Accounting > EXAM > Comprehensive Final Exam Module 1/ 1 Final Exam - Part I the income tax school (All)

Comprehensive Final Exam Module 1/ 1 Final Exam - Part I the income tax school

Document Content and Description Below

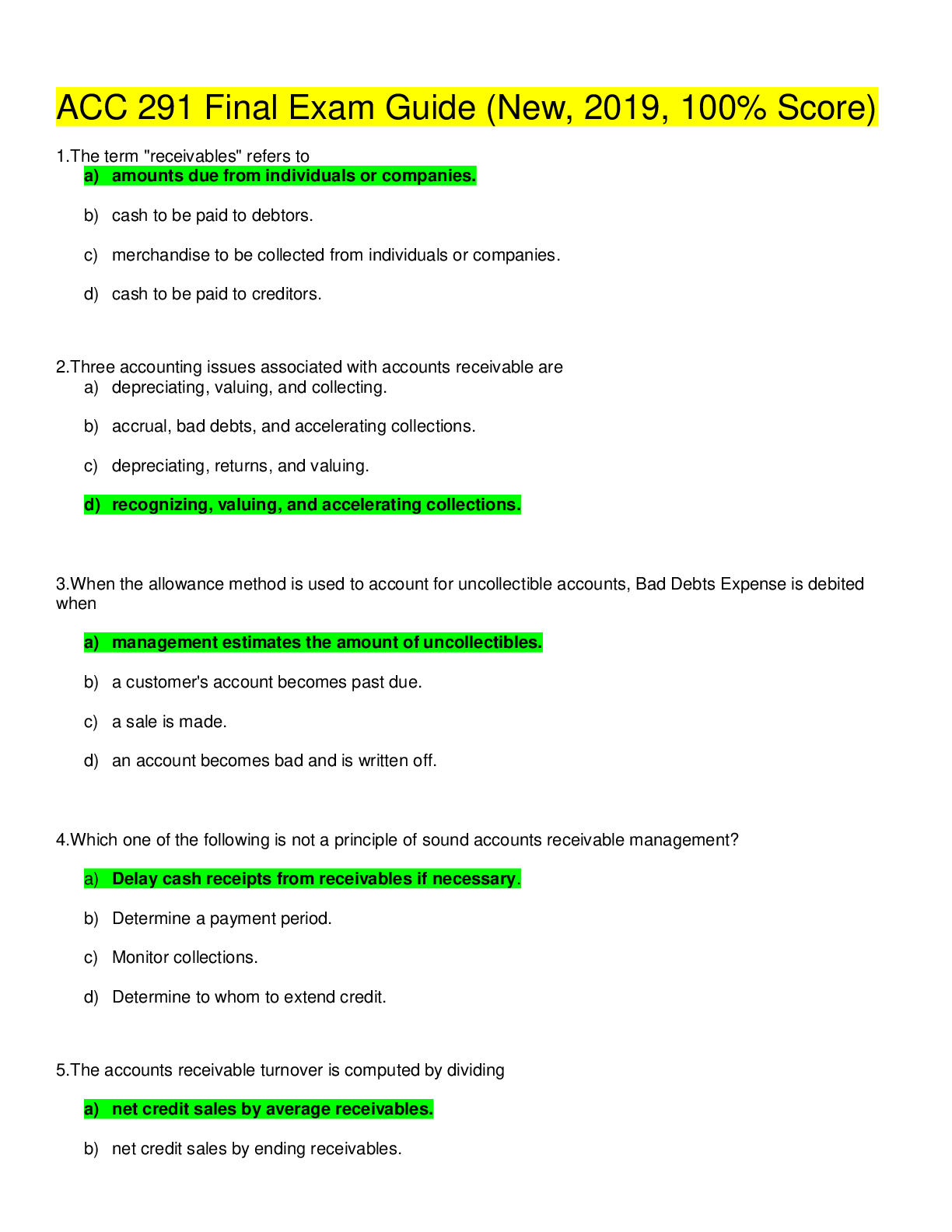

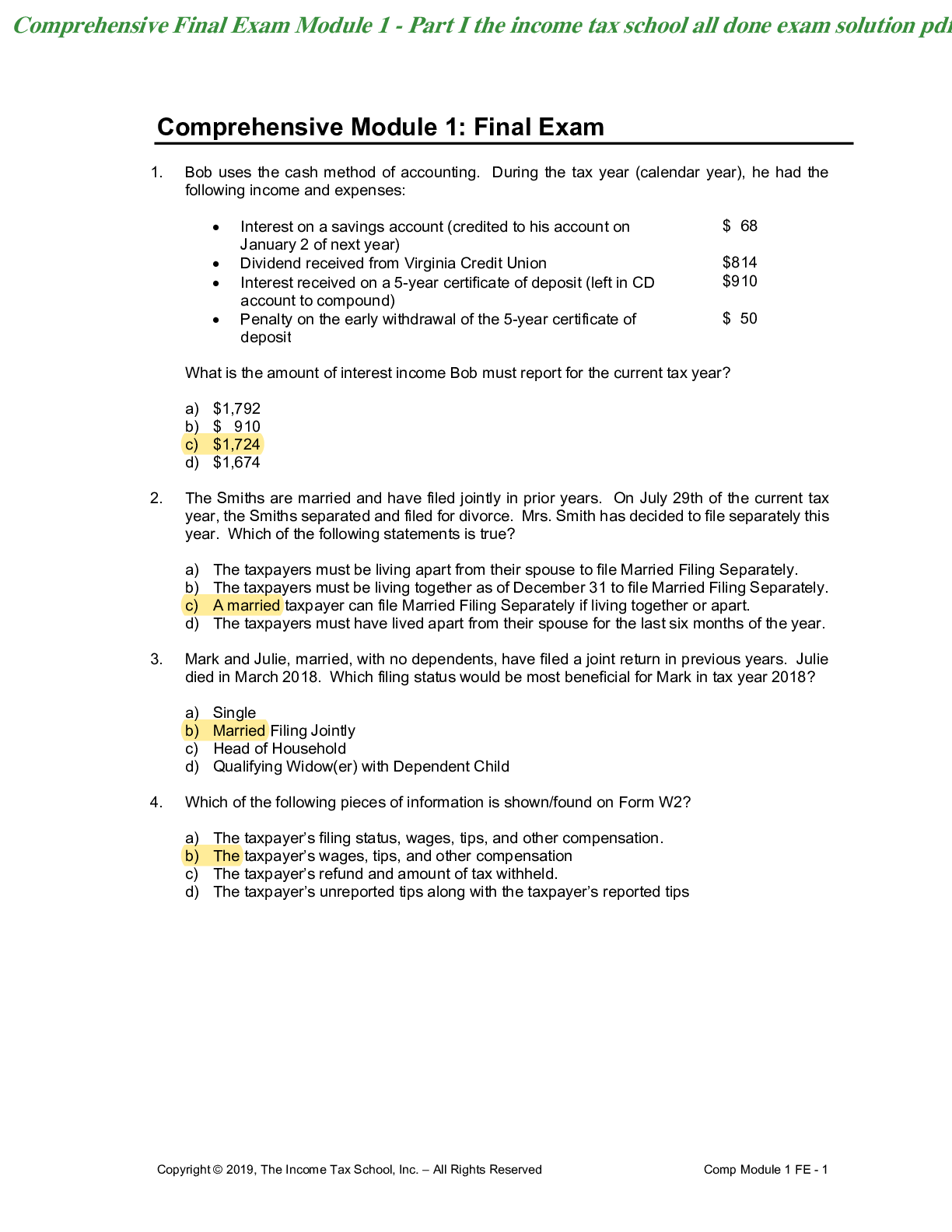

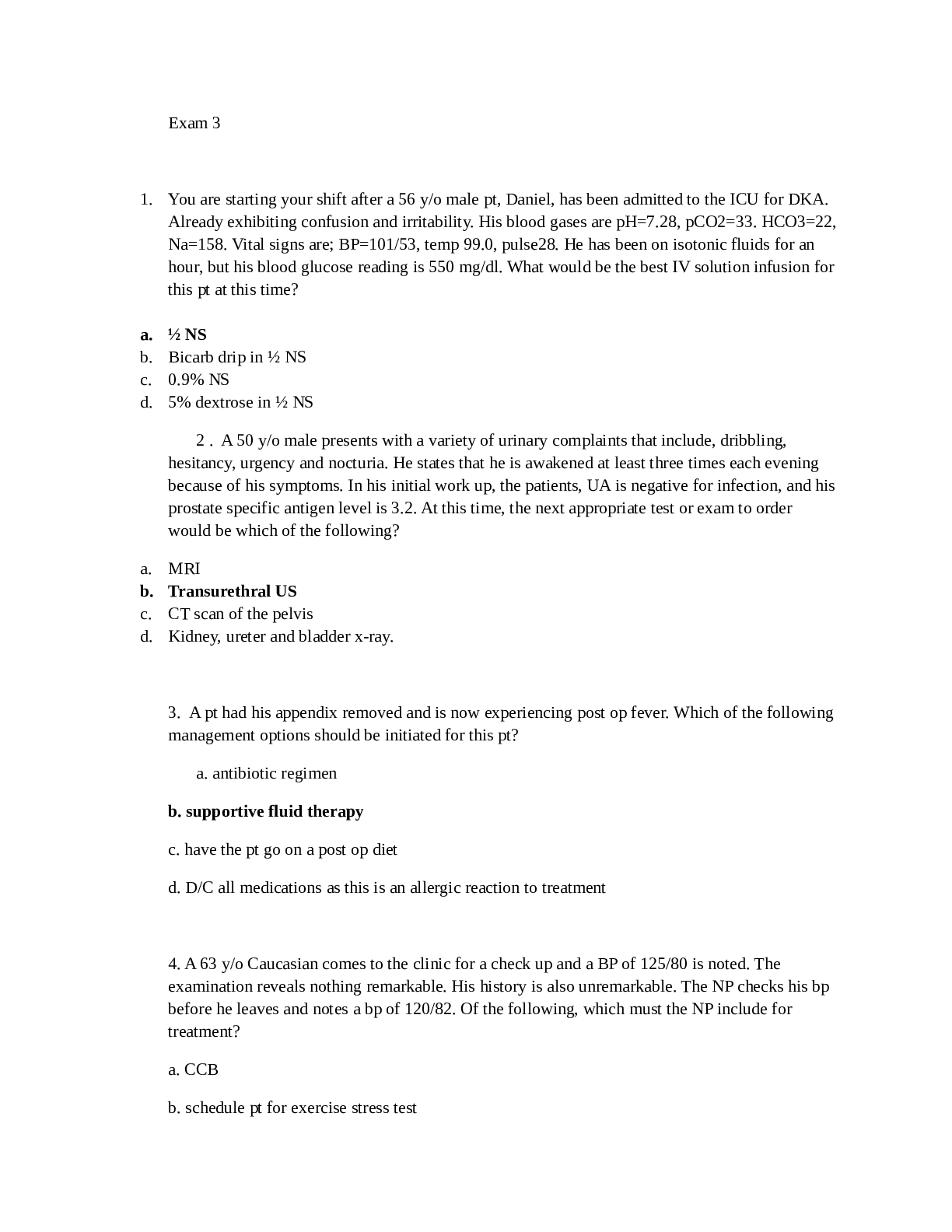

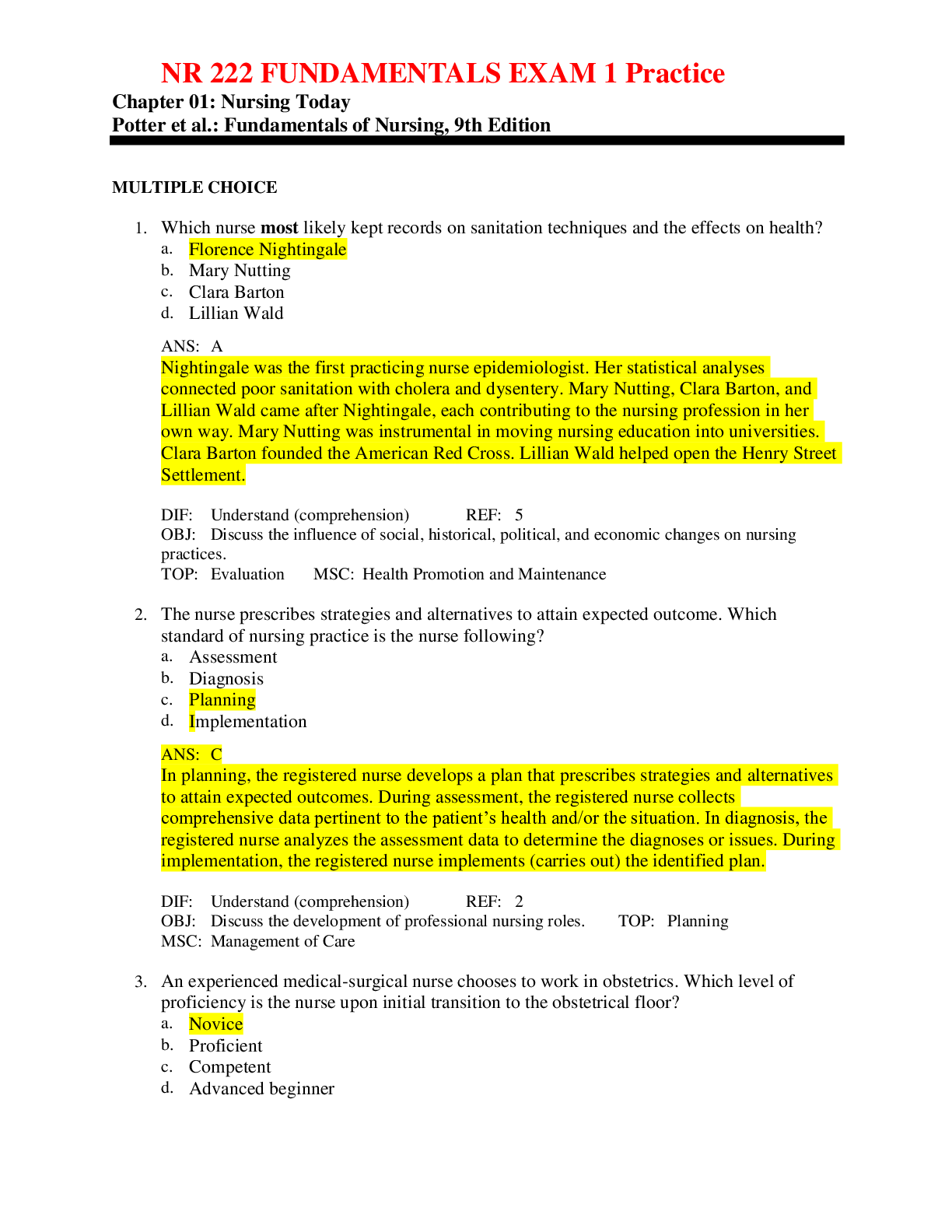

Comprehensive Module 1: Final Exam 1. Bob uses the cash method of accounting. During the tax year (calendar year), he had the following income and expenses: • Interest on a savings account ... (credited to his account on January 2 of next year) $ 68 • Dividend received from Virginia Credit Union $814 • Interest received on a 5-year certificate of deposit (left in CD account to compound) • Penalty on the early withdrawal of the 5-year certificate of deposit $910 $ 50 What is the amount of interest income Bob must report for the current tax year? a) $1,792 b) $ 910 d) $1,674 2. The Smiths are married and have filed jointly in prior years. On July 29th of the current tax year, the Smiths separated and filed for divorce. Mrs. Smith has decided to file separately this year. Which of the following statements is true? a) The taxpayers must be living apart from their spouse to file Married Filing Separately. b) The taxpayers must be living together as of December 31 to file Married Filing Separately. c) A married taxpayer can file Married Filing Separately if living together or apart. d) The taxpayers must have lived apart from their spouse for the last six months of the year. 3. Mark and Julie, married, with no dependents, have filed a joint return in previous years. Julie died in March 2018. Which filing status would be most beneficial for Mark in tax year 2018? a) Single b) Married Filing Jointly c) Head of Household d) Qualifying Widow(er) with Dependent Child 4. Which of the following pieces of information is shown/found on Form W2? a) The taxpayer’s filing status, wages, tips, and other compensation. b) The taxpayer’s wages, tips, and other compensation c) The taxpayer’s refund and amount of tax withheld. d) The taxpayer’s unreported tips along with the taxpayer’s reported tips 5. Dani is a 25-year old full-time graduate student. Following are the tax-related facts we know about Dani. • Beginning in tax year 2018, Dani is no longer a dependent on her parent’s tax return. • Dani was laid off at her job on October 15th and received a Form W-2 for earnings from January through October. • Dani received unemployment income from October 15th through December 31st after being laid off from her job. • Dani paid for her graduate school education in the current tax year and is eligible for a nonrefundable tax credit. Which Schedule(s) must Dani complete in addition to Form 1040? a) Schedules 1 and 3 b) Schedules 1 and 2 c) Schedule 6 d) Schedules 3 and 5 6. Which of the following statements is most accurate as related to the requirements of a paid tax preparer?. A paid preparer must sign the taxpayer’s tax return and provide their SSN on the return. The paid preparer must sign the taxpayer’s tax return and provide their PTIN on the tax return. c) A paid preparer must sign the taxpayer’s tax return, provide their SSN and PTIN on the tax return. d) A paid prepaprer must provide their PTIN on a taxpayer’s tax return. 7. Don, age 18, is being claimed as a dependent on his parent’s tax return. Which of the following would require Don to file a tax return? Don is married and has earned income totaling $12,000. Don also has unearned income totaling $295. b) Don is single and has earned income totaling $12,000. c) Don’s only source of income was unearned interest income totaling $1,000. d) Don has unearned interest income totaling $1,000 and earnings totaling $11,000 from a part-time job. 8. Henry and Jane are married and file jointly. Jane’s birthday is 12/31/1953 and Henry’s birthday is 1/1/1954. What is their filing requirement for 2018? a) $24,000 b) $25,300 c) $26,600 d) $28,500 9. Mary’s husband, Bob, died March 12, 2018. She married Richard on December 15, 2018. What will Bob’s filing status be? a) Single b) Married Filing Jointly c) Married Filing Separately d) Head of Household 10. Bob died March 12, 2017, leaving Mary with a two-year-old son. If Mary does not remarry, what is the most beneficial filing status Mary could use for the tax year 2018? a) Married Filing Jointly b) Married Filing Separately c) Head of Household d) Qualifying Widow(er) with Dependent Child 11. Bob died March 12, 2015, leaving Mary with a two-year-old son. In the tax year 2018, Mary has not remarried, what would be the most beneficial filing status Mary could use? a) Single b) Married Filing Jointly c) Qualifying Widow(er) with Dependent Child d) Head of Household 12. Mr. and Mrs. Collins were having marital problems and temporarily separated in May 2018. Their two young children live with Mrs. Collins. They don’t want to file a joint return. When would a taxpayer be considered unmarried and able to file as Head of Household? a) The taxpayer is married and living with his spouse as husband and wife. b) The taxpayer is living with his spouse in a common-law marriage that is recognized in the state where he now lives, or in the state where the common-law marriage began. c) The taxpayer is married and living apart from his spouse in August, but not legally separated under a decree of divorce or separate maintenance. The spouse did not live in the home at all during the last six months of the year, has a qualifying child, and is otherwise eligible to file as Head of Household. 13. Which scenario can use Form 1040 with no Schedules attached? a) Married taxpayers with W-2 income and capital gains from stock sales. b) A single teacher who deducts educator expenses. c) A married couple with interest and dividends totaling less than $1,500, two dependents, with childcare expenses. d) A single taxpayer with distributions from an IRA retirement plan, Social Security income, and interest income. 