Financial Accounting > TEST BANK > Other Percentage Taxes (OPT). 140 Questions and Answers. (All)

Other Percentage Taxes (OPT). 140 Questions and Answers.

Document Content and Description Below

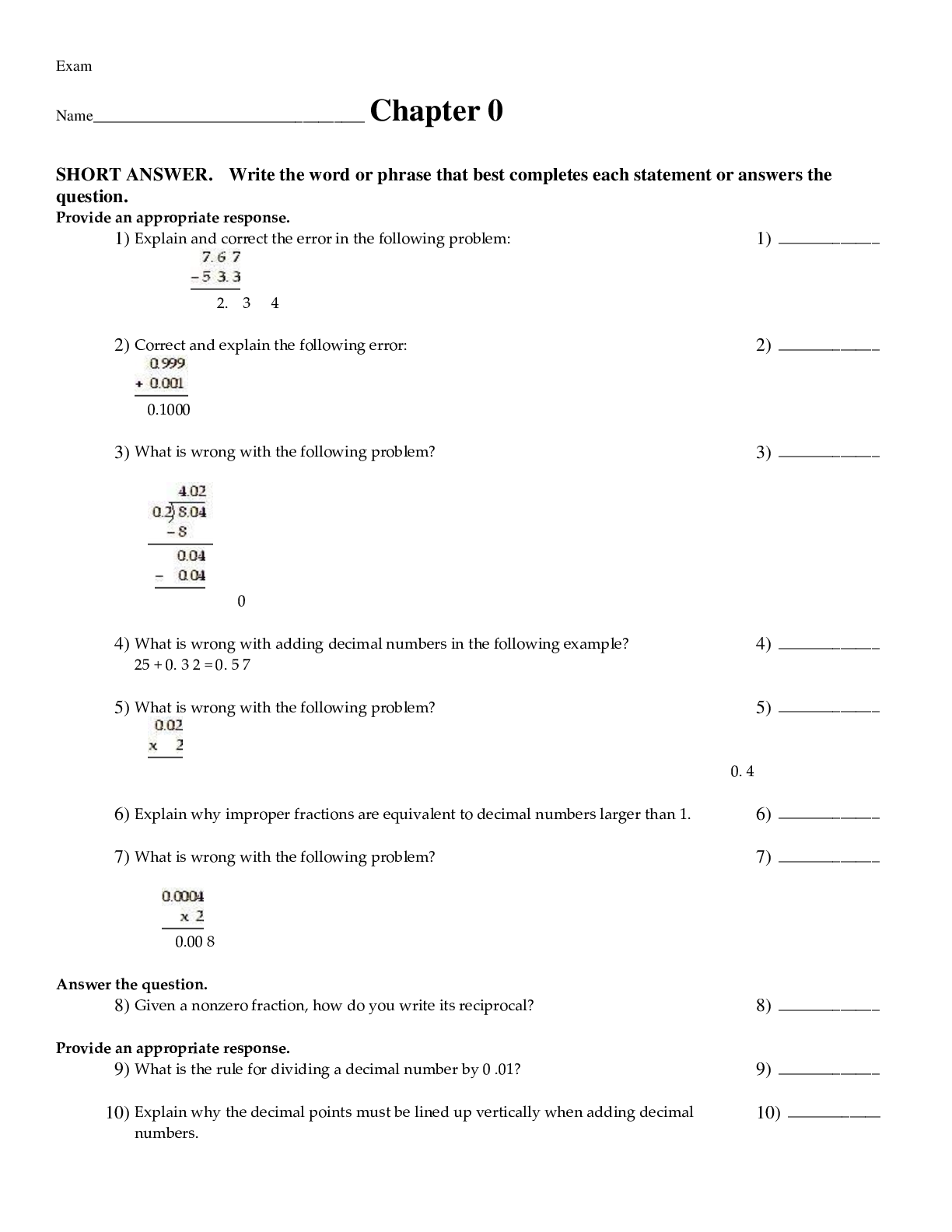

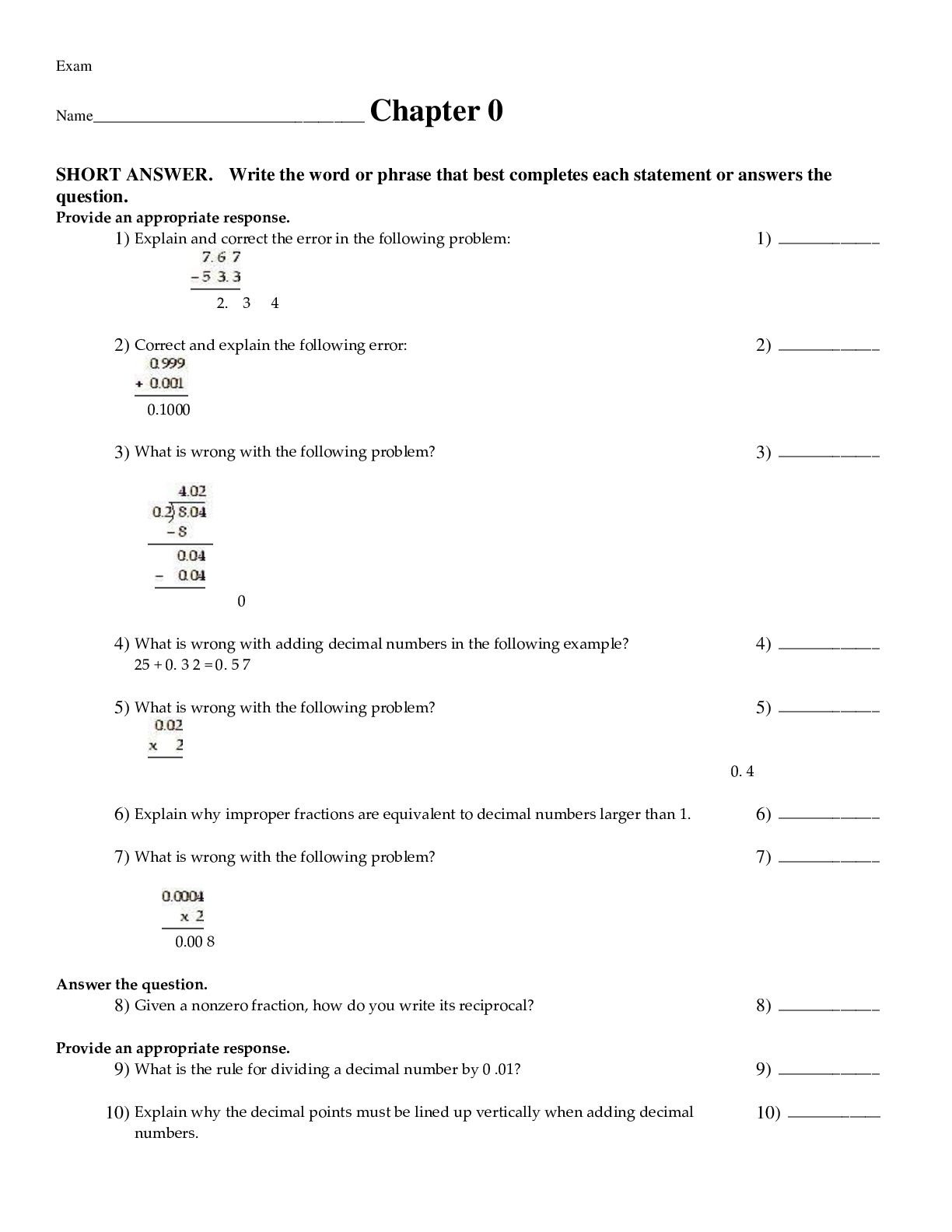

KINDS OF PERCENTAGE TAXES: 1) Tax on person exempt from value-added tax (Sec. 116); 2) Percentage tax on domestic carriers and keepers of garages (Sec. 117); 3) Percentage tax on international carr... iers (Sec. 118); 4) Tax on franchises (Sec. 119); 5) Tax on overseas dispatch, message or conversation originating from Philippines (Sec. 120); 6) Tax on banks and non-bank financial intermediaries (Sec. 121); 7) Tax on other non-bank financial intermediaries (Sec. 122); 8) Tax on life insurance premiums (Sec. 123); 9) Tax on agents of foreign insurance companies (Sec. 124); 10) Amusement taxes (Sec. 125); 11) Tax on winnings (Sec. 126); 12) Tax on sale, barter or exchange of shares of stock listed and traded through the local stock exchange or through initial public offering (Sec. 127). TAX ON PERSONS EXEMPT FROM VALUE-ADDED TAX (Sec. 116). Requisites: 1) Not a VAT registered person; and 2) The annual gross sales or receipts do not exceed P3,000,000 (P1,919,500 prior to 2018). Exempt Person – 1) Cooperatives 2) Beginning Jan 1, 2018, Self-employed individuals and professionals availing of the 8% tax on gross sales and/or receipts and other non-operating income under the TRAIN Law. Formula: Tax Base PXXX Rate 3% Percentage Tax PXXX Tax Base 1)Seller of Goods - Gross Sales 2) Seller of Services - Gross Receipts SUMMARY RULES Annual Gross Sales/Receipts Business Tax Applicable More than P3M (P1919,500 prior to 2018) VAT P3M and below (P1,919,500 and below prior to 2018) VAT or OPT If the taxpayer opts to pay VAT, it will be irrevocable for 3 consecutive years PERCENTAGE TAX ON DOMESTIC CARRIERS AND KEEPERS OF GARAGES (Sec. 117). Common Carriers - refers to the persons, corporations, firms or associations engaged in the business of carrying or transporting passengers or goods, or both by land for compensation, offering their services to the public, and shall include transportation contractors. Persons Liable: 1) Cars for rent or hire driven by the lessee (rent-a-car); 2) Transportation contractors, including persons who passengers for hire;3) Other domestic carriers by land for transport of passengers; 4) Keepers of garages. Exempt Persons: 1) Owners of bancas 2) Owners of animal-drawn two-wheeled