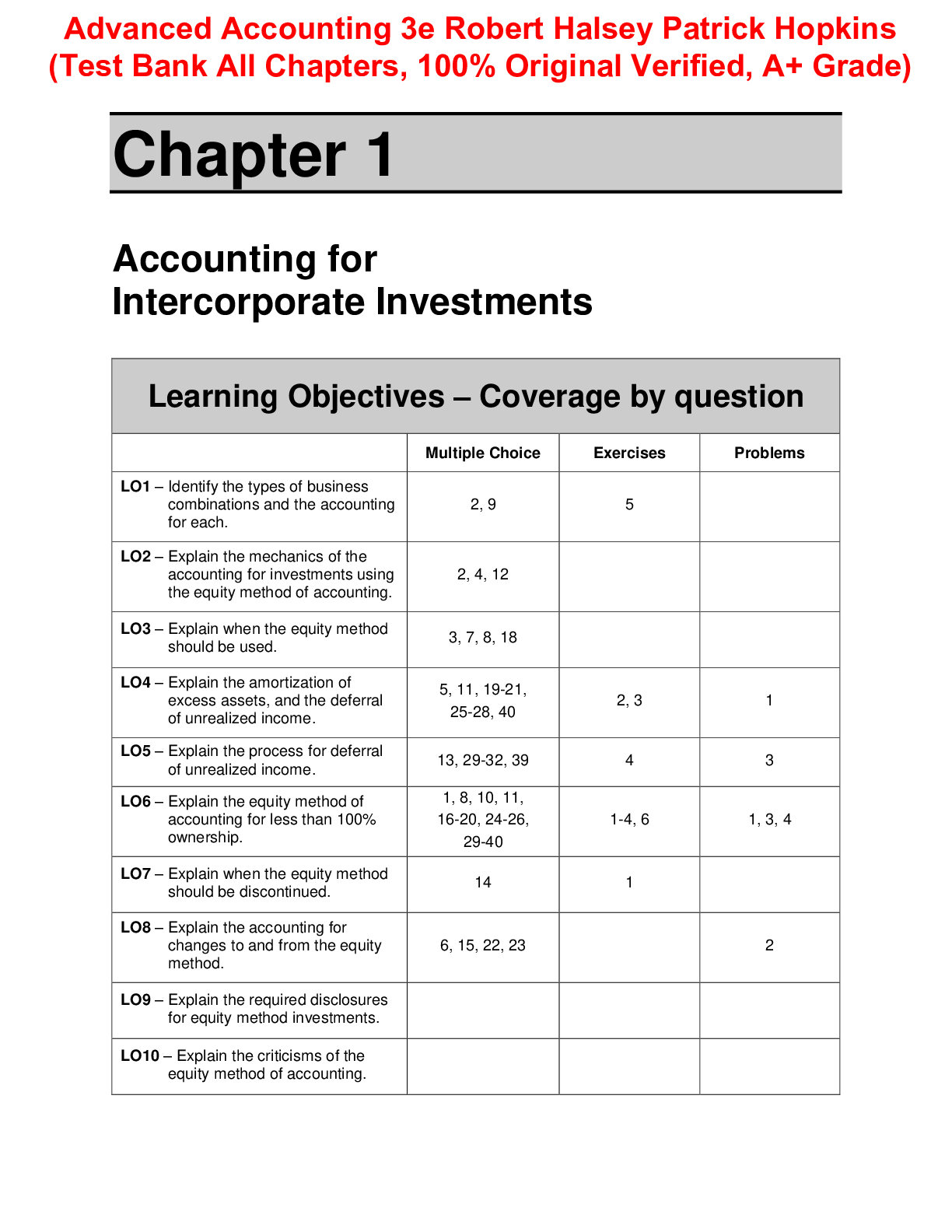

*NURSING > TEST BANK > Capella UniversityFPX 5014 MBA-FPX5014 Assesment1-1. Financial Condition Analysis of Amazon.- Alread (All)

Capella UniversityFPX 5014 MBA-FPX5014 Assesment1-1. Financial Condition Analysis of Amazon.- Already Graded A+

Document Content and Description Below

Capella UniversityFPX 5014 MBA-FPX5014 Assesment1-1. Financial Condition Analysis of Amazon. Financial Condition Analysis 2 Executive Summary PacificCoast Technology is a small company that is con sid... ering a buyout by a larger corporation with financial stability that can provide solid growth for the technology they have created. The senior leaders have tasked a group to analyze Amazon financial sustainability as a potential buyer. This report will conduct a financial analysis that examines multiple ratios to determine the viability of an acquisition. Using the data analyzed a comparison will be made to provide a trend and industry analysis and identify the strengths and weaknesses of Amazon. Lastly the report will come to conclusions and make a recommendation on whether a buyout by Amazon would be most beneficial to PacificCoast. Company Background Amazon.com, Inc. is a multinational publicly traded company that works mostly is the ecommerce sector founded by Jeff Bezos in 1994. They were on the forefront of their industry and has emerged in the 21st as one of the largest and most recognizable companies in the world. Amazon is one of the few companies that has affected other businesses performance across many industries and sectors. Amazon states that they are guided by four principles: customer obsession over competitor focus, passion for innovation, commitment to operational excellence, and long-term thinking (Amazon, 2020). They are seeking to dominate multiple markets by having a variety of subsidiaries and innovation including amazon.com, Amazon web services, Prime Video, Amazon music, Fire Tablet, Kindle e-readers, Fire TV, Echo and Alexa (Amazon, 2020). Amazon has been growing their reach over the last few years by acquiring companies like Whole Foods, Audible, and Ring. Having a hand in many sectors and capitalizing on a global internet driven world has led to Amazon being only the second company to be worth over a trillion dollars (Tuttle, 2018). Financial Analysis Liquidity Liquidity ratios use current assets and liabilities to determine whether a company can pay their short-term debt without putting stress on their finances (). While these ratios focus on the immediate, they can affect whether lenders and creditors will do business with a firm in the long run. Two calculations used to determine liquidity is the current and quick ratios. The major difference between the two ratios is the belief that inventory is a liquid asset. The quick ratio eliminates the inventory believing it cannot be turned into readily available cash to pay debts (). The tables below demonstrate the current and quick ratio for Amazon.com, Inc. The current ratio, including inventory is close to the ideal range and shows an increasing trend since 2017. Amazon currently has $1.10 in assets for every $1.00 in liabilities. The quick ratio, omitting the inventory, performs slightly worse at $0.86 in asset to every $1.00 in liability. However, the trend has a 3-year upward momentum and outperforms the industry average. This indicates that Amazon is year over year improving their assets to give them the ability to pay their short-term debts.****************** CONTINUED************ References Amazon (2020). Retrieved from https://www.aboutamazon.com/?utm_source=gateway&utm_medium=footer Tuttle, B. (September 4, 2018). Amazon just became the second company to reach $1 trillion. Here’s how much Jeff Bezos is worth now. Money. Retrieved from https://money.com/amazon-1-trillion-jeff-bezos-net-worth [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 05, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Sep 05, 2021

Downloads

0

Views

46

(1).png)

.png)

(1).png)