Financial Accounting > QUESTIONS & ANSWERS > BSA 10129802c-Notes-Payable-Debt-Restructuring/ Questions and Answers > FINANCIAL ACCOUNTING THEORY (All)

BSA 10129802c-Notes-Payable-Debt-Restructuring/ Questions and Answers > FINANCIAL ACCOUNTING THEORY & PRACTICE NOTES PAYABLE & DEBT RESTRUCTURING QUIZZER. Answer Key at the end.

Document Content and Description Below

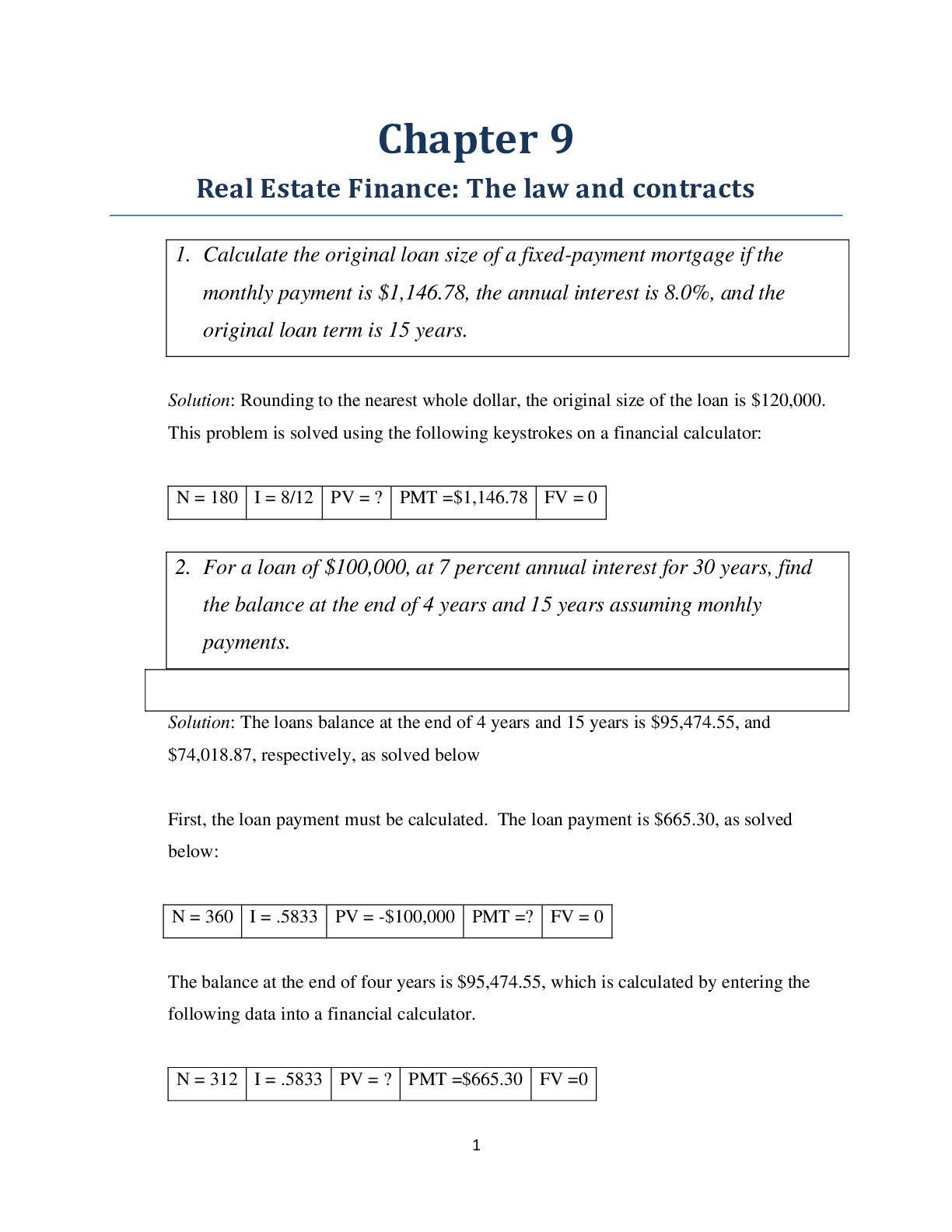

FINANCIAL ACCOUNTING THEORY & PRACTICE NOTES PAYABLE & DEBT RESTRUCTURING QUIZZER Notes Payable Essay Questions: Notes Payable Page 1 NOTES PAYABLE Essay Questions 1. What is a promissory no... te? A promissory note is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay on demand or at a fixed or determinable future time a sum certain in money to order or to bearer. 2. Explain the "initial measurement" of note payable. PFRS 9, paragraph 5.1.1, provides that a note payable shall be measured initially at fair value minus transaction costs that are directly attributable to the issue of the note payable. In other words, transaction costs are included in the measurement of note payable. However, if the note payable is irrevocably designated at fair value through profit or loss, the transaction costs are expensed immediately. The "fair value" of the note payable is equal to the present value of the future cash payment to settle the note payable. The term "present value" is the discounted amount of the future cash outflow in settling the note payable using the market rate of interest. 3. Explain the "subsequent measurement" of note payable. PFRS 9, paragraph 5.3.1, provides that after initial recognition, a note payable shall be measured either: a. At amortized cost using the effective interest method. b. At fair value through profit or loss if the note payable is designated irrevocably as measured at fair value through profit or loss, 4. What is the "amortized cost" of note payable? The amortized cost of note payable is the amount at which the note payable is measured initially minus principal repayment, plus or minus the cumulative amortization using the effective interest method of any difference between the initial carrying amount and maturity amount. Simply stated, the difference between the face amount and present value of the note payable is amortized through interest expense using the effective interest method. Actually, the difference between the face amount and present value is either discount or premium on the issue of note payable. FINANCIAL ACCOUNTING Essay Questions: Notes Payable Page 2 5. Explain the "fair value option" of measuring note payable. PFRS 9, paragraph 4.2.2, provides that at initial recognition, a note payable may be irrevocably designated as at fair value through profit or loss. In other words, under the fair value option, the note payable shall be measured initially at fair value and remeasured at every year-end at fair value and any changes in fair value are recognized in profit or loss. There is no amortization of transaction cost, discount and premium on note payable. As a matter of fact, interest expense is recognized using the nominal or stated interest rate and not the effective interest rate. 6. On January 1, 2013, an entity borrowed from a bank P4,000,000 on a 12% 5-year interest bearing note. The entity received P4,000,000 which is the fair value of the note on January 1, 2013. Transaction cost of P 100,000 was paid by the entity. The fair value of the note payable was P3,500,000 on December 31, 2013 and P3,800,000 on December 31, 2014. The entity has elected irrevocably the fair value option for measuring the note payable. Prepare all journal entries for 2013 and 2014. Jan. 1 | Cash Note payable Transaction cost | 4,000,000 | 4,000,000 1 | 100,000 Cash Interest expense (12% x 4,000^00) Cash Note payable Gain from change in fair value Note payable -January 1, 2013 | 100,000 Dec. 31 | 480,000 480,000 31 | 500,000 500,000 4,000,000 Fair value-December 31, 2013 | 3,500,000 Decrease in fair value of liability - gain | 500,0002014 Dec. 31 | Interest expense Cash Loss from change in fair value Note payable Note payable - December 31, 2013 | 480,000 480,000 31 | 300,000 300,000 3,500,000 Fair value-December 31, 2014 | 3,800,000 Increase in fair value of liability - loss | 300,000 Debt Restructure Essay Questions: Debt Restructure Page 3 7. Explain briefly the treatment of the following: a. Note issued solely for cash b. Interest bearing note issued for property c. Noninterest bearing note issued for property a. When a note is issued solely for cash, the present value is equal to the cash proceeds. b. When a property or noncash asset is acquired by issuing a promissory note which is interest bearing, the property or asset is recorded at the purchase price. The purchase price is reasonably assumed to be the present value of the note and therefore, the fair value of the property because the note issued is interest bearing. c. When a noninterest bearing note is issued for property, the property is recorded at the cash price of the property. The cash price is assumed to be the present value of the note issued. The difference between the cash price and the face of the note issued represents the imputed interest. The imputed interest is based on the sound philosophy that no lender would part away with money or property interest-free. DEBT RESTRUCTURE Essay Questions 1. Explain "dacion en pago". Dacion en pago arises when a mortgaged property is offered by the debtor in full settlement of the debt. This transaction shall be accounted for as an "asset swap" form of debt restructuring. This requires recognition of gain or loss based on the balance of the obligation including accrued interest and other charges. If the balance of the obligation including accrued interest and other charges is more than the carrying amount of the property mortgaged, there is a gain on extinguishment of