Finance > TEST BANK > University of Melbourne FNCE 30002 Chapter 15 - Testbank ( WITH ANSWER KEY ) (All)

University of Melbourne FNCE 30002 Chapter 15 - Testbank ( WITH ANSWER KEY )

Document Content and Description Below

Chapter 15 - Testbank Student: ___________________________________________________________________________ 1. A deep market is defined as a market in which: A. low volumes of a particular security ... are traded. B. large volumes of a particular security are traded. C. low-priced securities are traded. D. high-priced securities are traded. 2. Which of the following are characteristics of a liquid asset? A. The asset can be turned into cash quickly. B. Turning the asset into cash will result in low transaction costs. C. Turning the asset into cash will result in little or no loss in principal value. D. All of the listed options are correct. 3. Which of the following statements is true? A. Liquid assets pay high interest rates. B. Liquid assets bear low default risk. C. Holding a high proportion of funds in liquid assets will result in increased profitability. D. All of the listed options are correct. 4. Which of the following statements is true? A. FIs are required to hold some liquid assets to lessen the threat of insolvency. B. FIs are required to hold some liquid assets for the purpose of monetary policy. C. FIs are required to hold some liquid assets for the purpose of taxation implications. D. FIs are required to hold some liquid assets to lessen the threat of insolvency, for the purpose of monetary policy and for the purpose of taxation implications. 5. Reserve requirement tax is defined as: A. The cost of holding reserves when the central bank pays no—or below market—interest on these balances. B. The benefits of holding reserves when the central bank pays above market interest on these balances. C. The tax paid on liquidating near-cash assets. D. The tax benefit received from liquidating near-cash assets. 6. Liquid asset ratio describes: A. The minimum ratio of liquid assets to total equity set by the central bank. B. The minimum ratio of liquid assets to total liabilities set by the central bank C. The minimum ratio of liquid assets to total assets set by the central bank. D. None of the listed options are correct.7. Which of the following statements relating to required stable funding is true? A. The required stable funding (RSF) is found by subtracting the value of assets held and funded by the FI, multiplied by a specific RSF factor assigned to specific asset types. B. The RSF is found by adding the value of assets held and funded by the FI, multiplied by a specific RSF factor assigned to specific asset types. C. Assets that are more liquid receive a higher RSF factor. D. The RSF amount is determined by the liquidity characteristics of the FI's various on-balance sheet contingent exposures. 8. Which of the following statements is true? A. All banks are required to comply with the liquidity coverage ratio by 2015 and will need to hold highquality liquefiable assets that can be converted to cash to meet liquidity needs for 5 days. B. All banks are required to comply with the liquidity coverage ratio by 2015 and will need to hold highquality liquefiable assets that can be converted to cash to meet liquidity needs for 30 days. C. Large banks are required to comply with the liquidity coverage ratio by 2015 and will need to hold highquality liquefiable assets that can be converted to cash to meet liquidity needs for 30 days, whereas small banks will only need to meet liquidity needs for 5 days. D. These days only small banks are subject to the liquidity requirement. 9. Which of the following statements is true? A. In the current situation, only small FIs have to hold 9 per cent of their liabilities in specified high-quality liquefiable assets. B. Currently, FIs are required to have in place a regulator-approved liquidity management strategy. C. Currently, FIs are not subject to the user-pays approach. D. Currently, FIs are required to have in place a regulator-approved liquidity management strategy and only small FIs have to hold 9 per cent of their liabilities in specified high-quality liquefiable assets. 10. Which of the following statements is true? A. The stock of liquid assets held in an FI's balance sheet will depend on the FI's willingness to trade off liquidity against returns and on its ability to use purchased liquidity. B. The stock of liquid assets held in an FI's balance sheet will depend on the FI's willingness to trade off liquidity against returns but not on its ability to use purchased liquidity. C. The stock of liquid assets held in an FI's balance sheet will not depend on the FI's willingness to trade off liquidity against returns, it will depend, however, on its ability to use purchased liquidity. D. The stock of liquid assets held in an FI's balance sheet will neither depend on the FI's willingness to trade off liquidity against returns, nor on its ability to use purchased liquidity. 