Economics > QUESTIONS & ANSWERS > Intermediate Macroeconomics, Econ 2020,- ECON 2020>Problem_set_10_solutions(focused answers that wil (All)

Intermediate Macroeconomics, Econ 2020,- ECON 2020>Problem_set_10_solutions(focused answers that will help you score grade A.)

Document Content and Description Below

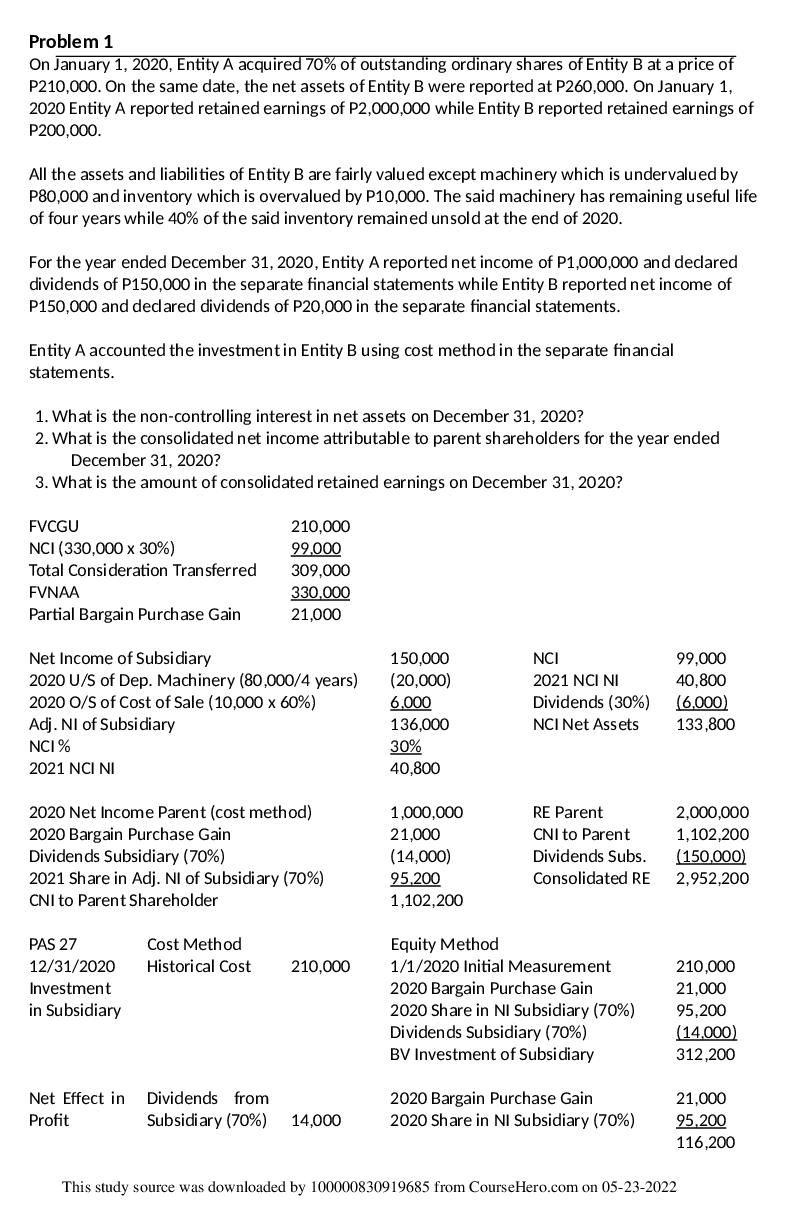

Problem set 10. Due 11/21/2016 in class. Problem 1. An economy has the following equation for the Phillips curve: π = Eπ - 0:5(u - 6) People form expectations of inflation by taking a weighted ... average of the previous two years of inflation: Eπ = 0:7π -1 + 0:3π-2 Okun’s law for this economy is: (Y - Y-1)=Y-1 = 3:0 - 2:0(u - u-1) The economy begins at its natural rate of unemployment with a stable inflation rate of 5 percent. 1. What is the natural rate of unemployment for this economy? 2. Graph the short-run trade-off between inflation and unemployment that this economy faces. Label the point where the economy begins as point A. (Be sure to give numerical values for point A.) 3. A fall in aggregate demand leads to a recession, causing the unemployment rate to rise 4 percentage points above its natural rate. On your graph in part (1), label the point the economy experiences that year as point B. (Once again, be sure to give numerical values.) 4. Unemployment remains at this high level for two years (the initial year described in part (3) and one more), after which it returns to its natural rate. Create a table showing unemployment, inflation, expected inflation, and output growth for 10 years beginning two years before the recession. (These calculations are best done on a computer spreadsheet.) The table below identifies the unemployment rate, inflation rate, expected inflation rate, and rate of output growth over the 10 years. Note that the initial year is year 0, followed by two years with higher unemployment, and then 8 years of unemployment at the natural rate. To calculate the values in the table, use the formulas provided at the beginning of the problem. Year Unemployment Rate Inflation Rate Expected Inflation Rate Rate of Output Growth 0 | 6 | 5 | 5 | 3 1 | 10 | 3 | 5 | -5 2 | 10 | 1.6 | 3.6 | -5 3 | 6 | 2.02 | 2.02 | 3 4 | 6 | 1.894 | 1.894 | 3 5 | 6 | 1.9318 | 1.9318 | 3 6 | 6 | 1.9205 | 1.9205 | 3 7 | 6 | 1.9239 | 1.9239 | 3 8 | 6 | 1.9228 | 1.9228 | 3 9 | 6 | 1.9231 | 1.9231 | 3 10 | 6 | 1.9231 | 1.9231 | 32 Problem set 10 Intermediate Macroeconomics, Econ 2020, Fall 2016 Yury Yatsynovich 5. On the same graph you used in part (2), graph the short-run trade-off the economy faces at the end of this 10-year period. Label the point where the economy finds itself as point C. (Again, use numerical values.) 6. Compare the equilibrium before the recession with the new long-run (period ten) equilibrium. How much does inflation change? How many percentage points of out- put are lost during the transition? What is this economy’s sacrifice ratio? Problem 2. Assume that people have rational expectations and that the economy is described by the sticky- price model. Explain why each of the following propositions is true. In this question, we consider several implications of rational expectations – the assumption that people optimally use all of the information available to them in forming their expectations – for the model of sticky prices that we considered in this chapter. 3 Problem set 10 Intermediate Macroeconomics, Econ 2020, Fall 2016 Yury Yatsynovich Based on this model, monetary policy can affect real GDP only by affecting (P˘EP) – that is, causing an unexpected change in the price level. 