debt. Otherwise, if the balance of the obligation is less than the carrying amount of property mortgaged, there is a loss on extinguishment of debt. 2. What is meant by "debt restructuring?" Debt restructuring is a situation where the creditor, for economic or legal reasons related to the debtor's financial difficulties, grants to the debtor concession that would not otherwise be granted in a normal business relationship. The concession either stems from an agreement between the creditor and debtor, or is imposed by law or a court. The objective of the creditor in a debt restructuring is to make the best of a bad situation or maximize recovery of investment. FINANCIAL ACCOUNTING Essay Questions: Debt Restructure Page 4 Thus, the creditor usually sustains an accounting loss on debt restructuring and the debtor realizes an accounting gain. 3. What are the common forms of debt restructuring? The common forms of debt restructuring are: a. Asset swap b. Equity swap c. Modification of terms 4. Explain an asset swap. Asset swap is the transfer of any asset such as real estate, inventory or investment by the debtor to the creditor in full settlement of an obligation. Under PFRS 9, paragraphs 3.3.1 and 3.3.3, asset swap is treated as a derecognition of a financial liability or extinguishment of an obligation. The difference between the carrying amount of the financial liability and the consideration given shall be recognized in profit or loss. 5. Explain an equity swap. An "equity swap" is a transaction whereby a debtor and creditor may renegotiate the terms of a financial liability with the result that the liability is fully or partially extinguished by the debtor issuing equity instruments to the creditor. Simply stated, equity swap is the issuance of share capital by the debtor to the creditor in full or partial payment of an obligation. 6. How should an entity initially measure the equity instruments issued to extinguish a financial liability? This accounting issue of "extinguishment of a financial liability by issuing equity instruments" is now well-settled under IFRIC 19. IRFIC 19 provides that when equity instruments issued to extinguish all or part of a financial liability are recognized initially, an entity shall measure the equity instruments at the fair value of the equity instruments issued, unless that fair value cannot be reliably measured. If the fair value of the equity instruments issued cannot be reliably measured, the equity instruments shall be measured to reflect the fair value of the financial liability extinguished. Needless to say, if both the fair value of the equity instruments issued and the fair value of the financial liability extinguished cannot be measured reliably, the equity instruments issued shall be measured at the "carrying amount of the financial liability extinguished". Debt Restructure Essay Questions: Debt Restructure Page 5 Accordingly, the equity instruments issued to extinguish a financial liability shall be measured at the following amounts in the order of priority: a. Fair value of equity instruments issued b. Fair value of liability extinguished c. Carrying amount of liability extinguished The difference between the carrying amount of the financial liability extinguished and the "initial measurement" of the equity instruments issued shall be recognized in profit or loss. Such gain or loss on extinguishment shall be disclosed as a separate line item in the income statement. 7. Explain modification of terms of a financial liability. Modification of terms of a financial liability may involve either the interest or maturity value or both. Interest concession may involve a reduction of the interest rate, forgiveness of unpaid interest or a moratorium on interest payment. Maturity value concession may involve an extension of the maturity date or reduction of the amount to be paid at maturity. PFRS 9, paragraph 3.3.2, provides that a substantial modification of terms of an existing financial liability shall be accounted for as an extinguishment of the old financial liability and the recognition of a new financial liability Under Application Guidance B3.3.6 of PFRS 9, there is substantial modification of terms if the gain or loss on extinguishment is at least 10% or 10% or more of the carrying amount of the old financial liability. The difference between the carrying amount of the old liability and the present value of new or restructured liability shall be accounted for as gain or loss on extinguishment. The present value of the new liability shall be determined using the original effective interest rate. Any costs or fees incurred as a result of the substantial modification of terms shall be recognized as part of gain or loss on extinguishment. 8. Explain the accounting procedure if there is no substantial modification of terms of the old financial liability. Under Application Guidance B3.3.6, if the gain or loss on extinguishment of the old liability is less than 10% of the carrying amount of the old liability, there is no substantial modification of terms. In this case, the gain or loss is not recognized because the modification is not an extinguishment of the old liability. Any costs incurred in modifying the terms are adjusted to the carrying amount of the old liability and amortized over the remaining term of the modified liability. In other words, the old liability is simply continued but with modified interest charges. Accordingly, a new effective interest rate must be computed to equate the carrying amount of the old liability with the present value of the cash outflows of the modified liability. FINANCIAL ACCOUNTING MCQ – Theory: Notes Payable Page 6 MCQ – Theory: Notes Payable Initial measurement 1. An entity shall measure initially a note payable not designated at fair value through profit or loss at Valix 2012 A. Face amount C. Fair value minus transaction cost B. Fair value