11. Potential sources of liquidity include investment in: A. housing loans. B. new equipment. C. short-term securities such as treasury notes and bank accepted bills. D. housing loans and investment in bank accepted bills. 12. Which of the following items are sources of stored liquidity? A. interbank market loans B. large certificates of deposits C. interbank market for exchange settlement funds D. semi-government securities13. Which of the following statements is true? A. Bank accepted bills classify as purchased liquidity. B. Loans to short-term money market dealers classify as purchased liquidity. C. Securities sold under agreements to repurchase classify as stored liquidity. D. Certificates of deposits classify as stored liquidity. 14. What does 'constrained optimisation' in the context of liquidity management refer to? A. It refers to the case that any liquid asset holdings over and above the reserve requirements imposed by regulators need to be balanced by the same amount of short-term liabilities. B. It refers to the case that any increases in an FI's current liability holdings incur a decrease in the profitability of the FI's liquidity holdings. C. It refers to the case that any liquid asset reserve requirements imposed by regulators set a minimum bound on the level of liquid reserve assets in the balance sheet. D. It refers to the case that any liquid asset reserve requirements imposed by regulators need to be balanced by the same amount of short-term liabilities. 15. Which of the following statements is true? A. Australian FIs are required to hold a minimum of three days' estimated cash requirements to enable them to manage a short run on deposits. B. Australian FIs are required to hold a minimum of five days' estimated cash requirements to enable them to manage a short run on deposits. C. Australian FIs are required to hold a minimum of seven days' estimated cash requirements to enable them to manage a short run on deposits. D. None of the listed options are correct. 16. Which of the following are determinants of an FI's optimal liquidity? A. The variability of deposit inflows and outflows. B. The yield on liquid assets. C. The acquisition costs of highly non-liquid assets. D. All of the listed options are correct. 17. Which of the following statements is true? A. An increase in the liquidation costs of non-liquid assets encourages an FI to shift more funds into more liquid, lower yielding assets. B. A decrease in the yield of non-liquid assets will reduce holdings of liquid assets due to higher opportunity costs of holding liquid assets. C. The greater the volatility of the level of deposits, the greater the optimal proportion of reserve assets held to deposits. D. An increase in the liquidation costs of non-liquid assets encourages an FI to reduce their holdings of more liquid, lower yielding assets. 18. The supervision of FI's liquidity management is undertaken by the: A. ASIC. B. RBA. C. APRA. D. ACCC.19. Scenario analysis refers to the part of a bank's liquidity policy that caters for: A. a range of predictable events, to ensure that the FI can operate under these operating conditions. B. worst-case events only, to ensure how worst-case events affect the FI's operating conditions. C. the most likely scenario, to ensure that the FI's liquidity policy is still valid. D. a range of specific events, to ensure that the FI can operate under a wide spectrum of operating conditions. 20. APS210 specifies that 'high-quality liquid assets' must be free from encumbrances and include: A. cash. B. long-term loans. C. cash and eligible securities approved by APRA. D. cash and long-term loans. 21. Which of the following elements should be included in an FI's liquidity management strategy? A. Clearly defined managerial responsibilities and controls. B. A formal plan to minimise excess liquidity. C. An agreement to predominantly focus on stored liquidity management. D. Clearly defined managerial responsibilities and controls and a formal plan to minimise excess liquidity only. 22. Which of the following statements is true? A. Going-concern scenario refers to abnormal behaviour of cash flows in the course of business. B. Going-concern scenario focuses on the bank's liquidity policy in a worst case scenario. C. Going-concern scenario focuses on the bank's day-to-day liquidity management. D. None of the listed options are correct. 