Accounting > EXAM > ACCT 525 QUIZ 1 WITH QUESTIONS 1-10 WELL SET (All)

ACCT 525 QUIZ 1 WITH QUESTIONS 1-10 WELL SET

Document Content and Description Below

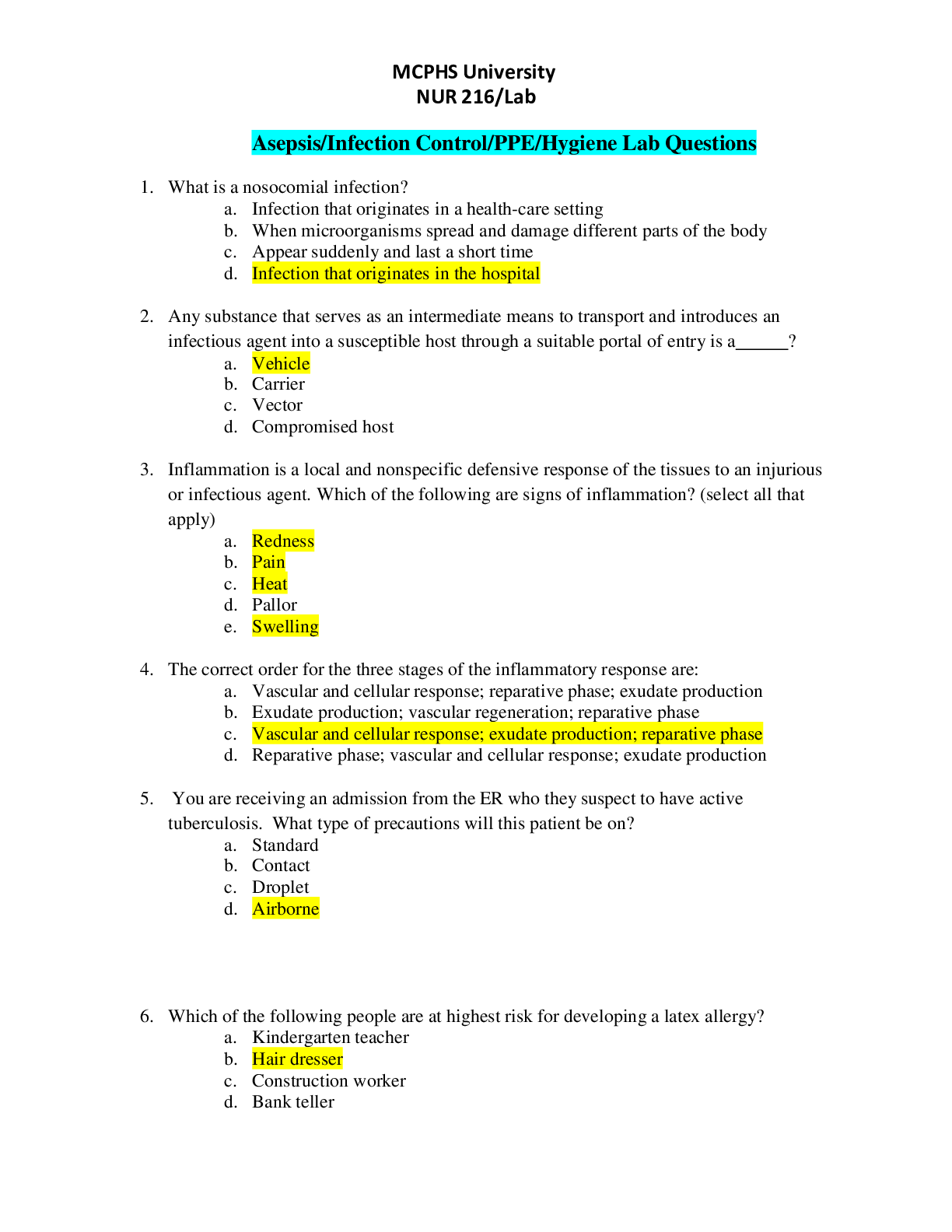

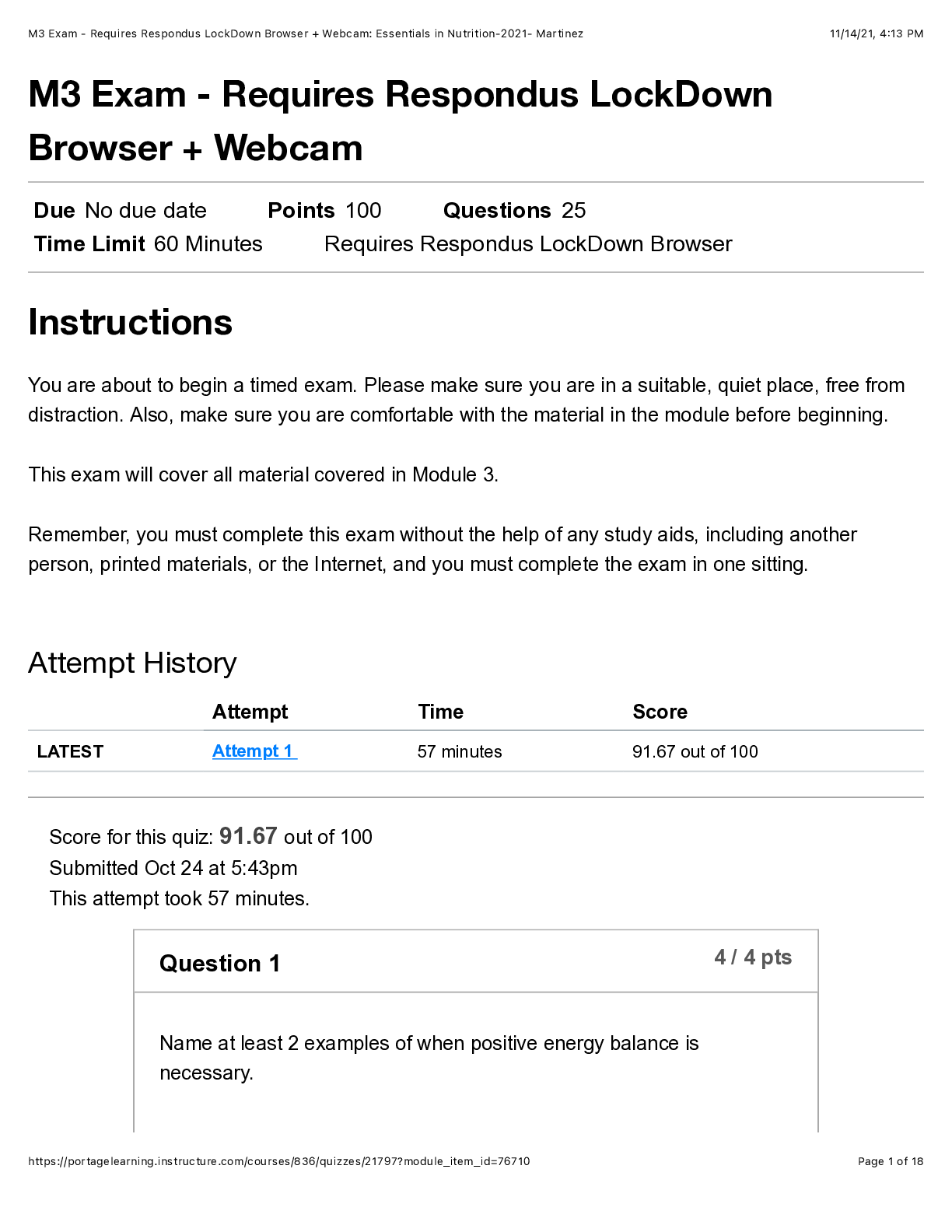

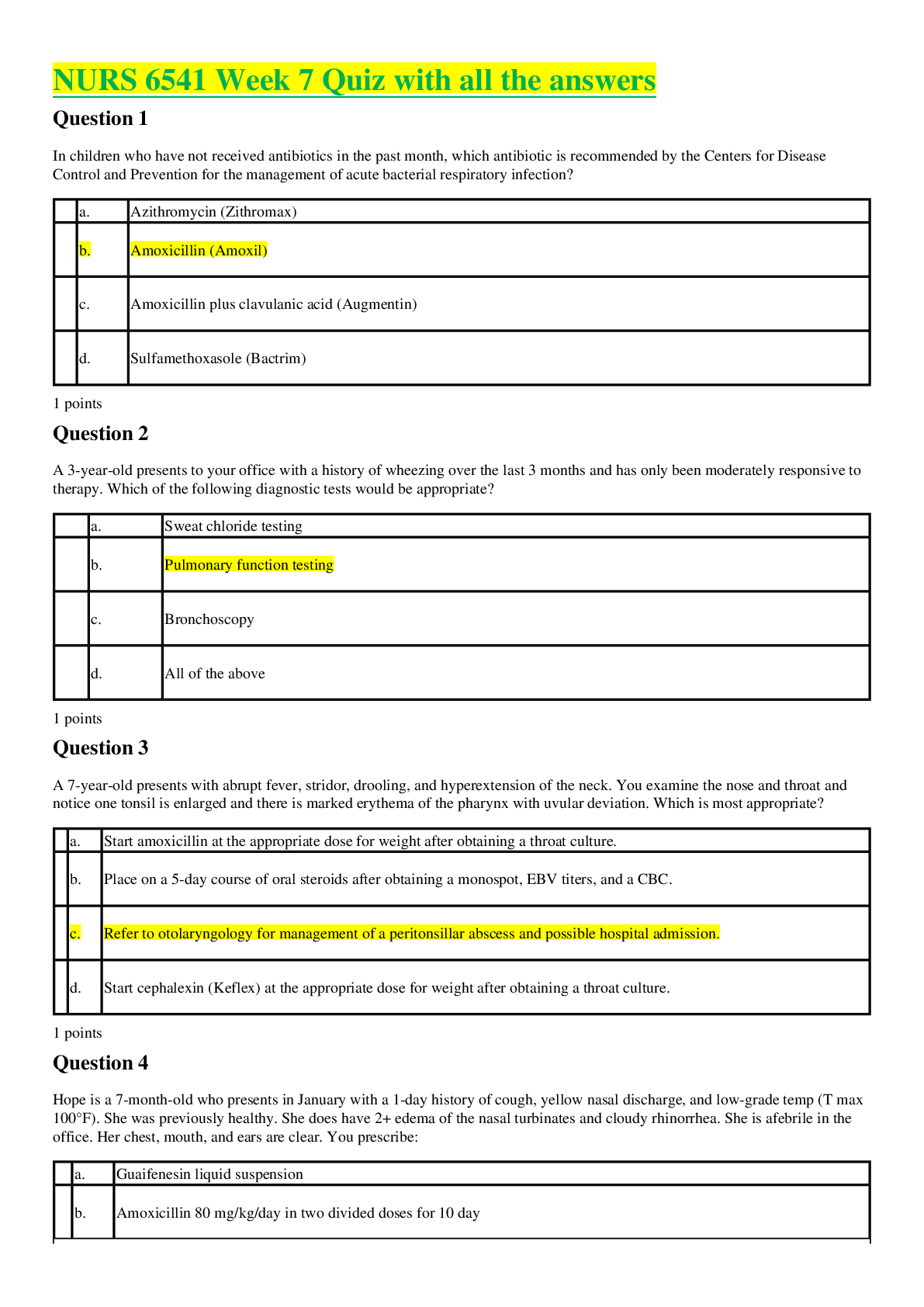

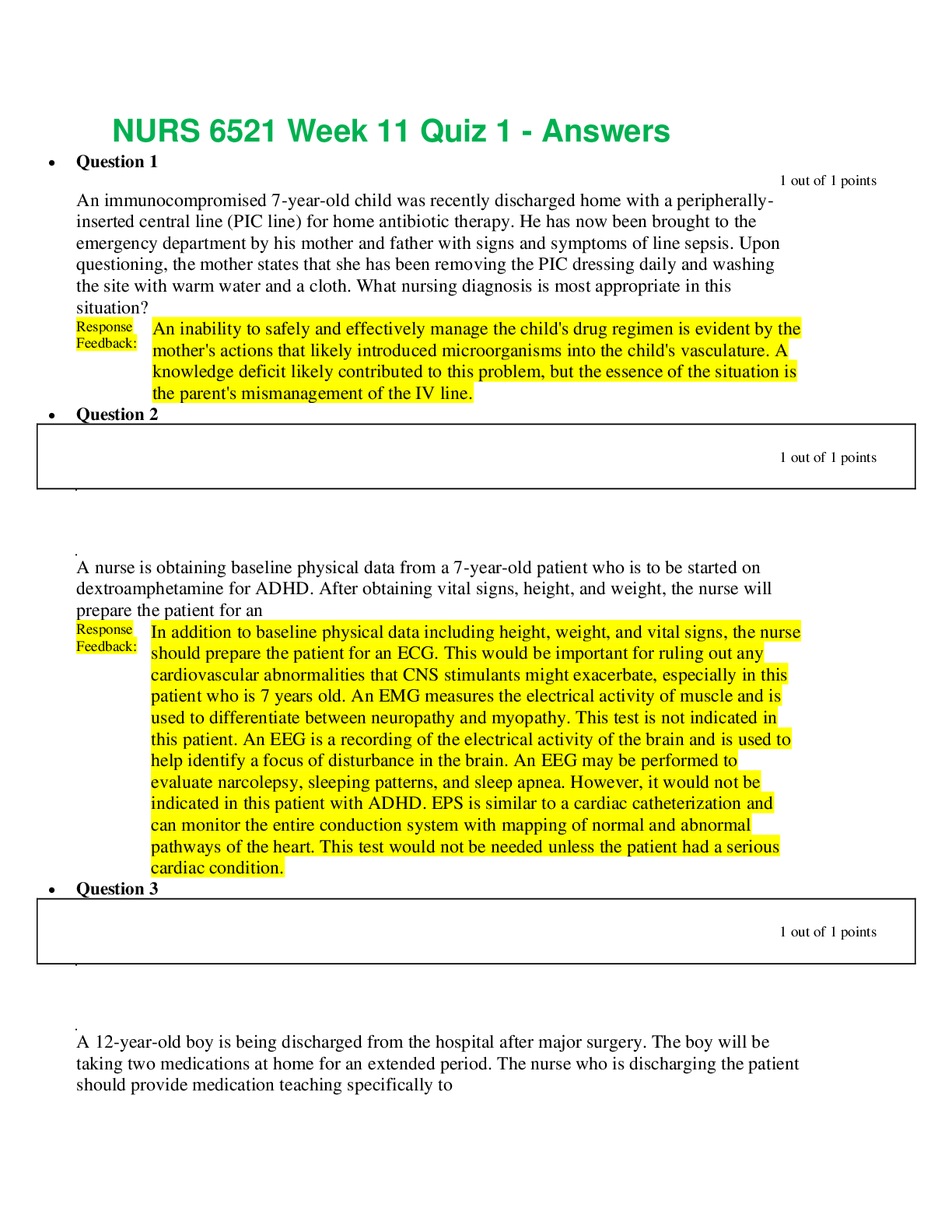

ACCT 525 Quiz 1 Question: (TCO A) (CPA-06619) A company is required to file quarterly financial statements with the United States Securities and Exchange Commission on Form 10-Q. The company oper... ates in an industry that is not subject to seasonal fluctuations that could have a significant impact on its financial condition. In addition to the most recent quarter end, ………. to present balance sheets on Form 10-Q? Question: (TCO A) (CPA-00125) Taft Corp. discloses supplemental industry segment information. The following information is available for the current year. Question: (CPA-05450) Savor Co. had $100,000 in cash¬basis pretax income for Year 2. At December 31, Year 2, accounts receivable had increased by $10,000 and accounts payable had decreased by $6,000 from their December 31, Year 1, balances. Compared to the accrual basis method of accounting, Savor’s cash pretax income is: Question: (CPA-03689) Management has plans to mitigate conditions causing substantial doubt about the entity’s ability to continue as a going concern. Management believes that those plans will be effectively implemented and successful in mitigating the adverse conditions. Which of the following is true? Question: (TCO A) (CPA-05189) Which of the following should be disclosed in a summary of significant accounting policies? Question: (CPA-08589) Which of the following should be disclosed in a summary of significant accounting policies? Question: (CPA-08564) Savor Co. had $100,000 in accrual basis pretax income for the year. At year¬end, accounts receivable had increased by $10,000 and accounts payable had decreased by $6,000 from their prior year¬end balances. Under the cash basis of accounting, what amount of pretax income should Savor report for the year? Question: (CPA-00104) What is the purpose of information presented in notes to the financial statements? Question: (CPA-00733) Ace Co. settled litigation on February 1, Year 2, for an event that occurred during Year 1. An estimated liability was determined as of December 31, Year 1. This estimate was significantly less than the final settlement. The transaction is considered to be material. The financial statements for year¬end Year 1 have not been issued. How should the settlement be reported in Ace’s year¬end Year 1 financial statements? Question: (TCO A) (CPA-05432) Stent Co. had total assets of $760,000, capital stock of $150,000, and retained earnings of $215,000. What was Stent’s debt-to-equity ratio? [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 25, 2021

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Aug 25, 2021

Downloads

0

Views

38

(1).png)

.png)

.png)