Business > QUESTIONS & ANSWERS > BUS 401 Principles of Finance questions and answers solution docs 2020 liberty university (All)

BUS 401 Principles of Finance questions and answers solution docs 2020 liberty university

Document Content and Description Below

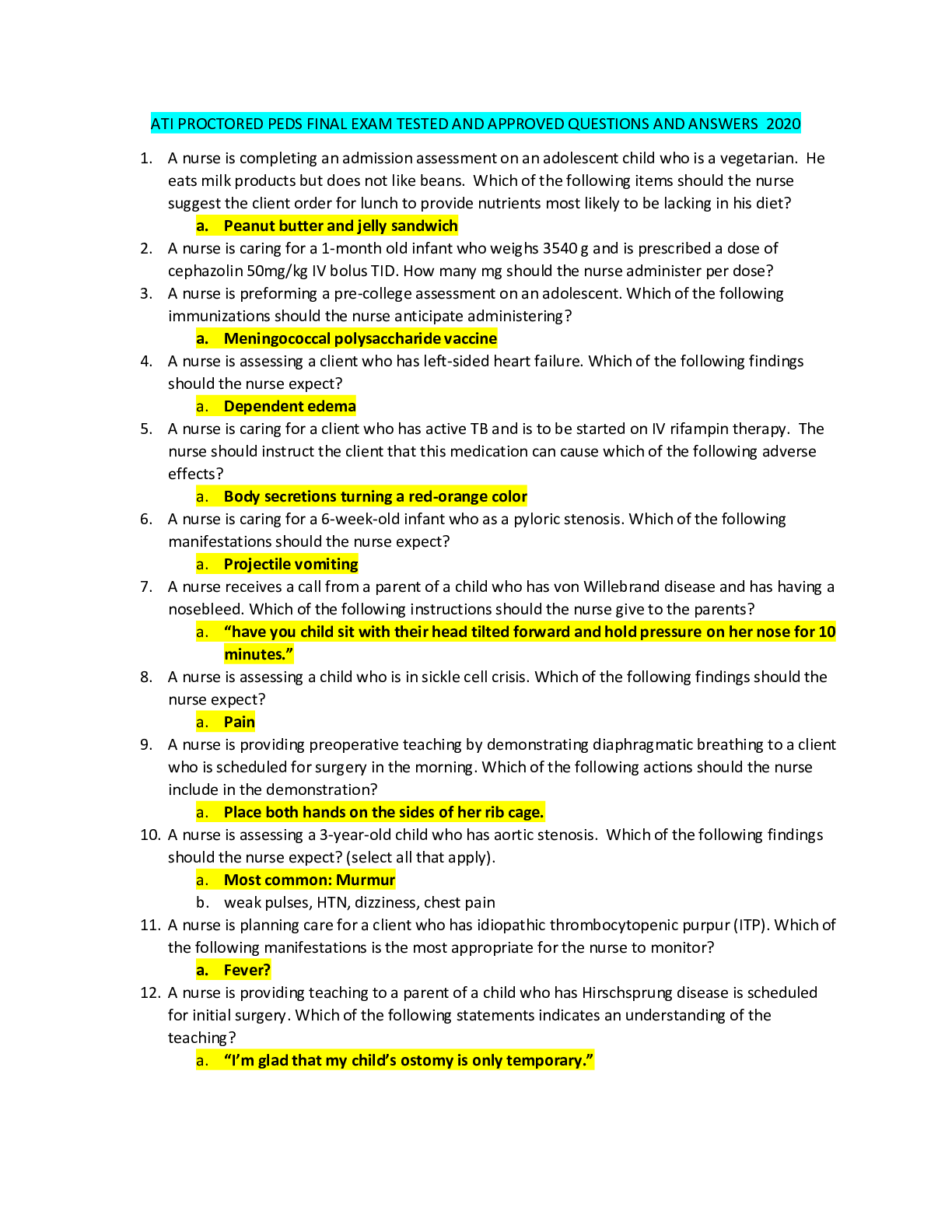

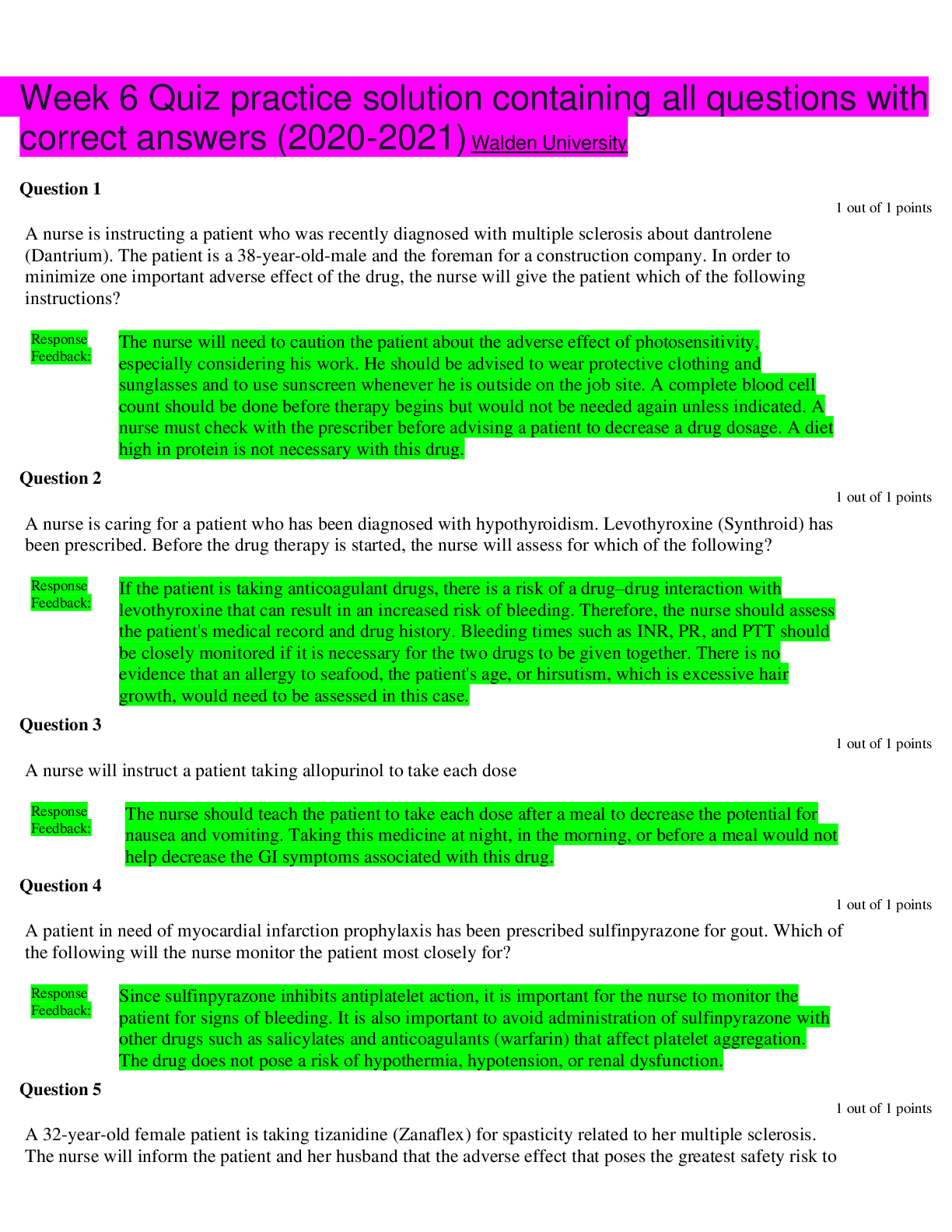

BUS 401 Principles of Finance questions and answers solution docs 2020 liberty university 21.) Which business development increases cash? • Decrease in long term liabilities • Decrease in ac... counts receivable • Increase in PP&E • Increase in inventory 22.) Which statement shows a company’s cost of revenues? • Statement of cash flows • Balance sheet • Income statement 23.) For which of these ratios would a lower value indicate lower risk to the firm’s operations? • Current ratio • Debt ratio • Quick ratio 24.) What is Moody’s formula for liquidity? • Cash & marketable securities/ total assets • Total assets – goodwill - intangibles / total debt • Net after – tax income before X-items + depreciation – dividends/ total debt + 8 X rental expense 25.) In trend statements, each account is re-expressed as a multiple of what? • That year’s revenue • The benchmark year’s balance • That year’s total assets 26.) which calculation measures the profitability of a company’s operations? • Gross profit minus indirect costs • EBIT minus financing costs and taxes • Revenue minus COGS 27.) Which ratios measure the firm’s ability to meet principle and interest payments over the long term? • Liquidity ratios • Profitability ratios • Debt ratios 28.) When a firm issues new shares of common stock, which of these measures increases? • P/E • BVPS • DPS • EPS 29.) which of these changes would indicate increased risk to the firm’s operations? • An increase in the quick ratio • A decrease in the times interest earned ratio • A decrease in the debt ratio 30.) when a firm buys back outstanding shares of common stock, which of these measures increase? • P/B and P/E • P/E and EPS • BVPS and P/B • EPS and BVPS[ [Show More]

Last updated: 1 year ago

Preview 1 out of 2 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 01, 2020

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Dec 01, 2020

Downloads

0

Views

105