Accounting > EXAM > DeVry University, Keller Graduate School of Management ACCT504 | ACCT 504 Week 8, Final Exam 2 (all (All)

DeVry University, Keller Graduate School of Management ACCT504 | ACCT 504 Week 8, Final Exam 2 (all answers solved correctly)

Document Content and Description Below

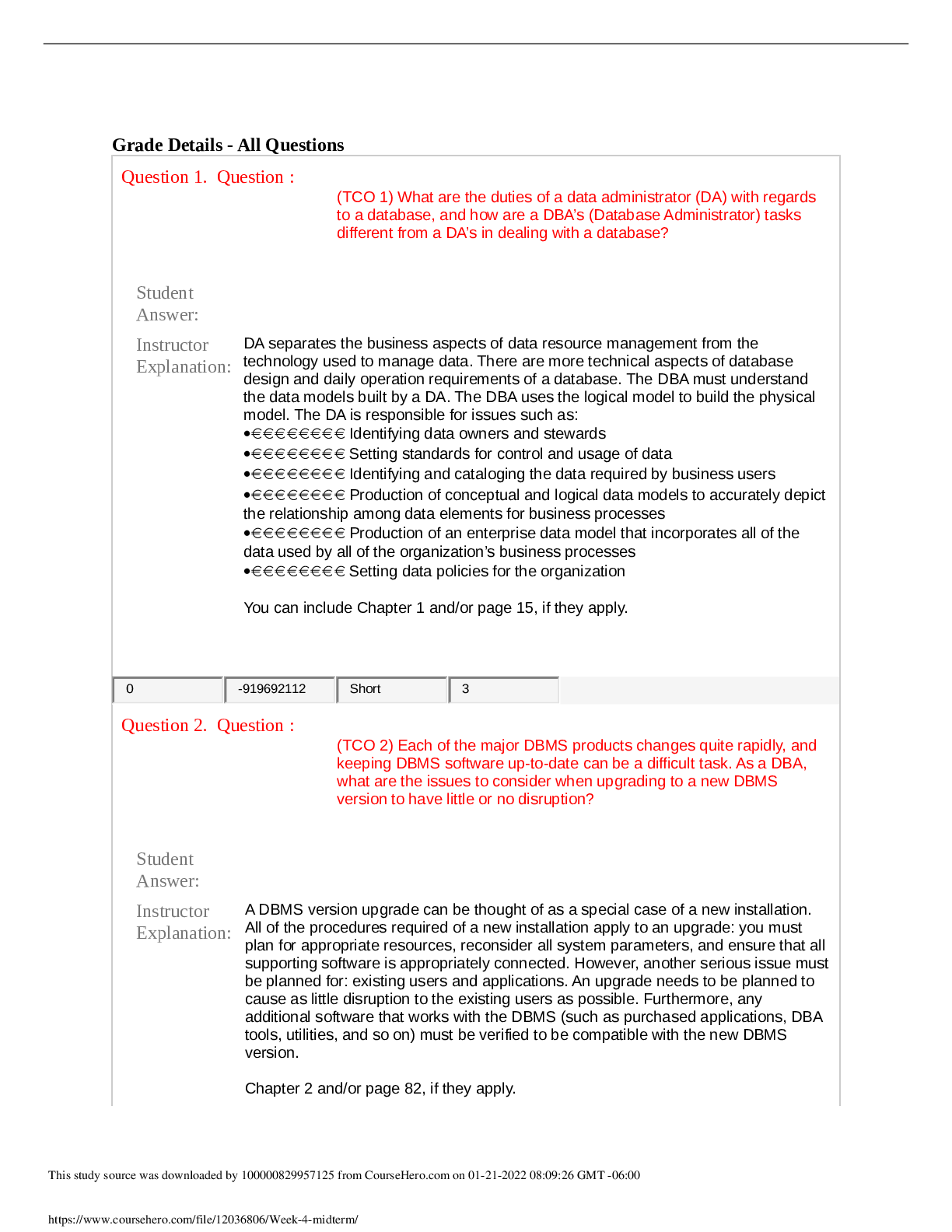

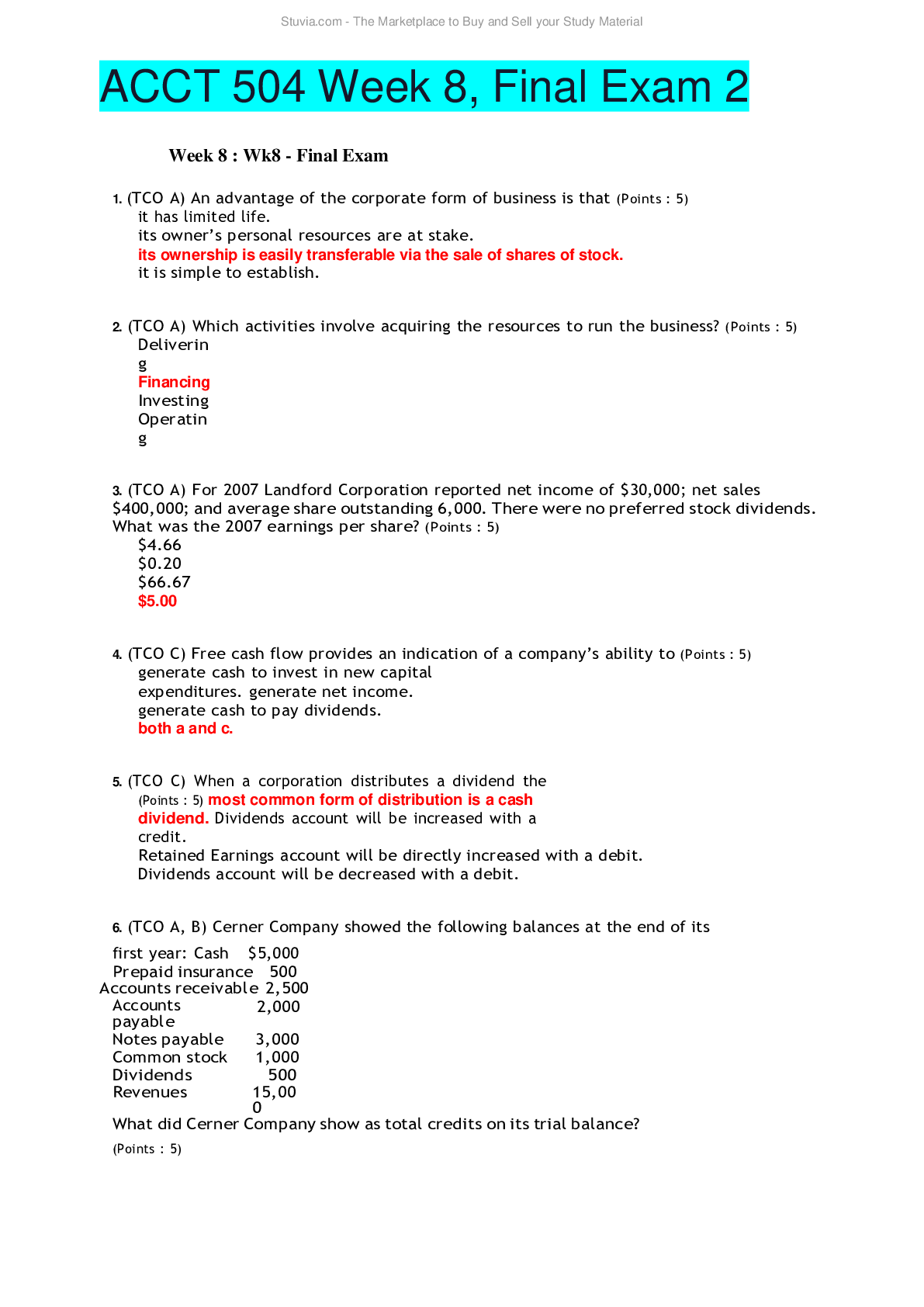

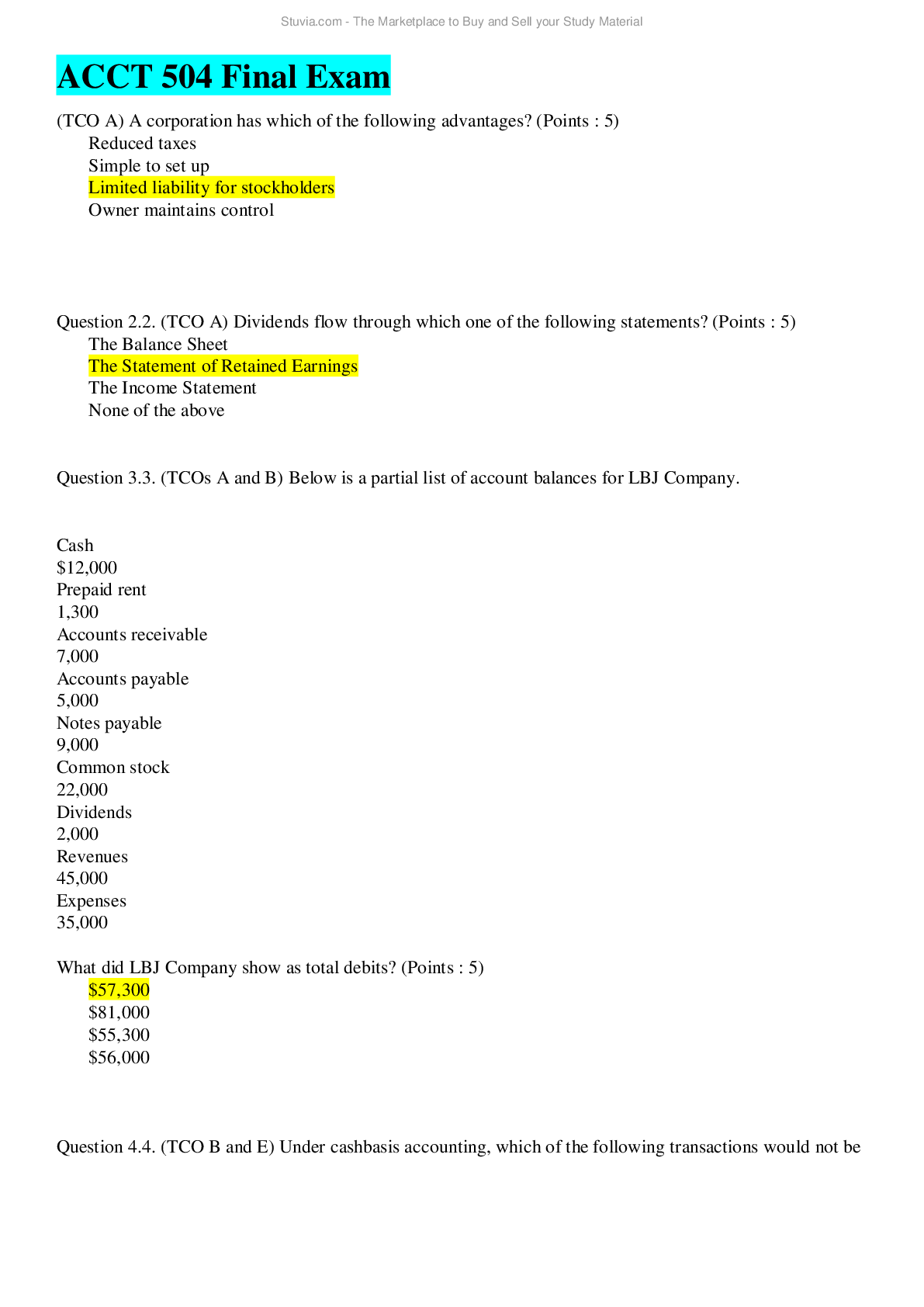

ACCT 504 Week 8, Final Exam 2 Week 8 : Wk8 - Final Exam 1. (TCO A) An advantage of the corporate form of business is that (Points : 5) it has limited life. its owner’s personal resources are at stak... e. its ownership is easily transferable via the sale of shares of stock. it is simple to establish. 2. (TCO A) Which activities involve acquiring the resources to run the business? (Points : 5) Delivering Financing Investing Operating 3. (TCO A) For 2007 Landford Corporation reported net income of $30,000; net sales $400,000; and average share outstanding 6,000. There were no preferred stock dividends. What was the 2007 earnings per share? (Points : 5) $4.66 $0.20 $66.67 $5.00 4. (TCO C) Free cash flow provides an indication of a company’s ability to (Points : 5) generate cash to invest in new capital expenditures. generate net income. generate cash to pay dividends. both a and c. 5. (TCO C) When a corporation distributes a dividend the (Points : 5) most common form of distribution is a cash dividend. Dividends account will be increased with a credit. Retained Earnings account will be directly increased with a debit. Dividends account will be decreased with a debit. 6. (TCO A, B) Cerner Company showed the following balances at the end of its first year: Cash $5,000 Prepaid insurance 500 Accounts receivable 2,500 What did Cerner Company show as total credits on its trial balance? (Points : 5) $21,500 $21,000 $20,500 $22,000 7. (TCO B, E) Under the accrual basis of accounting (Points : 5) cash must be received before revenue is recognized. net income is calculated by matching cash outflows against cash inflows. events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received. the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles. 8. (TCO A, B) The Village Laundry