DeVry University, Alpharetta FIN 515 Week 8 final exam 515 fall 2020

Document Content and Description Below

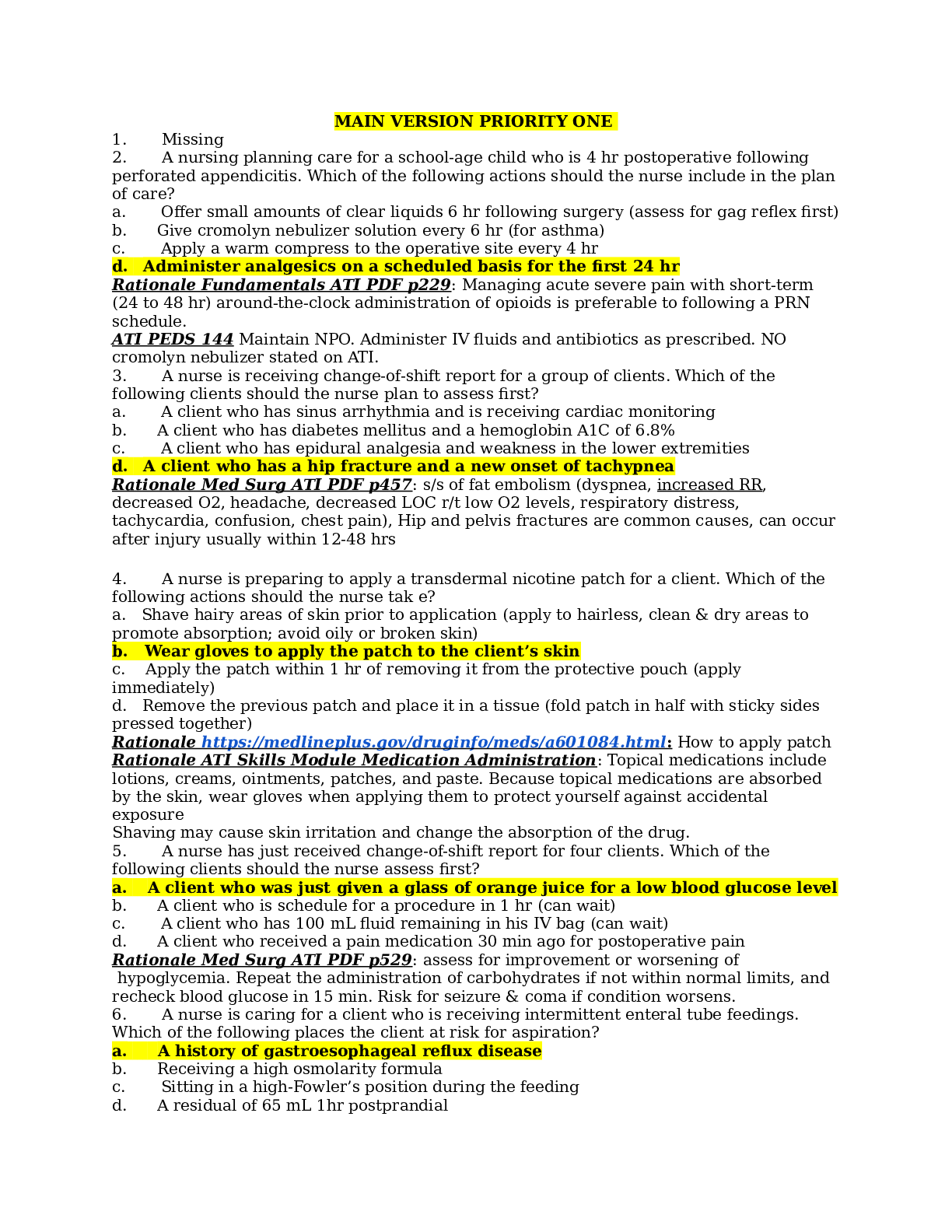

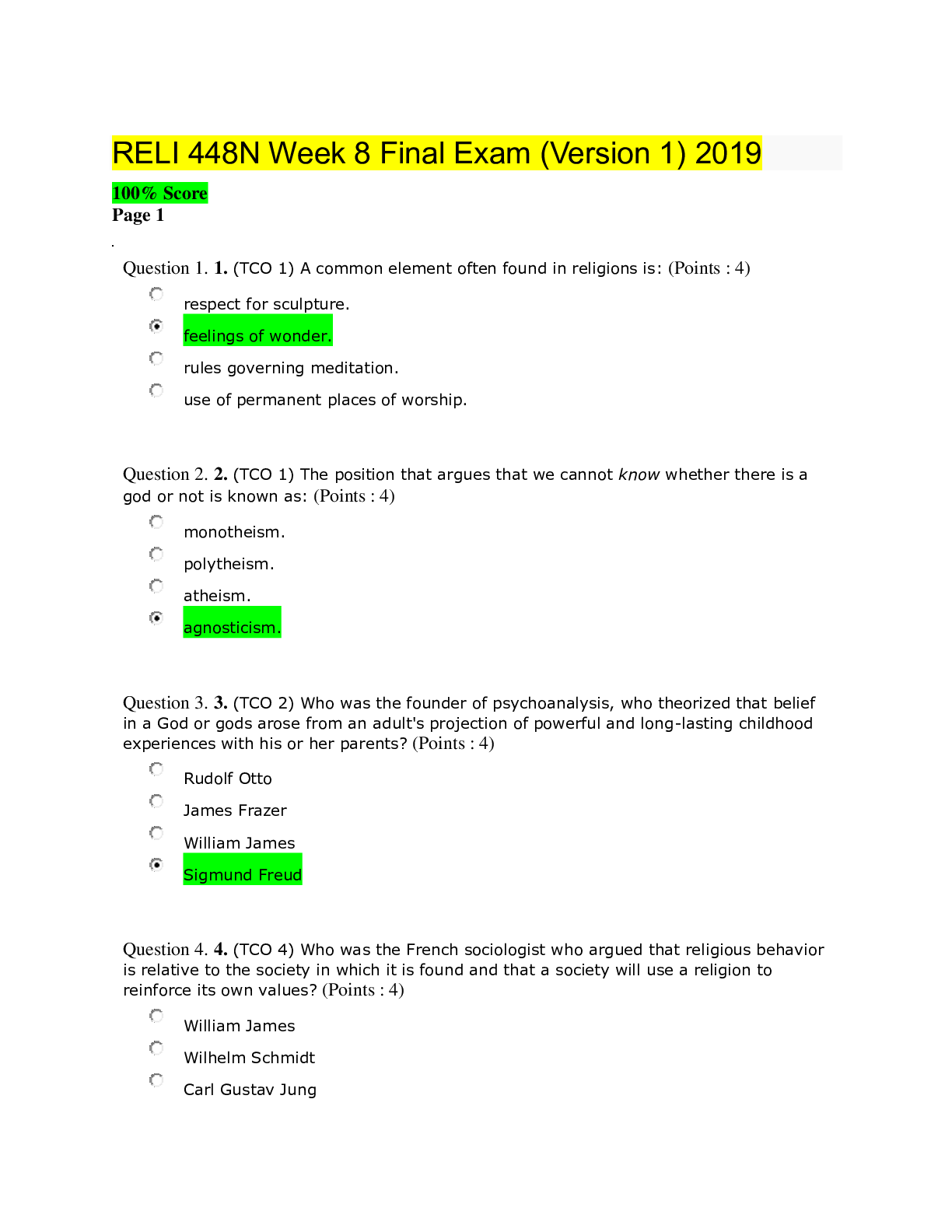

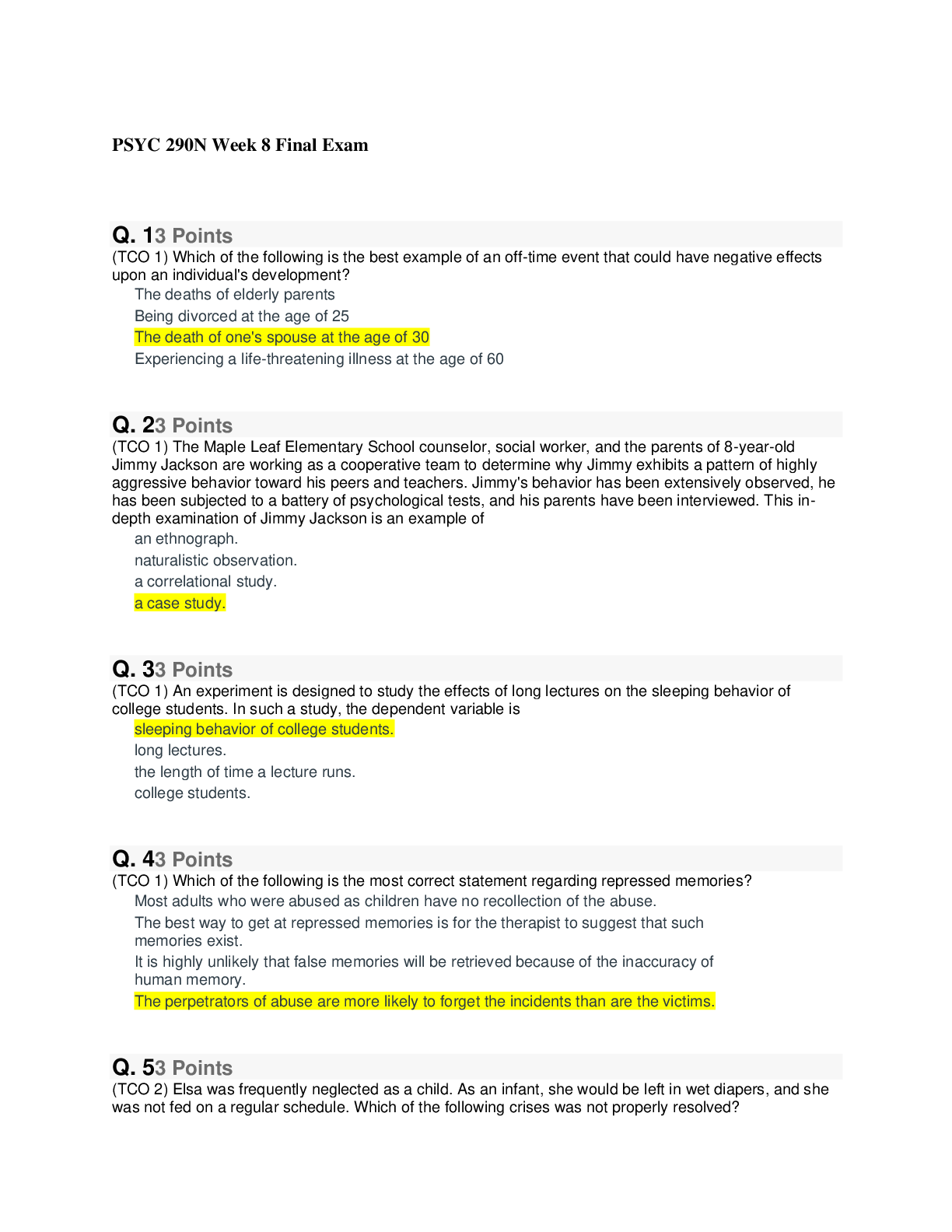

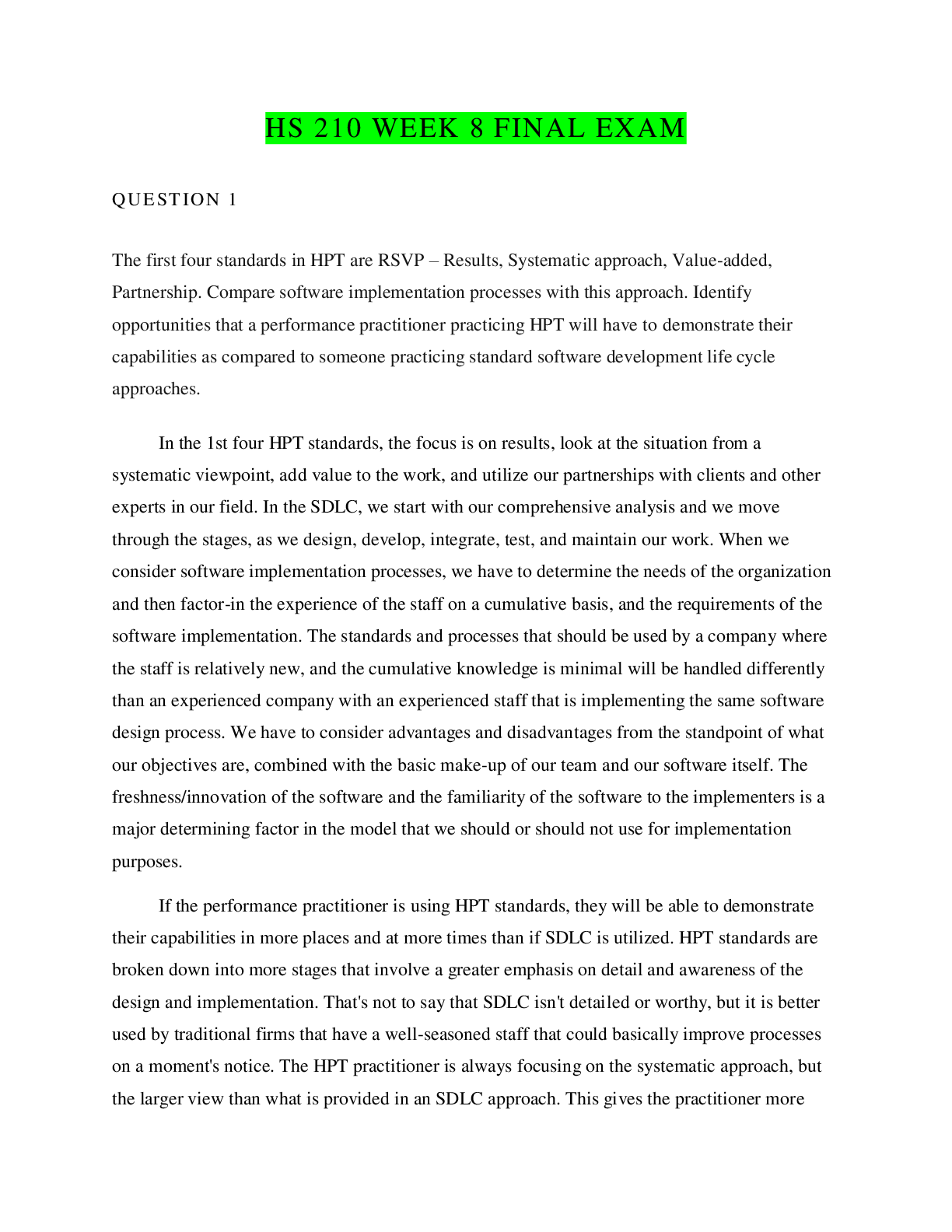

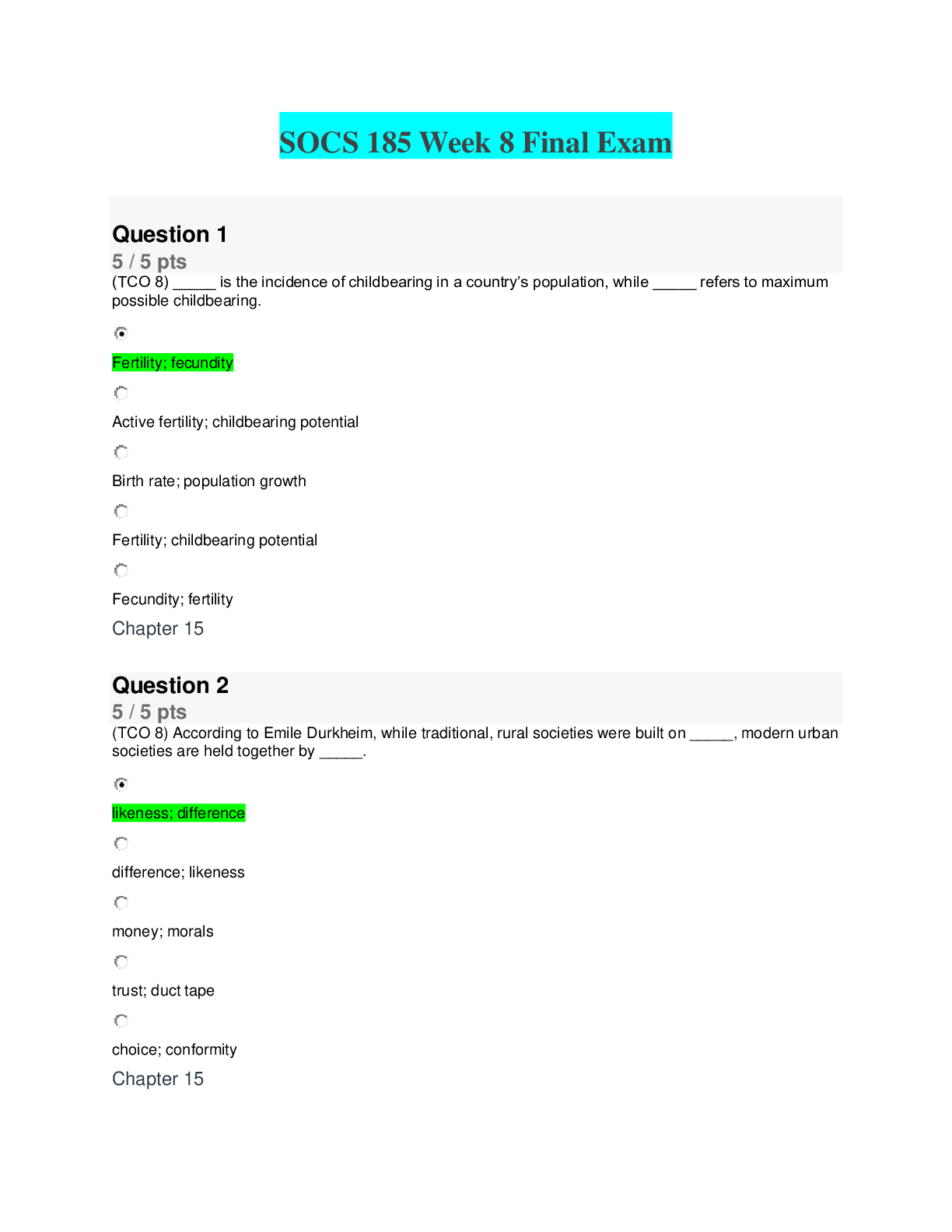

Page 1 Question 1.1. (TCO A) Double taxation is a drawback for which of the following types of business organization except? (Points : 5) S corporation C corporation Limited partnership correct a... nswer Limited liability company Question 2.2. (TCO A) Sole proprietorships have all of the following advantages except (Points : 5) easy to set up. single taxation of income. limited liability. ownership