Financial Accounting > QUESTIONS & ANSWERS > University of Texas, Dallas: ACCOUNTING 6344 Midterm 2A. 60 Q& A. 100% Score Guarantee. With Rationa (All)

University of Texas, Dallas: ACCOUNTING 6344 Midterm 2A. 60 Q& A. 100% Score Guarantee. With Rationale and Worked Solutions.

Document Content and Description Below

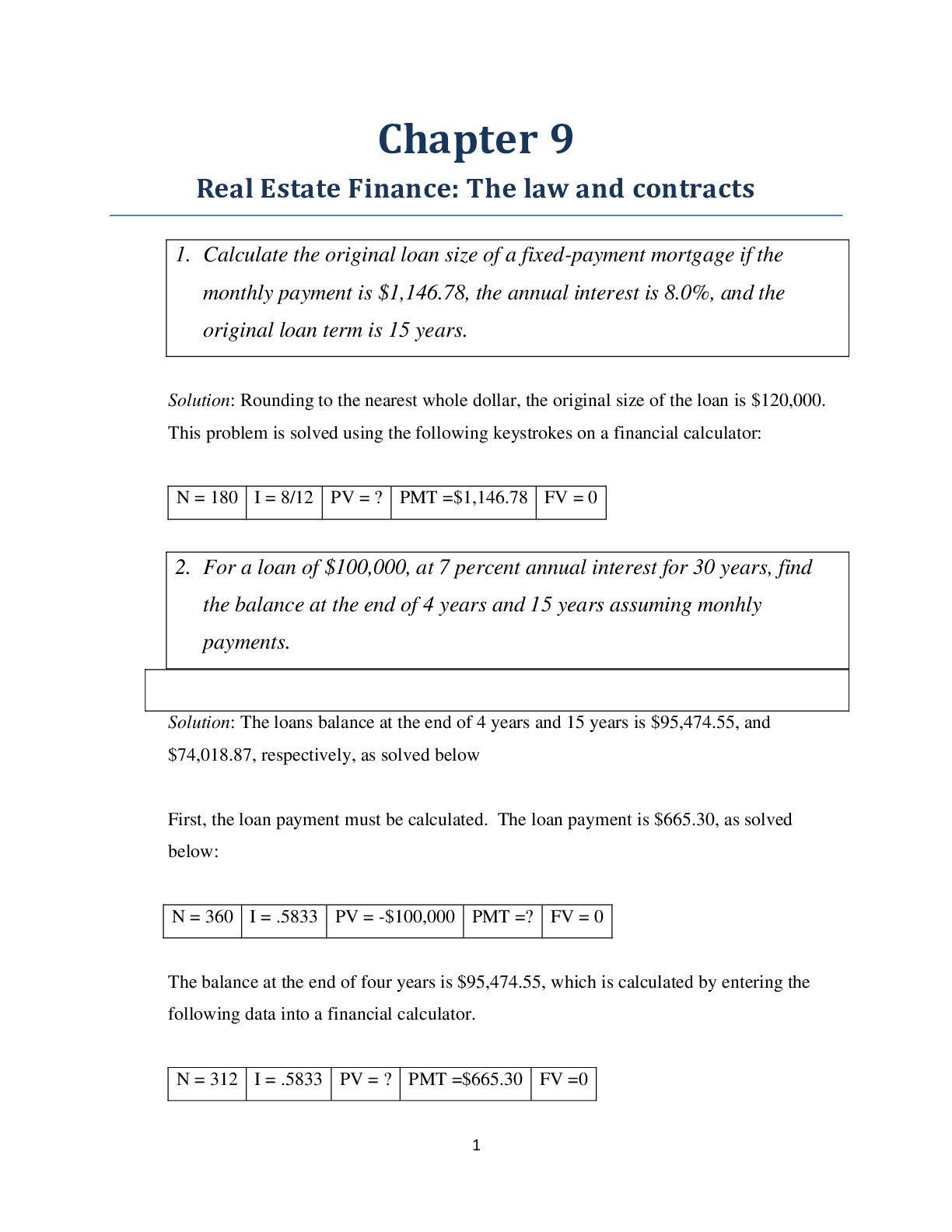

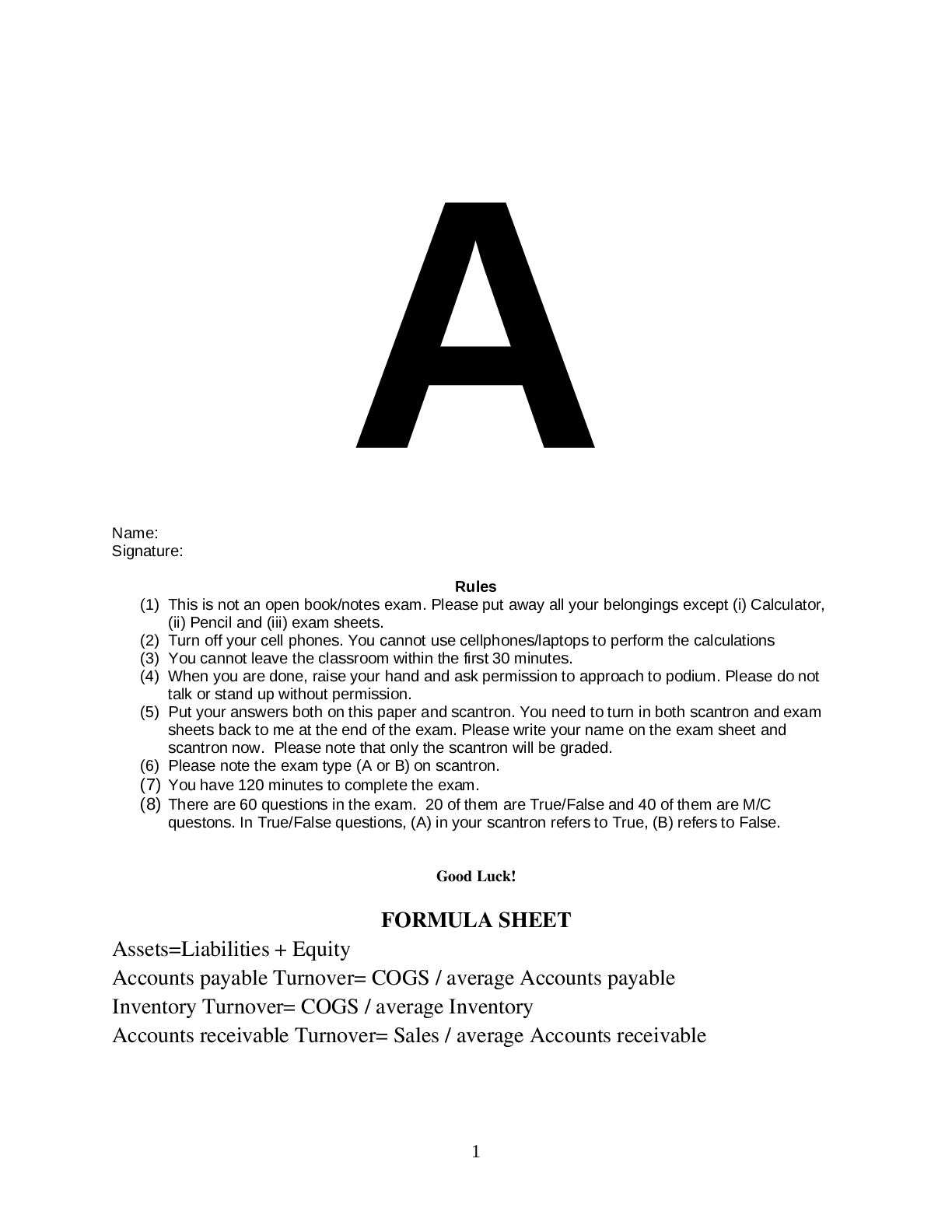

ACCOUNTING 6344 Midterm 2A Name: Signature: Rules (1) This is not an open book/notes exam. Please put away all your belongings except (i) Calculator, (ii) Pencil and (iii) exam sheets. (2) Tur... n off your cell phones. You cannot use cellphones/laptops to perform the calculations (3) You cannot leave the classroom within the first 30 minutes. (4) When you are done, raise your hand and ask permission to approach to podium. Please do not talk or stand up without permission. (5) Put your answers both on this paper and scantron. You need to turn in both scantron and exam sheets back to me at the end of the exam. Please write your name on the exam sheet and scantron now. Please note that only the scantron will be graded. (6) Please note the exam type (A or B) on scantron. (7) You have 120 minutes to complete the exam. (8) There are 60 questions in the exam. 20 of them are True/False and 40 of them are M/C questons. In True/False questions, (A) in your scantron refers to True, (B) refers to False. Good Luck! FORMULA SHEET Assets=Liabilities + Equity Accounts payable Turnover= COGS / average Accounts payable Inventory Turnover= COGS / average Inventory Accounts receivable Turnover= Sales / average Accounts receivable True/False 1. Next year, Dow Chemical Corporation plans to build a laboratory dedicated to a special project. The company will not use the laboratory after the project is finished. Under GAAP, this laboratory should be expensed. 2. Revenues from discontinued operations of a company are reported separately from revenues from continuing operations in the income statement. 3. Accounts payable are a short-term source of non-interest-bearing financing. 4. Accrued liabilities are obligations for which there is no external transaction. 5. If accrued liabilities are overestimated in the current period, the reported income in a following period will be lower than it should be. 6. Contingent liabilities that are ‘probable’ and can be reasonably estimated are recorded on the balance sheet as a liability and as an expense in the income statement. 7. The principal and interest that will be paid on long-term debt within the next operating cycle are reported on the balance sheet as “current portion of long-term debt.” 8. All gains and losses on bond repurchases are reported as extraordinary items. 9. For an item to be classified as extraordinary, it needs to be both unusual and infrequent. However, there is an exception for material items – for one-time items that are extremely large, firms have the option of classify these items as extraordinary to provide better information to investors. 10. Income tax expense is not recorded at the amount owing to the tax authorities even if this is the most objectively measured amount. 