Company purchased $6,500 worth of laundry supplies on June 2 and recorded the purchase as an asset. On June 30, an inventory of the laundry supplies indicated only $3,000 on hand. The adjusting entry that should be made by the company on June 30 is (Points : 5) Debit Laundry Supplies Expense, $3,000; Credit Laundry Supplies, $3,000. Debit Laundry Supplies Expense, $3,500; Credit Laundry Supplies, $3,000. Debit Laundry Supplies, $3,500; Credit Laundry Supplies Expense, $3,500. Debit Laundry Supplies Expense, $3,500; Credit Laundry Supplies, $3,500. 9. (TCO E) A credit sale of $800 is made on April 25, terms 2/10, net/30, on which a return of $50 is granted on April 28. What amount is received as payment in full on May 4? (Points : 5) $735 $784 $800 $750 10. (TCO B) During the year, Darla’s Pet Shop’s merchandise inventory decreased by $20,000. If the company’s cost of goods sold for the year was $300,000, purchases must have been (Points : 5) $320,000. $280,000. $260,000. Unable to determine. 11. (TCO D) Two companies report the same cost of goods available for sale but each employs a different inventory costing method. If the price of goods has increased during the period, then the company using (Points : 5) LIFO will have the highest ending inventory. FIFO will have the highest cost of goods sold. FIFO will have the highest ending inventory. LIFO will have the lowest cost of goods sold. 12. (TCO D) The inventory turnover ratio is calculated by dividing cost of goods sold by (Points : 5) beginning inventory. ending inventory. average inventory. 365 days. 13. (TCO D) A consequence of separation of duties is that (Points : 5) theft by employees becomes impossible. operations become extremely inefficient because of constant training of employees. more employees will need to be bonded. theft is still possible when several employees are involved. 14. (TCO D) Which of the following is not a suggested procedure to establish internal control over cash disbursements? (Points : 5) Anyone can sign the checks. Different individuals approve and make the payments. Blank checks are stored with limited access. The bank statement is reconciled monthly. 