Business > Final Exam Review > Chapter 4 Accumulating and Assigning Costs to Products Atkinson, Solutions Manual t/a Management Acc (All)

Chapter 4 Accumulating and Assigning Costs to Products Atkinson, Solutions Manual t/a Management Accounting, 6E

Document Content and Description Below

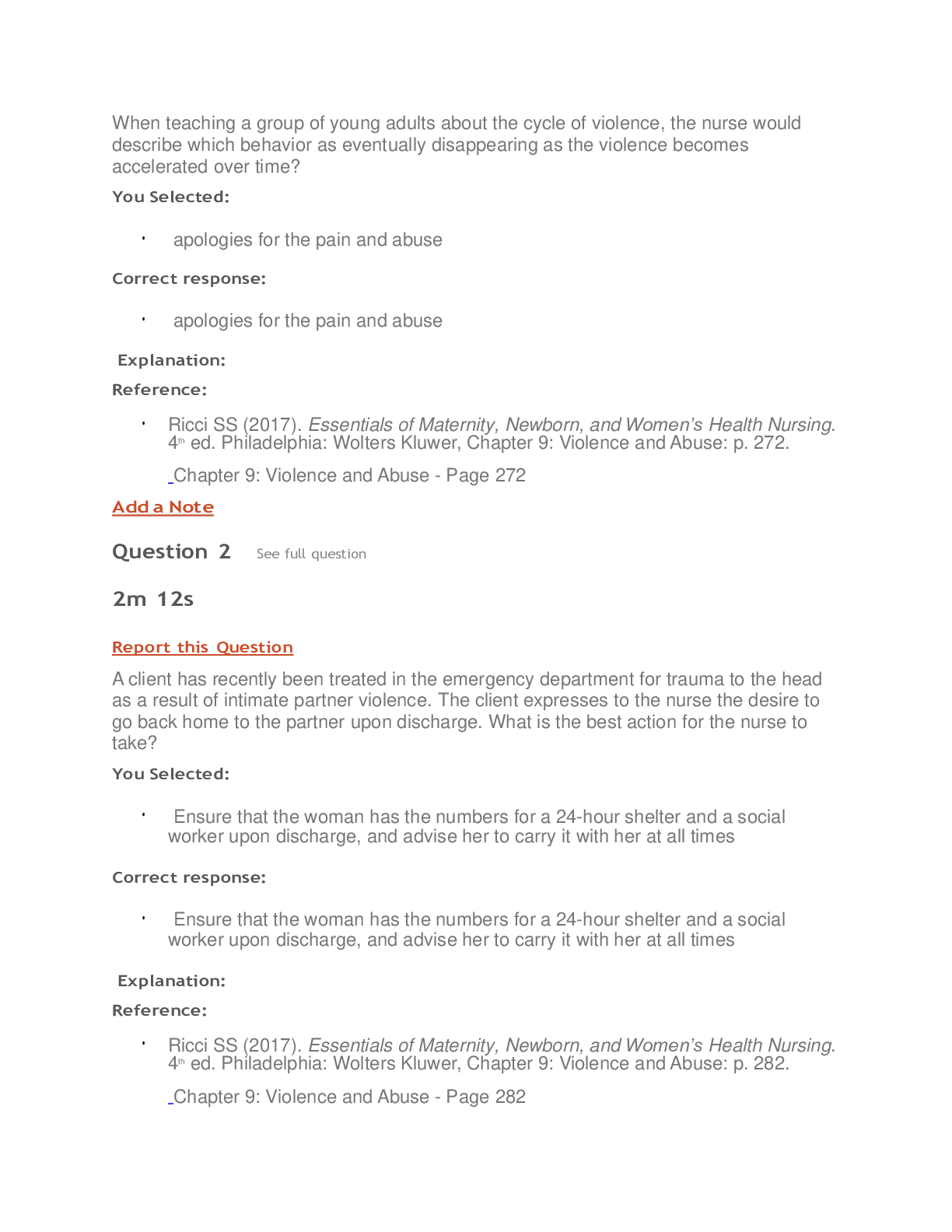

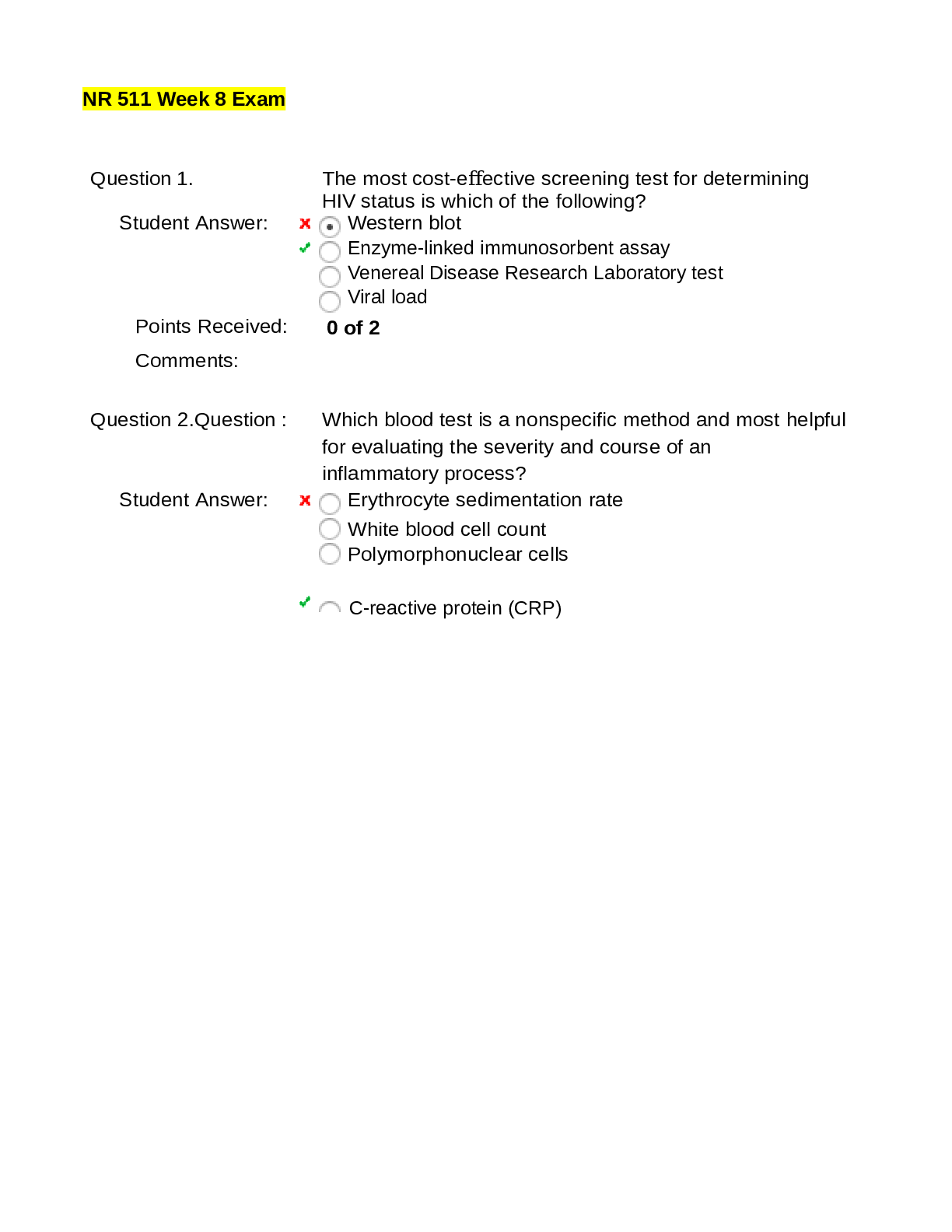

Chapter 4 Accumulating and Assigning Costs to Products QUESTIONS 4-1 The cost of the raw materials entered into production is moved from the raw materials account to the work-in-process i... nventory account. The cost of manufacturing labor and overhead items are assigned to production by adding them to the work-in-process inventory account. Overhead costs are assigned (or allocated or apportioned) as determined by the cost system. When manufacturing is completed, work is transferred to finished goods inventory, and costs are moved from the work-in-process inventory account to the finished goods inventory account. Finally, when goods are sold their costs are moved from the finished goods inventory account to cost of goods sold. 4-2 Manufacturing organizations face greater challenges in product costing, especially the assignment of overhead costs, than retail or service organizations do. The basic idea behind all manufacturing costing systems is to determine the costs that products accumulate as they consume organization resources during manufacturing, as described above in 4-1. In retail organizations, goods are purchased rather than manufactured; the cost of the goods purchased is entered into an account that accumulates the cost of merchandise inventory in the store. Stores incur various overhead costs such as labor, depreciation on the store, lighting, and heating. The primary focus in retail operations is the profitability of product lines or departments. Therefore, retail organizations, like manufacturing operations, face the issue of how to allocate various overhead costs to determine, for example, the cost of purchasing and selling products, or department costs. Service organizations that undertake major projects, such as in a consultancy, focus on determining the cost of a project. In such situations, the major direct cost, employee pay, is often a large proportion of the project’s cost. The organization will also assign various overhead costs to determine project profitability 4-3 A cost object is anything for which a cost is computed. Examples of cost objects are activities, products, product lines, customers, patients, departments, or even entire organizations. 