1. Only unanticipated changes in the money supply affect real GDP. Changes in the . 2. If the Fed sets the money supply at the same time as people are setting prices, so that everyone has the same information about the state of the economy, then monetary policy cannot be used systematically to stabilize output. Hence, a policy of keeping the money supply constant will have the same real effects as a policy of adjusting the money supply in response to the state of the economy. (This is called the policy irrelevance proposition.) 3. If the Fed sets the money supply well after people have set prices, so that the Fed has collected more information about the state of the economy, then monetary policy can be used systematically to stabilize output. If the Fed sets the money supply after people set wages and prices, then the Fed can use monetary policy systematically to stabilize output. The assumption of rational expectations means that people use all of the information available to them in forming expectations about the price level. This includes information about the state of the economy and information about how the Fed will respond to this state. This does not mean that people know what the state of the economy will be, nor do they know exactly how the Fed will act: they simply make their best guess. As time passes, the Fed learns information about the economy that was unknown to those setting wages and prices. At this point, since contracts have already set these wages and prices, people are stuck with their expectations EP. The Fed can then use monetary policy to affect the actual price level P, and hence can affect output systematically. Problem 3: DAD-DAS under zero lower bound This problem asks you to derive the expression for dynamic aggregate demand (DAD) under the zero lower bound for the nominal interest rate. 1. Begin with the expression for the nominal interest rate it = max 8<: πt + ρ + θπ(πt - πt∗) + θy(Yt - Y¯t) 0 and following the steps in Lecture 21 (or page 451 in Chapter 15 of the textbook) derive the expression for dynamic aggregate demand curve (DAD). Hint: now DAD will have a kink and be described by the equation of the form Yt - Y¯t = min 8<: -αθ π(πt - πt∗) - αθy(Yt - Y¯t) α(πt - ρ) For more details see the file Problem_set_10_solutions_problem_3.pdf 2. Depict the new dynamic aggregate demand curve (DAD). See the file Problem_set_10_solutions_problem_3.pdf 5 Problem set 10 Intermediate Macroeconomics, Econ 2020, Fall 2016 Yury Yatsynovich 3. Depict the consequences of positive supply shock when the economy is in the liquidity trap (i.e. it=0) and when it is out of the liquidity trap. Is the positive supply f Problem 4. Use the dynamic AD –AS model to solve for inflation as a function of only lagged inflation and supply and demand shocks. (Assume target inflation is constant.) 1. According to the equation you have derived, does inflation return to its target after a shock? Explain. (Hint: Look at the coefficient on lagged inflation.) 2. Suppose the central bank does not respond to changes in output but only to changes in inflation, so that θY = 0. How, if at all, would this fact change your answer [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$7.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 20, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Apr 20, 2021

Downloads

0

Views

43

.png)