D. Fair value plus transaction cost 2. When an entity issued a note solely in exchange for cash, the present value of the note at issuance is equal to A. Face amount B. Proceeds received C. Face amount discounted at the market interest rate D. Proceeds received discounted at the market interest rate Valix 2012 3. An entity issued a note solely in exchange for cash. Assuming that the items listed below differ in amount the present value of the note at issuance is equal to A. Face amount B. Proceeds received C. Face amount discounted at the prevailing interest rate D. Proceeds received discounted at the prevailing interest rate Valix 2012 4. A note payable with no ready market is exchanged for property whose fair value is currently indeterminable. When such a transaction takes place A. The entity receiving the property should estimate a value for the property. B. The present value of the note payable must be approximated using an imputed interest rate. C. The note payable should not be recorded until the fair value of the property becomes evident. D. Both entities involved in the transaction should negotiate a value to be assigned to the property. FA 2 © 2014 5. When a note payable is issued for property, the present value of the note is measured by A. The fair value of the property B. The fair value of the note payable FA 2 © 2014 C. All of these are considered in measuring the present value of the note payable D. Using an imputed interest rate to discount all future payments on the note payable Notes Payable MCQ – Theory: Notes Payable Page 7 6. When a note payable is exchanged for property, the stated interest rate is presumed to be fair when A. No interest rate is stated. B. The stated interest rate is unreasonable. C. The stated interest rate is equal to the market rate. D. The face amount of the note is materially different from the cash sale price for similar property. FA 2 © 2014 7. If the present value of a note issued in exchange for a property is less than its face amount, the difference should be A. Included in the cost of the asset B. Included in interest expense in the year of issuance C. Amortized as interest expense over the life of the note D. Amortized as interest expense over the life of the asset FA 2 © 2014 8. At issuance date, the present value of a promissory note is equal to the face amount if the note A. Bears a stated rate of interest which is realistic. B. Bears a stated rate of interest which is less than the pervading market rate for similar notes. C. Is noninterest bearing and the implicit interest rate is less than the prevailing market rate for similar notes. D. Is noninterest bearing and the implicit interest rate is equal to the prevailing market rate for similar notes. Valix 2012 9. An entity borrowed cash from a bank and issued to the bank a short-term noninterest bearing note payable. The bank discounted the note at 10% and remitted the proceeds to the entity. The effective interest rate paid by the entity in this transaction would be A. Equal to the stated discount rate of 10% B. More than the stated discount rate of 10% C. Less than the stated discount rate of 10% D. Independent of the stated discount rate of 10% Valix 2012 After initial recognition 10. After initial recognition, an entity shall measure a note payable at A. Amortized cost B. Fair value through profit or loss C. Either amortized cost or fair value through profit or loss D. Either amortized cost or fair value through other comprehensive income Valix 2012 FINANCIAL ACCOUNTING MCQ – Theory: Notes Payable Page 8 Amortized cost 11. What is the amortized cost of note payable? A. The amount at which the note payable is initially recognized. B. The amount at which the note payable is initially recognized minus principal repayment. C. The amount at which the note payable is initially recognized plus or minus the cumulative effective interest amortization of the difference between the initial carrying amount and maturity amount. D. The amount at which the note payable is initially recognized minus principal repayment, plus or minus the cumulative effective interest amortization of the difference between the initial carrying amount and maturity amount. Valix 2012 12. Which of the following statements concerning discount on note payable is incorrect? A. Discount on note payable may be debited when entity discounts its own note with the bank. B. The discount on note payable is a contra liability account which is shown as a deduction from note payable. C. The discount on note payable represents interest charges applicable to future periods. D. Amortizing the discount on note payable causes the carrying amount of the liability to gradually decrease over the life of the note. FA 2 © 2014 Fair value option 13. Under the fair value option, an entity shall measure the 'note payable initially at FA 2 © 2014 A. Fair value C. Fair value plus transaction cost B. Face amount D. Fair value minus transaction cost 14. Which the following statements is incorrect in relation to the fair value option of measuring note payable? A. At initial recognition, an entity may irrevocably designate the note payable as at fair value through profit or loss. B. At initial recognition, an entity may revocably designate the note payable as at fair value through profit or loss. C. The interest expense on the note payable is recognized using the stated interest rate. D. After initial recognition, the note payable is remeasured at fair value at every year-end with changes in fair value recognized partly in other comprehensive income and partly in profit or loss. Valix 2012 Notes Payable MCQ – Theory: Notes Payable Page 9 Interest expense 15. A two-year note was issued in an arm's length transaction at face value solely for cash at the beginning of this year. There were no other rights or privileges exchanged. The interest rate is specified at 10% per year. Principal