Financial Accounting > Final Exam Review > FAC1502 EXAM PACK - FINANCIAL ACCOUNTING PRINCIPLES, CONCEPTS & PROCEDURES (1) (All)

FAC1502 EXAM PACK - FINANCIAL ACCOUNTING PRINCIPLES, CONCEPTS & PROCEDURES (1)

Document Content and Description Below

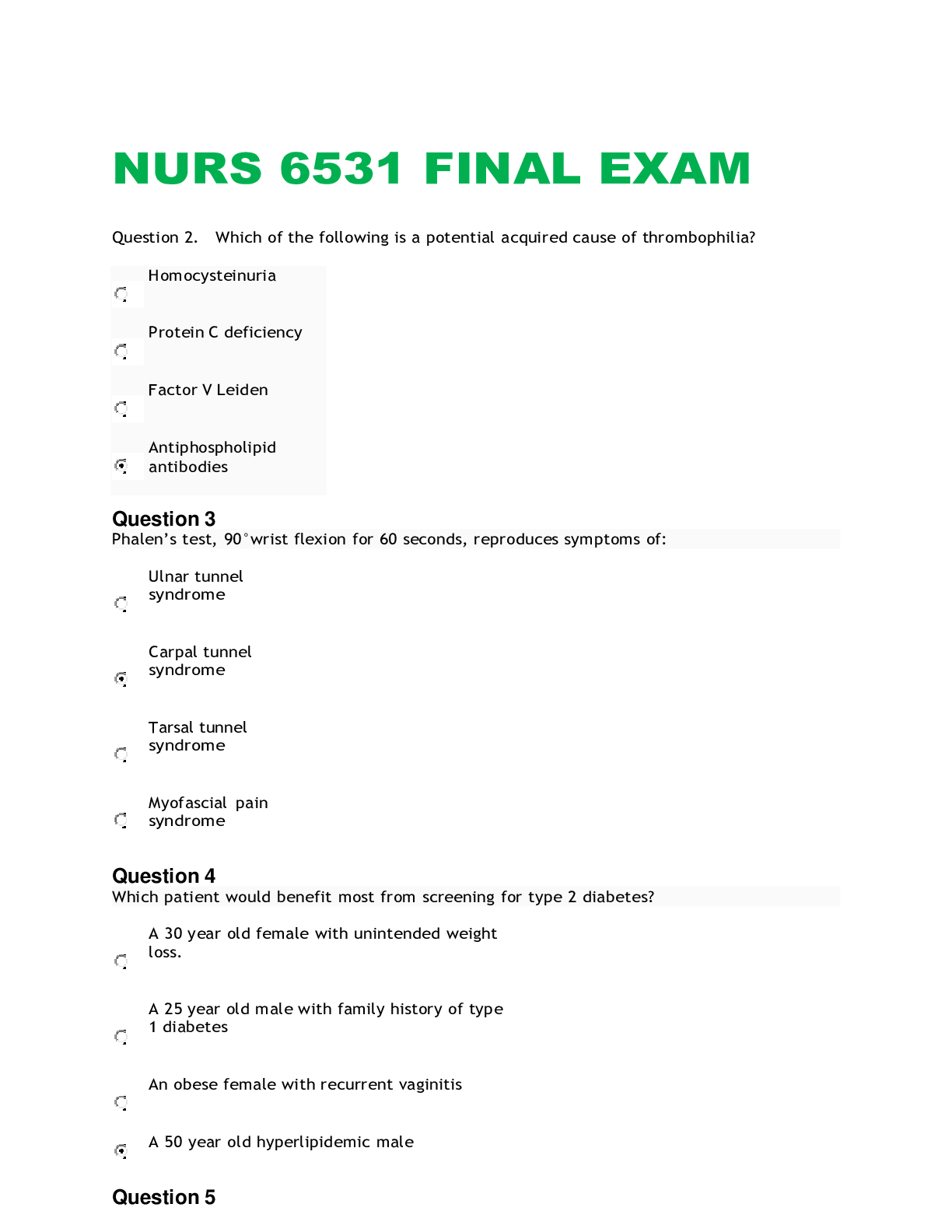

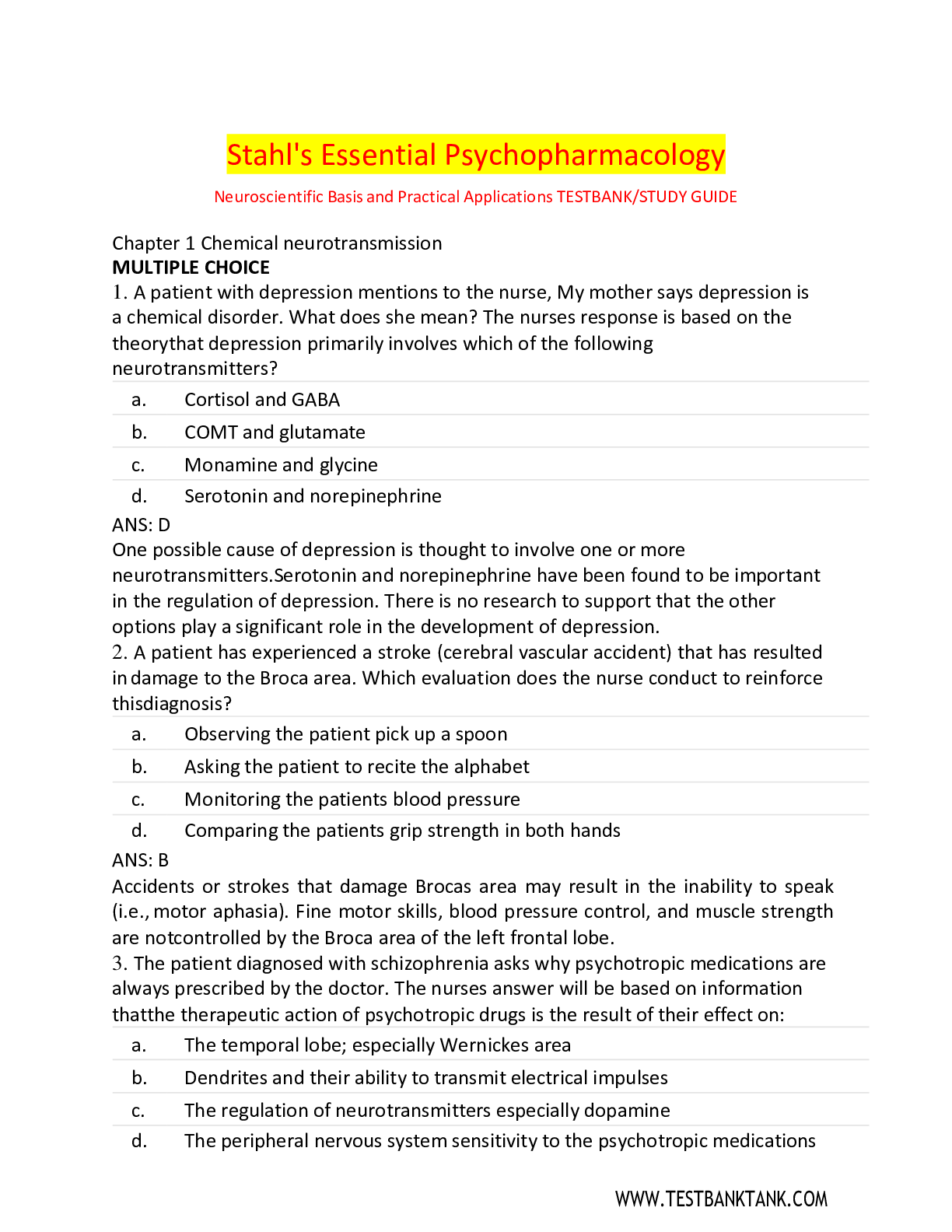

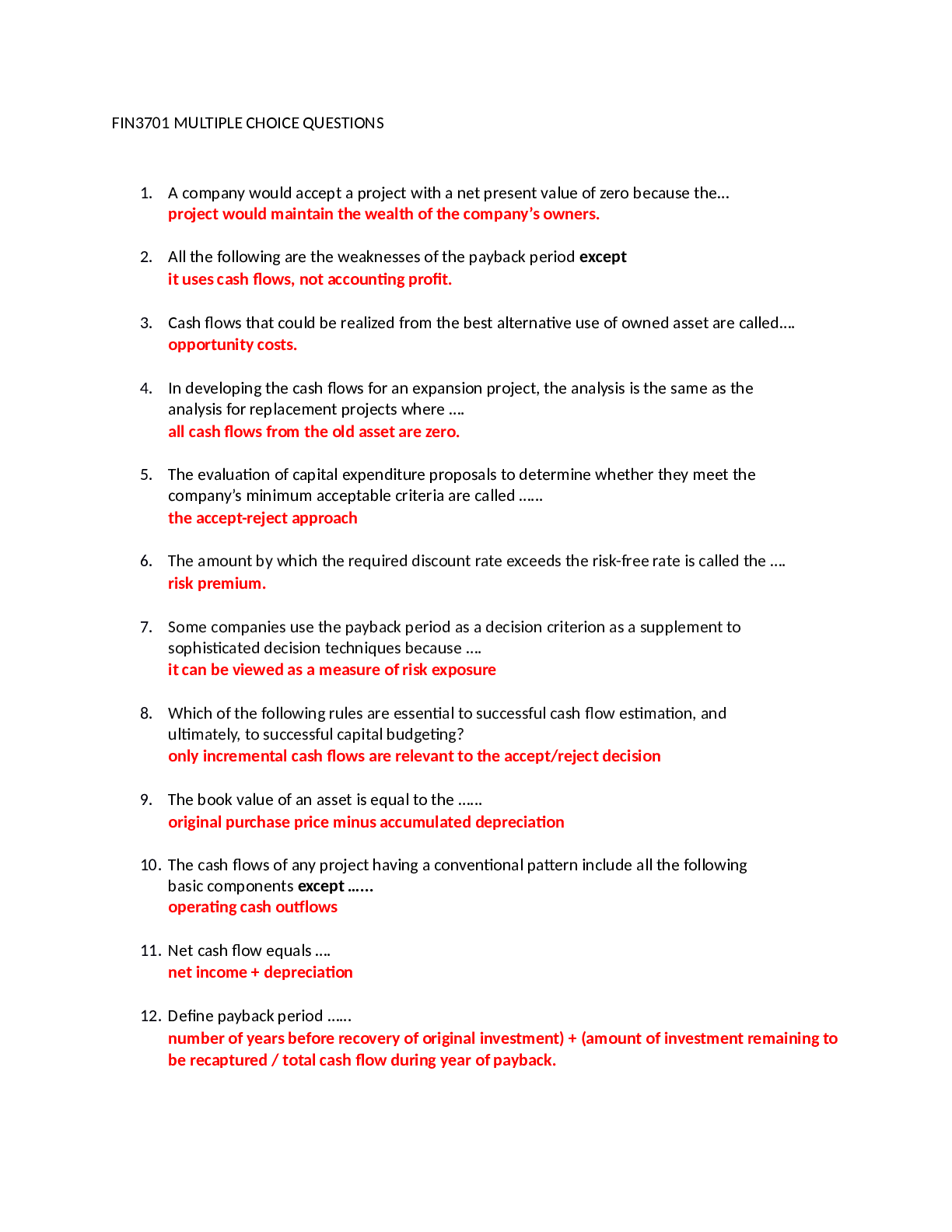

FAC1502 EXAM PACK FINANCIAL ACCOUNTING PRINCIPLES, CONCEPTS & PROCEDURES MAY – JUNE 2016 SOLUTION 1: STATEMENT OF PROFIT OR LOSS & OTHER COM... PREHENSIVE INCOME (a) N & N ENTERPRISES STATEMENT OF PROFIT OR LOSS & OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2015 R Revenue 500 000 Cost of Sales (362 800) Opening Inventory 100 000 Purchases (283 000 + 39 000 – 5 000) 317 000 Freight charges on purchases 5 000 Shipping Fees 2 800 Import duties 3 300 Delivery Fees 4 100 Modification Costs 2 600 Closing Inventory (72 000) Gross Profit 137 200 Other Income 2 860 Interest on fixed deposit (800 + 1 060) 1 860 Rental Income (2 400 * 5 / 12) 1 000 Total Income Less Expenses 140 060 (143 300) Administrative, Distribution & Other Expenses 139 300 Insurance expenses (5 000 – 3 500) 1 500 30 000 76 800 1 400 9 600 2 600 7 400 10 000 Administration expenses