and control are not separated. Correct answer Question 3.3. (TCO B) Which of the following would cause the present value of an annuity to decrease? (Points : 5) Reducing the number of payments. Increasing the number of payments. Correct answer Decreasing the interest rate. Decreasing the liquidity of the payments. Question 4.4. (TCO B) In a TVM calculation, if incoming cash flows are positive, outgoing cash flows must be (Points : 5) positive. negative. Correct answer either positive or negative. It really doesn’t matter. stated in time units that are different from the time units in which the interest rates are stated. Question 5.5. (TCO G) If net income, total assets, and book value of equity stayed the same, what would be the effect on the DuPont Identity of an increase in sales? (Points : 20) answer DuPont is just the extension of the formula of ROE(return on Equity). In normal terms ROE is calculated as follows: ROE = Net Income / Equity In DuPont Analysis we have ROE = (Net Income / Sales) x (Sales / Assets) x (Assets / Equity). If we cut Sales with Sales and Assets with Assets we have left with the same formula, i.e., ROE = Net Income / Equity. DuPont is not giving any new formula, it is just dividing the formula for analysis of ROE that if ROE is low where is the drawback in the 3 components. Thus, we can say that increase in sales will not affect the ROE in any way, given the net income, total assets, and book value of equity stayed the same. the financial result will be same. DuPont Identity will only be help in better decision making not improving any financial results. Question 6.6. (TCO D) A stock has just paid a dividend and will pay a dividend of $3.00 in a year. The dividend will stay constant for the rest of time. The return on equity for similar stocks is 14%. What is P0? (Points : 20) answer A stock has just paid a dividend and will pay a dividend of $3.00 in a year therefore we can say that that Dividend for Year 0 and coming years will be $3 Rate of Dividend growth will be zero as The dividend will stay constant for the rest of time NOw we need to use the below to calculate the P0 ( ie Price for Today or Price at year 0 ) P0 = D1 / (r-g) where P0 = today's price D1 = dividends in period 1 r = required rate of return (in decimals) g = dividend growth rate Just paid a dividend ( $)D0 3 Dividend next Year( $) D1 3 Return on equity for similar stocks is 14% r 14% Dividend will stay constant for the rest of time ( Growth Rate ) g 0 :- Todays Price P0 = D1 / ( r-g) P0 21.43 Question 7.7. (TCO D) A stock has just declared an annual dividend of $2.25 to be paid one year from today. The dividend is expected to grow at a 7% annual rate. [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 05, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Aug 05, 2021

Downloads

0

Views

53