*NURSING > STUDY GUIDE > Midterm exam actual key questions and answers solution 2020 exam solution (All)

Midterm exam actual key questions and answers solution 2020 exam solution

Document Content and Description Below

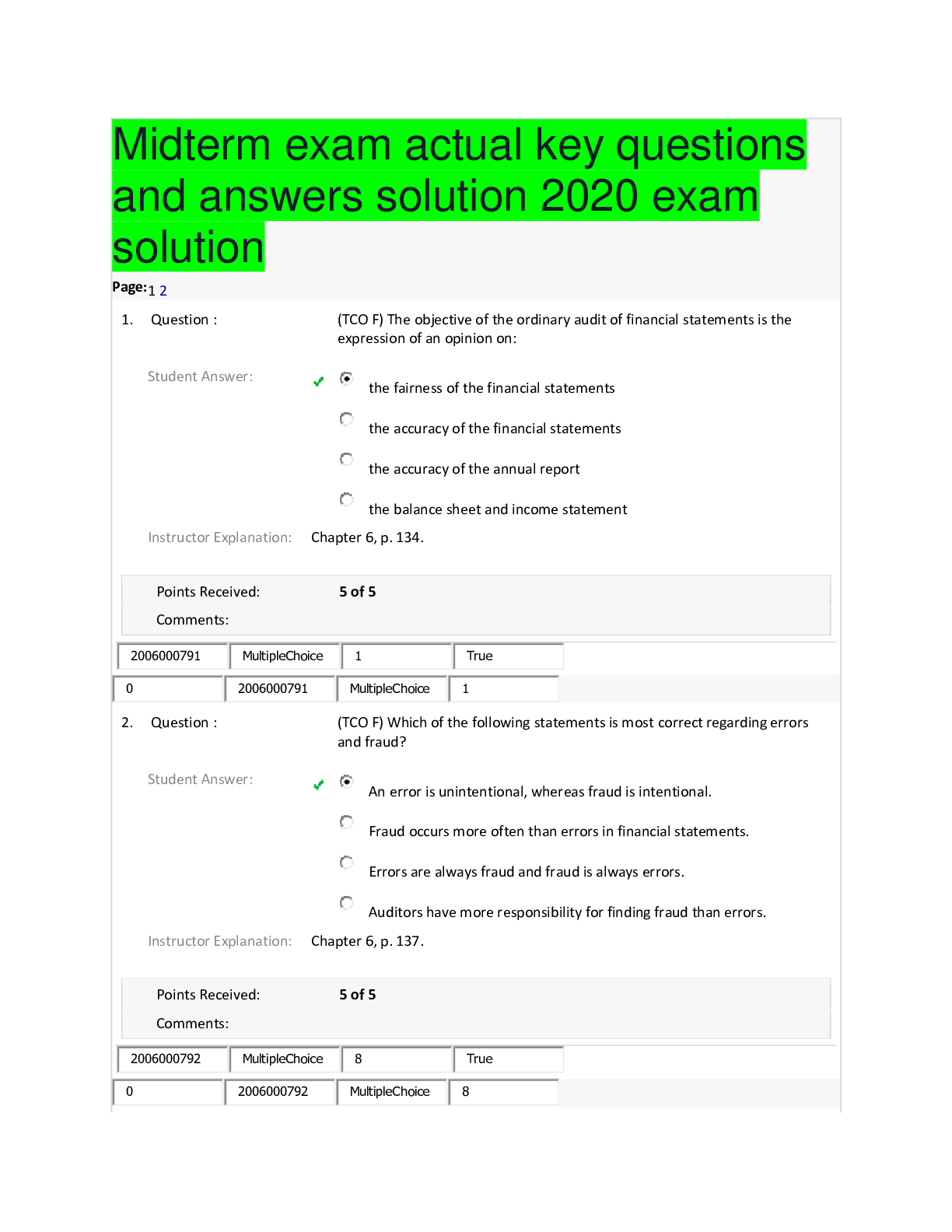

Midterm exam actual key questions and answers solution 2020 exam solution GRADED A Midterm exam actual key questions and answers solution 2020 exam solution Page: 1 2 1. Question : (TCO F) The ... objective of the ordinary audit of financial statements is the expression of an opinion on: Points Received: 5 of 5 Comments: 2. Question : (TCO F) Which of the following statements is most correct regarding errors and fraud? Points Received: 5 of 5 Comments: 3. Question : (TCO F) If the auditor believes that the financial statements are not fairly stated or is unable to reach an conclusion because of insufficient evidence, the auditor: Points Received: 5 of 5 Comments: 4. Question : (TCO F) Auditors accumulate evidence to: Points Received: 5 of 5 Comments: 5. Question : (TCO F) Which of the following forms of evidence is most reliable? Points Received: 5 of 5 Comments: 6. Question : (TCO F) Analytical procedures are required during which phase(s) of the audit? Test of Controls; Planning; Completion Points Received: 5 of 5 Comments: 7. Question : (TCO F) To be considered reliable evidence, confirmations must be controlled by: Points Received: 5 of 5 Comments: 8. Question : (TCO F) When the auditor has reason to believe an illegal act has occurred without any corrective action being taken, the auditor should: Points Received: 0 of 5 Comments: one level below. If it was one level above, then yes, you would have been right. 9. Question : (TCO F) Traditionally, confirmations are used to verify: Points Received: 5 of 5 Comments: 10. Question : (TCO G) Which of the following is correct with respect to the use of analytical procedures? Points Received: 5 of 5 Comments: 11. Question : (TCO G) Which is a liquidity activity ratio? Points Received: 5 of 5 Comments: Page: 1 2 Page: 1 2 1. Question : (TCO A) Match the following definitions to the terms. ____ Public Company Accounting Oversight Board Auditing Standards ____ Generally Accepted Auditing Standards ____ Statements on Auditing Standards a. Pronouncements providing specific guidance on auditing matters for all entities except public companies b. The standards used for public company audits c. Standards used by non-public companies and for interim audits for public companies as initially adopted by the PCAOB Points Received: 0 of 5 Comments: 2. Question : (TCO B) The following is a portion of a qualified audit report issued for a private company: Independent Auditor's Report To the shareholders of Tamarak Corporation, We have audited the accompanying balance sheet of Tamarak Corporation as of October 31, 2009, and the related statements of income, retained earnings, and cash flows for the past year. These financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. The company has included in property and debt in the accompanying balance sheet certain lease obligations that, in our opinion, should be expensed in order to conform with generally accepted accounting principles. If these lease obligations were capitalized, property would be decreased by $4,000,000, long-term debt by $2,000,000, and retained earnings by $180,000 as of October 31, 2009, and net income and earnings per share would be decreased by $180,000 and $0.62, respectively, for the past year. Required: Complete the above qualified audit report by preparing the opinion paragraph. Do not date or sign the report. Points Received: 20 of 20 Comments: 3. Question : (TCO C) The following situation involves a possible violation of the AICPA's Code of Professional Conduct. For each situation, (1) determine the applicable rule number from the Code, (2) decide whether or not the Code has been violated, and (3) briefly explain how the situation violates (or does not violate) the Code. Your answer should be set up something