and interest are payable at maturity. The prevailing rate of interest for a loan of this type is 15% per year. What annual interest rate should be used to record interest expense for this year and next year? Valix 2012 | A. | B. | C. | D. This year | 10 percent | 10 percent | 15 percent | 15 percent Next year | 10 percent | 15 percent | 10 percent | 15 percentInterest payable 16. On September 1, 2013, an entity borrowed cash and signed a two-year interest-bearing note on which both the principal and interest are payable on September 1, 2015. How many months of accrued interest would be included in the liability for accrued interest on December 31, 2013 and December 31,2014? Valix 2012 | A. | B. | C. | D. December 31, 2013 | 4 months | 4 months | 12 months | 20 months December 31, 2014 | 4 months | 16 months | 24 months | 8 monthsFinancial statement presentation & disclosure 17. The discount resulting from the determination of the present value of a note payable should be reported in the statement of financial position as A. Deferred credit separate from the note. B. Addition to the face amount of the note. C. Deferred charge separate from the note. D. Direct deduction from the face amount of the note. AICPA 0594 18. On October 1, 2014, an entity borrowed cash and signed a three-year interest bearing note in which both the principal and interest are payable on October 1, 2017. On December 31, 2014, accrued interest should A. Not be reported B. Be reported as current liability C. Be reported as noncurrent liability D. Be reported as part of the note payable FA 2 © 2014 FINANCIAL ACCOUNTING MCQ – Theory: Notes Payable Page 10 19. On September 1, 2013, an entity borrowed cash and signed a one-year interest-bearing note on which both the principal and interest are payable on September 1, 2014. How will the note payable and the accrued interest be classified in the December 31, 2013 statement of financial position? Wiley 2011 | A. | B. | C. | D. Note payable | Current liability | Current liability | Noncurrent liability | Noncurrent liability Accrued interest | Current liability | Noncurrent liability | Current liability | No entry20. Some borrowing agreements incorporate covenants which have the effect that the liability becomes payable on demand if certain conditions related to the covenants are breached. In such a case, the liability is classified as I. Current even if the lender has agreed, after the reporting period and before the statements are authorized for issue, not to demand payment as a consequence of the breach. II. | Noncurrent when the lender has agreed on or before the end of the reporting period to provide a period of grace ending at least twelve months after that date. A. | I only | C. Either I or IIB. II only D. Neither I nor II FA 2 © 2014 21. An entity has a loan due for repayment in six months time, but the entity has the option to refinance for repayment two years later. The entity plans to refinance this loan. In which section of the statement of financial position should this loan be presented? A. Current assets C. Noncurrent assets B. Current liabilities D. Noncurrent liabilities FA 2 © 2014 22. A long-term debt which is due to be settled within twelve months after the reporting period is classified as noncurrent when I. An agreement to refinance or to reschedule payments on a long-term basis is completed on or before the end of the reporting period and before the financial statements are authorized for issue. II. | The entity has the discretion to refinance or roll over the obligation for at least twelve months after the reporting period under an existing loan facility. A. | I only | C. Both I and IIB. II only D. Neither I nor II FA 2 © 2014 Debt Restructuring MCQ – Theory: Debt Restructuring Page 11 23. With respect to loans classified as current liabilities, all of the following events that occur between the end of the reporting period and the date the financial statements are authorized for issue are disclosed as non-adjusting events, except A. Refinancing on a long-term basis B. Rectification of a breach of a long-term loan arrangement C. The entity has the discretion to refinance an obligation for a shorter period D. The granting by the lender of a period to rectify a breach of a long-term loan arrangement ending at least twelve months after the reporting period. FA 2 © 2014 24. Note disclosures for long-term debt generally include all of the following, except A. Asset pledged as security C. Name of creditor FA 2 © 2014 B. Call provision D. Restrictions imposed by creditor MCQ – Theory: Debt Restructuring Asset swap 25. In a debt restructuring that is considered an asset swap, the gain on extinguishment is equal to the A. Excess of the fair value of the asset over its carrying amount B. Excess of the carrying amount of the debt over the fair value of the asset C. Excess of the fair value of the asset over the carrying amount of the debt FA2 © 2014 D. Excess of the carrying amount of the debt over the carrying amount of the asset 26. The difference between the carrying amount of a financial liability extinguished and the consideration given shall A. Be included in equity C. Be recognized in profit or loss B. Be included in retained earnings D. Not be recognized Valix 2012 Equity swap 27. An entity shall initially measure equity instruments issued to extinguish all or part of a financial liability at A. Fair value of the liability extinguished B. Par value of the equity instruments issued C. Fair value of the equity instruments issued D. Carrying amount of the liability extinguished Valix 2012 28. If the fair value of the equity instruments issued cannot be reliably measured, the equity instruments issued to extinguish a financial liability shall be measured at A. Fair value of the liability extinguished B. Par value of the equity instruments issued C. Book value of the equity instruments