Accounting > STUDY GUIDE > ACCT 4302 TAX PROJECT 2-REVIEWED BY EXPEETS 2021 (All)

ACCT 4302 TAX PROJECT 2-REVIEWED BY EXPEETS 2021

Document Content and Description Below

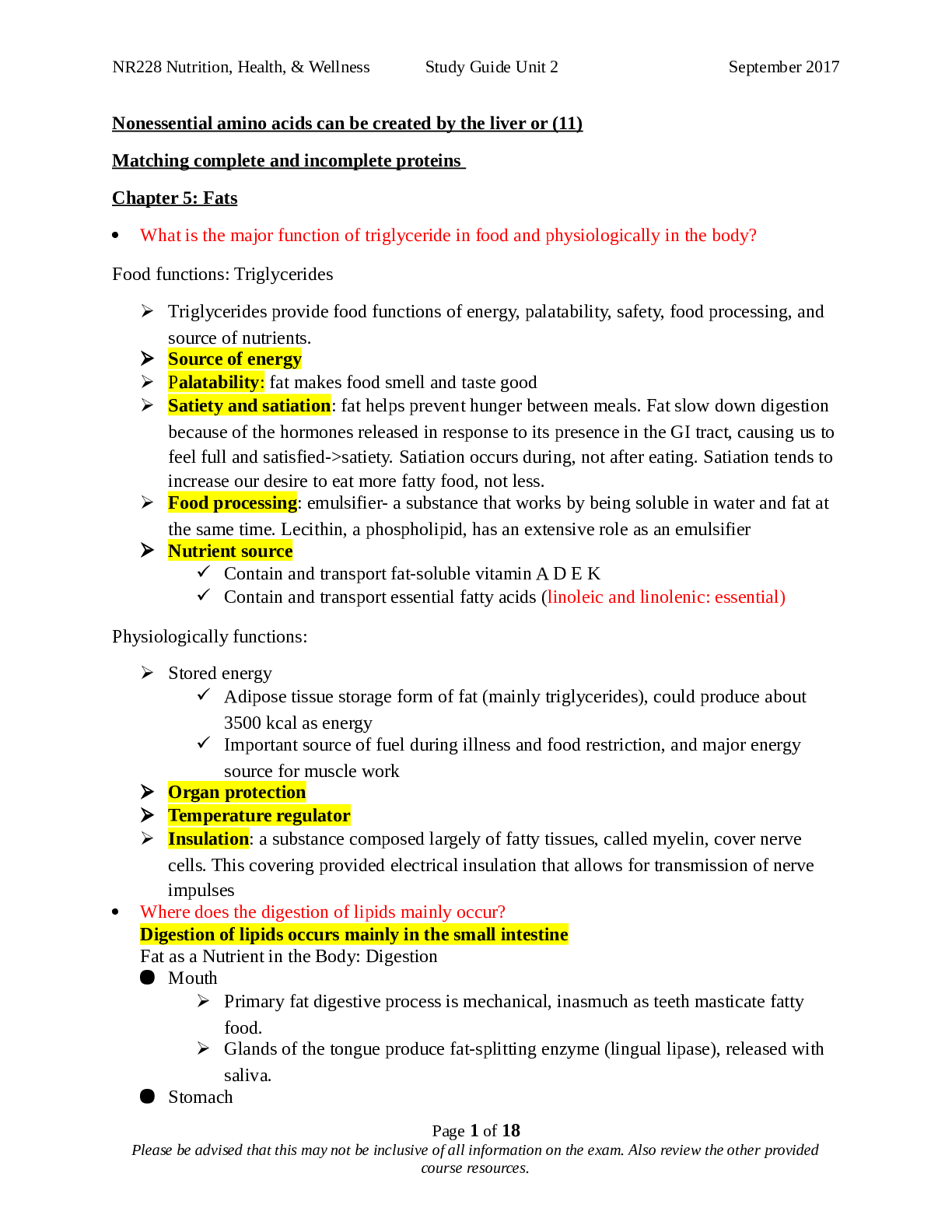

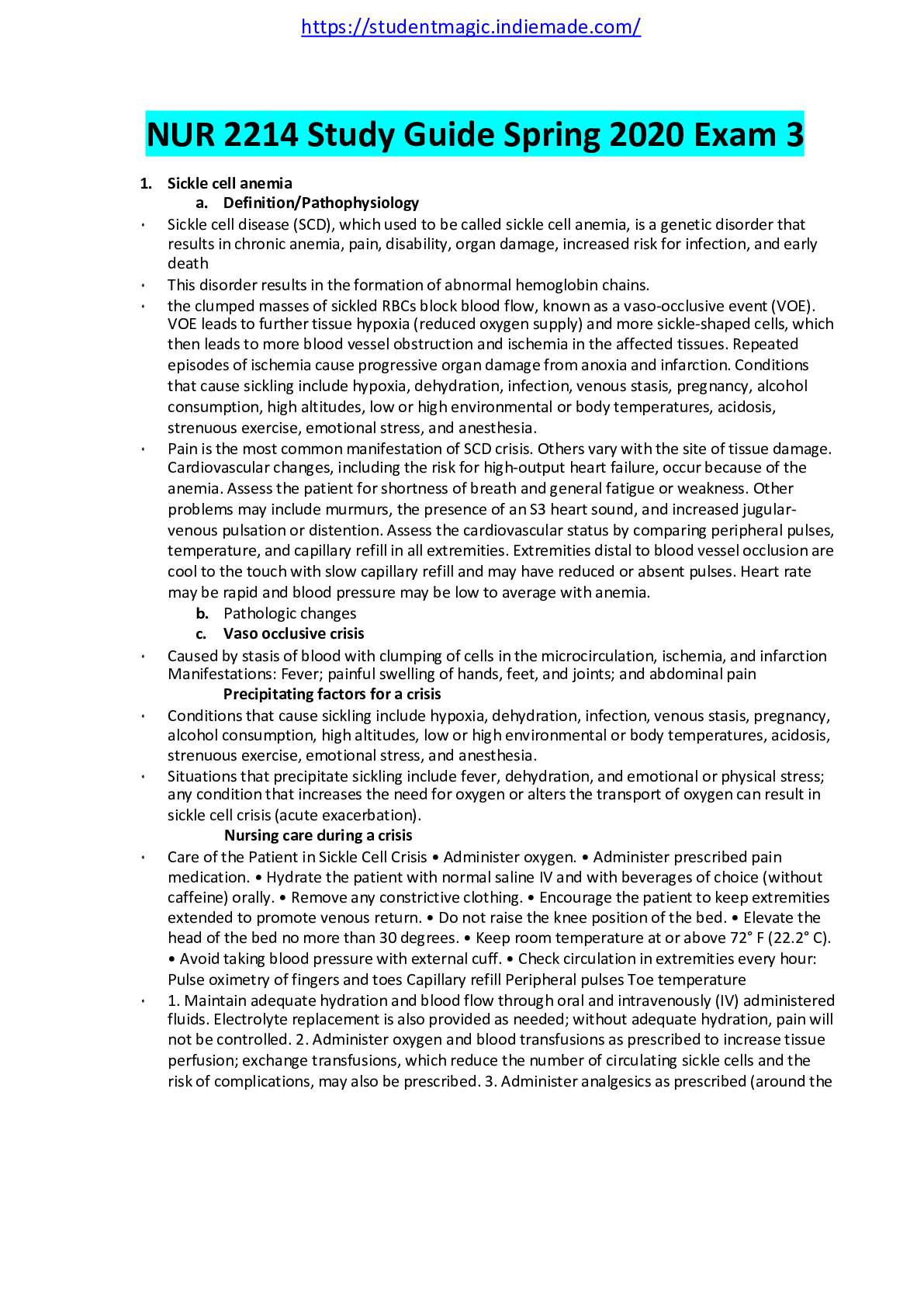

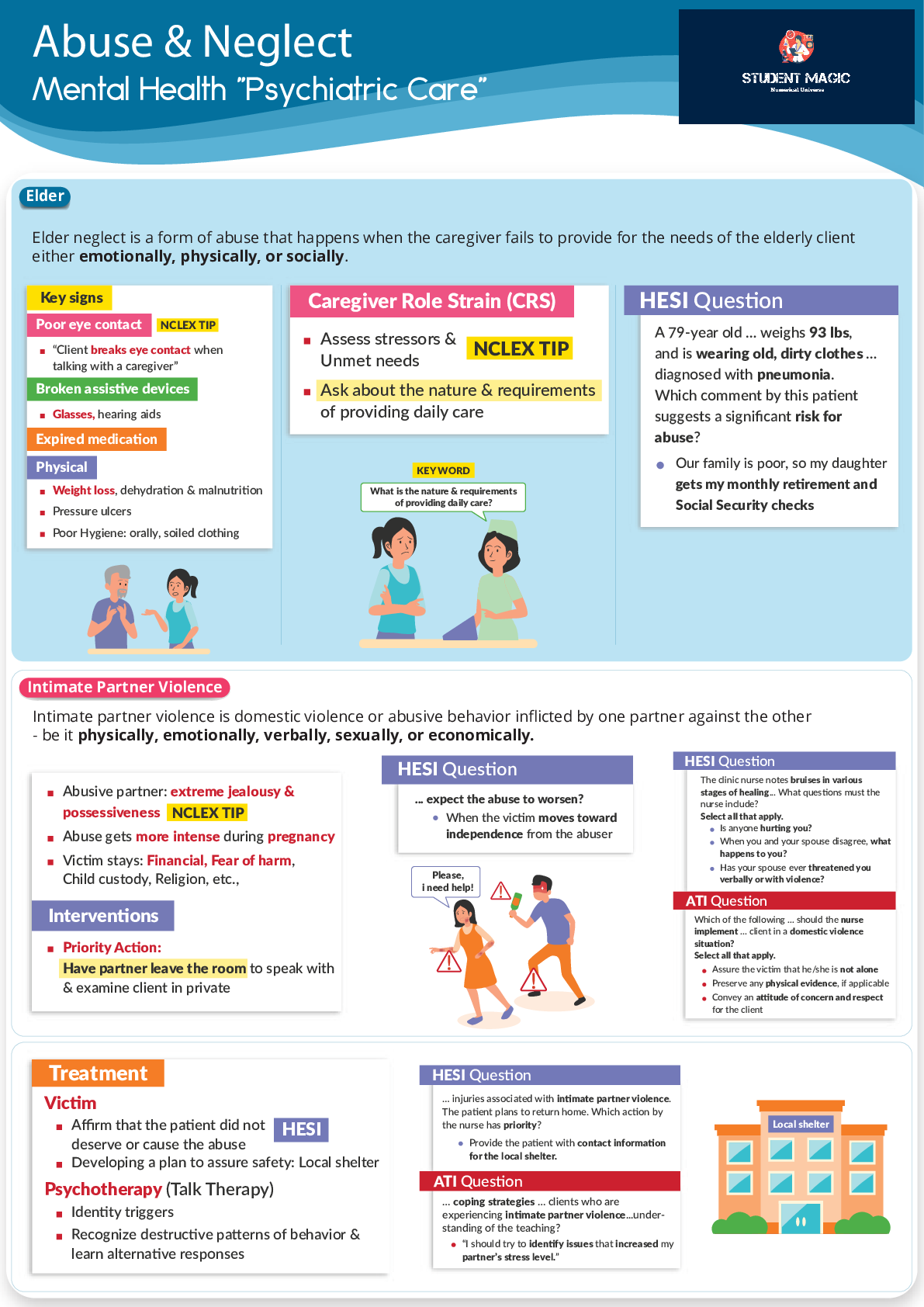

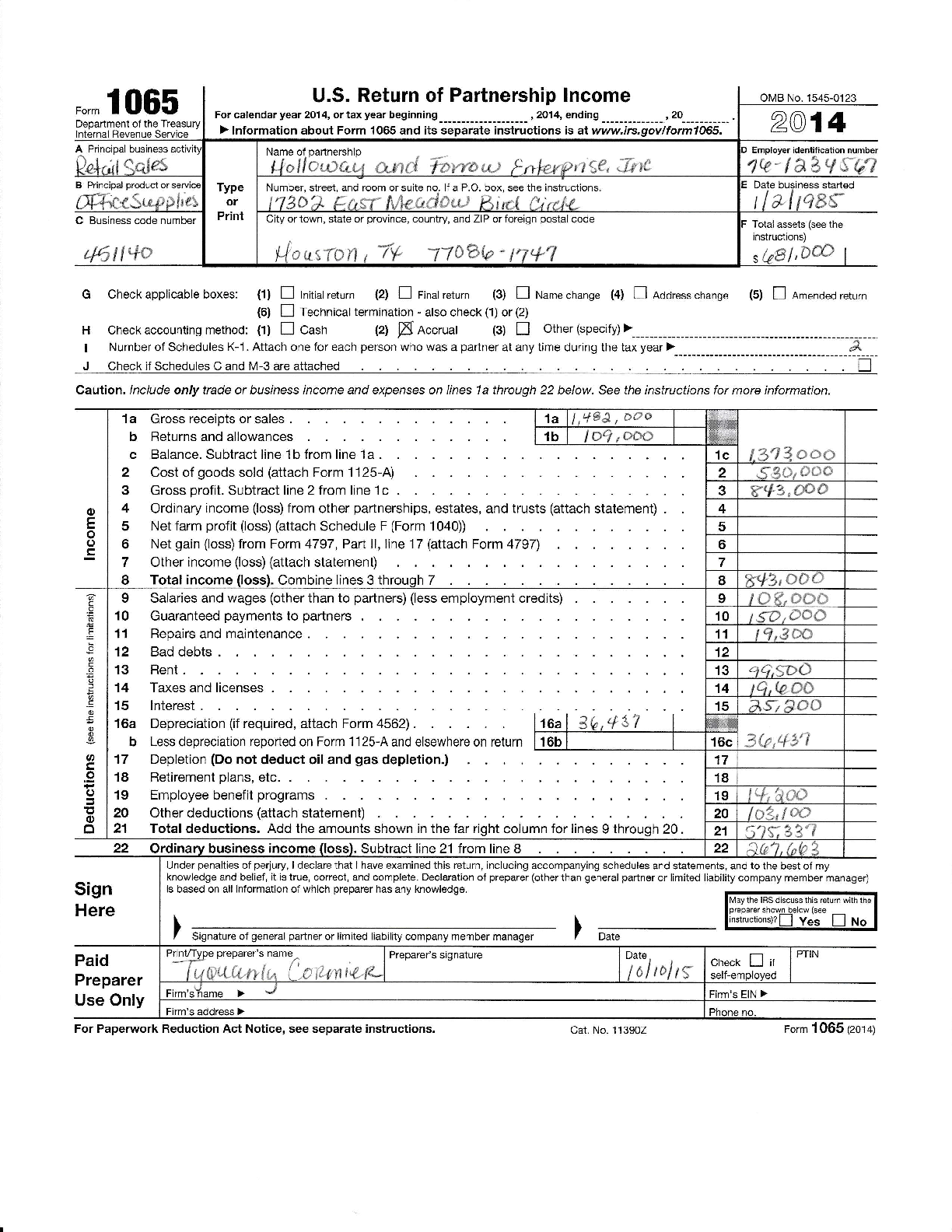

U.S. Return of Partnership lncome OMB No. 2@14 Employer identif ication number 1A- I AaV{m Date buginess started For calendar year 2014, or tax year beginning ) lnformation about Form 1065 and i... ts separate instructions is al www. irs.gov lf orm 1 065. A Principal business B Principal product or C Business code number 44t{+0 gri,e\ tl&ln8{ Total assets (see the instructions) l,DD G Check applicable boxes: (1) E tnitiat return (2) n rinat return (3) n ruame change (4) fl Address change (6) E Technical termination - also check (1) or (2) (5) E Amended return HCheckaccountingmethod:(1)ECash(2)ffAccrual(glnother(specify) I Number of Schedules K-1. Attach one for each person