Finance > QUESTIONS & ANSWERS > FIN 6710 Wall Street Prep2 Accounting & Financial Statement Analysis Exam Review.WITH CORRECT DETAIL (All)

FIN 6710 Wall Street Prep2 Accounting & Financial Statement Analysis Exam Review.WITH CORRECT DETAILED ASNSWER KEY AFTER EVERY QUESTION, 100% SCORE

Document Content and Description Below

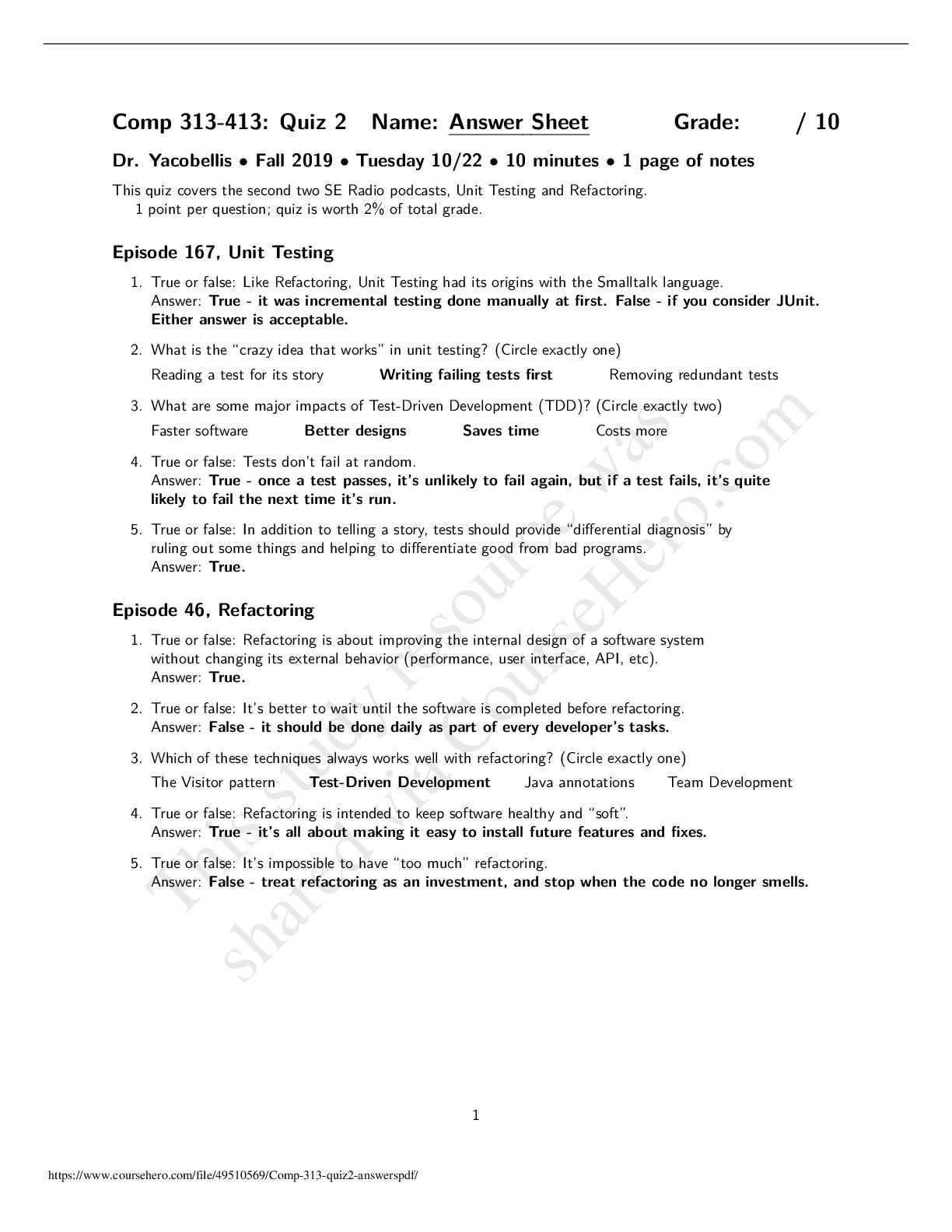

Wall Street Prep My Courses The Premium Package Self-Study Courses Public Boot Camps Corporate Training On-Campus Training WSP Consulting Free Training & Articles The WSP Blog Support/Contac... t Us About Wall Street Prep Wall Street Prep Hi, Shuobo return icon Back to Exams Review: Accounting & Financial Statement Analysis Exam Score: 36%, 24 correct out of 66 | Taken On: 09-10-18 Question 1 The regulating body that oversees the development of accounting standards in the U.S. is: SFAS GAAP FASB IASB Your answer is correct. FASB formulates accounting standards through the issuance of Statements of Financial Accounting Standards (SFAS). These statements make up the body of accounting rules known as the Generally Accepted Accounting Principles (GAAP). IASB oversees international financial reporting standards (IFRS). See Lesson: Introduction Question 2 Which of the following statements is TRUE? GAAP requires that firms show recorded values for acquired intangible assets such as patents and trademarks on their financial statements GAAP requires that firms show recorded values for intangible assets such as employee and customer loyalty GAAP requires that financial statements accurately reflects the market value of internally-developed trademarks such as the value of the Coca-Cola brand name All of the above Your answer is incorrect. GAAP requires that firms only show measurable activities, such as the value of acquired intangible assets. Assets such as employee, customer loyalty and internally-developed trademarks are not shown on financial statements because they’re difficult to quantify. See Lesson: Basic Accounting Principles Question 3 Which of the following statements is TRUE? Publicly traded US companies are required to file four 10-Q's and one 10-K annually All US companies are required to file three 10-Q's and one 10-K annuallyPublicly traded US companies are required to file three 10-Q's and one 10-K annually Publicly traded US companies are required to file one 10-K annually; 10-Q's are typically filed but are technically voluntary Your answer is incorrect. Publicly-traded US companies must file three quarterly (10-Q) reports at the end of their 1Q, 2Q and 3Q, and a 10-K at the end of their fiscal year. See Lesson: Financial Reportings & Important Filings Question 4 The income statement is designed to measure: the liquidity of a firm how solvent a company has been the income position of a firm at a point in time Cash inflows/outflows generated over a period of time the accrual-based accounting profits of a firm over a period of time Your answer is correct. The income statement is designed to show the operations of the business (revenues and associated expenses). The balance sheet is designed to show a firm’s financial position, while the cash flow statement shows the amount of cash generated by a firm. See Lesson: Basic Accounting Principles Question 5 The Matching Principle states that: Costs associated with making a product must be recognized at the end of the production process Costs associated with making a product must be recognized immediately as incurred Costs associated with making a product must be recognized during the same period as revenue