Mathematics > QUESTIONS and ANSWERS > FINANCIAL LITERACY QUIZ,100% CORRECT (All)

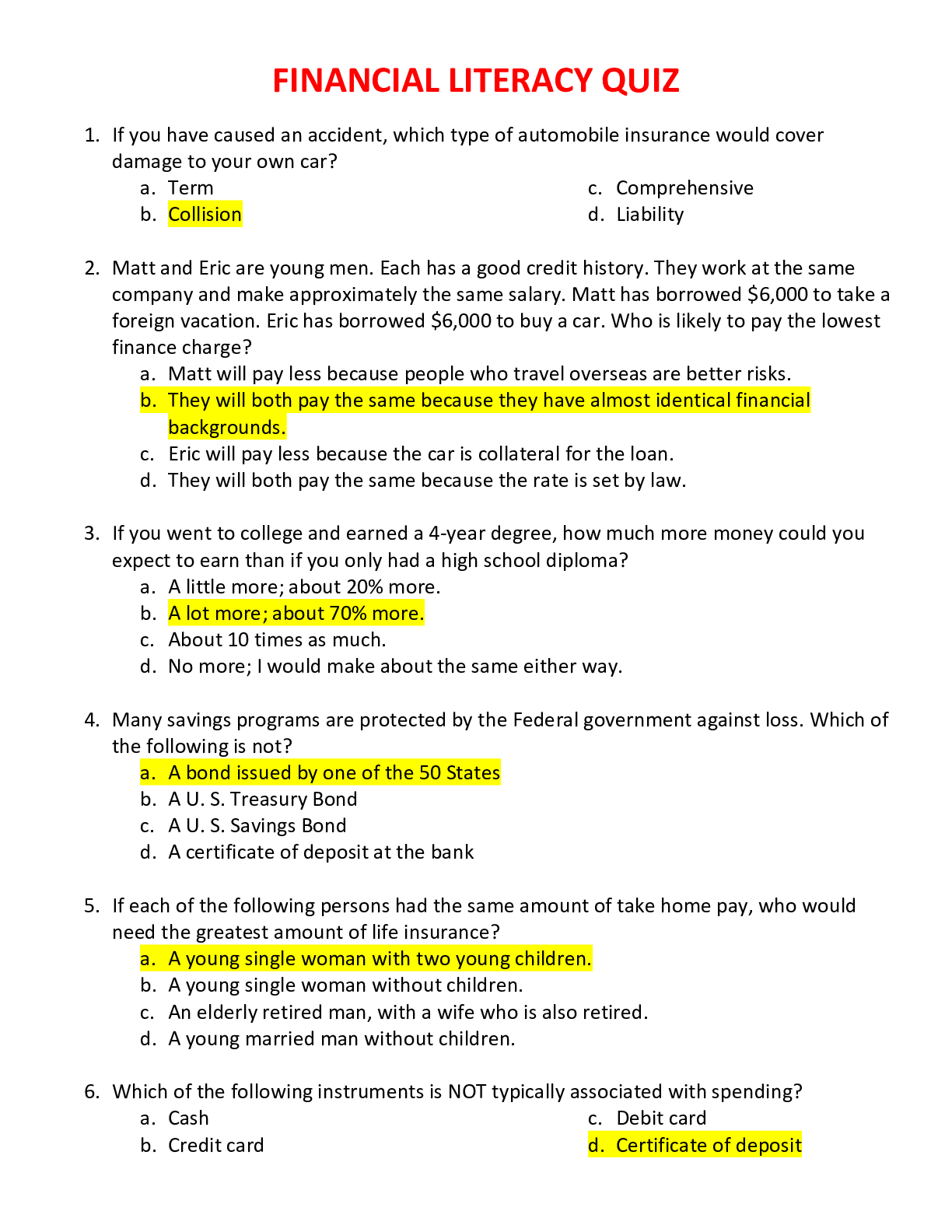

FINANCIAL LITERACY QUIZ,100% CORRECT

Document Content and Description Below

1. If you have caused an accident, which type of automobile insurance would cover damage to your own car? a. Term b. Collision c. Comprehensive d. Liability 2. Matt and Eric are young men. ... Each has a good credit history. They work at the same company and make approximately the same salary. Matt has borrowed $6,000 to take a foreign vacation. Eric has borrowed $6,000 to buy a car. Who is likely to pay the lowest finance charge? a. Matt will pay less because people who travel overseas are better risks. b. They will both pay the same because they have almost identical financial backgrounds. c. Eric will pay less because the car is collateral for the loan. d. They will both pay the same because the rate is set by law. 3. If you went to college and earned a 4-year degree, how much more money could you expect to earn than if you only had a high school diploma? a. A little more; about 20% more. b. A lot more; about 70% more. c. About 10 times as much. d. No more; I would make about the same either way. 4. Many savings programs are protected by the Federal government against loss. Which of the following is not? a. A bond issued by one of the 50 States b. A U. S. Treasury Bond c. A U. S. Savings Bond d. A certificate of deposit at the bank 5. If each of the following persons had the same amount of take home pay, who would need the greatest amount of life insurance? a. A young single woman with two young children. b. A young single woman without children. c. An elderly retired man, with a wife who is also retired. d. A young married man without children. 6. Which of the following instruments is NOT typically associated with spending? a. Cash b. Credit card c. Debit card d. Certificate of deposit 7. Which of the following credit card users is likely to pay the GREATEST dollar amount in finance charges per year, if they all charge the same amount per year on their cards? a. Vera, who always pays off her credit card bill in full shortly after she receives it. b. Jessica, who only pays the minimum amount each month. c. Megan, who pays at least the minimum amount each month and more, when she has the money. d. Erin, who generally pays her credit card in full but, occasionally,will pay the minimum when she is short of cash. 8. Which of the following statements is true? a. Your bad loan payment record with one bank will not be considered if you apply to another bank for a loan. b. If you missed a payment more than 2 years ago, it cannot be considered in a loan decision. c. Banks and other lenders share the credit history of their borrowers with each other and are likely to know of any loan payments that you have missed. d. People have so many loans it is very unlikely that one bank will know your history with another bank. 9. Doug must borrow $12,000 to complete his college education. Which of the following would NOT be likely to reduce the finance charge rate? a. If his parents took out an additional mortgage on their house for the loan. b. If the loan was insured by the Federal Government. c. If he went to a state college rather than a private college. d. If his parents cosigned the loan. 10. If you had a savings account at a bank, which of the following would be correct concerning the interest that you would earn on this account? a. Sales tax may be charged on the interest that you earn. b. You cannot earn interest until you pass your 18th birthday. c. Earnings from savings account interest may not be taxed. d. Income tax may be charged on the interest if your income is high enough. 11. What does credit measure? a. How likely someone is to pay back a loan b. How well someone has made payments in the past c. How trustworthy someone is with money d. All of the above 12. When do you need credit? a. When you apply for a loan b. When you apply for a credit card c. When you apply for a house d. All of the above 13. What range of scores describes people with “good” credit? a. 350 – 619 b. 620 – 659 c. 660 – 719 d. 720 – 850 14. Which of the following probably has the highest credit score? Assume that all of them have made regular monthly payments on time. a. An 18 year old college freshman b. A 20 year old waitress with two active credit cards c. A 40 year old business owner with two cars, a house, and four active credit cards d. A 50 year old with five credit cards who rents his house. 