23. Which of the following liability products does not have withdrawal risk? A. wholesale CDs B. money market deposit accounts C. cheque and retail saving accounts D. All of the given options have withdrawal risk. 24. Which of the following observations concerning repurchase agreements is not true? A. They can be viewed as collateralised short term loans where a financial security is swapped for cash. B. The repurchase market is a highly liquid and flexible source of funds for DIs needing to access liquidity to offset deposit withdrawals. C. Repos under the intra-day facility system are discouraged and attract an interest rate charge of 25 basis points above the target cash rate. D. It is difficult to transact a repurchase agreement borrowing late in the day.25. Which of the following is a mechanism used by FI managers to reduce demand deposit withdrawal rates? A. implicit interest payments B. minimum balance requirements C. explicit interest payments D. There is no way to mitigate withdrawal risk. 26. Which of the following procedures does APRA require to be adopted by FIs as part of their liquidity management strategies? A. Liquidity management policy approved by the board. B. Procedures for assessing and measuring liquidity. C. A formal contingency plan for dealing with a liquidity crisis. D. All of the listed options are correct. 27. Which of the following statements is true? A. The issuers of Treasury notes are local governments. B. The issuers of Treasury notes are state governments. C. The issuer of Treasury notes is the Australian federal government. D. The issuers of Treasury notes are corporations. 28. Which of the following statements is true? A. Treasury bonds are short-term instruments. B. Corporate promissory notes are long-term instruments. C. Corporate bonds are long-term instruments. D. Semi-government bonds are short-term instruments. 29. Use the following information to answer the question. A current deposit account requires a minimum balance of $500 if annual interest of 5 per cent is to be earned monthly on its deposits. An account holder has maintained an average balance of $300 for the first nine months of the year and $800 for the last three months of the year. She has written an average of 20 cheques a month and is not charged for these services. However, it costs the bank $0.02 to process each cheque. What is the average return earned (both explicit and implicit) by the account holder over the full year? A. 2.98 per cent B. 3.48 per cent C. 4.28 per cent D. 4.79 per cent30. Use the following information to answer the question. A current deposit account requires a minimum balance of $500 if annual interest of 5 per cent is to be earned monthly on its deposits. An account holder has maintained an average balance of $300 for the first nine months of the year and $800 for the last three months of the year. She has written an average of 20 cheques a month and is not charged for these services. However, it costs the bank $0.02 to process each cheque. The bank would like to limit the average return (both explicit and implicit) earned by the account holder to 5 per cent per year. How much should it charge for processing each check to this Account holder assuming that it will pay annual interest of 5 per cent and minimum balances of $200 are maintained? A. 1 cent per cheque B. 2 cents per cheque C. 3 cents per cheque D. 4 cents per cheque. 31. Over the past 30 years in the DI industry: A. the loan portfolio has become more liquid because of increased securitisation. B. lower amounts of very liquid assets need to be held to manage withdrawal risk. C. DIs have intentionally managed liabilities to reduce withdrawal risk. D. All of the listed options are correct. 32. What is the average implicit interest rate on a $100 000 account if the bank's average management costs are $2500 and annual fees average $1750? A. 2.50 per cent B. 1.75 per cent C. 0.75 per cent D. –0.75 per cent 33. Which of the following statements is true? A. Australian DI payments are processed through either RTGS or RITS. B. Australian DI payments are processed through either RTGS or CHESS. C. Australian DI payments are processed through either RTGS or ESA. D. Australian DI payments are processed through either RTGS or DNSS. 34. A committed liquidity facility is a: A. facility that allows the FI to access funds from the RBA to obtain liquidity to meets its settlement needs. B. liquidity facility that allows the FI to access funds from the RBA to obtain liquidity to meets its short-term needs. C. liquidity