4-4 The defining characteristic of a consumable (flexible) resource is that its cost depends on the amount of resource that is used. Examples of consumable resources are wood in a furniture factory, fabric in a clothing factory, and iron ore in a steel mill. The cost of a consumable resource is often called a variable cost because the total cost depends on how much of the resource is consumed. The contrasting defining characteristic of a capacity-related resource is that its cost depends on the amount of resource capacity that is acquired and not on how much of the capacity is used. As the size of a proposed factory or warehouse increases, the associated capacity-related cost will increase. Examples of capacity-related costs are depreciation on production equipment (the capacity-related resource) and salaries paid to employees (the capacity-related resource) in a consultancy. The cost of a capacity-related resource is often called a fixed cost because the cost of the resource is independent of how much of the resource is used. 4-5 Direct and indirect costs are specified in relation to distinct cost objects. A direct cost is a cost that is uniquely and unequivocally attributable to a single cost object. If the cost fails the test of being direct it is classified as indirect with respect to the designated cost object. For example, if the cost object is a unit of product, then direct material (e.g., wood, steel) and direct labor are direct costs, and manufacturing overhead costs (e.g., factory rent, supervisors’ salaries) are indirect costs. However, if a department within a plant is the chosen cost object, then the department manager’s salary is a direct cost for the department (assuming the manager only manages that department) and the cost of heat for the plant is an indirect cost. 4-6 From the time of the Industrial Revolution until the early 20th century, manufacturing operations were mainly labor paced and direct costs comprised the majority of product costs. Since then indirect costs in the form of automation have gradually replaced labor costs and, for many products, are now the major component of total product costs. This increased use of indirect costs in manufacturing has increased the need for costing systems to deal adequately with indirect manufacturing costs. ........................................................................................continued.............................................................................. [Show More]

Last updated: 1 year ago

Preview 1 out of 41 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 18, 2021

Number of pages

41

Written in

Additional information

This document has been written for:

Uploaded

Oct 18, 2021

Downloads

0

Views

145

.png)