who was a padner at any time during the tax year ) 3--- J CheckilschedulesCandM-3areattached . . . . I . . . n Caution. Include only trade or busrness income and expenses on lines 1a through 22 below. See the instructions for more information. oEoos 1a Gross receipts or sales . b Returns and allowances c Balance. Subtract line 1b from line 1a . 2 Cost of goods sold (attach Form 1125-t 3 Gross profit. Subtract line 2 from line 1r 4 Ordinary income (loss) from other pann 5 Net farm profit (loss) (attach Schedule F 6 Net gain (loss) from Form 4797 , Part ll, 7 Other income (loss) (attach statement) 8 Total income (loss). Combine lines 3 tl I ta 11,+eg, ooo I 3'13 ooo tCTlE4,CIss c) I 1c 2 ':ltt. ; ' ' 3 rq 3. *3# erships, estates, and trusts (attach statement) :(Form 1040)) line 17 (attach Form 4797) lrouqh 7 4567I c .9 6 Eo c .9 l .E ! oo oooJoo 9 Salaries and wages (other than to partners) (less employment credits) 10 Guaranteed payments to partners 11 Repairs and maintenance . 12 Bad debts . 13 Rent. 14 Taxes and licenses . I 10 ttc,oao 11 f':/,-';''- 12 13 qq,so() 14 tq,{Q co 15 lnterest . 16a Depreciation (if required, attach Form 4 b Less depreciation repofied on Form |125-l 17 Depletion (Do not deduct oil and gas r 15 ZSt 3OO 562). I roa \ and elsewhere on return FOL lepletion.) I afp,'fe? 16c 3Q,+3'l 17 18 Retirement plans, etc. 19 Employee benefit programs 20 Other deductions (attach statement) 21 Total deduetions. Add the amounts shown in the far right column for lines 9 through 2( 18 19 '/-; *#{} 20 /6/;:.,{ o0 21 51tq?:.',1 22 business income Subtract line 21 from line 8 22 a@,hb Sign Here Under penahies of periury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, conect, and complete. Declaration of preparer (other than general partner or limited liability company member manager) isbasedonallinformationofwhichpreparerhasanyknowledg".ffi loreoarer shown below lse t \ \ _ liniructionstrl-l w^- l-l rr^ I 7 Signature of general paftner or limited liability company member manager 7 Date Paid Preparer