facility that allows the FI to access funds from the RBA to obtain liquidity to meets its long-term needs. D. facility providing a secured line of credit from the RBA to allow access to liquid assets to meet Basel III liquidity reforms.35. An FI offers a $2500 minimum balance investment savings account paying 4 per cent annual interest, and there are no service charges as long as the customer maintains the minimum balance. The customer maintains a balance of $5000, and averages 750 cheques per year. Each cheque has a processing cost to the FI of $0.15. What is the annual gross interest return on this account to the customer? A. $112.50 B. $100.00 C. $312.50 D. $212.50 36. Which of the following are the two main sources of exchange settlement liquidity for Australian FIs provided by RBA repos? A. ESAs and intra-day repurchase agreement facilities. B. Inter-day repurchase agreement facilities and overnight repurchase agreement facilities. C. ESAs and inter-day repurchase agreement facilities. D. Intra-day repurchase agreement facilities and overnight repurchase agreement facilities. 37. Why do FIs face a return or interest earnings penalty by holding large amounts of assets such as cash, T-bills, and T-bonds to reduce liquidity risk? A. These assets carry a reserve requirement tax. B. These assets offer low returns. C. These assets offer higher returns that reflect their risk. D. Inflation increases the purchasing power value of these assets. 38. The average implicit interest rate can be calculated as follows: the difference between an FI's average: A. management costs per account per year and the average fees earned per account per year, multiplied by the average annual size of the account. B. management costs per account per year and the average fees earned per account per year, divided by the average annual size of the account. C. fees earned per account per year and average management costs per account per year, multiplied by the average annual size of the account. D. fees earned per account per year and average management costs per account per year, divided by the average annual size of the account. 39. Assume the average management cost per account per year is $200 and the average fees earned per account per year is $170. The average annual size of account is $1800. What is the average implicit interest rate (round to two decimals)? A. –1.67 per cent B. 1.67 per cent C. 4.86 per cent D. 15 per cent 40. The contagious effect: A. stems from the positive correlation in FI returns. B. results when interest rate risk increases credit risk and liquidity risk exposures. C. occurs when liquidity risk problems at bad banks damages well-run banks. D. is completely eliminated by government provided deposit insurance against bank runs.41. What is the benefit of a regulatory guarantee or deposit insurance program for liability holders of FIs? A. It decreases the likelihood contagious runs. B. It increases concerns about the asset quality of FI. C. It increases concerns about solvency of an FI. D. It provides preference to those who are first in line to withdraw funds over those last in line. 42. All of the following are associated with contagious runs except: A. liability holders not distinguishing between good and bad FIs. B. liability holders seeking to quickly turn their liabilities into cash or safe securities. C. a contractionary effect on the supply of credit and negative social welfare effects. D. an expansionary effect on the money supply. 43. Regulators seek to provide depositor protection to depositors than other FI creditors because deposits are: A. a critical part of the financial system as they facilitate economic transactions. B. the main source of funding for banks. C. the primary form of savings for individuals and loss of deposits causes significant hardship for depositors. D. All of the listed options are correct. 44. The Reserve Bank of Australia has responsibility for providing depositor protection. This is seen as: A. a blanket guarantee for all deposits and a protection against all FIs' failure. B. the RBA using its available powers in the interest of protecting depositors' funds. C. deposit insurance for all FIs. D. All of the listed options are correct. 45. FIs are particularly vulnerable to sudden and unexpected demand for funds. Liquidity regulations are imposed for all of the following reasons, except to: A. ensure that authorised DIs have sufficient liquidity. B. prevent liquidity problems and possible contagion effects that may spread to other FIs. C. increase liquidity for prudential management. D. ensure that authorised DIs have sufficient capital. 