11. In order to report accounts receivable, net, companies estimate the amount they do not expect to collect from their credit customers. 12. Overestimating the allowance for uncollectible accounts receivable can shift income from the current period into one or more future periods. 13. The financial statement effects for uncollectible accounts occur when the company writes off the account because that is when all the uncertainty is resolved. 14. The three components of manufacturing costs are direct materials, direct labor, and manufacturing overhead. 15. LIFO inventory costing yields more accurate reporting of the inventory balance on the balance sheet. 16. Companies using LIFO are required to disclose the amount at which inventory would have been reported had it used FIFO. Similarly, companies using FIFO are required to disclose what their inventory would have been if the company had used LIFO. 17. In general, in a period of falling prices, LIFO produces higher gross profits than FIFO. 18. Impairment of long-term assets is determined by comparing the sum of the present value of the asset’s expected future cash flows to the asset’s net book value. 19. The gain or loss on the sale of the asset is computed by: Gain/(Loss) on sale = Market value of asset – Net book value of asset 20. For self-constructed assets, a firm may capitalize any expenses required to place the asset in service. This includes any interest expense on loans during the construction period. Multiple Choice 21. Boston Consulting Group (BCG) is a management consulting, technology services and outsourcing organization. Which of the following actions should managers take when there is evidence that a fixed-rate contract is over budget and will generate a loss for the firm? A) Use the percentage of completion method to recognize the loss over the remaining term of the engagement. B) Recognize the loss in the current period rather than over the remaining term of the engagement. C) Restate the financial statements and recognize the loss in the earliest period of the engagement. D) Use the percentage of completion method and pro rate the loss over the entire term of the engagement. E) None of the above is an appropriate action. 22. On December 31, 2012, Tri-State Construction Inc. signs a contract with the state of Texas Department of Transportation to manufacture a bridge over the Rio Grande. Tri-State anticipates the construction will take three years. The company’s accountants provide the following contract details relating to the project: Contract price $420 million Estimated construction costs $300 million Estimated total profit $120 million During the three-year construction period, Tri-State incurred costs as follows: 2013 $ 30 million 2014 $180 million 2015 $ 90 million Tri-State uses the percentage of completion method to recognize revenue. Which of the following represent the revenue recognized in 2013, 2014, and 2015? A) $140 million, $140 million, $140 million B) $30 million, $180 million, $90 million C) $12 million, $72 million, $36 million D) $42 million, $252 million, $126 million E) None of the above 23. In spring 2012, Mainline Engineering Company signed an $80 million contract with the city of Duluth, to