14. Mr. Simpson died on September 26, 2018. Mr. Simpson failed to file tax returns for tax years 2016 and 2017. The Simpsons divorced in 2016. Mrs. Simpson filed her tax return using the Married Filing Separate filing status. Who is responsible for filing Mr. Simpson’s final returns? a) His mother must file all returns. b) His attorney must file all returns. c) His administrator must file all returns. d) His ex-wife must file the 2016 tax return, and the administrator must file the 2017 and 2018 tax returns. 15. Allen, a fiscal year taxpayer, is trying to determine the final date for submitting his tax return. His fiscal year begins on April 1 and ends on March 31. Which of the following would be Allen’s due date for filing his tax return? b) April 15th unless the due date falls on a Saturday, Sunday or legal holiday. c) The due date will be the last day of the month following the end of his fiscal year. d) June 15th, unless the date falls on a Saturday, Sunday or legal holiday. 16. Mr. and Mrs. Kelly have completed their joint return and want to mail it to the IRS. They will file Form 1040, schedules, forms, and worksheets. They are ready to assemble their return for mailing. Which of the following statements is correct? All applicable forms, schedules, attachments, and worksheets must be included. Form 1040 should be the first form. All applicable forms and schedules (with any applicable attachments) should then be included in order by sequence number. c) They must sign their tax return, have it notarized, mail the original and retain a copy. d) The IRS does not accept returns by mail. Tax returns must be electronically filed through an IRS approved software. 17. The Browns filed their tax return using the Married Filing Jointly filing status, and they have four dependents. All of the following would qualify as a dependent except: a) A qualifying child b) A qualifying foster child c) A parent d) A spouse 18. Mr. Costello died on March 15, 2018. His 2017 return had not yet been filed. His personal representative will file all necessary tax forms. In tax year 2017 and 2018, Mr. Costello received income from a pension, Social Security, dividends, and interest. Which of the following statements is correct? a) The decedent’s personal representative must file Form 1310 for Mr. Costello if he claims a refund. b) The personal representative should include all income received by Mr. Costello up to the date of death and file the tax return by the due date in 2018. c) The personal representative will prepare and submit the 2017 and 2018 tax returns no later than April 15, 2019. The personal representative will file Mr. Costello’s 2017 return by the due date and then will file the final return for 2018 (through the date of death) by the due date in 2019. 19. Forms 1099 were issue to Clark for the following types of income: • Dividends on various common stocks • Distributions totaling $40,000 from an employer pension plan • Social Security payments • Interest income totaling $5,000 from various certificates of deposit • Miscellaneous income of $10,000 from handyman jobs Clark is worried about not having enough federal withholding to cover his tax liability and incurring a penalty when he files for the year. Which of the following statements is correct? Dividends are always subject to backup withholding on Form 1099-DIV. Withholding is not required on any of these types of income. However, Clark can either request withholding or plan to make timely estimated payments to fullfil his tax liability obligations. c) Since 20% is automatically withheld from his Social Security benefits on Form SSA-1099, he will only get a different withholding rate if he specifically requests it. d) He can only request withholding on the distributions from the employer pension plan. 20. Ann, age 18, lived with her parents Jim and Amy all year. She is married, and her husband is stationed overseas. Ann’s parents provided more than 50% of her support for the year. Ann and her husband file a joint return. When Jim and Amy file their joint return, they should: a) Not claim Ann as a dependent. b) Claim Ann and her husband as dependents. c) Claim Ann as a dependent since she is under 19 and they provided more than half of her support. d) Claim Ann as a dependent because she is their daughter under age 19. 21. Doris is explaining the citizen or resident test for claiming a dependent to a client. Which of the following statements concerning this test is correct? a) Canadian residents do not meet this test. b) Adopted children who are not U.S. citizens when legally adopted cannot meet this test. c) Foreign exchange students who reside with an American citizen for at least six months meet this test. United States resident aliens, American Samoans, and Mexican residents meet the citizenship or resident test. 22. Brenda and John are married, file a joint return, and have a son (Ben, age 5). They lived with Brenda’s mother the entire year. Brenda is 32 years old. She earned $15,000, and her mother earned $28,000 for the tax year. John earned $25,000. Which of the following statements is correct? a) Brenda and John would claim Ben as a qualifying child unless they both choose not to claim their son as a qualifying child. b) Brenda’s mother would claim Ben as her qualifying child since she has the highest AGI. c) Brenda and John must claim Ben as a qualifying child. d) Only Brenda’s mother can claim Ben as a qualifying child since she had the highest AGI, and Ben lived with her for the entire year. 23. Bill has a full-time and part-time job. He wants to change his federal withholdings for both jobs. What does Bill need to do to change his federal withholdings? a) Contact the payroll department for both jobs and tell them how much he wants withheld per pay period. b) Bill needs to complete a new Form W-4 and mail it to the IRS. Once the IRS has Bill’s new Form W-4 in their system, the IRS will notify Bill’s employers about the change in withholdings. Bill must notify his employers, in writing, of the changes he wants made to his withholdings. Bill must complete Form W-4 for each employer to determine how many withholding allowances he is eligible to claim. Bill would then provide a completed Form W-4 to each employer. 