Financial Accounting > TEST BANK > University of Texas, Dallas ACCOUNTING 6344FSAV4e_testbank_Mod 06 073114 FSAV4e_testbank_Mod 06 0731 (All)

University of Texas, Dallas ACCOUNTING 6344FSAV4e_testbank_Mod 06 073114 FSAV4e_testbank_Mod 06 073114 .

Document Content and Description Below

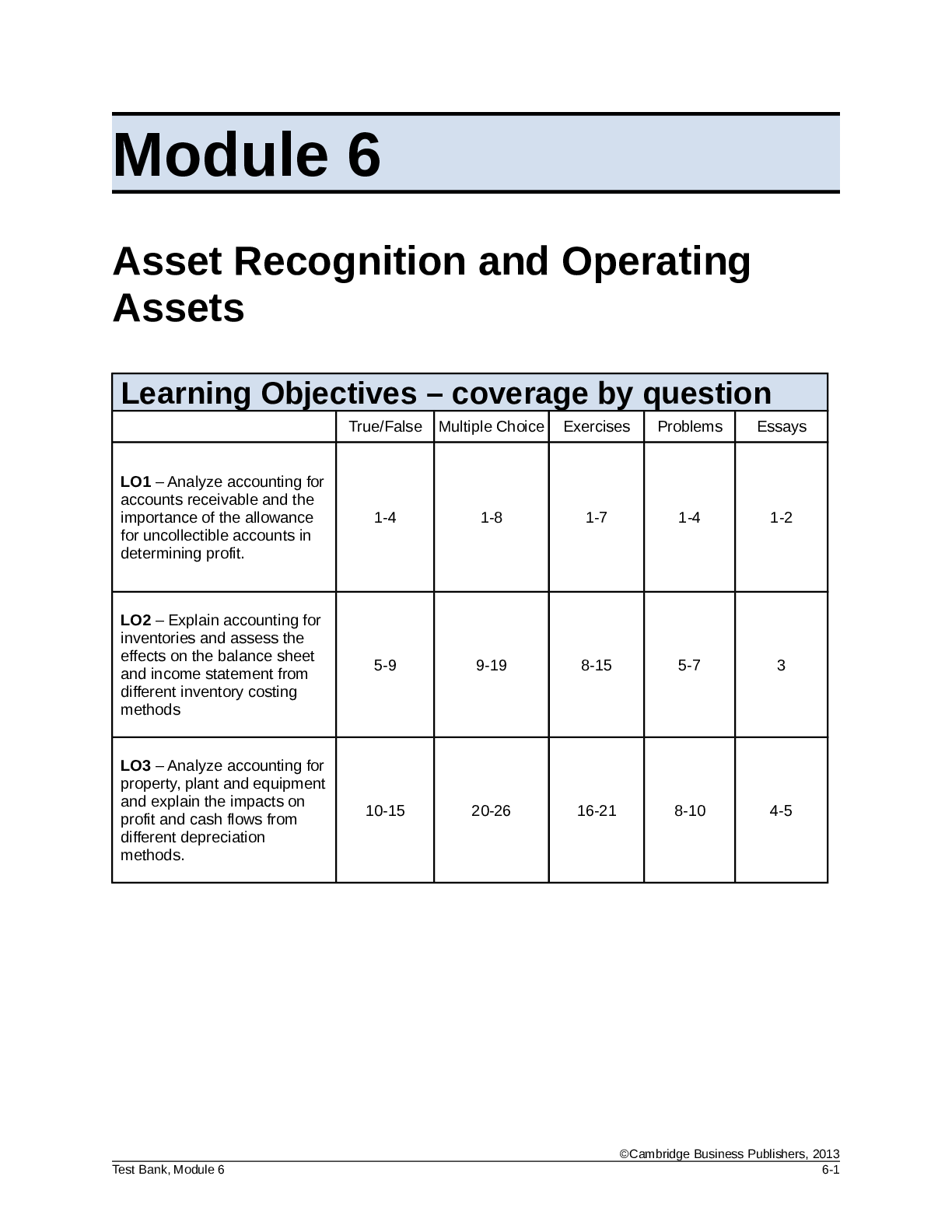

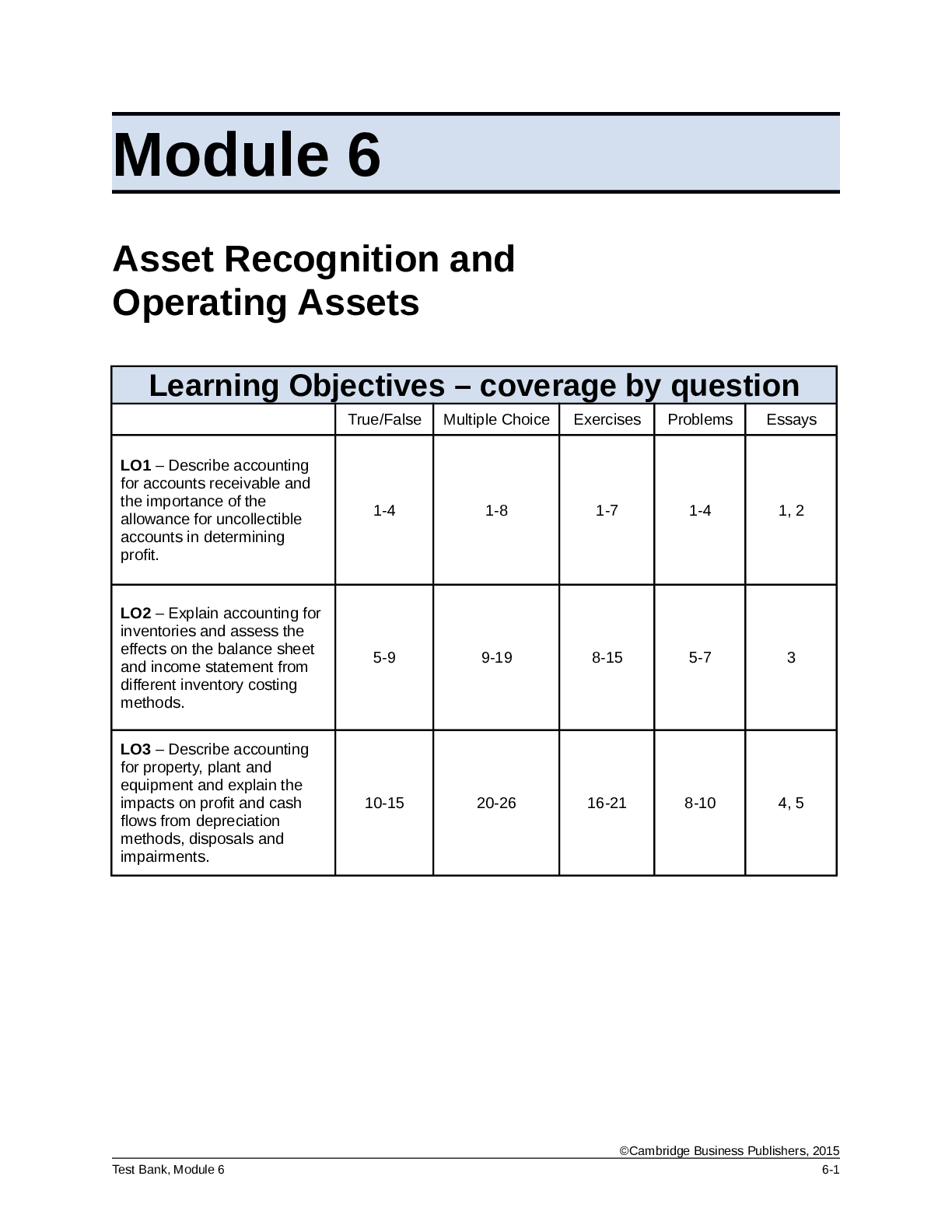

Module 6: Asset Recognition and Operating Assets True/False Topic: Accounts Receivable LO: 1 1. Accounts receivables (net) reported in the current asset section of a company’s balance sheet rep... resents the total amount owed by customers within the next year. Answer: False Rationale: A company makes two representations when reporting A/R in the balance sheet. The first being that it expects to collect the amount reported on the balance sheet. The second is that it expects to collect within the next year. The company may not expect to collect the total amount owed by customers, thus, the statement is incorrect. Topic: Collectibility of Accounts Receivable LO: 1 2. In order to report accounts receivable, net, companies estimate the amount they do not expect to collect from their credit customers. Answer: True Rationale: Companies must report the amount of accounts receivable that they expect to collect. To do this, they estimate the amount they expect to not collect. Topic: Income Shifting LO: 1 3. Overestimating the allowance for uncollectible accounts receivable can shift income from the current period into one or more future periods. Answer: True Rationale: By overestimating current accounts receivable provisions, current income decreases because expenses are increased. However, due to the overestimation, future year provisions will need to decrease to compensate, thus increasing future profitability. Income has been shifted to future periods from the present. Topic: Bad Debt Expense LO: 1 4. The financial statement effects for uncollectible accounts occur when the company writes off the account because that is when all the uncertainty is resolved. Answer: False Rationale: Under GAAP, costs relating to anticipated bad debts expense are matched with sales in the period that the sales are recognized. Upon write-off, both the receivable and the allowance account are reduced, leaving net receivables unchanged. [Show More]

Last updated: 1 year ago

Preview 1 out of 44 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 27, 2022

Number of pages

44

Written in

Additional information

This document has been written for:

Uploaded

Apr 27, 2022

Downloads

0

Views

78