construct a new city hall. Mainline expects to construct the building within two years and incur expenses of $60 million. The city of Duluth paid $20 million when the contract was signed, $40 million within the next six months, and the final $20 million exactly one year from the signing of the contract. Mainline incurred $24 million in costs during 2012 and rest in 2013 to complete the contract on time. Using the percentage-of-completion method how much revenue should Mainline recognize in 2012? A) $32 million B) $60 million C) $20 million D) $40 million E) None of the above 24. Tickets Now contracts with the producer of Riverdance to sell tickets online. Tickets Now charges each customer a fee of $4 per ticket and receives $10 per ticket from the producer. Tickets Now does not take control of the ticket inventory. Average ticket price for the event is $150. How much revenue should Tickets Now recognize for each Riverdance ticket sold? A) $4 because the $10 from the producer is similar to a negative cost of goods sold B) $14 because both the fee from the customer and the producer are earned C) $150 because the $140 is cost of goods sold paid to the Riverdance producer D) $186 because the $140 is cost of goods sold paid to the Riverdance producer E) None of the above 25. On its 2011 income statement, Yahoo! reported Product development expense of $1,005,090. Which of the following statements must be true? A) Yahoo spent $1,005,090 in cash to develop new products and improve old products. B) Product development expense reduced Yahoo’s 2011 net income by $1,005,090. C) Yahoo capitalized at least $1,005,090 of product development costs in 2011. D) The $1,005,090 included amortized product development costs from prior years that were not previously expensed, because Yahoo incurs such expenses each year. E) None of the above 26. Life Technologies Corporation and Affymetrix Inc. are competitors in the life sciences and clinical healthcare industry. Following is a table of Total revenue and R&D expenses for both companies. Life Technologies Corporation Affymetrix Inc 2011 2010 2009 2011 2010 2009 Total revenue $3,775,672 $3,588,094 $3,280,344 $241,273 $277,743 $279,186 R&D expenses $377,924 $375,465 $337,099 $63,591 $67,934 $77,358 Which of the following is true? A) Life Technologies Corporation is the more R&D intensive company of the two. B) Life Technologies Corporation has become more R&D intensive over the three years. C) Affymetrix is more R&D intensive in 2011 than in 2010. D) Affymetrix is less R&D intensive in 2011 than in 2010. E) None of the above 27. Dow Chemical recorded pretax restructuring charges of $689 million in 2009. The charges consisted of asset write-downs of $454 million, costs associated with exit or disposal activities of $66 million, and employee severance costs of $169 million. The company paid $72 million cash to settle these restructuring charges during the year (2009). At year end, the restructuring accrual associated with these charges was: A) $689 million B) $617 million C) $163 million D) $ 97 million E) There is not enough information to determine the amount. 