46. Authorised depository institutions' liquidity management strategy includes the following elements except: A. an informal contingency plan to deal with a liquidity crisis. B. defined managerial responsibilities and controls. C. a liquidity management policy statement approved by the FI's board. D. a system for measuring, assessing and reporting liquidity. 47. Which one of the following statements relating to scenario analysis is incorrect? A. Going-concern scenario relates to 'normal' behaviour of cash flows in the ordinary course of business. B. Going-concern scenario relates to 'abnormal' behaviour of cash flows in the ordinary course of business. C. Name crisis scenario relates to the FI operating in adverse operating conditions and can fund operations for 5 days. D. All of the listed options are correct.48. Basel III liquidity reforms: A. will strengthen global illiquidity rules with the key aim of promoting a resilient global sector. B. introduce the need for adequate high-quality liquid assets that meet the available stable funding (ASF) requirement C. introduce the need for adequate high-quality liquid assets that meet the net stable funding ratio (NSFR). D. introduce the need for adequate high-quality liquid assets that meet the liquidity coverage ratio (LCR). 49. Covered bonds are issued by: A. NBFIs and must have a pool of assets covering the bonds that meet 105 per cent of the face value of the outstanding covered bonds. B. depository institutions and must have a pool of assets covering the bonds that meet 105 per cent of the face value of the outstanding covered bonds. C. by depository institutions and must have a pool of assets covering the bonds that meet 100 per cent of the face value of the outstanding covered bonds. D. depository institutions and must have a pool of assets covering the bonds that meet 103 per cent of the face value of the outstanding covered bonds. 50. Basel III liquidity reforms costs are: A. reduced profitability due to more liquid balance sheets. B. reduced impact of the liquidity coverage ratio and net stable funding ratio on credit unions and building societies. C. competitiveness of Australian banks will be negatively impacted if other countries do not take up the reforms. D. All of the listed options are correct. 51. Historically, asset liquidity was the primary method by which banks met cash demands. True False 52. Measuring stored liquidity is easy because many assets cannot be clearly classified as liquid or nonliquid. True False 53. The challenge of liquidity management is to maintain enough liquidity to avoid a crisis but to sacrifice no more earnings than absolutely necessary. True False 54. To reduce liquidity risk, an FI can efficiently manage the liability structure of its portfolio. True False 55. The net stable funding ratio requirement promotes a more diversified, stable funding base that ensures that short-term assets are funded by stable liabilities. True False56. Managing liabilities as a means of managing liquidity risk involves the trade-off between lower funding cost and higher risk of withdrawals. True False 57. Funding costs generally are positively related to the period of time the liability remains on the balance sheet. True False 58. The gross interest return is calculated as explicit interest less implicit interest. True False 59. NCDs are short-term, fixed-term deposits and are known as wholesale CDs, which have a face value of below $100 000. True False 60. A viable liability management strategy is the diversification of funding sources. True False 61. Because retail CDs have fixed maturities, FI managers always should have perfect information regarding the scheduling of interest and principal payments. True False 62. Although Australia has only had an explicit deposit insurance scheme since 2008, it has had depositor protection since 1959 and has always had depositor preference. True False 63. The adverse effects of a contagious run include the restrictions on the ability of individuals to transfer wealth through time and a negative impact on the level or rate of savings. True False 64. Graphically show the relationship between funding cost and funding or withdrawal risk. Explain your graph.65. What are the withdrawal risks and costs associated with the following types of liabilities? a) cheque account and other demand deposits. b) fixed-term deposits c) interbank funds 66. Why have regulators of financial service firms in Australia introduced the deposit guarantee programs? Why may regulators seek to provide greater protection to depositors than to other DI creditors?Chapter 15 - Testbank Key [Show More]

