Business > Final Exam Review > Taxes and Taxing Jurisdictions_Types of Taxes and the Jurisdictions That Use Them_Chapter 1 (All)

Taxes and Taxing Jurisdictions_Types of Taxes and the Jurisdictions That Use Them_Chapter 1

Document Content and Description Below

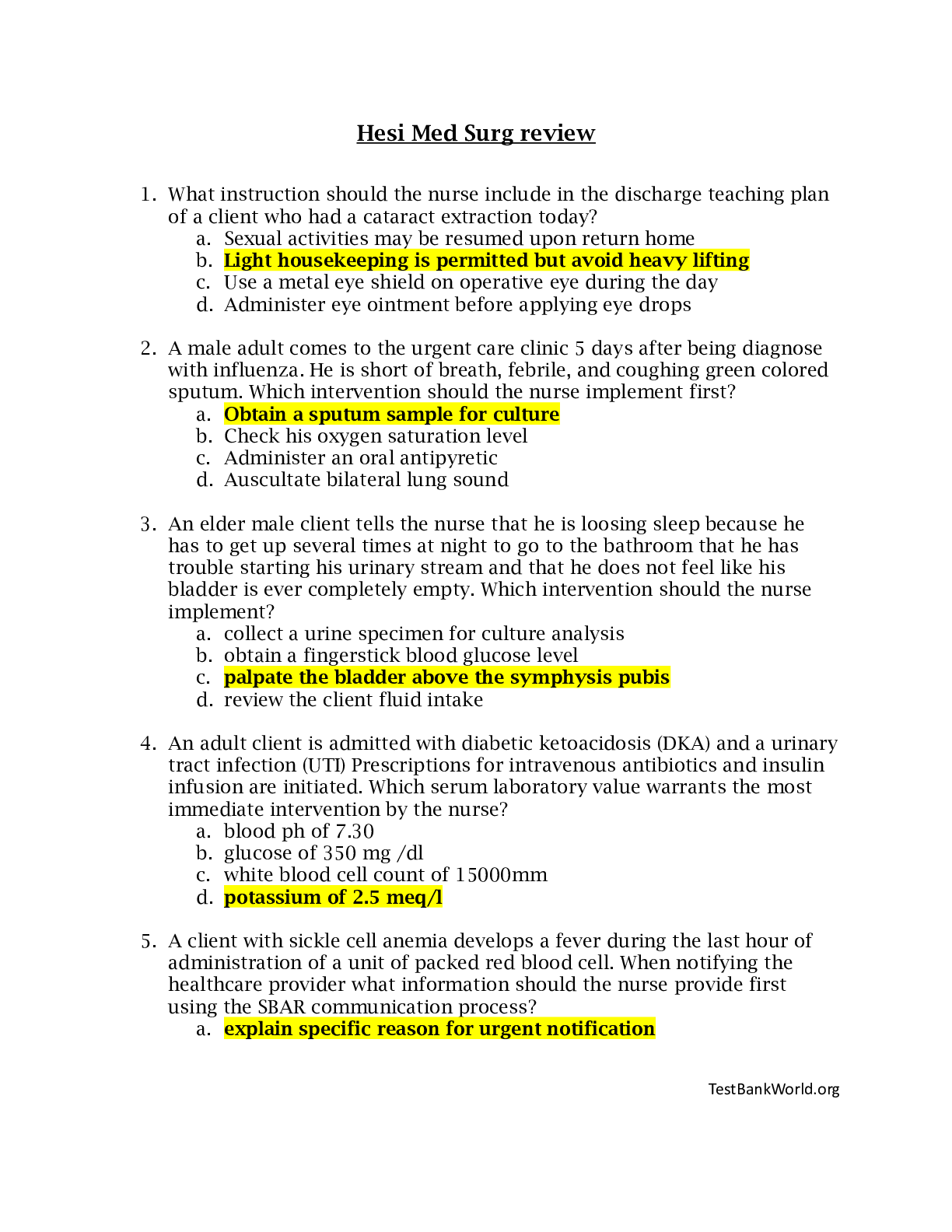

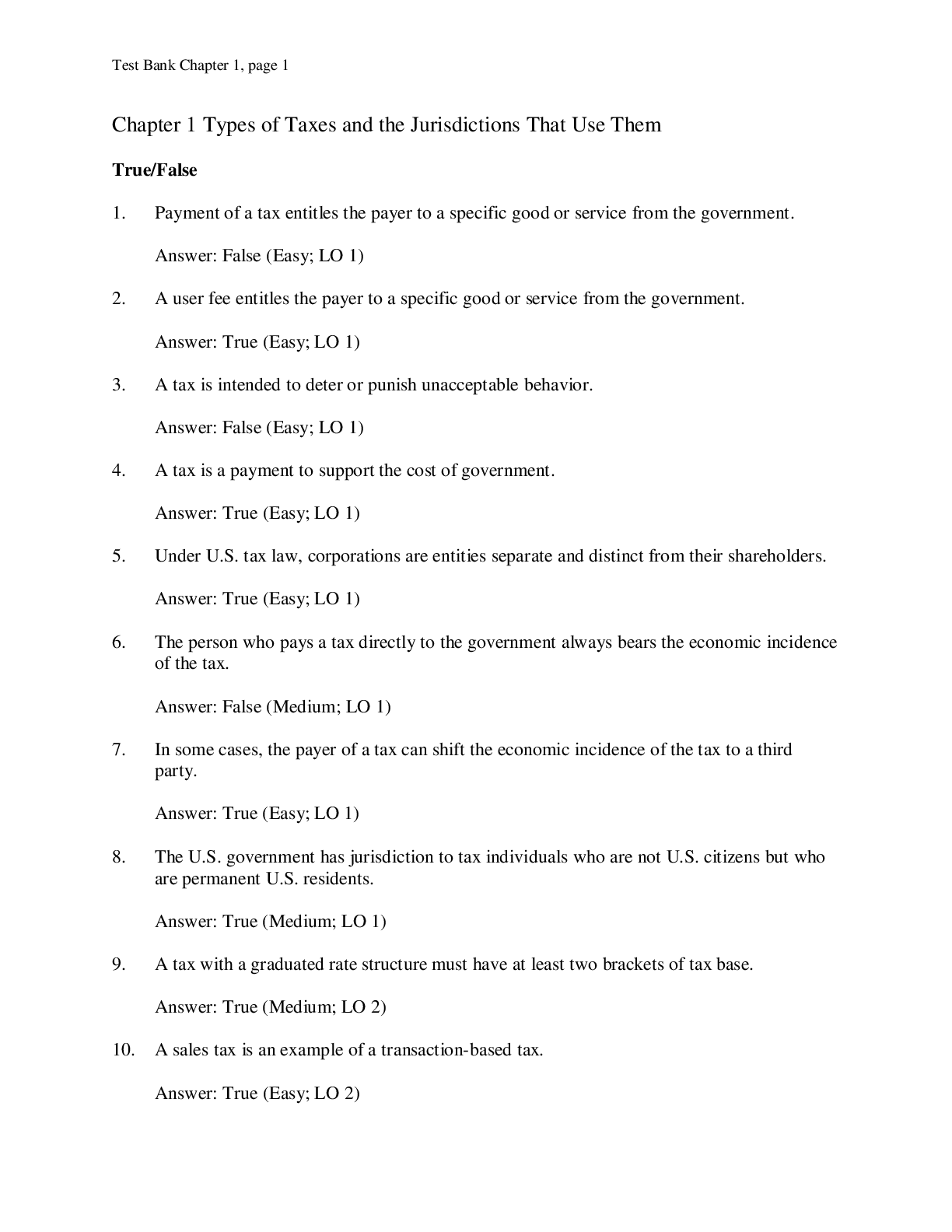

Chapter 1 Types of Taxes and the Jurisdictions That Use Them True/False 1. Payment of a tax entitles the payer to a specific good or service from the government. 2. A user fee entitles th... e payer to a specific good or service from the government. 3. A tax is intended to deter or punish unacceptable behavior. 4. A tax is a payment to support the cost of government. 5. Under U.S. tax law, corporations are entities separate and distinct from their shareholders. 6. The person who pays a tax directly to the government always bears the economic incidence of the tax. 7. In some cases, the payer of a tax can shift the economic incidence of the tax to a third party. 8. The U.S. government has jurisdiction to tax individuals who are not U.S. citizens but who are permanent U.S. residents. 9. A tax with a graduated rate structure must have at least two brackets of tax base. 10. A sales tax is an example of a transaction-based tax. 11. A tax on net income is an example of a transaction-based tax. 12. A sales tax is an example of an activity-based tax. 13. Ad valorem property taxes are the major source of revenue for local governments. 14. Taxes on personal property are more difficult to administer and enforce than taxes on real property. 15. A state government may levy either a sales tax or a use tax on consumers but not both. 16. Sellers of retail goods are responsible for collecting sales tax from their customers and remitting the tax to the state government. 17. Purchasers of consumer goods through the mail are responsible for paying use tax on goods for which sales tax was not collected by the seller. 18. The majority of state governments raise revenue from both personal and corporate income taxes. 19. The federal government imposed the first income tax to raise money to fight the War of 1812. 20. The U.S. Constitution gives the federal government the power to impose a tax on income from whatever source derived. 21. The federal government collects more revenue from the corporate income tax than from the individual income tax. 22. The federal government does not levy property taxes or a general sales tax. 23. A business that operates in more than one state is required to pay state income tax only to the state in which it is incorporated. 