issued D. Carrying amount of the liability extinguished Valix 2012 FINANCIAL ACCOUNTING MCQ – Theory: Debt Restructuring Page 12 29. If both the fair value of the equity instruments issued and the fair value of the financial liability extinguished cannot be measured reliably, the equity instruments issued shall be measured at A. Par value of equity instruments issued B. Value assigned by the Board of Directors C. Book value of the equity instruments issued D. Carrying amount of the liability extinguished Valix 2012 30. The difference between the carrying amount of the financial liability extinguished and the fair value of equity instruments issued or fair value of liability extinguished in the absence of the fair value of equity instruments issued shall be recognized in A. General reserve C. Profit or loss B. Other comprehensive income D. Retained earnings FA2 © 2014 31. The gain or loss from extinguishment of a financial liability by issuing equity instruments shall be presented in the statement of comprehensive income as A. Component of finance cost B. Other income or other expense C. Separate line item in profit or loss D. Component of other comprehensive income Valix 2012 Substantial Modification of Terms 32. There is substantial modification of terms of an old financial liability if the gain or loss on extinguishment is A. At least 10% of the new liability B. Less than 10% of the new liability C. At least 10% of the carrying amount of the old liability D. Less than 10% of the carrying amount of the old liability FA2 © 2014 33. For a debt restructuring involving substantial modification of terms, it is appropriate for a debtor to recognize a gain when the carrying amount of the debt A. Exceeds the total future cash payments specified by the new terms. B. Is less than the total future cash payments specified by the new terms. FA2 © 2014 C. Exceeds the present value of the future cash payments specified by the new terms. D. Is less than the present value of the future cash payments specified by the new terms. Debt Restructuring MCQ – Theory: Debt Restructuring Page 13 34. In a debt extinguishment in which the debt is continued with modified terms and the carrying amount of the debt is more than the fair value of the debt A. A loss should be recognized by the debtor. B. A gain should be recognized by the debtor. C. A new effective interest rate must be computed. D. No interest expense should be recognized in the future. FA2 © 2014 35. Under a debt restructuring involving substantial modification of terms, the future cash flows under the new terms should be discounted using A. Interest rate under the new terms C. Original effective interest rate B. Market rate of interest D. Prime interest rate FA2 © 2014 FINANCIAL ACCOUNTING MCQ – Problems: Notes Payable Page 14 MCQ – Problems: Notes Payable Current liabilities 1. Able Company had the following amounts of long-term debt outstanding on December 31, 2014: 14% term note, due 2015 11% term note, due 2017 8% note, due in 11 equal annual principal payments, plus interest beginning December 31, 2015 7% guaranteed debentures, due 2016 | 30,000 1,070,000 1,100,000 1,000,000 Total | 3,200,000 The annual sinking fund requirement on the guaranteed debentures is P40,000 per year. What total amount should be reported as current liabilities on December 31, 2014? A. 40,000 | C. 100,000B. 70,000 D. 130,000 FA 2 © 2014 2. Dean Company has a P2,000,000 note payable due June 30, 2015. On December 31, 2014, the entity signed an agreement to borrow up to P2,000,000 to refinance the note payable on a long-term basis. The financing agreement called for borrowing not to exceed 80% of the value of the collateral the entity was providing. On December 31, 2014, the value of the collateral was P1,500,000. On December 31, 2014, what amount of the note payable should be reported as current liability? A. 500,000 C. 1,500,000 B. 800,000 D. 2,000,000 FA 2 © 2014 3. On December 31, 2014, Ace Company had P6,000,000 note payable due on February 28, 2015. On December 23, 2014, the entity arranged a line of credit with City Bank which allowed the entity to borrow up to P5,000,000 at 6% per annum for three years. On February 1, 2015, the entity borrowed P4,000,000 from City Bank and used P2,000,000 additional cash to liquidate the note payable. The 2014 financial statements were issued on March 15, 2015. What amount of note payable should be reported as current in the December 31, 2014 statement of financial position? A. 2,000,000 C. 5,000,000 B. 4,000,000 D. 6,000,000 FA 2 © 2014 4. Tagkawayan Company reported the following liability balances on December 31, 2014: 10% note payable issued on October 1, 2013, maturing October 1, 2015 3,000,000 12% note payable issued on March 1, 2013, maturing on March 1, 2015 5,000,000 Notes Payable MCQ – Problems: Notes Payable Page 15 The 2014 financial statements were issued on March 31, 2015. On January 31, 2015, the entire P5,000,000 balance of the 12% note payable was refinanced through issuance of a long-term obligation payable lump sum. Under the loan agreement for the 10% note payable, the entity has the discretion to refinance the obligation for at least twelve months after December 31, 2014. What amount of the notes payable should be classified as current on December 31, 2014? A. 0 C. 5,000,000 B. 3,000,000 D. 8,000,000 FA 2 © 2014 5. Witt Company reported the following liability account balances on December 31, 2014: 6% note payable issued October 1, 2013 maturing October 1, 2015 500,000 8% note payable issued April 1, 2013 maturing April 1,2015 800,000 The 2014 financial statements were issued on March 31, 2015. On March 1, 2015, the entire P800,000 balance of 8% note was refinanced by issuance of a long-term obligation payable lump sum. On December 31, 2014, what amount of the notes payable should be classified as current? A. 0 C. 800,000 B. 500,000 D. 