15. (TCO A, B, D) An aging of a company's accounts receivable indicates that $3,000 is estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,200 credit balance, the adjustment to record bad debts for the period will require a (Points : 5) debit to Bad Debts Expense for $3,000. debit to Allowance for Doubtful Accounts for $1,800. debit to Bad Debts Expense for $1,800. credit to Allowance for Doubtful Accounts for $3,000. 1. (TCO A, B, D) Using the percentage of receivables method for recording bad debts expense, estimated uncollectible accounts are $25,000 at the end of the year. If the balance of the Allowance for Doubtful Accounts is $8,000 debit before adjustment; what is the amount of bad debt expense for that period? (Points : 5) $25,000 $8,000 $33,000 $17,000 2. (TCO A, E) Bale Company buys land for $100,000 on 12/31/06. As of 3/31/07, the land has appreciated in value to $101,000. On 12/31/07, the land has an appraised value of $103,600. By what amount should the Land account be increased in 2007? (Points : 5) $0 $1,000 $2,600 $3,600 3. (TCO A, E) Equipment with a cost of $192,000 has an estimated salvage value of $18,000 and an estimated life of 4 years or 12,000 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used 3,300 hours? (Points : 5) $48,000 $52,500 $49,500 $43,500 4. (TCO D) A cash register tape shows cash sales of $3,000 and sales taxes of $150. The journal entry to record this information is (Points : 5) Debit Cash 3,000 Credit Sales 3,000 Debit Cash 3,150 Credit Sales Tax Revenue 150 Credit Sales 3,000 Debit Cash 3,000 Debit Sales Tax Expense 150 Credit Sales 3,150 Debit Cash 3,150 Credit Sales 3,000 Credit Sales Taxes Payable 150 5. (TCO D) Joyce Corporation issues 1,000, 10-year, 8%, $1,000 bonds dated January 1, 2007, at 102. The journal entry to record the issuance will show a (Points : 5) debit to Cash of $1,020,000. debit to Discount on Bonds Payable for $20,000. credit to Bonds Payable for $1,020,000. credit to Cash for $1,000,000. 6. (TCO A) New Corp. issues 1,000 shares of $10 par value common stock at $14 per share. When the transaction is recorded, credits are made to: (Points : 5) Common Stock $10,000 and Paid-in Capital in Excess of Stated Value $4,000. Common Stock $14,000. Common Stock $10,000 and Paid-in Capital in Excess of Par Value $4,000. Common Stock $10,000 and Retained Earnings $4,000. 