generated from that product Costs associated with making a product must be recorded during the same period as the sales, general, and administrative expenses that are also associated with the product Your answer is incorrect. Under the matching principle, costs associated with making a product must be recorded during the same period as revenue generated from that product. See Lesson: Basic Accounting Principles Question 6 During the current year, accounts receivable increased from $27,000 to $41,000 and sales were $225,000. Based on this information, how much cash did the company collect from its customers during the year? $239,000 $225,000 $211,000 $252,000 $266,000 Your answer is incorrect. Accounts receivable increased by $14,000, implying that the company did not collect that amount in cash, so cash sales were $225,000-$14,000 = $211,000.See Lesson: Cash, Receivables & Prepaid Expenses Question 7 Use the following information provided to answer the question below: Computer resellers Co. purchases $10,000 worth of computers from Dell on 9/30/14. Computer resellers Co. receives a credit card order for $5,000 for the purchase of one quarter of the computers on 11/1/14. The computers are shipped to the customer on 11/30/14 Computer Sales Co. cashes the $5,000 check on 12/31/14 Based on the accrual method of accounting, computer resellers should recognize revenue on which date? 9/30/14 11/1/14 11/30/14 12/31/14 Your answer is incorrect. According to the revenue recognition principle, a company cannot record revenue until that order is shipped to a customer (only then is the revenue actually earned) and collection from that customer, who used a credit card, is reasonably assured. See Lesson: Revenue Recognition Question 8 Cash interest expense payments lead to: Lower cash from operations Lower cash from investing activities Lower cash from financing activities Lower debt balances Higher retained earnings Your answer is correct. Cash interest expense lowers net income which in turn lowers cash from operations. See Lesson: The Lemonade Stand, Part 4 Question 9 Which of the following is NOT a required SEC filing? 10-Q 10-K Annual Report Form 14-A Your answer is correct. Companies are not required to file an annual report with the SEC. They create this report as part of their marketing efforts to introduce the firm, its performance and financials to investors and the general public. See Lesson: Financial Reportings & Important Filings Question 10 Non-recurring unusual or infrequent items (such as a restructuring charge) are: Reported net of tax after net income from continuing operations (i.e., below the line)Reported pre-tax before net income from continuing operation (i.e., above the line) Reported net of tax after net income as discontinued operations Amortized over the useful life of the non-recurring asset Your answer is incorrect. Unusual or infrequent items are usually reported pre-tax before net income. Extraordinary charges, discontinued operations, and changes due to accounting practices are reported after-tax after net income. See Lesson: Nonrecurring Items Overview Question 11 Which of the following is FALSE regarding revenue recognition? Revenues must be recorded when they are earned and measurable Under the percentage of completion method, revenues are recognized on the basis of the tot [Show More]

Last updated: 1 year ago

Preview 1 out of 25 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2021

Number of pages

25

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2021

Downloads

1

Views

48

.png)