24. Which of the following statements is most accurate? The taxpayer is the only person allowed to complete and submit a Form W-4 to an employer. At a minimum, the taxpayer should complete Form W-4 annually to determine if his withholdings are adequate. b) The taxpayer is the only person allowed to complete and submit a Form W-4 to an employer. There is no need for the taxpayer to complete a new Form W-4 unless his tax return has a balance due of $1,000 or more. c) A professional preparer is the only person allowed to complete Form W-4 for a taxpayer. An updated Form W-4 must be completed and filed with the taxpayer's tax return. d) The IRS is responsible for sending an updated Form W-4 to a taxpayer’s employer. The IRS will send an updated Form W-4 to an employer after the taxpayer’s return is processed. 25. George and Martha are married, lived together all year, both 67 years old, and file separate returns. Their itemized deductions total $19,000. Martha files her return and claims $14,000 in itemized deductions. What standard or itemized deduction should George and Martha claim on their tax returns? a) Martha: $14,000 itemized deduction; George: $5,000 itemized deduction b) Martha: $14,000 itemized deduction; George: $12,000 standard deduction c) Martha: $14,000 itemized deduction; George: $13,300 standard deduction d) Martha: $14,000 itemized deduction + $1,300 extra deduction for age 65 or older, George: $5,000 itemized deduction + $1,300 extra deduction for age 65 or older. 26. Dollie Kincaid is single with no dependents. Dolly has a fulltime job where she earns $62,575 annually. Dollie also has a part-time job where she earns $1,300 annually. Complete the following section of worksheet from Form W-4 for Dollie. Determine how many withholding allowances would be entered on Line H of the worksheet and Dollie’s filing status. a) Dollie will use the Single filing status and claim one allowance on lines A, D, and F for a total of 3 allowances on line H. Dollie will use the Single filing status and claim one allowance of lines A and D for a total of 2 allowances on line H. c) Dollie will use the Head of Household filing status and claim one allowance on lines A, C, and D for a total of 3 allowances on line H. d) Dollie will use the Single filing status and claim one allowance on line A and two exemptions on line D for a total of 3 allowances on line H. 27. Bob is single and has no dependents. Last tax year Bob was refunded all federal withholding because he had no tax liability. Since his income and circumstances are not expected to change, Bob isn’t expecting to have a tax liability for the current tax year. Which of the following statements is most accurate? Bob should complete a new Form W-4 no later than February 15th. Bob should claim to be exempt from federal withholding by writing “Exempt” on line 7 of Form W-4. b) Bob should complete a new Form W-4 no later than January 1st. Bob should claim to be exempt from federal withholding by writing “Exempt” on line 7 of Form W-4. Bob must attach the new Form W-4 to his prior-year tax return to prove he had no tax liability in the prior tax year. The prior year Form 1040 and W-4 must be mailed to the IRS. c) Bob should write “Exempt” at the top of Form 1040 and ask his employee to stop withholding federal taxes. d) Bob should complete a new Form W-4 using the Single filing status and claim ten exemption to ensure that his employer doesn’t withhold federal income tax. 28. Wiley Kayodee worked fulltime until March 1st, at which time he requested to move to a part- time schedule. Although Wiley had a small balance due on his federal tax return last year, his tax preparer projects he will not have a federal tax liability for the current tax year. Which of the following statements is most accurate? Wiley should complete a new Form W-4 for the current tax year and claim to be exempt. Wiley should complete a new Form W-4 to determine if he should change the number of allowances he should claim or claim to be “exempt.” c) Wiley cannot change his Form W-4 after February 15th. d) Wiley must change his Form W-4 and submit it to his employer within ten days. 29. Tim will receive considerable tip income this year. Tim knows the tip income is subject to federal tax but, is uncertain about whether the tips are subject to federal tax withholding. Which of the following statements concerning tax withholding on tip income is correct? a) If Tim’s pay is too low to withhold all taxes, he must give his employer money to cover the shortage. b) Tip income is not subject to Social Security and Medicare tax withholding. c) All tips are subject to income tax withholding. d) Taxes will be withheld only on reported tips, not allocated tips. 30. On August 14th, Olaf was involved in an electrical accident which left him completely blind in one eye and only partial vision in the other eye. Olaf’s ophthalmologist was able to correct Olaf’s vision to 20/200 with a prescribed contact lens in one eye. However, due to the pain, Olaf can only wear the contact lens for a few hours each day. Olaf’s vision is not expected to improve beyond the present condition. Is Olaf entitled to the higher stand deduction for blindness? a) No, Olaf must be completely blind in both eyes to be eligible for the higher standard deduction. b) No, Olaf is not entitled to the higher standard deduction because his vision is correctable with a contact lens. Yes, Olaf is entitled to the higher standard deduction because he can only wear the contact lens briefly. d) Yes, Olaf is entitled to the higher standard deduction, but only beginning in the year following the accident. 