7. (TCO A, C) Outstanding stock of the Bell Corporation included 20,000 shares of $5 par common stock and 10,000 shares of 6%, $10 par non-cumulative preferred stock. In 2006, Bell declared and paid dividends of $4,000. In 2007, Bell declared and paid dividends of $12,000. How much of the 2007 dividend was distributed to preferred shareholders? (Points : 5) $8,000 $14,000 $6,000 None of the above 8. (TCO C) Accounts receivable arising from sales to customers amounted to $80,000 and $70,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $240,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is (Points : 5) $240,000. $250,000. $310,000. $230,000. 9. (TCO C) Loster Company reported a net loss of $10,000 for the year ended December 31, 2007. During the year, accounts receivable decreased $5,000, merchandise inventory increased $8,000, accounts payable increased by $10,000, and depreciation expense of $5,000 was recorded. During 2007, operating activities (Points : 5) used net cash of $2,000. used net cash of $8,000. provided net cash of $2,000. provided net cash of $8,000 10. (TCO F) One variation of the horizontal analysis is known as (Points : 5) nonlinear analysis. vertical analysis. trend analysis. common size analysis. 11. (TCO F) Comparisons of data within a company are an example of the following comparative basis: (Points : 5) Industry averages Inter-company Intra-company Inter-regional 12. (TCO F) The best way to study the relationships among the components within a financial statement is to prepare (Points : 5) a vertical analysis. a trend analysis. profitability analysis. comparative analysis. 13. (TCO F) Ratios are most useful in identifying (Points : 5) trends. differences. causes. relationships among different numbers. 14. (TCO F) Short-term creditors are usually most interested in assessing (Points : 5) solvency. liquidity. marketability. profitability. 