28. Intelligentsia Corp. recorded restructuring charges of $157,028 thousand during fiscal 2012 related entirely to anticipated employee separation payments. Intelligentsia had never before incurred restructuring charges. At the end of the year, the company’s balance sheet included a restructuring accrual of $19,762. The cash flow effect of Intelligentsia’s restructuring during fiscal 2012 was: A) $19,762 thousand B) $157,028 thousand C) $176,790 thousand D) $137,266 thousand E) None of the above 29. The 2010 annual report of Dow Chemical Company disclosed a valuation allowance of $682 million related to various deferred tax assets. The 2009 valuation allowance had a balance of $721 million. What effect did this decrease in the allowance have on Dow Chemical’s net income in 2010? A) Increase net income by $39 million B) Decrease net income by $39 million C) Increase net income by $682 million D) Decrease net income by $682 million E) None of the above 30. As a result of using accelerated depreciation for tax purposes, The MED Corporation reported $186 million income tax expense in its income statement, while the actual amount of taxes paid by the company was $206 million. How did these tax transactions affect the company’s balance sheet? A) Increase deferred tax liability by $20 million B) Decrease deferred tax assets by $186 million C) Decrease retained earnings by $186 million D) Decrease cash by $186 million E) Both C and D 31. The income tax footnote to the financial statements of Life Technologies Company for the year ended December 31, 2011, includes the following information (in thousands). How much of the income tax expense is payable in 2011? Current tax provision Federal $113,783 State 1,771 Foreign 45,237 160,791 Deferred tax provision Federal (50,907) State (6,119) Foreign (4,514) (61,540) Changes in tax rate (95) Changes in valuation allowance 1,712 Provision for income taxes $100,868 A) $100,868 thousand B) $61,540 thousand C) $160,791 thousand D) $99,251 thousand E) None of the above 32. All of the following are potentially dilutive in computing diluted EPS except: A) Employee stock options B) Convertible preferred stock C) Convertible bonds D) Warrants E) All of the above are dilutive securities 33. The 2011 financial statements of Leggett & Platt, Inc. include the following information in a footnote. What are the company’s gross accounts and other receivables at the end of 2011? (in millions) 2011 2010 Allowance for doubtful accounts $24.3 $22.1 Total accounts and other receivables, net $503.6 $478.9 A) $503.6 million B) $479.3 million C) $503.2 million D) $527.9 million E) None of the above 34. The 2012 annual report of Oracle Corporation included the following information relating to their allowance for doubtful accounts: Balance in allowance at the beginning of the year $372 million, accounts written off during the year of $141 million, balance in allowance at the end of the year $323 million. What did Oracle Corporation report as bad debt expense for the year? A) $49 million B) $190 million C) $92 million D) $182 million E) None of the above 35. Magic Animation Corporation has aged its accounts receivable and estimated uncollectible accounts as follows (in thousands). What bad debt expense should the company report for the current period? Age of Receivables AR Balance Estimated % uncollectible Allowance Current $4,000 × 1% $40 30-60 days past due 1,600 × 3% 48 61-90 days past due 900 × 6% 54 Over 90 days past due 510 × 10% 51 A) $52 thousand B) $193 thousand C) $7,010 thousand D) $6,816 thousand E) There is not enough information to determine the amount. 