31. Lester is retired with only investment income and prefers not to make estimated tax payments. If he has a balance due, he’d rather pay the entire balance due when he files his tax return. Which of the following statements is most accurate? Lester had a tax liability in the previous tax year and expects to owe approximately $1,350 in the current tax year. Lester must make estimated payments. b) Lester had a tax liability in the previous tax year and expects to owe approximately $990 in the current year. Lester must make estimated payments c) He was a U.S. citizen or resident for the whole year and his prior-year tax year covered a 12 month-period. Lester is not required to make estimated tax payments d) Lester had no tax liability for in the previous tax year, was a U.S. citizen for the entire year and his prior tax year tax return covered 12-months. Lester had withholding of $2,650, but expects to owe $1,000 in the current year. Lester must make estimated tax payments. 32. Dan and Sara are married and plan to file separate returns. They have lived together all year. Which of the following statements is correct? a) They both have the choice of itemizing deductions or taking the standard deduction no matter what the other spouse does. b) Dan and Sara both filed using the standard deduction. After filing, Dan found that he could have itemized. Dan can file the amended return without Sara’s consent. Sara will not need to make changes to her tax return. c) Dan and Sara have no choice; they must itemize their deductions if they decide to file Married Filing Separately. If one spouse itemizes deductions, the other spouse must also itemize. 33. Ray’s preparer tells him that he may owe an underpayment penalty on this year’s taxes. Which of the statements below would prevent a taxpayer from owing an underpayment penalty? a) He fails to withhold enough income tax. b) He fails to make the required estimated tax payments. c) He fails to make estimated tax payments on time. d) He did not have a tax liability in the previous tax year. 34. Jeff is 18 years old. He lives with his parents, who claim him as a dependent on their joint return. Jeff works part-time, earned $4,500, and files his a tax return. What would Jeff’s standard deduction be? a) $1,050 b) $1,400 c) Jeff is not entitled to a standard deduction since his parents claim him as a dependent. d) $4,850 35. Greg has a balance due on his current year’s tax return. He will not owe a penalty if his total tax, less withholding, is less than which of the following amounts? a) $1,500 c) Last year’s tax liability d) $2,000 36. Greg’s preparer tells him he may be required to pay estimated taxes. Which of the following conditions would cause Greg to be required to pay estimated taxes? a) He expects to owe at least $400. b) He expects to owe Federal income taxes. d) Only if he receives a Form 1099. 37. Wayne’s employer provides meals and lodging on business trips. Taxpayers can avoid reporting the value of the meals and lodging income in all of the following situations except: a) The meals are furnished on the business premises of the employer for the convenience of the employer. b) Lodging is furnished on the business premises of the employer for the convenience of the employer. c) When meals and/or lodging are a condition of employment (the taxpayer must accept meals and/or lodging to properly perform their duties). d) The lodging is convenient for the employee to get to work quickly. 38. Riley received benefits from a medical insurance plan for which his employer paid 75% of the premiums. The employer’s contributions are not included in Riley’s gross income. Riley received reimbursed for more than his medical expenses for the calendar year. What part, if any, of the excess reimbursements, would be taxable to Riley, the employee? a) All the excess reimbursements would be taxable to Riley. b) Riley must include 75% of the excess reimbursement in income. c) None of the excess reimbursements would be taxable to Riley. d) Riley must include 25% of the excess reimbursement in Riley. 39. Connie’s employer-provided her with a company vehicle that she is allowed to drive home and use for personal use. What part of the vehicle usage is taxable to Connie? a) Connie’s business and personal use of the vehicle is taxable. b) None of the vehicle usage is taxable to Connie. c) Only the personal use portion that is not commuting to and from work is taxable. d) All of Connie’s personal use of the vehicle is taxable. 40. Teresa’s employer sold her a new car at a discount. To prevent Teresa from paying taxes on the discount she received, which of the following statements must be true? The discount Teresa received must be the same discount offered to customers in the ordinary course of business in which Teresa works. b) The employer must decide before the sale if he is going to report the discount as a taxable fringe benefit. c) Teresa must pay cash for the car. d) Teresa’s employer must offer the same discount plus 20% to all customers. 41. Becky is a flight attendant for a company that owns both an airline and a hotel chain. Her employer allows her to take personal flights, only if there is an unoccupied seat. He also allows her to stay in any one of their hotels, only if there is an unoccupied room, at no cost. What value will Becky report as income? a) Becky will not be required to report any value as income. b) Becky will report the value of the flight as income. c) Becky will report both the value of the flight and the hotel stay as income. d) Becky will report only the value of the hotel stay as income. 42. Sam’s employer provides transportation benefits. All of the following are qualified transportation benefits except: a) A transit pass for Sam to take the train to work. b) Reimbursement for tolls for Sam to get to work faster. c) Onsite parking at the job site. d) The Rideshare van Sam shares with other employees from work to a set drop off location. 43. Sam’s employer provides his employees with the following benefits. All the benefits would be considered de minimis except: a) Company picnics b) Cab fare home when working overtime c) A gift card d) Discounts at the company cafeteria 44. The Smiths are separated and live in a community property state. They may have to allocate all of the following items unless: a) They only have wages to report. b) They itemize deductions c) They qualify for credits d) They file a joint return. 