Salaries (76 000 + 800) Depreciation (10 % * 14 000) Municipal taxes Credit losses Advertising expenses (9 800 – 2 400) Water, Electricity and telephone expenses Finance Cost Interest on mortgage (50 000 * 8%) Loss for the year Other Comprehensive Income 4 000 4 000 (3 240) - Total Comprehensive Income (3 240) SOLUTION 2: DEBTORS` & CREDITORS` CONTROL ACCOUNTS 2.1 ZIZOBENZA TRADERS GENERAL LEDGER Date Details Folio Amount Date Details Folio Amount R R Debtors Control Account 2013 2013 Mar 1 Balance b/d 32 780 Mar 1 Balance b/d 1 780 31 Sales and VAT 31 Sales Returns and (R16 840 – R2 736 SJ 14 104 VAT SRJ 1 200 Bank CPJ 3 200 Bank and Sundry Debits GJ 2 760 Settlement Creditors control- Discount CRJ 22 750 set off GJ 1 780 Sundry Credits Creditors control- (R430 + R1 450) GJ 1 880 set off GJ 2 020 Balance c/d 29 034 Receipts 56 644 56 644 April 1 Balance b/d 29 034 NOTES We start by entering the balances brought forwards. Debtors is an asset, therefore, the normal balance appears on the debit side. There can also be an abnormal credit balance in a bank account. This is whereby the business now owes it`s traditional customers. This can happen as examples when a customer mistakenly overpays, or returns goods after