1,300,000 FA 2 © 2014 6. On December 31, 2014, Largo Company had a P750,000 note payable outstanding due July 31, 2015. The entity planned to refinance the note by issuing long-term bonds. Because the entity temporarily had excess cash, it prepaid P250,000 of the note on January 15, 2015. In February 2015, the entity completed a P1,500,000 bond offering. The entity will use the bond offering proceeds to repay the note payable at maturity. On March 31, 2015, the 2014 financial statements were authorized for issue. What amount of the note payable should be included in current liabilities on December 31, 2014? A. 0 C. 500,000 B. 250,000 D. 750,000 FA 2 © 2014 Short-term note payable Initial measurement 7. At year-end, Roth Company issued a P1,000,000 face value note payable in exchange for services rendered. The note, made at usual trade terms, is due in nine months and bears interest, payable at maturity, at the annual rate of 3%. The market interest rate is 8%. The compound interest factor of 1 due in nine months at 8% is .944. At what amount should the note payable be reported at year-end? A. 944,000 C. 1,000,000 B. 965,200 D. 1,030,000 FA 2 © 2014 FINANCIAL ACCOUNTING MCQ – Problems: Notes Payable Page 16 Effective interest rate 8. On July 1, 2013, Cody Company obtained a P2,000,000, 180-day bank loan at an annual rate of 12%. The loan agreement requires Cody to maintain a P400,000 compensating balance in its checking account. Cody would otherwise maintain a balance of only P200,000 in this account. The checking account earns interest at an annual rate of 6%. What is the effective interest rate on the borrowing? A. 12.00% C. 13.33% B. 12.67% D. 13.50% P1 © 2013 Non-interest bearing long-term note – lump sum payment Interest expense 9. On January 1, 2014, Pares Company borrowed P3,600,000 from a major customer evidenced by a noninterest bearing note due in three years. The entity agreed to supply the customer's inventory needs for the loan period at an amount lower than market price. At the 12% imputed interest rate for this type of loan, the present value of the note is P2,550,000 at the date of issuance. What amount of interest expense should be reported in the income statement for 2014? A. 0 C. 350,000 B. 306,000 D. 432,000 FA 2 © 2014 10. On January 1, 2014, Wisconsin Company lent P1,780,000 cash to Stone Company. The promissory note made by Stone for P2,000,000 did not bear explicit interest and was due on December 31, 2015. The prevailing interest rate for a loan of this type was 6%. The present value of 1 for two periods at 6% is .89. What amount of interest expense should be recognized for 2014? A. 0 C. 110,000 B. 106,800 D. 120,000 FA 2 © 2014 11. On January 1, 2014, Monk Company purchased equipment. There was no established market price for the equipment which has an 8-year life and no residual value. The entity gave a P5,250,000 noninterest-bearing note payable in three equal annual installments of P 1,750,000 with the first payment due December 31, 2014. The prevailing rate of interest for a note of this type is 8%. The present value of the note at 8% was P4,509,950. The entity used the straight line method of depreciation. What amount should be reported as interest expense for 2014? A. 0 C. 360,796 B. 220,796 D. 420,000 FA 2 © 2014 Notes Payable MCQ – Problems: Notes Payable Page 17 Carrying amount 12. | On January 1, 2014, Lizelle Company signed a P1,000,000 noninterest-bearing note due in three years at a discount rate of 10%. The entity has elected the fair value option. On December 31, 2014, the risk factors indicated that the rate of interest applicable to the borrowing was 9%. The present value factors at 10% and 9% are as follows: PV factor 10%, 3 periods PV factor 10%, 2 periods PV factor 10%, 1 period | .751 .826 .909 | PV factor 9%, 3 periods PV factor 9%, 2 periods PV factor 9%, 1 period | .772 .842 .917What is the carrying amount of the note payable on December 31, 2014? A. 75,100 C. 82,610 B. 77,200 D. 84,200 FA 2 © 2014 Non-interest bearing long-term note – Installment payments 13. On December 31, 2014, Bart Company purchased a machine from Fell Company in exchange for a noninterest bearing note requiring eight payments of P200,000. The first payment was made on December 31, 2014 and the others are due annually on December 31. At date of issuance, the prevailing rate of interest for this type of note was 11%. Present value factors are as follows: PV of an ordinary annuity of 1 at 11% for 8 periods PV of an annuity of 1 in advance at 11% for 8 periods | 5.146 5.712 In the December 31, 2014 statement of financial position, what is the carrying amount of the note payable? A. 942,400 | C. 1,046,200B. 1,029,200 D. 1,142,400 FA 2 © 2014 Interest-bearing long-term note payable – Lump sum payment 14. On March 1, 2013, Fine Company borrowed P1,000,000 and signed a 2-year note bearing interest at 12% per annum compounded annually. Interest is payable in full at maturity on February 28, 2015. What amount should be reported as accrued interest payable on December 31, 2014? A. 100,000 C. 232,000 B. 120,000 D. 240,000 FA 2 © 2014 Interest-bearing long-term note payable – Equal principal payments + interest Interest payable 15. Mann Company reported a 10% note payable of P3,600,000 on June 30, 2013. The note is dated October 1, 2012 and payable in three equal annual payments of P1,200,000 plus interest. The first interest and principal payment was made on October 1, 2013. On June 30, 2014, what amount should be reported as accrued interest payable for this note? A. 60,000 C. 180,000 B. 90,000 D. 270,000 FA 2 © 2014 FINANCIAL ACCOUNTING MCQ – Problems: Notes Payable Page 18 16. On September 1, 2013, Pine Company issued a note payable in the amount of P 1,800,000, bearing interest at 12%, and payable in three equal annual principal payments of P600,000. On this date, the prime rate was 11%. The first