Risk Management and Insurance > Study Notes > RSK4803 Study Notes Risk management is the minimization of the adverse effects of a risk at minimum (All)

RSK4803 Study Notes Risk management is the minimization of the adverse effects of a risk at minimum cost through its identification, measurement, and control.

Document Content and Description Below

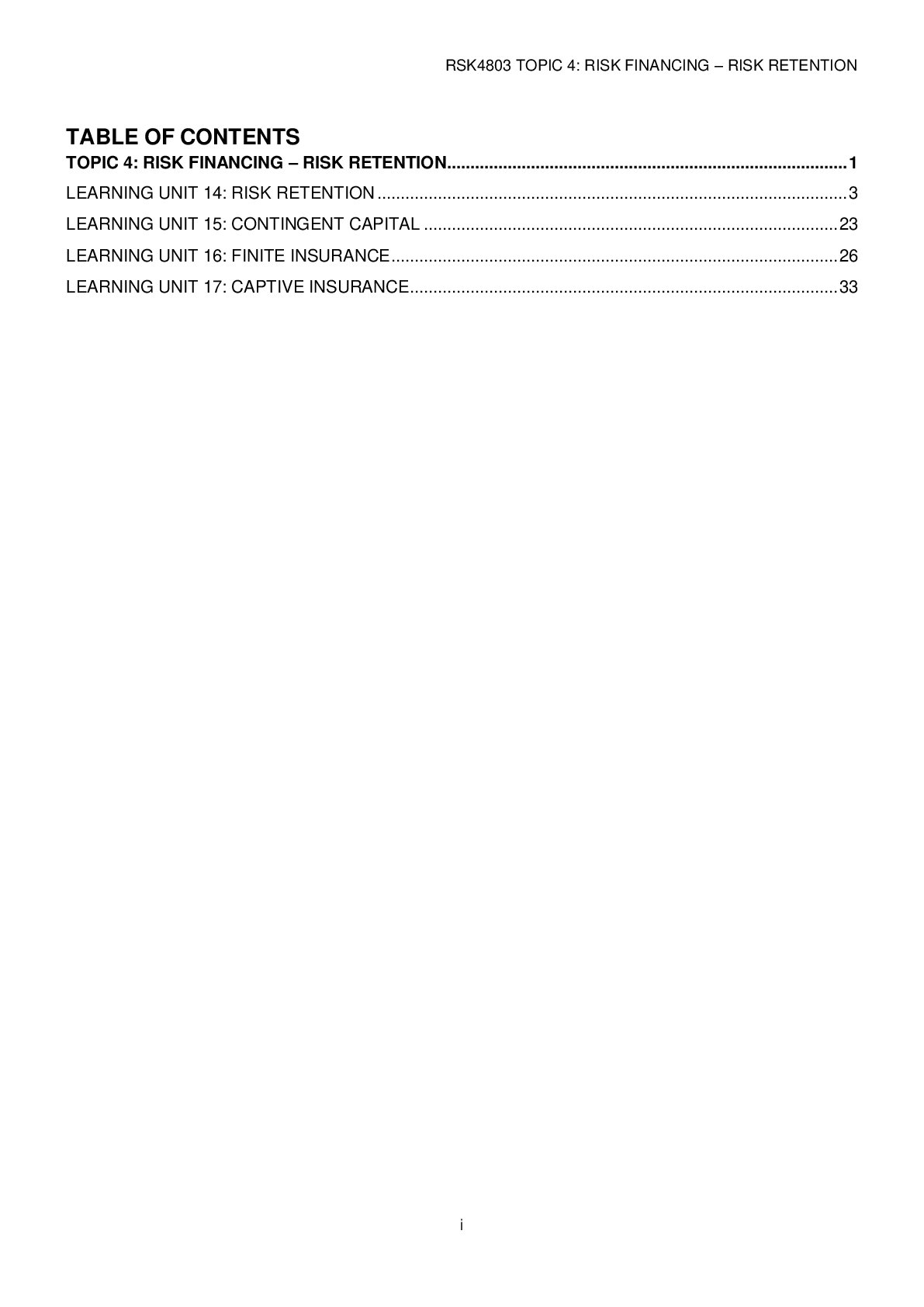

Risk management is the minimization of the adverse effects of a risk at minimum cost through its identification, measurement, and control. Page 225 Learning Unit 1 – Study Guide Only Overview o... f Risk management and Self-‐funding Learning Outcomes Distinguish between risk financing and self-‐funding Understand the goals and objectives of risk financing Understand the role and purpose of risk financing Comment on the advantages and disadvantages of self-‐funding Key Concepts Risk financing Self-‐funding Pre-‐loss objectives Post-‐loss objectives Risk retention Risk financing is aimed at providing financially for the consequences of occasional losses that cannot be eliminated. Risk financing is defined as the process of arranging a source of finance to cater for the effect of fortuitous loss in the organization’s business cycle. Goals and objectives of risk financing The goal of risk financing is to ensure that funds are available to fund losses when required. As to support the goal of the organization to maximize stakeholder wealth, the refunding of the organization should be achieved in the most cost effective manner. In practice, this means retaining the maximum risk possible for own account (self-‐ funding) relative to the organization’s financial capacity to absorb loss. This has the effect of limiting the amount of financial contingency capacity (insurance) required, and avoid the costs additional to the risk portion of the premium associated with conventional insurance such as acquisition costs, admin costs and the insurer’s profit margin. Pre-‐loss objectives of risk financing Maintain operating efficiency operating efficiency refers to minimizing the cost of finance while paying attention to the constraint that has to be available at short notice. retaining funds is cheaper than insurance, but it places additional strain on financial resources. the liquidity requirement must be considered in relation to the opportunity cost attached to funds to be held in liquid form to cover losses as the occur. Maintain acceptable levels of risk when loss occurs, primary concern is the availability of funds over the cost of funds. The risk manager must insure that the sources of funds have been secured in relation to the various types and sizes of losses that can be retained. Conforming to legal constraints and provisions the risk manager must insure that the company is compliant to any laws relating to the purchase of insurance. there may be contractual requirements which must be followed requiring the purchase of insurance. .....................................................................................................continued....................................................................................................... [Show More]

Last updated: 1 year ago

Preview 1 out of 41 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 24, 2021

Number of pages

41

Written in

Additional information

This document has been written for:

Uploaded

Aug 24, 2021

Downloads

0

Views

65

.png)

.png)

.png)