Last updated: 11 months ago

Preview 1 out of 29 pages

.png)

Reviews( 0 )

Recommended For You

Pathophysiology> TEST BANK > Test Bank - Essentials of Pathophysiology (4th Edition by Porth) ( with ANSWER KEY ) VERIFIED ANSWERS, 100% CORRECT (All)

Test Bank - Essentials of Pathophysiology (4th Edition by Porth) ( with ANSWER KEY ) VERIFIED ANSWERS, 100% CORRECT

Table of Contents Table of Contents Chapter 01 - Cell Structure and Function Chapter 02 - Cellular Responses to Stress, Injury, and Aging Chapter 03 - Inflammation, the Inflammatory Response, and...

By Cheryshev , Uploaded: Jun 24, 2021

$13

Computer Science> TEST BANK > A Practical Guide to Advanced Networking 3rd Edition By Jeffrey Beasley, Piyasat Nilkaew (Test Bank) (All)

.png)

A Practical Guide to Advanced Networking 3rd Edition By Jeffrey Beasley, Piyasat Nilkaew (Test Bank)

A Practical Guide to Advanced Networking, Third Edition takes a pragmatic, hands-on approach to teaching advanced modern networking concepts from the network administrator’s point of view. Thoroughly...

By eBookSmTb , Uploaded: Mar 13, 2023

$25

History> TEST BANK > A History of Western Art 5th Edition By Laurie Adams (Test Bank) (All)

.png)

A History of Western Art 5th Edition By Laurie Adams (Test Bank)

MCQ Answers are given. Short Questions Answers not given by Author. These Answers can be learned from the relevant Chapters. Appropriate for one-semester art history surveys or historically-focused...

By eBookSmTb , Uploaded: Mar 13, 2023

$20

History> TEST BANK > A History of Roman Art 2nd Edition By Fred Kleiner (Test Bank) (All)

.png)

A History of Roman Art 2nd Edition By Fred Kleiner (Test Bank)

MCQ Answers are given. Short Questions Answers not given by Author. These Answers can be learned from the relevant Chapters A HISTORY OF ROMAN ART, 2nd Edition, surveys the art of Rome and its empi...

By eBookSmTb , Uploaded: Mar 13, 2023

$20

History> TEST BANK > A History of Psychology, The Emergence of Science and Applications 6th Edition By William Douglas Woody, Wayne Viney (Test Bank) (All)

.png)

A History of Psychology, The Emergence of Science and Applications 6th Edition By William Douglas Woody, Wayne Viney (Test Bank)

A History of Psychology: The Emergence of Science and Applications, Sixth Edition, traces the history of psychology from antiquity through the early 21st century, giving students a thorough look into...