15. What makes a person a good cosigner? a. A high credit score b. A steady income c. The ability to pay for your loan if you can’t d. All of the above 16. Which person probably has the lowest credit score? a. A woman who has missed three credit card payments in a row b. A man who has had three car repossessions c. A woman who has a $125,000 house loan 17. True or false: Bad credit is better than no credit. a. True b. False 18. What does APR stand for? a. Annual purchase rate b. Annual percentage rate c. Approximate payment rotation d. Authorization processing rate 19. What would be the approximate one-month interest be for a $5,000 credit card balance with a 12% APR? a. $120 b. $600 c. $500 d. $50 20. If your credit limit is $1,500 and your available balance is $500, how much money have you charged to the card? a. $1,500 b. $2,000 c. $1,000 d. $500 21. How much money should you pay on your card each month? a. The minimum monthly payment b. 1/2 of your balance c. The full balance d. As much as you can afford, but at least the minimum payment 22. Inflation can cause difficulty in many ways. Which group would have the greatest problem during periods of high inflation that lasts several years? a. Older, working couples saving for retirement b. Older people living on fixed retirement incomes c. Young couples with not children who both work d. Young couples with children 23. Which of the following is true about sales taxes? a. The national sales tax percentage rate is 6% b. The federal government will deduct it from your paycheck c. You don’t have to pay the tax if your income is very low d. It makes things more expensive for you to buy 24. Laura has saved $12,000 for college expenses by working part-time. Her plan is to start college next year and she needs all of the money she saved. Which of the following is the safest place for her college money? a. Locked in her closet at home b. Stocks c. Corporate bonds d. A bank savings account 25. Which of the following types of investment would best protect the purchasing power of a family’s savings in the events of a sudden increase in inflation? a. A 10-year bond issued by a corporation b. A house with a fixed-rate mortgage c. A certificate of deposit at a bank d. A 25-year corporate bond 26. Under which of the following circumstances would it financially beneficial to you to borrow money to buy something now and repay it with future income? a. When you need to buy a car to get a much better paying job b. When you really need a week vacation c. When some clothes you like go on sale d. When the interest on the loan is greater than the interest you get on your savings 27. Which of the following statements describes your right to check your credit history for accuracy? a. Your credit history can be checked once a year for free b. You cannot see your credit history c. All credit histories are property of the federal government and access is only available to the FBI and Lenders d. You can only check your record for free if you are turned down for credit based on a credit report 28. Retirement income paid by a company is called: a. 401 K b. Pension c. Rents and profits d. Social Security 29. Many people put aside money to take care of unexpected expenses. If Gabriel and Sarah have money put aside for emergencies, in which of the following forms would it be of LEAST benefit to them if they needed it right away? a. Invested in a down payment on a house b. Checking account c. Stocks d. Savings account 30. David just found a job with a take-home pay of $2,000 per month. He must pay $900 for rent and $150 for groceries each month. He also spends $250 per month on transportation. If he budgets $100 each month for clothing, $200 for restaurants and $250 for everything else, how long will it take him to accumulate savings of $600? a. 3 months b. 4 months c. 1 month d. 2 months 31. Eva and Jared just had a baby. They received money as baby gifts and want to put it away for the baby’s education. Which of the following tends to have the highest growth over periods of a time as long as 18 years? a. A checking account b. Stocks c. A US government savings bond d. A savings account 32. Barbara has just applied for a credit card. She is an 18-year-old high school