vehicles Formula: Tax Base PXXX Rate 3% Common Carriers Tax PXXX Tax Base 1) Actual Gross Receipts Whichever is Higher 2) Minimum Gross Receipts SUMMARY RULES Type of Domestic Common Carrier Transporting Business Tax Applicable By Land Persons OPT Cargo/Goods VAT By Air Persons, Goods or Cargoes VAT By Sea Persons, Goods or Cargoes VAT PERCENTAGE TAX ON INTERNATIONAL CARRIERS (Sec. 118). Persons Liable: 1) International Air Carriers 2) International Shipping Carriers Formula: Gross Receipts PXXX Rate 3% Common Carriers Tax PXXX Gross Receipts - shall include, but shall not be limited to, the total amount of money or its equivalent representing the contract, freight/cargo fees, mail fees, deposits applied as payments, advance payments and other service charges and fees actually or constructivelyreceived during the taxable quarter from cargo and/or mail, originating from the Philippines in a continuous and uninterrupted flight, irrespective of the place of sale or issue and the place of payment of the passage documents. (RA No. 10378, RR NO. 15-2013) SUMMARY RULES Airline/Shopping Co. Business Tax Applicable Domestic Corp. Vat Resident Foreign Corp. Opt TAX ON FRANCHISES (Sec. 119). Persons Liable: 1) Franchises on Gas and Water Utilities 2) Franchises on Radio and/ or Television Broadcasting Companies Requisites for franchises on Radio and/ or Television Broadcasting Companies: 1) Not a VAT registered person; and 2) Annual gross receipts of the preceding year do not exceed P10,000,000. SUMMARY RULES APPLICABLE TO RADIO AND/OR TELEVISION BROADCASTING COMPANIES Annual Gross Receipts Business Tax Applicable More than P10,000,000 P.Y. Vat P10,000,000 and below P.Y VAT or OPT If the taxpayer opts to pay VAT, it will be irrevocable. Formula: Gross Receipts PXXX Rate X% Franchise Tax PXXX Rate: 1) Gas and Water -- 2% 2) Radio and/or Television Broadcasting Companies - 3% TAX ON OVERSEAS DISPATCHMESSAGE OR CONVERSATION ORIGINATING FROM THE PHILIPPINES (Sec. 120). Requisites: 1) There is an overseas dispatch, message or conversation: 2)It originated from the Philippines, 3) It was made through a telephone, telegraph, telewriter exchange,wireless and other communication equipment. Person Liable - the user of the facility Formula: Payments for Services PXXX Rate 10% Overseas Communications Tax PXXX Exempt Persons: 1) Diplomatic Services 2) International Organizations 3) News Agencies or Services 4) Government TAX ON BANKS AND NON-BANK FINANCIAL INTERMEDIARIES PERFORMING