By eBookSmTb , Uploaded: Mar 13, 2023

$25

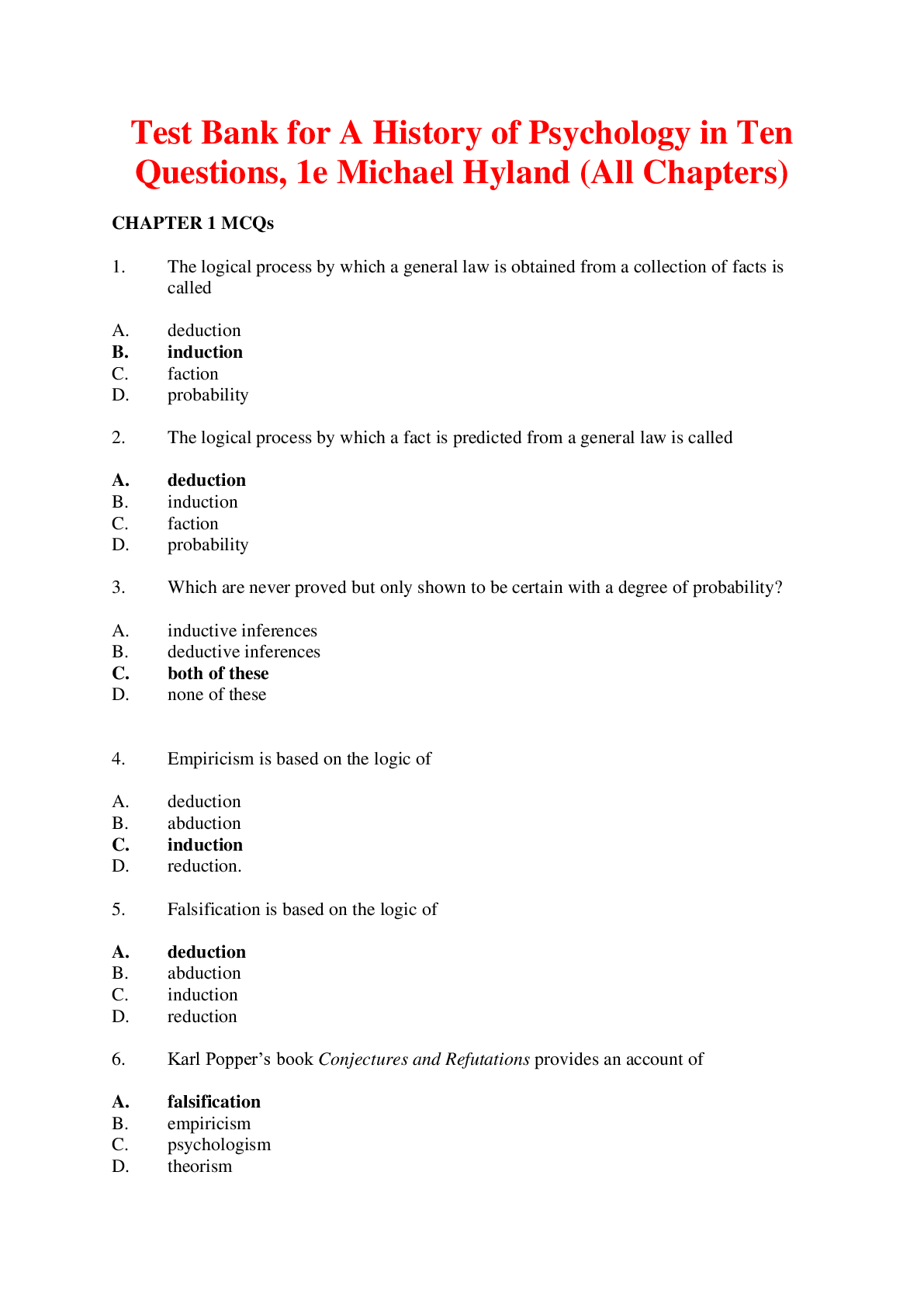

Psychology> TEST BANK > A History of Psychology in Ten Questions 1st Edition By Michael Hyland (Test Bank) (All)

A History of Psychology in Ten Questions 1st Edition By Michael Hyland (Test Bank)

This student-friendly book on the history of psychology covers the key historical developments and controversies in all areas of psychology, linking history to the present by focusing on ten conceptua...

By eBookSmTb , Uploaded: Jan 17, 2023

$25

History> TEST BANK > A History of Modern Psychology 11th Edition By Duane Schultz, Sydney Ellen Schultz (Test Bank) (All)

.png)

A History of Modern Psychology 11th Edition By Duane Schultz, Sydney Ellen Schultz (Test Bank)

History doesn't have to be dull, and this book is living proof with coverage of interesting topics ranging from the controversial use of IQ tests at Ellis Island to the psychodynamics of gum chewing....

By eBookSmTb , Uploaded: Mar 13, 2023

$25

Human Resource Management> TEST BANK > A Framework for Human Resource Management 7e Gary Dessler (Test Bank) (All)

.png)

A Framework for Human Resource Management 7e Gary Dessler (Test Bank)

This is the eBook of the printed book and may not include any media, website access codes, or print supplements that may come packaged with the bound book. A Framework for Human Resource Management pr...

By eBookSmTb , Uploaded: Mar 10, 2023

$25

Accounting> TEST BANK > Payroll Accounting 2023 9th Edition By Jeanette Landin, Paulette Schirmer (Test Bank, 100% Verified Original, A+ Grade) (All)

Payroll Accounting 2023 9th Edition By Jeanette Landin, Paulette Schirmer (Test Bank, 100% Verified Original, A+ Grade)

Payroll Accounting 2023, 9e Jeanette Landin, Paulette Schirmer (Test Bank, 100% Verified Original, A+ Grade) Payroll Accounting 2023, 9e Jeanette Landin, Paulette Schirmer (Test Bank, 100% Verified O...