graduate with few valuable possessions and no credit history. If Barbara is granted a credit card, which of the following is the most likely way that the credit card company will reduce ITS risk? a. It will make Barbara’s parents pledge their home to repay Barbara’s credit card debit b. It will require Barbara to have both parents co-sign for the card c. It will charge Barbara twice the fiancé change rate it charges older cardholders d. It will start Barbara out with a small line of credit to see how she handles the account 33. Chelsea worked her way through college earning $15,000 per year. After graduation, her first job pays $30,000. The total dollar amount Chelsea will have to pay in Federal Income taxes in her new job will: a. Double, at least, from when she was in college b. Go up a little from when she was in college c. Stay the same as when she was in college d. Be lower than when she was in college 34. Which of the following best describes the primary sources of income for most people age 20-35 a. Dividends and interest b. Salaries, wages, and tips c. Profits from businesses d. Rents 35. If you are behind on your debt payments and go to a responsible credit counseling service such as the Consumer Credit Counseling Services, what help can they give you? a. They can cancel and cut up all of your credit cards without your permission b. They can get the federal government to apply your income taxes to pay off your debts c. They can work with those who loaned you money to set up a payment schedule that you can meet d. They can force those who loaned you money to forgive all your debts 36. Rob and Mary are the same age. At age 25 Mary began saving $2,000 a year while Rob saved nothing. At age 50, Rob realized that he needed money for retirement and started saving $4,000 per year while Mary kept saving her $2,000. Now they are both 75 years old. Who has the most money is his or her retirement account? a. They would each have the same amount because they put away exactly the same amount b. Rob, because he saved more each year c. Mary, because she has put away more money d. Mary, because her money has grown for a longer time at compound interest 37. Many young people receive health insurance benefits through their parents. Which of the following statements is true about health insurance coverage? a. You are covered by your parents’ insurance until you marry, regardless of your age b. If your parents become unemployed your insurance coverage may stop, regardless of your age c. Young people don’t need health insurance because they are so healthy d. You continue to be covered by your parents’ insurance as long as you live a home, regardless of your age 38. If your credit card is stolen and the thief runs up a total debt of $1,000, but you notify the issuer of the card as soon as you discover it is missing, what is the maximum amount that you can be forced to pay according to Federal law? a. $500 b. $1000 c. Nothing d. $50 39. Which of the following statements is NOT correct about most ATM cards? a. You can generally get cash 24-hours a day b. You can generally obtain information concerning your bank balance at an ATM c. You can get cash anywhere in the world with no fee d. You must have a bank account to have an ATM card 40. Matt has a good job on the production line of a factory in his home town. During the past year or two, the state in which Matt lives has been raising taxes on its businesses to the point where they are much higher than in neighboring states. What effect is this likely to have on Matt’s job? a. Higher business taxes will cause more businesses to move into Matt’s state, raising wages b. Higher business taxes can’t have any effect on Matt’s job c. Matt’s company may consider moving to a lower-tax state, threatening Matt’s job d. He is likely to get a large raise to offset the effect of higher taxes 41. A larger down payment will reduce the amount of the mortgage needed. a. True b. False 42. A share of stock represents ownership in a company. a. True b. False 43. If you don’t pay a debt, a debt collector can legally harass you and threaten you. a. True b. False 44. The purpose of a consolidation loan is to: a. deduct amount owed from person’s paycheck b. pay off one credit card before others c. combine several debts into one payment d. reduce the amount owed for federal income taxes 45. Circle all the types