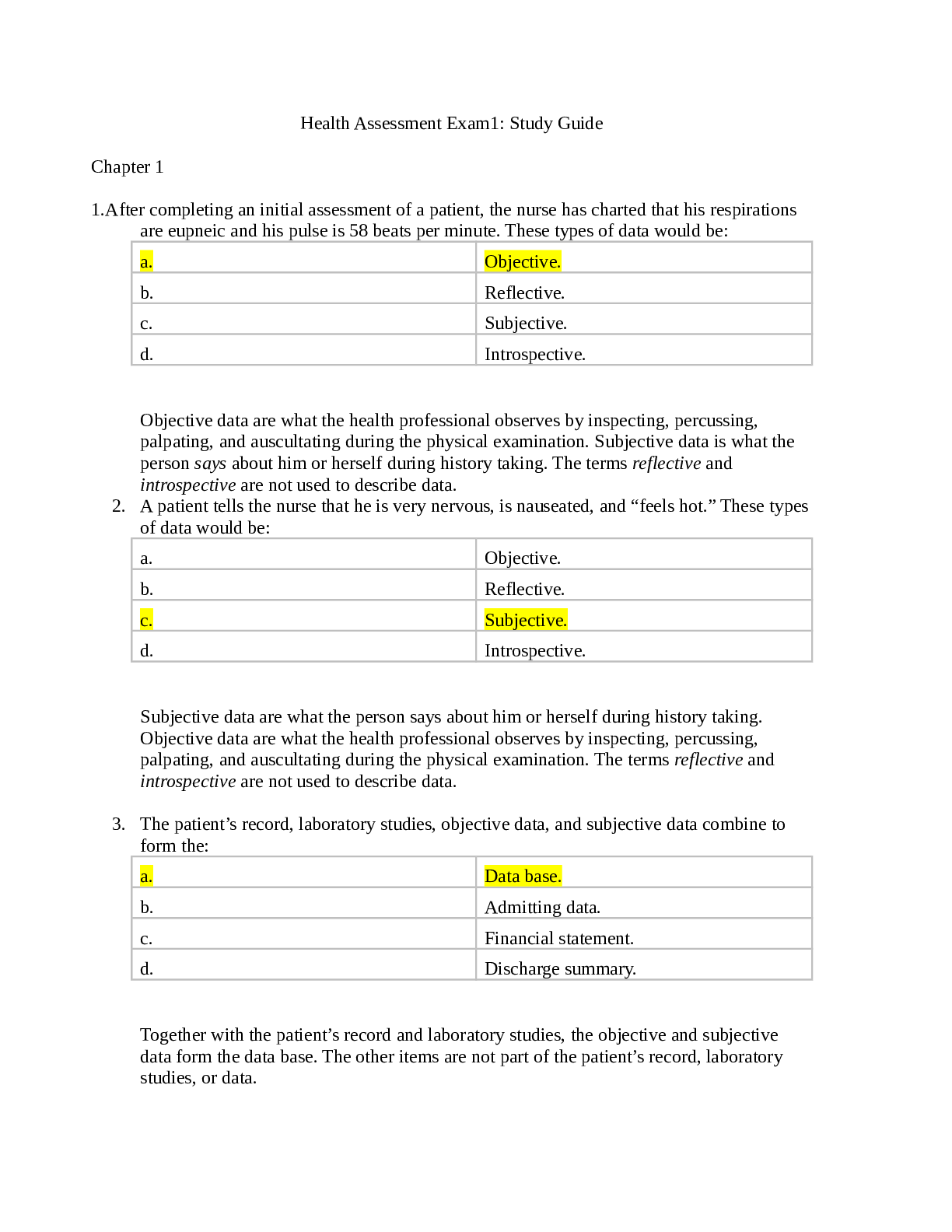

If the Reserve Bank of Australia sells bonds and securities in the open market, this is likely to lead to a: Selected The Reserve Bank of Australia can increase the cash rate by: Selected Answer:... • Question 3 10 out of 10 points Refer to Figure 16.4 for the following question. Figure 16.4 Refer to Figure 16.4. In this figure, suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B. Which of the following policies could the Reserve Bank of Australia use to move the economy to point C? Selected • Question 4 10 out of 10 points Which of the following does not function as an automatic stabiliser? Selected • Question 5 0 out of 10 points Refer to the Figure 16.6 for the following question. Figure 16.6 Refer to Figure 16.6. In this figure, suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B. Which of the following policies could the Reserve Bank of Australia use to move the economy to point C? Selected • Question 6 0 out of 10 points The effect of monetary policy on long-term interest rates is usually: Selected • Question 7 0 out of 10 points In which of the following situations would the Reserve Bank of Australia conduct contractionary monetary policy? Selected Question 8 10 out of 10 points If contractionary monetary policy is used, which of the following would be most likely to enhance the effect of the contractionary policy on aggregate demand? Selected Question 9 0 out of 10 points Not all households are net borrowers. For households that are net lenders, an increase in interest rates will: Selected Question 10 10 out of 10 points Refer to Figure 16.3 for the following question(s). Figure 16.3 The market for loanable funds in equilibrium Refer to Figure 16.3. As a result of an increase in the government budget deficit, the ________ for loanable funds will ________, thereby ________ the equilibrium real interest rate and ________ the equilibrium quantity of loanable funds. Selected [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$14.00

Document information

Connected school, study & course

About the document

Uploaded On

Mar 17, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Mar 17, 2021

Downloads

0

Views

52