Finance > TEST BANK > ACCOUTING-TEST BANK FOR INTERMEDIATE ACCOUNTION(COMPLETE GUIDE FOR EXAM PREPARATION)-GRADED A (All)

ACCOUTING-TEST BANK FOR INTERMEDIATE ACCOUNTION(COMPLETE GUIDE FOR EXAM PREPARATION)-GRADED A

Document Content and Description Below

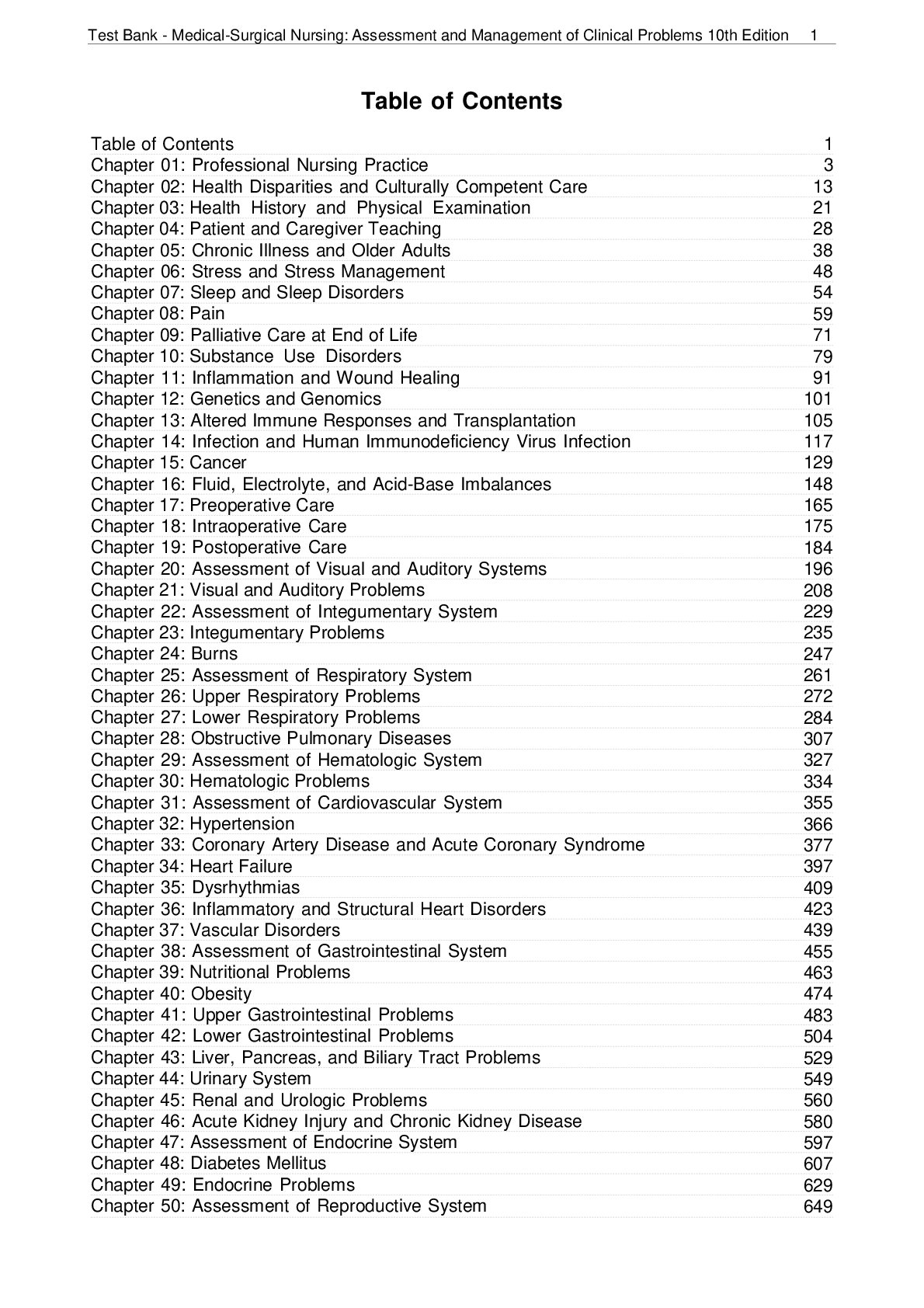

CHAPTER 10 ACQUISITION AND DISPOSITION OF PROPERTY, PLANT, AND EQUIPMENT CHAPTER LEARNING OBJECTIVES 1. Identify property, plant, and equipment and its related costs. 2. Discuss the accounting pr... oblems associated with interest capitalization. 3. Explain accounting issues related to acquiring and valuing plant assets. 4. Describe the accounting treatment for costs subsequent to acquisition. 5. Describe the accounting treatment for the disposal of property, plant, and equipment.Test Bank for Intermediate Accounting: IFRS Edition, 3e TRUE-FALSE—Conceptual 1. Assets classified as property, plant, and equipment can be either acquired for use in operations, or acquired for resale. 2. Assets classified as property, plant, and equipment must be both long-term in nature and possess physical substance. 3. When land with an old building is purchased as a future building site, the cost of removing the old building is part of the cost of the new building. 4. Insurance on equipment purchased, while the equipment is in transit, is part of the cost of the equipment. 5. Special assessments for local improvements such as street lights and sewers should be accounted for as land improvements. 6. Variable overhead costs incurred to self-construct an asset should be included in the cost of the asset. 7. Companies should assign no portion of fixed overhead to self-constructed assets. 8. When capitalizing interest during construction of an asset, an imputed interest cost on stock financing must be included. 9. Assets under construction for a company’s own use do not qualify for interest cost capitalization. 10. Avoidable interest is the amount of interest cost that a company could theoretically avoid if it had not made expenditures for the asset. 11. When a company purchases land with the intention of developing it for a particular use, interest costs associated with those expenditures qualify for interest capitalization. 12. Assets purchased on long-term credit contracts should be recorded at the present value of the consideration exchanged. 13. Companies account for the exchange of non-monetary assets on the basis of the fair value of the asset given up or the fair value of the asset received. 14. When a company exchanges non-monetary assets and a loss results, the company recognizes the loss only if the exchange has commercial substance. 15. A government grant generally subsidizes a company by transferring resources to that company. 16. When a company acquires an asset through a government grant, the asset's cost is zero so the cost recorded is the direct cost, such as legal fees, incurred. 17. Assets acquired through government grants are generally recorded at fair v [Show More]

Last updated: 1 year ago

Preview 1 out of 52 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 02, 2021

Number of pages

52

Written in

Additional information

This document has been written for:

Uploaded

May 02, 2021

Downloads

0

Views

55

.png)

.png)