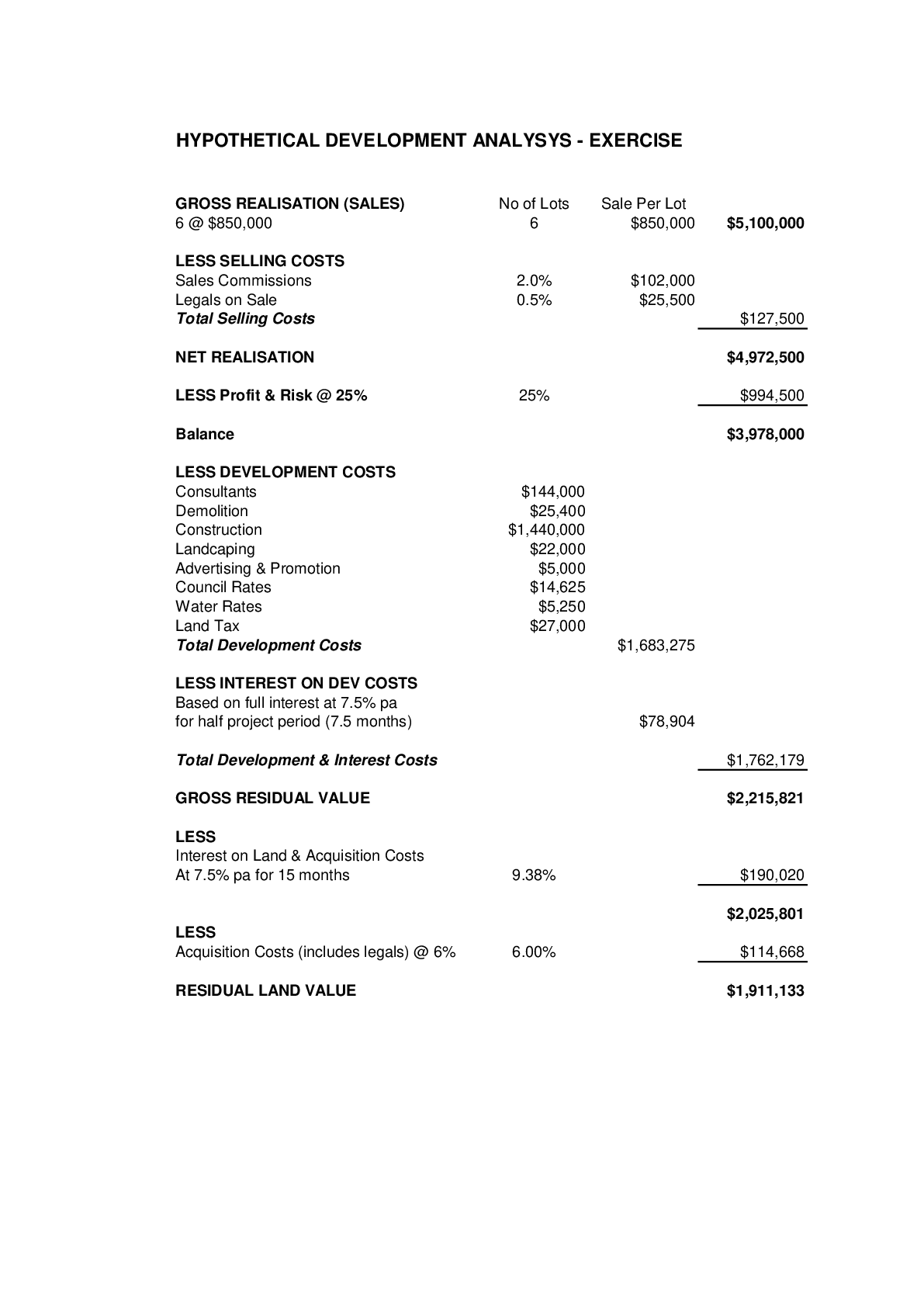

Architecture > Study Notes > Development Feasibility and Modelling -HYPOTHETICAL DEVELOPMENT ANALYSYS - EXERCISE, SOLUTION (All)

Development Feasibility and Modelling -HYPOTHETICAL DEVELOPMENT ANALYSYS - EXERCISE, SOLUTION

Document Content and Description Below

HYPOTHETICAL DEVELOPMENT ANALYSIS - QUESTION You have been approached to prepare a valuation of a residential development site using the hypothetical development method. Calculate the residual site ... value adopting a 25% allowance for profit and risk. Sales Revenue & Selling Costs 6 units x $ 850,000 each Legal costs on sale 0.5% (payable on settlement) Agents selling fees 2.0% (payable on settlement) Development costs Consultants $144,000 Demolition $25,400 Construction $1,440,000 Landcaping $22,000 Advertising & Promotion $5,000 Council Rates $14,625 Water Rates $5,250 Land Tax $27,000 Site acquisition costs 6% (includes legals) Development funds are available at 7.5% per annum nominal The development will take 15 months. [Show More]

Last updated: 1 year ago

Preview 1 out of 1 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 16, 2020

Number of pages

1

Written in

Additional information

This document has been written for:

Uploaded

Jun 16, 2020

Downloads

1

Views

107

.png)

.png)

How Do Geographically Dispersed Teams Collaborate Effectively Paper.png)