By eBookSmTb , Uploaded: Oct 04, 2023

$25

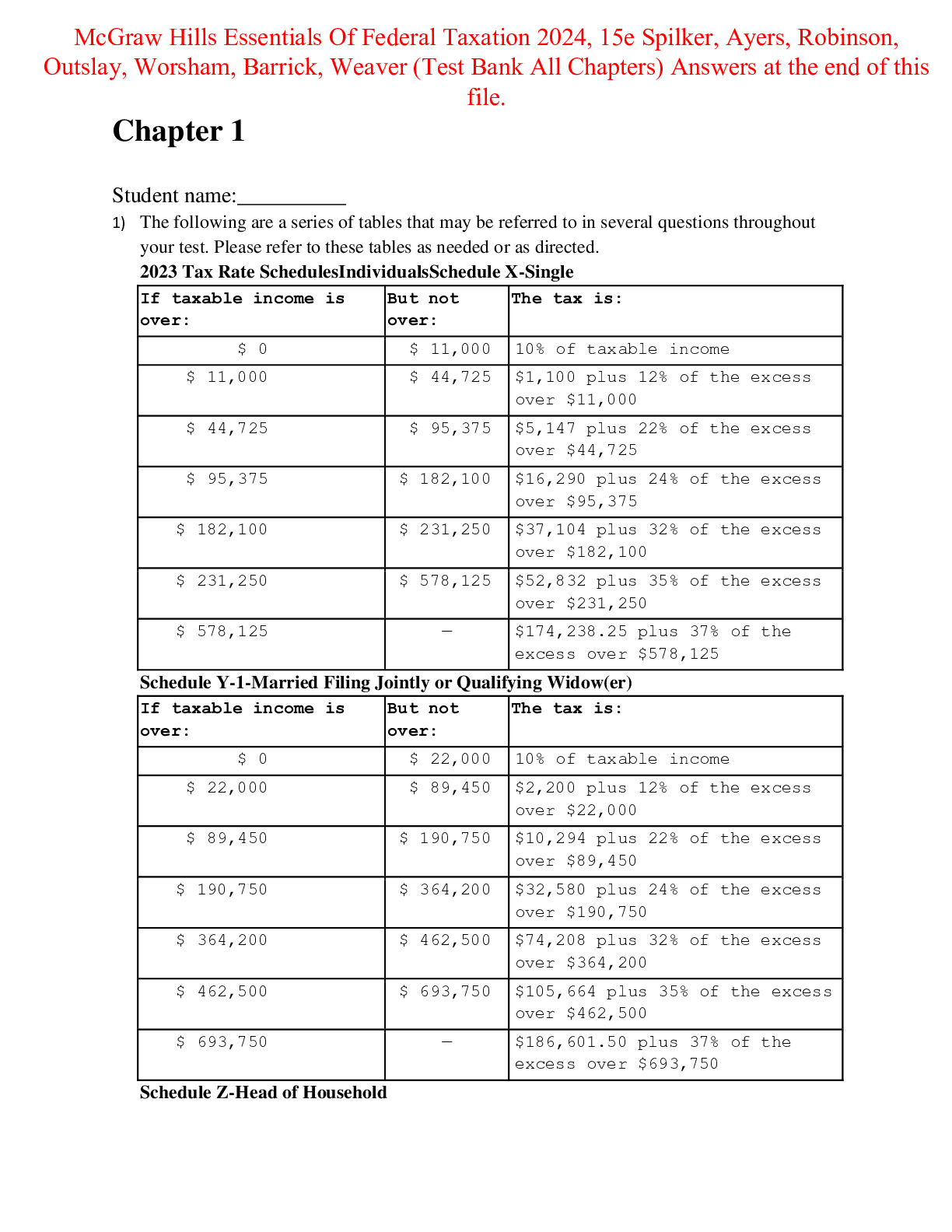

Accounting> TEST BANK > McGraw Hills Essentials Of Federal Taxation 2024 15th Edition By Spilker, Ayers, Robinson, Outslay, Worsham, Barrick, Weaver (Test Bank, 100% Verified Original, A+ Grade) (All)

McGraw Hills Essentials Of Federal Taxation 2024 15th Edition By Spilker, Ayers, Robinson, Outslay, Worsham, Barrick, Weaver (Test Bank, 100% Verified Original, A+ Grade)

McGraw Hills Essentials Of Federal Taxation 2024, 15e Spilker, Ayers, Robinson, Outslay, Worsham, Barrick, Weaver (Test Bank, 100% Verified Original, A+ Grade) McGraw Hills Essentials Of Federal Taxa...

By eBookSmTb , Uploaded: Oct 04, 2023

$25

Document information

Connected school, study & course

About the document

Uploaded On

Jun 29, 2021

Number of pages

29

Written in

Additional information

This document has been written for:

Uploaded

Jun 29, 2021

Downloads

0

Views

403