Business > QUESTIONS & ANSWERS > BUS 401 Principles of Finance part 1 to 3 questions with all correct answers solution 2020 liberty u (All)

BUS 401 Principles of Finance part 1 to 3 questions with all correct answers solution 2020 liberty university

Document Content and Description Below

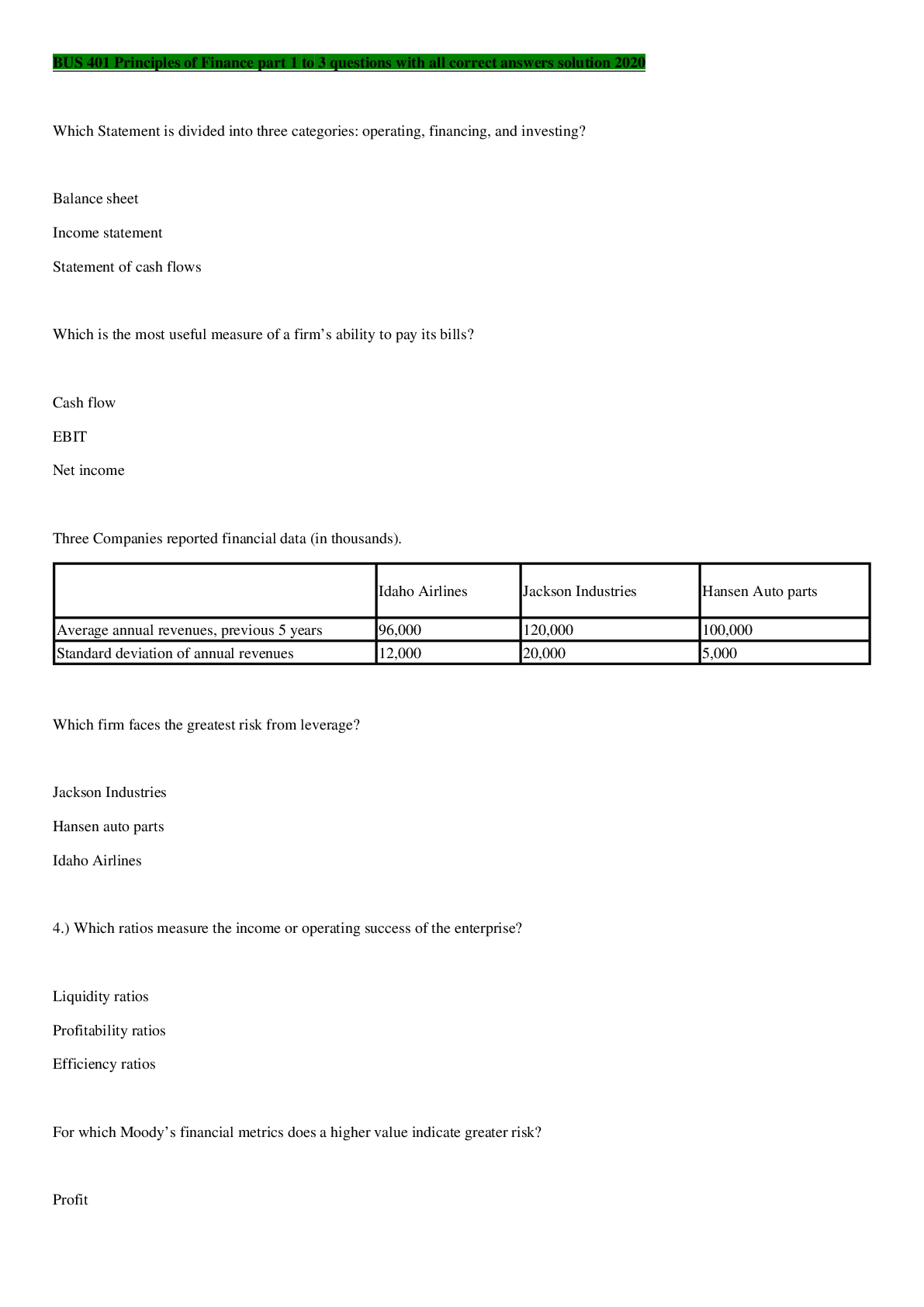

BUS 401 Principles of Finance part 1 to 3 questions with all correct answers solution 2020 1.) Which Statement is divided into three categories: operating, financing, and investing? • Balance ... sheet • Income statement • Statement of cash flows 2.) Which is the most useful measure of a firm’s ability to pay its bills? • Cash flow • EBIT • Net income 3.) Three Companies reported financial data (in thousands). Idaho Airlines Jackson Industries Hansen Auto parts Average annual revenues, previous 5 years 96,000 120,000 100,000 Standard deviation of annual revenues 12,000 20,000 5,000 Which firm faces the greatest risk from leverage? • Jackson Industries • Hansen auto parts • Idaho Airlines 4.) Which ratios measure the income or operating success of the enterprise? • Liquidity ratios • Profitability ratios • Efficiency ratios 5.) For which Moody’s financial metrics does a higher value indicate greater risk? • Profit • Interest coverage • Leverage • Return on assets 6.) Which acronym refers to a principle-based accounting system? • FASB • GAAP • IFRS 7.) Barton Industries borrowed $100 million to acquire Carlson foods. Carlson had $80 million in tangible assets, which became part of Barton’s assets. The remaining $20 million of the purchase price was listed on Barton’s balance sheet as Goodwill. What happened to Barton’s asset coverage? • Remained unchanged • Increased • Decreased 8.) Which statement compares the relative composition of accounts over time? • Trend statement • Income statement • Common size statement 9.) What is each account divided by to produce each year’s common size income statement? • The benchmark years balance • That year’s total assets • That year’s revenue 10.) For which of these ratios would a higher value indicate greater risk to the firm’s operations? • Times interest earned ratio = EBIT/interest (dollars) • Debt ratio = long term debt/ total long-term capital • Current ratio = current assets/ current liabilities 11.) Moody’s bond rating service uses a set of metrics to evaluate companies and rate their bonds. A company’s management decides to increase the dividend paid on common stock. What effect will this have? • Decreased cash flow/debt ratio • Increased liquidity ratio • Decreased revenue stability ratio 12.) Which account is part of operating expenses? • COGS • SG&A • Interest 13.) A company reported the following financial data (in thousands) over two quarters: Q1 Q2 Current assets 20,000 21,000 Current Liabilities 11,000 10,000 How was the current ratio affected? • Increased • Decreased • Remained unchanged 14.) What is the term for revenues minus COGS? • Gross profit • Net Income • Operating margin 15.) Which securities make payments that the firm cannot deduct as expenses? • Preferred stock and common stock • Bonds and preferred stock • Common stock and bonds 16.) Which statement is one of the primary tools with which the firm communicates with its stakeholders? • Statement of cashflows • Common size statement • Trend statement 17.) Which ratio includes COGS as a variable? • Gross profit margin • Earning power • Net profit margin 18.) Midland Materials reports the following data (in thousands): EBIT: 7,000 Total assets: 100,000 Management decides to finance expansion by borrowing at 8%. What happens to ROE? • Remains unchanged • Decreases • Increases 19.) If a company’s cash flow differs from its net income, which account is most likely the cause? • Depreciation • Interest • Taxes 20.) Which values are measures of the firm’s ability to meet its unexpected cash needs over the short term? • Liquidity ratios • Debt ratios • Measures of relative value • Efficiency ratios [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 01, 2020

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Dec 01, 2020

Downloads

0

Views

38