Finance > Study Notes > Capital Budgeting and Capital Rationing Issues University of Wisconsin, MilwaukeeFINANCE 350350week8 (All)

Capital Budgeting and Capital Rationing Issues University of Wisconsin, MilwaukeeFINANCE 350350week8

Document Content and Description Below

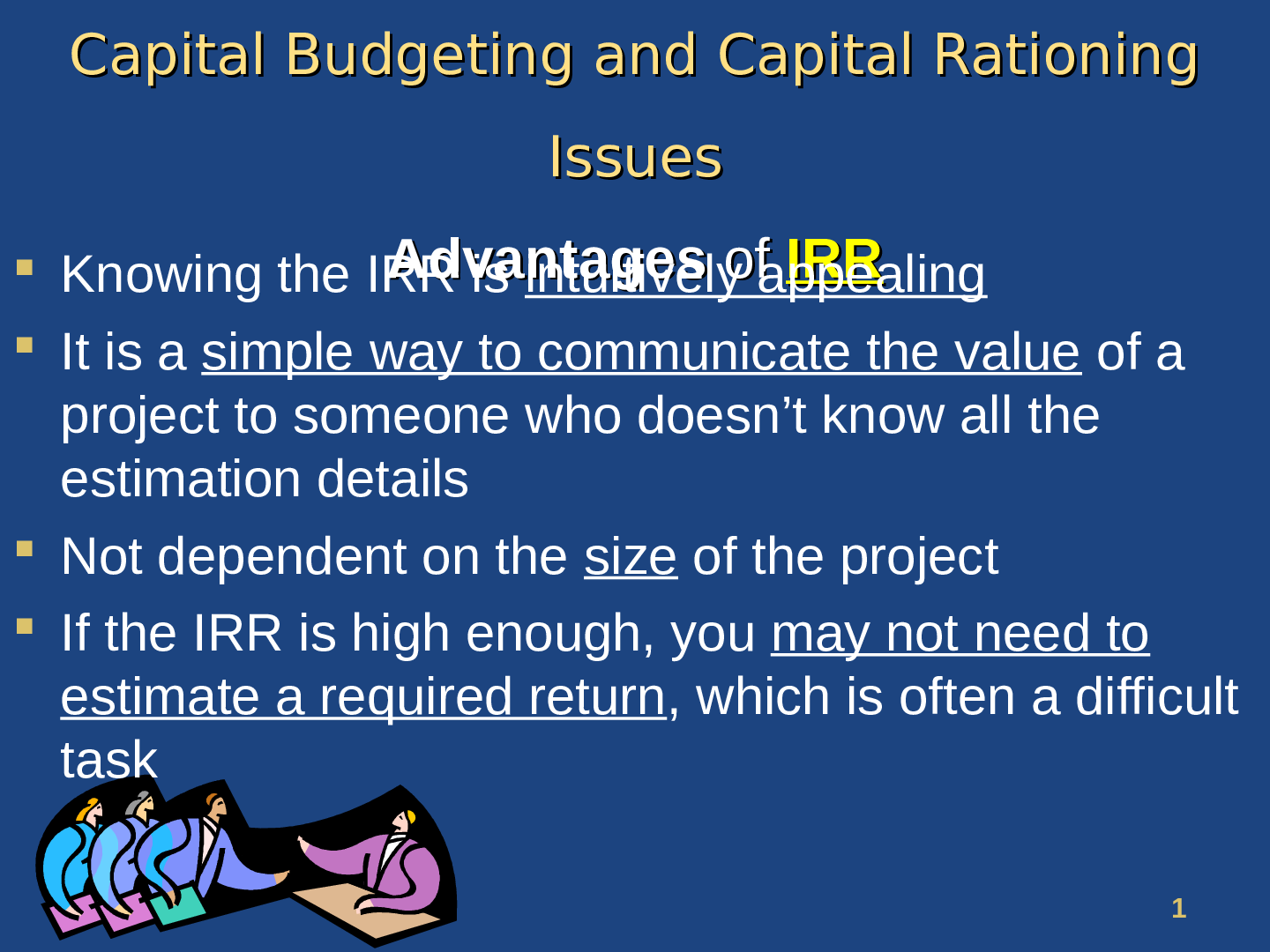

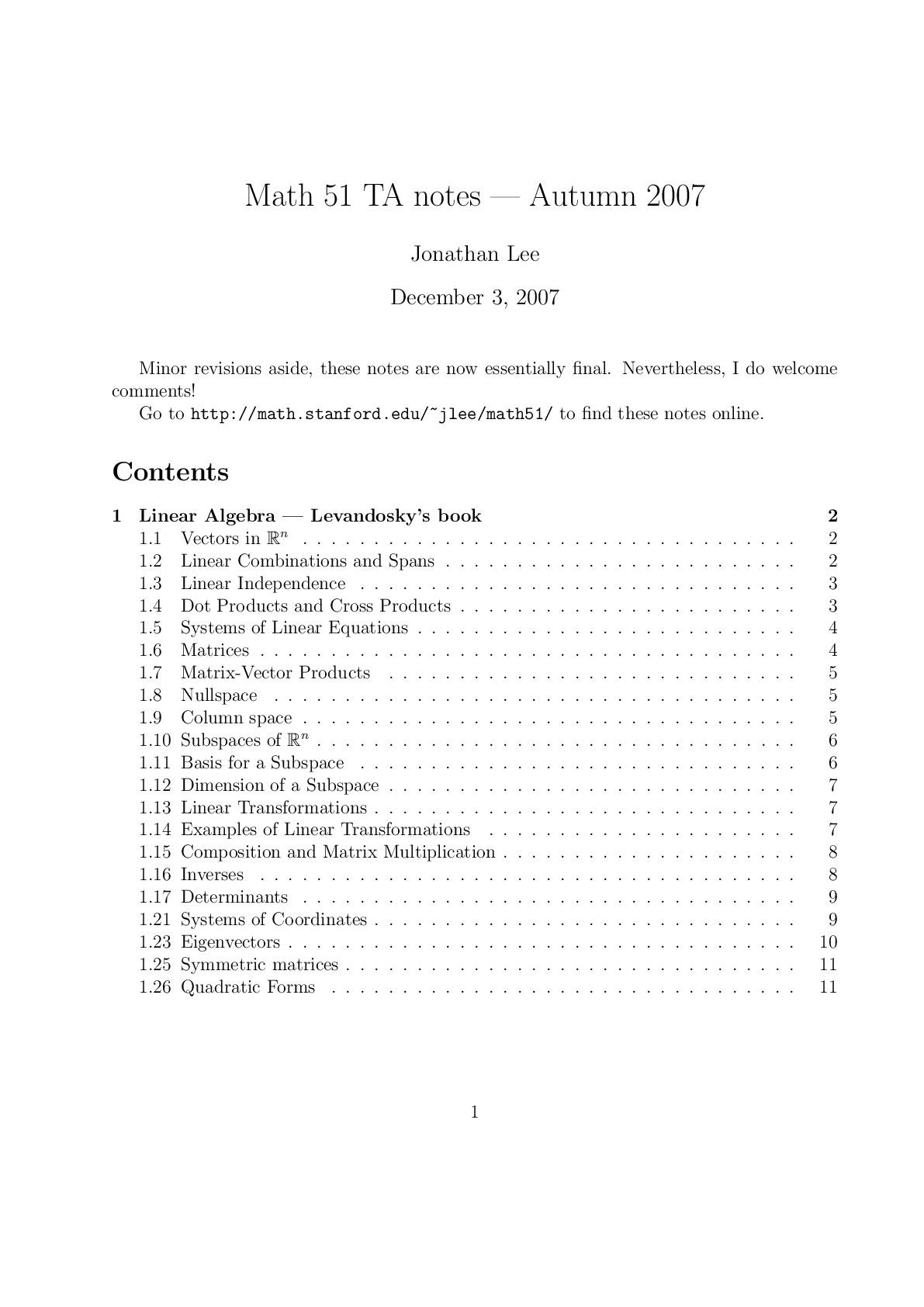

Capital Budgeting and Capital Rationing Issues Knowing the IRR is Advantages intuitively appealing of IRR It is a simple way to communicate the value of a project to someone who doesn’t ... know all the estimation details Not dependent on the size of the project If the IRR is high enough, you may not need to estimate a required return, which is often a difficult taskCalculating IRRs with Excel +@IRR(C8:C12)NPV vs. IRR NPV and IRR will generally give us the same decision With Two Exceptions: 1. Non-conventional cash flows – cash flow signs change more than once There can be multiple IRRs for the same project Discussed last class by counting ‘sign changes.’ 2. Mutually exclusive projects Initial investments are substantially different Timing of cash flows is substantially different4 IRR and Mutually Exclusive Projects Mutually exclusive projects If you choose one, you can’t choose the other Example: You can choose pursue an MBA at either the UWM or Marquette, but not both Intuitively you would use the following decision rules: NPV – choose the project with the higher NPV IRR – choose the project with the higher IRRExample With Mutually Exclusive Projects Period Project A Project B 0 -500 -400 1 325 325 2 325 200 IRR 19.43% 22.17% NPV 64.05 60.74 The required return for both projects is 10%. Which project should you accept and why?6 