45. Troy needed to have the transmission in his car rebuilt. Gene, Troy’s best friend, offered to rebuild the transmission in exchange for an old pickup truck belonging to Troy. Troy agreed and gave the truck to Gene. The value of the service Gene provided is $950. The value of the pickup is $750. How much bartering income must Troy report on his tax return? a) $ 950 b) $ 750 c) $ 0 d) $1,700 46. Sam started a new job and was told his employer offers a cafeteria plan. Which of the following is an example of a cafeteria plan? a) A plan allowing an employer to have an onsite facility for employee meals b) A corporate citizen plan to furnish meals to low-income residents c) An arrangement whereby an employer offers a choice of a nontaxable accident or health insurance. d) A plan awarding the employee with a variety of stock options 47. Last year John received a refund of an item he previously used as a deduction on his tax return. All of the following would be considered a taxable recovery item the following year except: a) A refund of a medical expense deducted in a prior year b) Reimbursement of an employee business expense deducted in a prior year c) Mortgage interest refund d) A state refund received for a tax year during which the taxpayer used the standard deduction 48. John is unsure how to report recoveries on his tax return. Which of the following is true regarding the reporting of recovery items? a) John only has to report recoveries that were itemized deductions. b) John does not have to report medical expenses since the deduction is limited. c) John must report any item that reduced his tax liability in the previous tax year. d) John is only required to report deductions, not credits he received. 49. Thomas received the following items paid by his employer and does not know if he is required to report these items on his tax return. Identify the taxable item for Thomas. a) $50,000 of group term life insurance b) $4,000 tuition for taking classes c) Breakroom donuts and coffee d) Vacation pay 50. Taxpayers are required to report all the following items on a tax return as income except: a) Employer-paid disability insurance. b) Bargain purchase of merchandise from an employer. c) Employer-paid health insurance plan covering an employee and his family. d) An interest-free loan from an employer. 51. Mandy was discharged from the military for medical reasons. Which of the following sources of income is considered taxable? a) Mandy’s income received before her discharge from the military. b) Educational benefits from the Department of Veterans Affairs. c) Disability compensation from the Department of Veterans Affairs. d) Child support payments from her ex-husband. 52. Sue and her husband divorced in 2018, and Sue received alimony. Which form of payment would be considered alimony? a) Transfer of services or property b) Execution of a debt instrument by the payer c) Cash payments (checks or money orders) d) The use of property 53. Sue’s divorce decree was amended to add child support to the alimony. Sue’s child support payments are: a) Alimony b) Taxable c) Nontaxable d) Voluntary 54. Tony and Jeff were married in a community property state. Although married, they will file separate returns. Which of the following items would be considered community property/income? a) Tony’s rental property in New Jersey that he had for five years before the marriage and still maintains. b) Jeff’s inheritance from his great-aunt that he received two years ago. c) Income Jeff receives from a family partnership incorporated in Delaware. d) The house Jeff and Tony purchased in the community property state with money from a joint account. 55. Tyler was laid off from his job earlier this year. He received unemployment income, child support for his son, and investment income from stocks and bonds. Since being laid off, Tyler starting painting scenic pictures to keep himself busy while his son is in school. Several of Tyler’s friends have purchased pictures Tyler painted. Which of the following types of income is considered an activity, not for profit? a) Unemployment income b) Child support c) Income received from friends for the painted pictures d) Investment income from stocks and bonds 56. Wilson’s employer offers health insurance. Wilson’s excess medical reimbursement would be fully taxable in all situations except: a) If Wilson pays all the premiums himself. b) The employer pays part of the premiums. c) Wilson pays part of the premiums. d) The employer did not include the contribution in the taxpayer’s income. 57. Ben’s medical insurance policy is $5,000 a year. His employer pays half of the premiums. If Ben receives excess medical reimbursement from his employer, how much does he need to report as gross income? a) None since his employer pays half of the premiums. b) 100% of the reimbursement he receives. c) Half of the amount he receives as reimbursement. d) The amount of the reimbursement up to $5,000. 