15. (TCO F) Return on assets ratio is most closely related to (Points : 5) profit margin and debt to total assets ratio. profit margin and asset turnover ratio. times interest earned and debt to stockholders’ equity ratio. profit margin and free cash flow. 1. (TCO A) The partial financial statement items below were taken from the financial statements of Prone, Inc. This information can be used to correctly solve each of the ratios below. The information is in alphabetical order. Depreciation Expense 4,800 DAdivdiditeionndasl information: The number of a5v,e3r0a0ge common shares outstanding during the year was 40,000. Equipment 48,000 IInntsetrruecsttioEnxsp:eCnosme pute the following: P(aa)tenCtsurrent ratio. 2,500 7,500 R(be)tainWeodrkEinagrncinagpsit,aJy 1 16,000 S(ca)larEieasrnEixnpgesnpser share. (Sda)lesDReebvtsentouetotal assets ratio. 5,200 36,500 STuoppelieasrn full credit, you4,5m0u0st show the formula you are using, sInhstoruwctioynosur computations and explain the meaning of each of your ratio results. P(Proeinptasr:e25a)n income statement and a retained earnings statement for Grove Company. (Points : 25) 3. (TCO C) Menschken Company reported net income of $150,000 for the current year. Depreciation recorded on buildings and equipment amounted to $65,000 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $20,000 $15,000 Accounts receivable 19,000 32,000 Inventories 50,000 65,000 Accounts payable 12,000 18,000 Instructions Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.(Points : 25) 4. (TCO D) As part of a Careers in Accounting program sponsored by accounting organizations and supported by your company, you will be taking a group of high-school students through the accounting department in your company. You will also provide them with various materials to explain the work of an accountant. One of the materials you will provide is the Stockholders’ Equity section of a recent balance sheet. Required: Prepare a short response explaining each major section: Common Stock, Additional Paid-in Capital, and Retained Earnings. You should try to be brief but clear. Remember to include a description of treasury stock as well.(Points : 25) [Show More]

Last updated: 1 year ago

Preview 1 out of 18 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 17, 2021

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

Jun 17, 2021

Downloads

0

Views

29

.png)

.png)