interest and principal payment was made on September 1, 2014. On December 31, 2014, what amount should be reported as accrued interest payable? A. 44,000 C. 66,000 B. 48,000 D. 72,000 FA 2 © 2014 Interest expense 17. Easy Company reported a note payable of P1,200,000 on December 31, 2013. The note is dated October 1, 2013, bears interest at 15%, and is payable in three equal annual payments of P400.000. The first interest and principal payment was made on October 1, 2014. In the 2014 income statement, what amount should be reported as interest expense for this note? A. 30,000 C. 165,000 B. 135,000 D. 180,000 FA 2 © 2014 Carrying amount 18. On January 1, 2014, Solemn Company sold land to Glory Company. There was no established market price for the land. Glory gave Solemn a P2,400,000 noninterest bearing note payable in three equal annual installments of P800,000 with the first payment due December 31, 2014. The note has no ready market. The prevailing rate of interest for a note of this type is 10%. The present value of a P2,400,000 note payable in three equal annual installments of P800,000 at a 10% rate of interest is PI,989,600. What is the carrying amount of the note payable on December 31, 2014? A. 1,388,560 C. 2,126,400 B. 1,989,600 D. 2,400,000 FA 2 © 2014 Fair value option 19. On January 1, 2014, Jonathan Company borrowed P500,000 8% noninterest-bearing note due in four years. The present value of the note on the date of issuance was P367,500. The entity has elected the fair value option. On December 31, 2014, the fair value of the note is P408,150. At what amount should the discount on note payable be presented on December 31, 2014? A. 0 C. 103,100 B. 91,850 D. 132,500 FA 2 © 2014 Notes Payable MCQ – Problems: Notes Payable Page 19 20. On January 1,2013, Lizelle Company signed a P100,000 noninterest bearing note due in three years at a discount rate of 10%. The entity elects the fair value option for reporting financial liabilities. On December 31,2013, the credit rating and risk factors indicated that the rate of interest applicable to its borrowings was 9%. The present value factors at 10% and 9% are as follows: PV factor 10%, 3 periods PV factor 10%, 2 periods PV factor 10%, 1 period | .751 .826 .909 | PV factor 9%, 3 periods PV factor 9%, 2 periods PV factor 9%, 1 period | .772 .842 .917 What is the carrying amount of the note payable on December 31, 2013? A. 75,100 | C. 82,610B. 77,200 D. 84,200 P1 © 2013 21. On July 1, 2014, Justine Company borrowed PI,000,000 on a 10% five-year interest-bearing note. On December 31, 2014, the fair value of the note is determined to be P975,000. The entity has elected the fair value option. On December 31, 2014, what amounts should be presented respectively for interest expense, note payable and gain for this note? FA 2 © 2014 | A. | B. | C. | D. Interest expense | 0 | 50,000 | 100,000 | 100,000 Note payable | 975,000 | 975,000 | 975,000 | 1,000,000 Gain (loss | (75,000) | 25,000 | 25,000 | 0Correction of error 22. Loob Company frequently borrowed from the bank in order to maintain sufficient operating cash. The following loans were at a 12% interest rate, with interest payable at maturity. The entity repaid each loan on the scheduled maturity date. Date of loan | Amount | Maturity date | Term of loan 11/1/2013 | 500,000 | 10/31/2014 | 1 year 2/1/2014 | 1,500,000 | 7/31/2014 | 6 months 5/1/2014 | 800,000 | 1/31/2015 | 9 months The entity recorded interest expense when the loans are repaid. As a result, interest expense of P150,000 was recorded in 2014. If no correction is made, by what amount would interest expense for 2014 be understated? A. 54,000 | C. 64,000B. 62,000 D. 72,000 FA 2 © 2014 FINANCIAL ACCOUNTING MCQ – Problems: Notes Payable Page 20 Sinking Fund 23. Able Company had the following amounts of long-term debt outstanding on December 31,2013: 14% term note, due 2014 | 30,000 11 % term note, due 2016 8% note, due in 11 equal annual principal payments, | 1,070,000 plus interest beginning December 31, 2014 7% guaranteed debentures, due 2015 | 1,100,000 1,000,000 Total | 3,200,000 The annual sinking-fund requirement on the guaranteed debentures is P40,000 per year. What amount should be reported as current maturities of long-term debt on December 31,2013? A. 40,000 | C. 100,000B. 70,000 D. 130,000 P1 © 2013 Refinancing Current liabilities 24. Witt Company reported the following liability account balances on December 31,2013: 6% note payable issued October 1, 2012 maturing September 30, 2014 | 500,000 8% note payable issued April 1,2012 maturing April 1,2014 | 800,000The December 31,2013 financial statements were issued on March 31, 2014. On January 15, 2014, the entire P800,000 balance of 8% note was refinanced by issuance of a long-term obligation payable in a lump sum. In addition, on March 15,2014, the entity consummated a noncancelable agreement with the lender to refinance the 6%, P500,000 note on a long-term basis. On December 31,2013, what amount of the notes payable should be classified as current? A. 0 C. 800,000 B. 500,000 D. 1,300,000 P1 © 2013 25. | Eliot Company reported liabilities on December 31,2013 as follows: Accounts payable and accrued interest | 1,000,000 12% note payable issued November 1, 2012 maturing July 1,2014 10% debentures payable, next annual principal installment ofP500,000 due February 1,2014 | 2,000,000 7,000,000On December 31, 2013, the entity consummated a noncancelable agreement with the lender to refinance the 12% note payable on a long-term basis. The December 31,2013 financial statements were issued on March 31,2014. In the December 31,2013 statement of financial position, what total amount should be reported as current liabilities? A. 1,500,000 C. 3,000,000 B. 2,500,000 D. 3,500,000 P1 © 2013 Notes Payable MCQ – Problems: Notes Payable Page 21 26. On December 31, 2013, Largo Company had a P750,000 note payable outstanding, due