NPV Profiles IRR for A = 19.43% IRR for B = 22.17% Crossover Point = 11.8%7 MUTUALLY EXCLUSIVE • With the cross– over in the NPV profiles, we find that the better project depends critically on the required return. • When the required return is low (less than 11.8%), pick project A. • When the required return is high (greater than 11.8%), pick project B.8 Conflicts Between NPV and IRR NPV directly measures the increase in value to the firm Whenever there is a conflict between NPV and another decision rule, you should always use NPV IRR is unreliable in the following situations: 1. Non-conventional cash flows 2. Mutually exclusive projects Modified Internal Rate of Return (MIRR) Controls for some problems with IRR Three Methods: 1. Discounting Approach = Discount future outflows (negative numbers) to present value and add to CF0 2.Reinvestment Approach = Compound all CFs except the first one forward to end (FV) 3.Combination Approach = Discount outflows to present; compound inflows to the end (FV) MIRR will be different number for each method For this reason, some of us call it the Meaningless IRR rather than the Modified IRR.MIRR Method 1 Discounting Approach Step 1: Discount future outflows (negative cash flows) to present and add to CF0 Step 2: Zero out negative cash flows which have been added to CF0. Step 3: Compute IRR normally [Show More]

Last updated: 1 year ago

Preview 1 out of 40 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 21, 2021

Number of pages

40

Written in

Additional information

This document has been written for:

Uploaded

May 21, 2021

Downloads

0

Views

62

.png)

.png)

How Do Geographically Dispersed Teams Collaborate Effectively Paper.png)