24. The potential for conflict among taxing jurisdictions is greatest for businesses operating on a global scale. 25 Less than half of the state governments depend on gambling as a source of revenue. 26. Businesses that sell over the internet must collect sales tax only from purchasers living in a state in which the business has a physical presence. 27. The Internal Revenue Code is written by the Internal Revenue Service. 28. Treasury regulations are tax laws written by the Treasury Department. Multiple Choice 1. Which of the following is not characteristic of a tax? 2. The state of Virginia charges motorists 50 cents for every trip across a toll bridge over the James River. This charge is an example of: 3. The city of Mayfield charges individuals convicted of DWI (driving while intoxicated) $500 for the first conviction and $2,000 for any subsequent conviction. These charges are an example of: 4. The property tax on a rent house owned by Mr. Janey increased by $1,200 this year. Mr. Janey increased the monthly rent charged to his tenant, Ms. Lacey, by $45. Who bears the incidence of the property tax increase? 5. Acme Inc.’s federal income tax increased by $100,000 this year. As a result, Acme reduced its annual dividend by $100,000. Who bears the incidence of the corporate tax increase? 6. Acme Inc.’s property taxes increased by $65,000 this year. As a result, Acme increased the sale prices of its products to generate $65,000 more revenue. Who bears the incidence of the corporate tax increase? 7. Acme Inc.’s property taxes increased by $19,000 this year. As a result, Acme eliminated $19,000 from its budget for the employee Christmas party. Who bears the incidence of the corporate tax increase? 8. Mr. Bilboa is a citizen of Portugal. Which of the following statements is true? 9. Mrs. King is a U.S. citizen who permanently resides in South Africa. Which of the following statements is true? 10. Mrs. Renfru is a Brazilian citizen who permanently resides in Houston, Texas. Which of the following statements is true? 11. Which of the following statements regarding tax systems is false? 12. Which of the following is an example of a transaction-based tax? a. A tax on net business income 13. Which of the following is an example of an activity-based tax? 14. Which of the following is an earmarked tax? 15. Which of the following characterizes a good tax base? 16. The city of Springvale imposes a net income tax on businesses operating within its jurisdiction. The tax equals 1% of income up to $100,000 and 1.5% of income in excess of $100,000. The