58. All the following are examples of interest income except: a) Income from money market funds b) Gifts received for opening a savings account in a financial institution c) Dividend received from a credit union d) Income received from U.S. obligations 59. Geoffrey received ordinary dividends from the following U.S. sources: • Acme Corp. $ 59 • CDR, Inc. $ 172 • VTEC $ 1,642 • BETA, Inc. $ 128 How should Geoffrey report his dividends income on his tax return? a) On line 3a of Form 1040 with no schedule required b) On line 2b of Form 1040 and Part I of Schedule B c) On line 3b of Form 1040 with no schedule required d) On line 3b of Form 1040 and Part II of Schedule B 60. Marilyn received ordinary dividends from the following sources. All the income is from U.S. sources. • TTS, Inc. $ 968 • PFS, Corp $ 515 How should Marilyn report the dividends she received on her tax return? a) On line 2b of Form 1040 b) On line 3a of Form 1040 c) On line 3b of Form 1040 with no schedule required d) On line 3b of Form 1040 and Part II of Schedule B 61. Mary has the following distributions from her investing companies. What is the amount of her nontaxable distributions? $ 500 Liquidating dividends from ABC Corp. (Stock basis after distribution $900) $1,800 Return of capital distribution from XYZ Co. (Stock basis after distribution $850) $1,200 Ordinary dividend distribution from M&M Co. a) $ 500 b) $1,800 c) $2,300 d) $3,500 62. Kelly is interested in investing some of her money in mutual funds. All of the statements below are true except: a) A mutual fund is a regulated investment company generally created by “pooling” funds of investors to allow them to take advantage of a diversity of investments and professional management. b) A distribution received from a mutual fund may be an ordinary dividend, a capital gain distribution, an exempt-interest dividend, a nontaxable return of capital or, a combination of two or more of these types of distributions. c) Distributions from a mutual fund are reported on Form 1099-DIV or a similar statement indicating the type of distributions. Mutual fund distributions are always taxable. 63. Tina received the following distributions from her mutual fund. Which of the following statements is correct? Ordinary dividend: $ 680 Capital gain distribution: $1,280 Exempt-interest dividend: $ 600 Return of capital: $ 500 Tina will report $680 as ordinary income, $1,280 as long-term capital gains, and $1,100 as nontaxable distributions. b) Tina will report $1,180 as ordinary income; $1,280 as long-term capital gains, and $600 as nontaxable distributions. c) Tina will report $1,960 as ordinary income and $1,100 as nontaxable distributions. d) Tina will report $680 as ordinary income, $1,780 as long-term capital gain, and $600 as nontaxable distributions. 64. Wendy received the following dividend income: • Capital, Inc. (ordinary dividends) $ 68 • ERC (ordinary dividends) $757 • Maapco (ordinary) $814 • Maapco (reinvested) $858 • Federal Credit Union $910 What is the amount of her taxable dividend income? a) $1,639 b) $2,497 c) $ 858 d) $1,768 65. Mark and Alice had the following income: • Dividends from the credit union $ 974 • Conco ordinary dividends $ 658 • Duval Fund (ordinary dividends) $ 169 • Reinvested dividend in Exxon Corp $ 500 • Media Corp (liquidating dividends, the stock basis has not been recovered yet) $ 245 What is the amount of dividend that taxed as ordinary income? b) $1,072 c) $1,801 d) $2,046 66. John and Joan had the following income during the year: • Dividends from the credit union $ 974 • Interest from National Bank $ 875 • Municipal bond interest $ 205 • Series EE bond interest (used to pay qualified education expenses) $ 547 • Interest received on a personal loan $1,458 How should John and Joan report their income on Schedule B (Form 1040) for 2018? a) Report $875 interest from National Bank, $547 Series EE bond interest, and $1,458 interest received on a personal loan on line 1 of Part I; report $547 on line 3 of Part I, and report $974 on line 5 of Part II. Report all the interest income items on line 1 of Part I, and report $547 on line 3 of Part I. Report $ 974 dividends from the credit union, $875 interest from National Bank, $547 Series EE bond interest, and $1,458 interest received on a personal loan on line 1 of Part I, and then report $547 on line 3 of Part I. d) Report all the interest income items on line 1 of Part I, and then report $752 on line 3 of Part I. 67. Tony is a cash method taxpayer. He is attempting to understand the concept of constructive receipt of interest income. He has received the following types of interest income: • Dividends from the credit union (credited on Jan. 2, 2019) $ 974 • Interest from National Bank (credited on Dec 31, 2018) $ 875 • Interest for the 2nd year of a 5-year Certificate of Deposit (credited on Dec 31, 2018, penalty for early withdrawal) $ 658 • Gift for opening account received in June 2018 $ 169 • Series EE savings bond interest (deferred to maturity) $ 547 What amount of taxable interest income should Tony report for 2018? a) $1,702 b) $2,249 c) $1,533 d) $2,676 68. In 2018, Josephine, a cash method taxpayer, purchased some Series EE and Series I savings bonds issued at a discount. Josephine is wondering how she would report the interest income from bonds. Which of the following statement is correct? a) Josephine must report the increase in redemption value as interest each year. b) If Josephine is an accrual basis taxpayer, she can postpone reporting interest until she receives it or until the bonds mature, whichever is earlier. Josephine can postpone reporting the interest income until the earlier of the year the bonds are disposed of or the year they mature, or she can choose to report the increase in redemption value as interest in each year. d) Josephine must postpone reporting the interest until she receives it or until she disposes of the bonds, whichever is earlier. 69. Jack has been using a calendar year accounting period for his federal returns since he began filing. He believes that a switch to an accounting period of July 1 – June 30 would be much easier for him from a record-keeping standpoint. What must he do to change the accounting period for his individual income tax return? a) File his next return with the IRS using the new accounting period. b) He must continue using a calendar year. c) He must submit Form 1128 to IRS to request a change to his accounting period. d) He must submit a letter to IRS which details his reasons for wanting to change his accounting period and request permission to make the change. 