like this: Rule # __________ Violation? Yes or No 1 or 2 line explanation: Brad Heist, CPA, was traveling from Dallas to Houston, Texas, when he was pulled over by a police officer on suspicion of driving under the influence. The breath-a-lyzer and a subsequent blood test revealed that Brad was definitely impaired. He was convicted in court of driving while under the influence of alcohol (DUI). This was Brad's fourth conviction of DUI in less than a year, a felony under current Texas law. Accordingly, Brad was sentenced to 18 months in prison. Points Received: 10 of 10 Comments: 4. Question : (TCO C) The following situation involves a possible violation of the AICPA's Code of Professional Conduct. For each situation, (1) determine the applicable rule number from the Code, (2) decide whether or not the Code has been violated, and (3) briefly explain how the situation violates (or does not violate) the Code. Your answer should be set up something like this: Rule # __________ Violation? Yes or No 1 or 2 line explanation: Jim is the audit partner for the small CPA firm of Jim, CPA, PA. Jim's neighbor Duffy has a financial advisement practice whereby she sells mutual funds to individuals for their retirement. Jim's firm is performing the audit for a privately held company Jim's best friend Cressy owns. Jim refers Cressy to Duffy for retirement advice. Cressy buys 10 units of ABC Mutual Fund which generates Duffy a fat little commission fee. Duffy buys Jim a $25 gift certificate to the local movie theater. Points Received: 10 of 10 Comments: 5. Question : (TCO C) Brandt, CPAs has obtained Big-Bucks, a new publicly-held client. Big-Bucks has various accounting-related needs that Brandt, CPAs would like to fulfill. Partner-in-charge D. Brandt has discussed with Big-Bucks the possibility of performing the annual audit of Big-Bucks as well as preparing the tax returns, business plan, quarterly write-up services, and providing consultation on the viability and valuation of mining gas reserves in Tennessee. An outside expert would be hired by Brandt CPAs to provide expert advice to the CPA firm on mining gas reserves. Additionally, Brandt, CPA's audit manager who will be assigned to this audit has previously been approached by Big-Bucks to come work for the company as Chief Financial Officer. The audit manager has refused the offer, since his cousin's sister-in-law is a 10 percent shareholder in Big-Bucks and does not want her to have any say in his employment. Under the Sarbanes-Oxley Act of 2002, what issues do you see and how would you advise Brandt, CPAs? Is there ever a time when Brandt, CPAs could perform any of these services for Big-Bucks? Points Received: 10 of 25 Comments: The only thing you talked about in SOX here was the cooling off period. The rest of it was good, but not SOX related. 6. Question : (TCO D) There are four major sources of an auditor's legal liability. One source is liability to the audit client under common law. Briefly summarize the other three sources. Points Received: 25 of 25 Comments: 7. Question : (TCO F) Below are 10 documents typically examined during an audit. Classify each document as either internal or external. Type of Document Documents ________________ 1. Canceled checks for payments of accounts payable ________________ 2. Payroll time cards ________________ 3. Duplicate sales invoices ________________ 4. Vendors’ invoices ________________ 5. Bank statements ________________ 6. Minutes of the board of directors’ meetings ________________ 7. Signed lease agreements ________________ 8. Notes receivable ________________ 9. Subsidiary accounts receivable records ________________ 10. Remittance advices Points Received: 25 of 25 Comments: 8. Question : (TCO G) Discuss the essential activities involved in the initial planning of an audit. Points Received: 25 of 25 Comments: Page: 1 2 [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 15, 2020

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Nov 15, 2020

Downloads

0

Views

52

.png)

.png)