QUASI-BANKING FUNCTIONS (Sec. 121). Banks or Banking institutions - refer to those entities as defined under Section 3 of Republic Act No. 8791, otherwise known as the General Banking Law of 2000, or more specifically, to entities engaged in the lending of funds obtained in the form of deposits. The term "banks" or "banking institutions" are synonymous and interchangeable and specifically include universal banks, commercial banks, thrift banks (savings and mortgage banks, stock savings and loan associations, and private development banks), cooperative banks, rural banks, Islamic banks and other classifications of banks as may be determined by the Monetary Board of the BSP. (RR NO. 8-08) Non-bank Financial Intermediaries - refer to persons or entities whose principal function include the lending, investing or placement of funds or evidences of indebtedness or equity deposited with them, acquired by them or otherwise coursed through them, either for their own account or for the account of others. This includes all entities regularly engaged in the lending of funds or purchasing of receivables or other obligations with funds obtained from the public through the issuance, endorsement or acceptance of debt instruments of any kind for their own account, or through the issuance of certificates, or of repurchase agreements, whether any of these means of obtaining funds from the public is done on a regular basis or only occasionally. (RR NO. 8-08) Quasi-banking Functions - shall refer to the borrowing of funds from twenty (20) or more personal or corporate lenders at any one time, through the issuance, endorsement or acceptance of debt instruments of any kind other than deposits, for the borrower's ownaccount or through the issuance of certificates of assignment or similar instruments, with recourse, or of repurchase agreements for purposes of relending or purchasing receivables or other similar obligations. Provided, however, that commercial, industrial and other nonfinancial companies, which borrows funds through any of these means for the limited purpose of financing their own needs or the needs if their agents or dealers, shall not be considered as performing quasi banking functions. [Show More]

Last updated: 11 months ago

Preview 1 out of 56 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 01, 2022

Number of pages

56

Written in

Additional information

This document has been written for:

Uploaded

Jul 01, 2022

Downloads

0

Views

28

TB.png)

.png)

.png)