70. Cassidy and Megan are married and have received income from the following sources during the tax year: Interest from Austin FCU $ 369 Interest from Crestar Bank $ 195 Interest from U.S. Treasury bills $ 259 Interest from Virginia State municipal bonds $ 197 Interest from Virginia state Henrico County municipal bonds $ 114 What is the amount of nontaxable interest that Cassidy and Megan must report on their return for the tax year? a) $ 197 b) $ 570 c d) $1,134 71. David received interest income during the year. He knows that some of his interest income is nontaxable. However, he does not know how to report the nontaxable interest income. All of the following are correct, except: a) Interest paid by state and local governments is exempt from federal but may be taxable at the state level. b) Tax-exempt interest must be reported on line 2a of Form 1040. c) Tax-exempt interest should not be reported on Schedule B. d) All interest income is taxable on the federal tax return regardless of the source. 72. Gerald had the following types of income: Wages $ 175,000 Interest from Fidelity Bank $ 649 Aggregate total $ 21,633 Dividends from Good Brothers $ 1,749 Aggregate total $ 249,895 Interest from a bank in India $ 299 Aggregate total $ 8,300 Which forms must Gerald file with his return? a) Form 1040, Schedule 1 b) Form 1040, Schedule D c) Form 1040, Schedule B d) Form 1040, Schedule B, and FinCEN Report 114 73. Lisa and John are married with one child, age 6. Lisa did not have any income during the tax year. John paid educator expenses and student loan interest. a) They file Form 1040, Schedule 3 b) They file Form 1040 with no schedules c) They file Form 1040, with Schedule 4 d) They file Form 1040 with Schedule 1 74. Sara and Joe are married with two children. Which of the following is a test for a qualifying child? a) The taxpayer’s child must have lived with the taxpayer for the entire year. b) Under the age of 18 (or 24 if a full-time student) at the end of the tax year and younger than the taxpayer or his spouse. c) The child must not have provided more than half of their own support for the year. d) The qualifying child’s gross income must be less than $4,150 for the tax year. 75. Mark and Dora divorced last year on April 1. Ben is their 10-year-old son. Ben lived with Dora after the divorce until August 17. He then moved in with Mark for the rest of the year. Mark’s AGI was $75,000, and Dora’s AGI was $55,000. Dora’s mother stayed with Ben at Dora’s house for four days in July when Dora went on a business trip. Ben then stayed at a friend’s house for five nights in July. Which of Ben’s parents is the custodial parent for purposes of claiming Ben as a qualifying child? a) Mark is the custodial parent since he had a higher income. b) Dora is the custodial parent since Ben lived with her for the greatest number of nights. c) Mark is the custodial parent since Ben lived with him for the greatest number of nights. d) Ben is not treated as living with either parent in the year of the divorce. 76. Ted and his siblings provided total support to his elderly father. Based on the following amounts of support provided by Ted and each of his siblings, who is eligible to claim their father as a dependent using the multiple support agreement? • Ted provided $6,200 for support • Ted’s brother Jack provided $2,000 for support • Ted’s sister Ann provided $3,750 for support • Ted’s brother Bob provided $5,000 for support • Ted’s sister Doris provided $4,000 for support a) Ted or Bob b) Ted only c) Ted, Bob, or Doris d) Ted, Ann, Bob, or Doris 77. John is a rising senior in high school. He has been competing for college scholarships since the beginning of his junior year. He has been awarded the following: • A $2,000 award which must be used only for tuition and fees at any accredited college. • An additional $1,000 received for research services to be performed by John as a condition of receiving the $2,000 scholarship indicated above. • A $3,000 award which may only be used for tuition, fees, books, supplies, or equipment at an accredited college. • A $2,500 award which may be used for tuition and fees, books, and room and board at an accredited college. • A $1,500 scholarship prize that John received by entering a contest. He can use it for any purpose. What total amount of qualified scholarships or fellowships can be excluded from John’s income? a) $7,500 b) $6,000 c) $9,000 d) $5,000 78. Mark is an ordained minister. Some rules will make certain types of income exempt from income tax, but still subject to self-employment tax. He received income during the tax year for the following items. • A housing allowance of $1,500 per month ($18,000 for the year) which was provided to Mark as part of his pay from the church. • Ministerial salary from the church of $24,000 for the year. • $6,000 received from officiating masses and performing baptisms. All were offerings to the church. • $10,000 received by Mark for performing marriages, baptisms, and funerals. All of these were given to him. He donated $1,000 of this amount to the church. What total amount will be taxable income for Mark? a) $40,000 b) $34,000 c) $33,000 d) $52,000 79. Rhonda received regular wages of $16,000 for the first three months of the year and then was unable to work due to a workplace injury. She received $15,000 of workers’ compensation from April 1 through August 31 and, although still qualifying for workers’ compensation, she returned to light-duty work from September 1 through November 30. She received $3,000 for this light-duty work and an additional $4,000 in reduced workers’ compensation for this period. She returned to her regular duties on December 1 and received $5,000 for the remainder of the year. What is Rhonda’s taxable income for the year? a) $21,000 b) $24,000 c) $44,000 d) $28,000 80. Which of the following would be considered nontaxable workers’ compensation? 1. Workers’ compensation paid under a workers’ compensation act due to an on the job injury. 2. Workers’ compensation received by a worker’s survivors for an injury that ultimately was fatal. 3. Workers’ compensation received by a worker during a period of light duty work after qualifying for workers’ compensation. 