paying for them. All transactions that increase what our customers owe us should be debited e.g. sales, interest charged on overdue accounts, dishonoured cheques, e.t.c, whilst the transactions which reduce our customers` debts should be credited e.g. payment by our customers, credit losses written off, returns by our customers, e.t.c. Our sales and sales returns should be included inclusive of VAT because our customers are liable to paying us the total amount including VAT The sales column in the cash receipts journal represent cash sales, therefore, these do not affect our debtors and should not be included in the debtors` control account. Debtor’s column in the cash payments journal represents transactions such as repayments to debtors, dishonoured cheques from debtors, e.t.c. These should be debited in the debtors` control account. The debtors` column in the cash receipts journal already includes the settlement discount granted. As such, the settlement discount should not be recorded in the control account as this will result in double accounting. Sundry debits in the debtors control account should be debited e.g. interest charged on overdue accounts. Sundry credits in the Debtors` control should be credited in the debtors control e.g. adjustments for overcharges. Allowance for credit losses, together with increases or decreases are not recorded in the debtors` control account because these will not have been written off as yet. They represent an estimation of future probable credit losses. Only confirmed credit losses are credited in the debtors` control account as they represent debtors written off (which reduces the asset debtors). The debit balances transferred from the creditors` ledger should be debited to introduce them in the debtors` control account and the credit balances in the debtors control to be transferred to the creditors` control are also debited to cancel them off from the debtors` control. The purchases wrongly recorded in the sales journal should be deducted from the sales. .............................................................................continued................................................................................ [Show More]

Last updated: 1 year ago

Preview 1 out of 96 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 22, 2021

Number of pages

96

Written in

Additional information

This document has been written for:

Uploaded

Jul 22, 2021

Downloads

0

Views

48

.png)