36. The 2011 financial statement of Willamette Valley Vineyards reported Net revenues of $15,661,905 and Cost of goods sold of $7,944,635. Note 3 reported that Inventories consisted of: 2011 2010 Winemaking and packaging materials $ 248,350 $ 296,012 Work-in-process 3,535,028 3,209,692 Finished goods 5,889,816 7,226,730 Obsolescence reserve (54,049) (20,416) Total inventories $9,619,145 $10,712,018 The inventory turnover for 2011 was: A) 1.63 B) 0.83 C) 0.78 D) 1.54 E) None of the above 37. The 2010 financial statements of Walgreen Co. reported the following information (in millions): 2010 2009 Cost of sales $48,444 $45,722 Inventories, net 7,378 6,789 LIFO reserve 1,379 1,239 The 2010 average inventory days outstanding is: A) 55.6 days B) 66.0 days C) 57.2 days D) 61.6 days E) None of the above 38. The 2010 financial statements of Walgreen Co. reported the following information (in millions). 2010 2009 Cost of sales $48,444 $45,722 Inventories, net 7,378 6,789 LIFO reserve 1,379 1,239 If Walgreen’s had used the FIFO method of inventory costing, 2010 inventory would have been: A) $7,378 million B) $8,757 million C) $5,999 million D) $8,316 million E) None of the above 39. The 2010 financial statements of Walgreen Co. reported the following information (in millions). 2010 2009 Cost of sales $48,444 $45,722 Inventories, net 7,378 6,789 LIFO reserve 1,379 1,239 If Walgreen’s had used the FIFO method of inventory costing, 2010 COGS would have been: A) $48,444 million B) $49,823 million C) $47,065 million D) $48,304 million E) None of the above 40. Assume that Campo Jewelry Co. uses the LIFO inventory costing method for both tax and financial reporting purposes. The balance sheet reports inventories at $204 million. Then, in its footnotes, the company reports that inventories would have been $266 million had the company used the FIFO method. The difference between these two numbers ($62 million) is referred to as: A) LIFO reserve B) LIFO conformity rule C) LIFO holding gain D) Inventory temporary difference E) None of the above 41. Montana Great Outdoors had the following inventory in fiscal 2012. The company uses the FIFO method of accounting for inventory. Beginning Inventory, August 1, 2011: 140 units @ $19.50 Purchase 300 units @ $19.00 Purchase 50 units @ $20.00 Purchase 120 units @ $20.30 Ending Inventory, July 31, 2012: 130 units The company’s cost of goods sold for fiscal 2012 is: A) $9,230 B) $2,636 C) $9,331 D) $11,866 E) None of the above 42. Montana Great Outdoors had the following inventory in fiscal 2012. The company uses the LIFO method of accounting for inventory. Beginning Inventory, August 1, 2011: 140 units @ $19.50 Purchase 300 units @ $19.00 Purchase 50 units @ $20.00 Purchase 120 units @ $20.30 Ending Inventory, July 31, 2012: 130 units The company’s cost of goods