Use Only PrinVType preparer's name ^ -Ti e,al,r, Ih (p i,fi ie,& Preparer's signature Date toltollE Cneck self-emoloved E ii PTIN Firm's hame > J Firm's address ) For Paperwork Reduction Act Notice, see separate instructions. Cat. No.113902 rorm 1 065 pot+yForm 1065 (2014) ace Other Wfat type of entity is filing this return? Check the applicable box: H Domestic general partnership b n Domestic limited partnership n Domestic limited liability company d E Domestic limited liability partnership F ftr At any time during the tax year, was any partner in the partnership a disregarded entity, a paftnership (including an entity treated as a partnership), a trust, an S corporation, an estate (other than an estate of a deceased paftner), or a nominee or similar person? At the end of the tax year: Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or taxexempt organization, or any foreign government own, directly or indirectly, an interest of SOYo or more in the profit, loss, or capital of the partnership? For rules of constructive ownership, see instructions. lf "Yes," attach Schedule B-1 , tnformation on Partners Owning SQYo or More of the Partnership Did any individual or estate own, directly or indirectly, an interest of SOYo or more in the profit, loss, or capital of the partnership? For rules of constructive ownership, see instructions. lf "Yes," attach Schedule B-1 , lnformation on Partners Owning 50%i or More of the Partnership At the end of the tax year, did the partnership: Own directly 2Oo/o ot more, or own, directly or indirectly, SOYo or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership, see instructions. lf "Yes," complete (i) through (iv) below . 4 a (i) Name of Corporation Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. lf "Yes," complete (i) thro [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Instant download

Instant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 22, 2021

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Jul 22, 2021

Downloads

0

Views

31

.png)