of records that are considered private and are protected by privacy restrictions. a. Telephone listings b. Credit reports c. Driver’s license d. Criminal records e. Real estate holdings f. Personnel files g. Medical records h. Voter registration 46. An insurance premium is: a. the amount owed each time you visit the doctor b. Measured on a yearly basis; refers to the amount you must pay before your insurance provider begins to cover costs c. The amount paid to the insurance provider everymonth in order to maintain an insurance plan 47. If your exemptions and withholdings are correct, your tax refund should be: a. $2,500 or more b. $1,500 to $2,500 c. $500 to $1,500 d. As close to $0 as possible 48. Imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. After one year, would the money in the account buy more than it does today, exactly the same or less than today? a. More b. Less c. Same 49. A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less. a. True b. False 50. The type of car you own affects the price you pay for auto insurance. a. True b. False 51. Negative financial information (excluding bankruptcy) can stay on your credit report for: a. 2 years b. 5 years c. 7 years d. 10 years 52. The "Rule of 72" tells you how long it will take to double your money. a. True b. False 53. Which item below would certainly depreciate if you owned it? a. A house b. A car c. Gold d. All of the above 54. You should put at least _____ % of any earnings into savings. a. 5 b. 10 c. 15 d. 20 55. An emergency fund should have enough money in it to cover your living expenses for ______ months. a. 1 b. 2 c. 6 d. 12 PERSONAL FINANCES The next section is based off your personal financial situation, and will only be used by YOU to help you assess your learning needs. 1. When you start to work full-time, after you finish your education, how much do you expect to make per year before deductions for taxes and other items? 2. How many credit cards do you use, including store credit cards? 3. How would you describe the way in which you make payments on your credit cards? (Pay off balance, pay minimum, etc.) 4. What is the total outstanding balance on all of your credit cards? 5. When did you get your first credit card? 6. How often are you late paying your credit card bills? 7. When you finish your undergraduate degree, how much do you expect to owe in student loans? 8. Aside from any credit card debt or student loans you might have, what other types of debt do you have? (Auto loans, mortgage, personal debt, etc.) 9. How much do you worry about your debts? 10. Do you know your credit score? Do you monitor your credit report? 11. Do you have a checking account? 12. How often have you bounced a check (had it returned for insufficient funds)? 13. How often do you balance your check book? 14. What type of savings and investments do you have? What are the interest rates for each account? Circle all that apply. a. Savings account b. Certificates of deposit c. US Savings Bonds d. Stocks e. Mutual funds f. Bonds other than US Savings Bonds g. Retirement accounts such as 401k’s and IRAs 15. How would you rate the savings and investments you have? 16. Who prepares your income taxes? 17. What types of insurance do you have? (Renters, auto, life, health, etc) 18. Do you understand your insurance policies? Do you feel like your coverage is accurate and will adequately provide for you in the case of an emergency? 19. What financial burdens do you anticipate you will need to save for in your future? a. Auto loan b. Mortgage c. Student loans d. Children- raising e. Children- college education f. Health expenses g. Other: ___________________ 20. At what age do you want to retire? 21. What are your retirement plans? How much do you think you will need to live comfortably? After completing the Financial Literacy Quiz and examining about your own financial status and knowledge level, list financial topics you would be interested in learning more about during this unit. In what areas do you want to become more literate? Please upload your requests to the discussion board titled “Financial Topics” under the Week of September 21st – 24th. [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 22, 2020

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Oct 22, 2020

Downloads

0

Views

411

– Chamberlain College of Nursing.png)

– Chamberlain College of Nursing.png)