sold for fiscal 2012 is: A) $9,230 B) $2,636 C) $11,866 D) $9,331 E) None of the above 43. Which of the following estimates are not always required when calculating depreciation expense? Select all that apply. A) Depreciation rate B) Useful life C) Depreciation method D) Salvage value E) None of the above 44. The 2011 financial statements for BNSF Railway report the following information: Year ended December 31, 2011 2010 (In millions) Revenues $19,548 $16,850 Property and equipment, net 48,047 45,486 Total assets 70,380 68,647 The 2011 property, plant and equipment turnover is: A) 0.41 B) 1.46 C) 0.42 D) 0.39 E) None of the above 45. Central Supply purchased a new printer for $30,000. The printer is expected to operate for eight (8) years, after which it will be sold for salvage value (estimated to be $3,000). How much is the first year’s depreciation expense if the company uses the double-declining-balance method? A) $7,500 B) $5,625 C) $3,750 D) $3,375 E) None of the above 46. Which of the following does not affect the current liabilities section of the balance sheet? A) Purchase of inventory on credit B) Wages owning to employees but not yet paid C) Insurance bill to be paid next month D) Sale of goods on credit E) A probable legal obligation, due within 12 months 47. Which of the following would not require the company to record an accrual on the balance sheet? A) The company owes $40,000 in wages to its employees for the previous two weeks. B) Interest will be paid when a note payable matures in the following accounting period C) Management believes a lawsuit against the company is meritless because they have never had a single complaint about dangerous side effects of their drug in two years. D) The company knows that they will be fined for pollution as a result of their manufacturing process and can estimate the amount of the obligation. E) None of the above 48. Which of the following does not represent a current liability? A) Accrual of taxes payable B) Short-term loan C) Purchase of equipment on credit D) Bond issue E) None of the above 49. On January 1, Powell’s Club borrows $20,000 from Second State Bank. The loan is due in one year along with 6% interest. The company is preparing its quarterly report for March 31. Which of the following best describes the necessary accrual for interest expense? A) $ 300 increase liabilities, increase expenses B) $1,200 decrease liabilities, decrease cash C) $1,200 increase expenses, decrease cash D) $1,200 increase liabilities, decrease expenses E) $ 300 decrease liabilities, decrease cash 50. Selected recent balance sheet and income statement information for American Eagle Outfitters follows: (in thousands) 2011 Year-end accounts payable $ 183,783 Average accounts payable 175,753 Sales 3,159,818 Cost of goods sold 2,031,477 Accounts payable turnover for 2011 is: A) 11.05 B) 17.19 C) 17.98 D) 11.56 E) None of the above 51. Selected recent balance sheet and income statement information for The Gap, Inc. follows: (in millions) 2011 Year-end accounts payable $ 1,066 Average accounts payable 1,058 Sales 14,549 Cost of goods sold 9,275 Accounts payable days outstanding for 2011 is: A) 41.6 days B) 42.0 days