Springvale Bar and Grill generated $782,000 net income this year. Compute its city income tax. 17. Government Q imposes a net income tax on businesses operating within its jurisdiction. The tax equals 3% of income up to $500,000 and 5% of income in excess of $500,000. Company K generated $782,000 net income this year. Compute the income tax that Company K owes to Q. 0 18. Which of the following taxes is not a significant source of revenue for local governments? 19. Which of the following taxes is a significant source of revenue for local governments? 20. Which of the following statements concerning property taxes is false? 21. A sales tax can best be described as: 22. Which of the following statements concerning sales taxes is false? 23. The incidence of a state sales tax levied on the purchase of retail goods is: 24. Mr. Dodd resides in a state with a 6% sales and use tax. He recently traveled to another state to buy a sailboat and paid that state’s 4% sales tax. Which of the following statements is true? 25. Mr. Smith resides in a state with a 6% sales and use tax. He recently traveled to another state to buy furniture and paid that state’s 7% sales tax. Which of the following statements is true? 26. Which of the following statements about sales and use taxes is true? 27. Which of the following taxes is a significant source of revenue for state governments? 28. Which of the following is not characteristic of an excise tax? 29. What is the major difference between a sales tax and an excise tax? a. Sales taxes are levied by state governments, while excise taxes are levied only by the 30. Which of the following is not an advantage of state conformity to federal corporate income tax laws? 31. Which tax raises the most revenue for the federal government? 32. Which of the following federal taxes is earmarked for a specific purpose? 33. Which of the following federal taxes is not earmarked for a specific purpose? 34. What gives the federal government the right to impose a tax on individual and corporate income? 35. When did the federal income tax become a permanent tax? 36. Which of the following does not characterize federal transfer taxes? 37. Which of the following does not characterize federal transfer taxes? 38. Company D, which has its home office in Raleigh, North Carolina, conducts business in the United States, Canada, and Mexico. Which of the following statements is true? 39. SJF Inc., which has its corporate offices in Boise, Idaho, conducts business in Idaho, Oregon, California, and British Columbia, Canada. Which of the following statements is true? 40. Which type of tax is not levied by the federal government? 