4. Retirement plan benefits based on length of service and age after a worker retired due to occupational sickness or injury. a) 1, 2, 3, and 4 b) 1, 2, and 3 c) 1 and 2 d) 1 only 81. Fay is a new tax preparer. She has been researching various types of nontaxable distributions. All of the following statements are correct except: a) A return of capital reported on Form 1099-DIV will reduce a taxpayer’s stock basis. b) Since liquidating dividends are a return of capital, they will reduce a taxpayer’s stock basis. c) A liquidating dividend will be reported as a taxable capital gain if the basis of the taxpayer’s stock has already been reduced to zero. Since an exempt-interest dividend paid by a mutual fund is not taxable, it will not be reported on any tax form by the taxpayer. 82. In past years, Sam’s employer has issued a Form W-2 to him for wages earned. This year Sam received a Form W-2 for some of the payments received from his employer, and a Form 1099-MISC for the remaining amount. The amount on the Form 1099-MISC was a bonus from Sam’s employer. Sam has requested a corrected W-2 to reflect the additional amount reflected on Form 1099-MISC, but his employer has refused. What should Sam do? File a Schedule C to reflect the amount reported on Form 1099-MISC. Report the amount from Form 1099-MISC as wages on line 7, Form 1040 and attach Form 8919 for the uncollected Social Security and Medicare Taxes to his Form 1040. c) Report the amount from Form 1099-MISC as “other income” on line 21, Form 1040. d) Only report the W-2 income and does not have to report the bonus on Form 1099-MISC. 83. Zeke, worked for a construction firm during the tax year. His employer withheld federal and state taxes from his wages. Zeke received a Form 1099-MISC for the wages he earned during the tax year. Zeke asked his employer to correct the error and provide a Form W-2 for the wages earned; showing the withholdings from his income. His employer refused. Zeke has the last paystub he received during the tax year. Which of the following is the most appropriate action for Zeke? a) Zeke should report his income on line 21 of Form 1040, Schedule 1. b) Zeke should report his income on line 1 of Form 1040. c) Zeke should report his income on line 1 of Form 1040 and complete Form 8919. d) Zeke should report his income on line 1 of Form 1040 and complete Forms 4070 and 4137. 84. Jim and Jan are married and file a joint return. Jan turned 65 on June 30, 2018. Jim turned 65 on January 1, 2019. Jim is also blind. Jan’s 88-year-old mother, Emma, has lived with them for five years. Emma is required to file a return to obtain a refund on withholding from her pension. Emma had no earned income during the year. Jim and Jan provide more than 65% of her support and claim her as a dependent. What amount of standard deduction should Jim and Jan claim when they file their joint return? What amount of standard deduction is Emma eligible to claim, if any? a) Jim and Jan: $26,600; Emma: $12,000 b) Jim and Jan: $29,200; Emma: $350 c) Jim and Jan: $27,900; Emma: $2,650 d) Jim and Jan: $27,200; Emma: $1,050 85. Kim has lived in California since 2008. In tax year 2019 she earned $2,800 per week for 52 weeks. Which of the following is the correct amount of SDI Kim should have had withheld from her wages for the entire year? a) $ 28.00 b) $ 112.00 c) $1,183.70 d) $1,456.00 86. Jim works for a landscape company in California. He injured his knee while playing basketball at home. Jim chose not to go to the doctor, although he can’t walk due to the injury to the knee. He has treated the knee at home with a brace purchased from the pharmacy, kept the knee elevated and applied ice as needed. Jim has been out of work for 3-weeks. Jim has SDI withheld from his wages each pay period. Which of the following statements is most accurate? a) Jim is eligible for SDI benefits because he is unable to work. b) Jim is not eligible for SDI benefits. c) Jim is not eligible for SDI benefits because his injury didn’t happen on the job. d) Jim is not eligible for SDI benefits because he required to exhaust all other insurance coverage before SDI benefits become available. 87. Chad works as a server at a local restaurant. He is one of the more popular servers and receives substantial tips from the customers. Which of the following statements is correct according to the tips Chad receives? a) Tip income is not subject to taxation. b) Tip income not subject to reporting to the employer is not taxable. c) Tip income is subject to federal income taxation. d) If Chad fails to report his tips as required, he may be subject to a penalty of 25% of the Social Security and Medicare taxes or railroad retirement tax owed on the unreported tips. 88. Bill took two W-2’s to his tax preparer to prepare his taxes for the previous year. Both of them were from the same employer. His employer’s accounting period (tax year is July 1 – June 30). All of the following are possible reasons for Bill to have two Forms W-2 except: a) One of the W-2’s is for the wrong year. b) One of the W-2’s was corrected. c) They are duplicate copies. d) Since Bill’s tax year is the calendar year, the employer issued a separate W2 to Bill for each half of the employer’s tax year. 89. Romero and Allison were married on October 31st. Romero is a nonresident alien and Allison is a U.S. citizen. They have lived together since they were married. Which of the following statements is correct? a) Since Romero is a nonresident alient, he and Allison must file separate tax returns; therefore, must itemize their deductions. b) Romero and Allison may use the Married Filing Jointly or Married Filing Separately filing status; however will be required to itemize their deductions since Romero is a nonresident alien. c) Romero and Allison must file jointly and must itemize deductions since Romero is a nonresident alien. Romero and Allison may file jointly or separately and they can choose to itemize or use the standard deduction. [Show More]

Last updated: 1 year ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Jun 01, 2022

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

Jun 01, 2022

Downloads

1

Views

45

.png)