C) 26.7 days D) 26.5 days E) None of the above 52. Selected recent balance sheet and income statement information for American Eagle Outfitters and The Gap, Inc. follows: American Eagle Outfitters The Gap, Inc. (in thousands) 2011 (in millions) 2011 Year-end accounts payable $ 183,783 Year-end accounts payable $ 1,066 Average accounts payable 175,753 Average accounts payable 1,058 Sales 3,159,818 Sales 14,549 Cost of goods sold 2,031,477 Cost of goods sold 9,275 Which of the two companies listed above is leaning on the trade more? A) American Eagle because its accounts payable turnover is greater and its accounts payable days outstanding is lower. B) Gap because its accounts payable turnover is lower and its accounts payable days outstanding is higher. C) Gap because its accounts payable turnover is higher and its accounts payable days outstanding is lower. D) American Eagle because its accounts payable turnover is lower and its accounts payable days outstanding is higher. E) Gap because its accounts payable turnover is lower and its accounts payable days outstanding is lower. 53. Kirner Electric Corp. sells $100,000 of bonds to private investors. The bonds have an 8% coupon rate and interest is paid semiannually. The bonds were sold to yield 9%. What periodic interest payment does Kirner make? A) $16,000 B) $ 4,000 C) $ 8,000 D) $ 2,250 E) None of the above 54. Which one of the following is not correct? A) For debt issued at par: interest expense reported on the income statement equals the cash paid for interest. B) For bond repurchases: Gain (loss) on bond repurchase = Cash paid to repurchase – Net book value of bonds. C) For debt issued at a discount: interest expense reported on the income statement equals cash interest payment less amortization of the discount. D) For debt issued at a premium, interest expense reported on the income statement equals cash interest payment less amortization of the premium. E) None of the above 55. Credit analysis concerns which of the following? A) The price of a company’s stock B) The ability of a company to consistently pay dividends C) The probability a company will make timely payments D) An assessment of a company’s credit-granting policies E) None of the above 56. Which of the following corporate debt ratings are ordered in terms of decreasing market interest rate? A) AAA, A, BB, C B) A, AAA, BB, C C) BB, C, A, AAA D) C, BB, A, AAA E) None of the above 57. Which of the following business factors does not play a role in determining a company’s credit rating? A) Industry characteristics B) Capital structure C) Management D) Corporate marketing E) Profitability 58. Which of the following does Moody’s not consider in deriving the credit rating of a company? A) Profitability ratios B) Loan covenants C) Solvency ratios D) Collateral E) None of the above 59. Calculate Inline’s warranty expense for 2012. a) $28.9 b) $38.9 c) $48.9 d) $58.9 60. How much did Inline pay during the year to repair and or replace goods under warranty? a) $28.8 b) $42.8 c) $24.8 d) $32.8 [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2020

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Oct 13, 2020

Downloads

0

Views

76