41. Company N operates a mail order business out of its headquarters in Tulsa, Oklahoma. This year, it mailed $892,000 worth of product to customers residing in Oklahoma and $489,300 worth of product to customers residing in Missouri. Which of the following statements is true? 42. Which of the following does not contribute to the dynamic nature of the tax law? 43. Which of the following statements regarding the political process of creating tax law is false? 44. Which of the following is not a primary source of authority for the tax law? 45. Which of the following statements about the Internal Revenue Code is false? 46. How often does Congress amend the Internal Revenue Code? 47. Which of the following statements about Treasury regulations is false? 48. Revenue rulings and revenue procedures are written by: a 49. Which of the following is not considered administrative authority? a 50. A revenue ruling is an example of: 51. Which of the following statements concerning judicial authority is false? 52. Which of the following sources of tax law carries the most authority? 53. Which of the following sources of tax law carries the least authority? Application Problems 1. Ms. Penser resides in the city of Lanock, Tennessee. She owns 100% of the stock of PSW Inc., which is incorporated under Tennessee law and conducts business in six different local jurisdictions in Tennessee. 2. Forrest Township levies a tax on the assessed value of real property located within in the town limits. The tax equals 1.4% of the value up to $300,000 plus 2% of any value in excess of $300,000. Mildred Payne owns real estate with a $983,500 assessed value. Compute her property tax. 3. Richton Company operates its business solely in Jurisdiction H, which levies a 6% sales and use tax. This year, Richton paid $1,438,000 to purchase tangible property from a dealer located in Jurisdiction W. This purchase was subject to W’s 3.5% sales tax. The property was shipped to Richton’s office in Jurisdiction H for use in its business. Compute Richton’s sales or use tax with respect to this transaction. 4. Grant Wilson is an employee of Market Enterprises, a corporation operating in state A. Identify the different types of potential taxes to be paid by both Grant and Market Enterprises with respect to this employment relationship. [Show More]

Last updated: 2 weeks ago

Preview 1 out of 15 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 18, 2020

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Oct 18, 2020

Downloads

0

Views

94