July 31, 2014. The entity planned to refinance the note by issuing long-term bonds. Because the entity temporarily had excess cash, it prepaid P250,000 of the note on January 15, 2014. In February 2014, the entity completed a P 1,500,000 bond offering. On March 31,2014, the entity issued the 2013 financial statements. What amount of the note payable should be included in current liabilities on December 31,2013? A. 0 C. 500,000 B. 250,000 D. 750,000 P1 © 2013 27. Dean Company had a P2,000,000 note payable due June 30,2014. On December 31,2013, the entity signed an agreement to borrow up to P2,000,000 to refinance the note payable on a long-term basis. The financing agreement called for borrowing not to exceed 80% of the value of the collateral the entity was providing. On December 31,2013, the value of the collateral was P1,500,000. On December 31,2013, what amount of the note payable should be reported as current liability? A. 500,000 C. 1,500,000 B. 800,000 D. 2,000,000 P1 © 2013 28. On December 31,2013, Ace Company had P6,000,000 note payable due on February 28,2014. On December 31,2013, the entity arranged a line of credit with City Bank which allows the entity to borrow up to P5,000,000 at 6% per annum for three years. On February 1, 2014, the entity borrowed P4,000,000 from City Bank and used P2,000,000 additional cash to liquidate the note payable. The 2013 financial statements were issued on March 15, 2014. What amount of note payable should be reported as current on December 31,2013? A. 2,000,000 C. 5,000,000 B. 4,000,000 D. 6,000,000 P1 © 2013 Noncurrent liabilities 29. Jam Company had P5,000,000 note payable due on March 1,2014. The entity borrowed P3,500,000 on February 1, 2014 which had a five-year term and used the proceeds to pay down the note and used other cash to pay the balance. The December 31, 2013 financial statements were issued on March 31,2014. What amount of the note payable should be classified as noncurrent on December 31,2013? A. 0 C. 3,500,000 B. 1,500,000 D. 5,000,000 P1 © 2013 FINANCIAL ACCOUNTING MCQ – Problems: Notes Payable Page 22 30. Dana Company had P2,000,000 note payable due on June 30, 2014. Under the existing loan facility, the entity had the discretion to refinance or roll over the note payable for at least twelve months after the end of reporting period. On December 31, 2013, what amount of the note payable should be reported as noncurrent liability? A. 0 C. 2,400,000 B. 2,000,000 D. 3,000,000 P1 © 2013 Comprehensive Questions 31 & 32 are based on the following information. FA 2 © 2014 Joshua Company bought a new machine and agreed to pay in equal annual installment of P600,000 at the end of each of the next five years. The prevailing interest rate for this type of transaction is 12%. The present value of an ordinary annuity of 1 at 12% for five periods is 3.60. The future amount of an ordinary annuity of 1 at 12% for five periods is 6.35. The present value of 1 at 12% for five periods is 0.567. 31. What amount should be reported as note payable if financial statements were prepared today? A. 1,700,000 C. 3,000,000 B. 2,160,000 D. 3,810,000 32. What is the interest expense for the first year? A. 187,200 C. 360,000 B. 259,200 D. 457,200 Questions 33 & 34 are based on the following information. FA 2 © 2014 Jason Company offered a contest in which the winner would receive PI,000,000 payable over twenty years. On December 31, 2014, the entity announced the winner of the contest and signed a note payable to the winner for PI,000,000, payable in P50,000 installments every January 2. Also on December 31, 2014, the entity purchased an annuity for P418,250 to provide the P950.000 prize remaining after the first P50.000 installment which was paid on January 2, 2015. 33. On December 31, 2014, what amount should be reported as note payable-contest winner, net of current portion? A. 368,250 C. 900,000 B. 418,250 D. 950,000 34. In the 2014 income statement, what amount should be reported as contest prize expense? A. 0 C 468,250 B. 418,250 D. 1,000,000 Debt Restructuring MCQ – Problems: Debt Restructuring Page 23 MCQ – Problems: Debt Restructuring Asset Swap 35. During 2014, Mann Company experienced financial difficulties and is likely to default on a P5,000,000, 15% three-year note dated January 1, 2012 payable to Summit Bank On December 31, 2014, the bank agreed to settle the note and unpaid interest of P750,000 for P4,100,000 cash payable on January 31, 2015. What amount should be reported as gain from extinguishment of debt in the 2014 income statement? A. 0 C. 900,000 B. 750,000 D. 1,650,000 FA2 © 2014 36. Hull Company is indebted to Apex Company under a P5,000,000, 12%, three-year note dated December 31, 2012. Because of financial difficulties developing in 2014, Hull Company owed accrued interest of P600,000 on the note on December 31, 2014. Under a debt restructuring on December 31, 2014, Apex Company agreed to settle the note and accrued interest for a tract of land having a fair value of P4,500,000. The acquisition cost of the land is P3,600,000. What amount of pretax gain on extinguishment should Hull Company report as component of income from continuing operations in 2014? A. 900,000 C. 1,400,000 B. 1,100,000 D. 2,000,000 FA2 © 2014 37. The following information pertains to the transfer of real estate pursuant to a debt restructuring by Knob Company to Mene Company in full liquidation of Knob Company's liability to Mene Company: Carrying amount of liability liquidated Carrying amount of real estate transferred Fair value of real estate transferred | 1,500,000 1,000,000 1,200,000 What amount of pretax gain should Knob Company report as component of income from continuing operations? A. 0 | C. 300,000B. 200,000 D. 500,000 FA2 © 2014 38. Versatile Company, after having experienced financial difficulties in 2014, negotiated with a major creditor and arrived at an agreement to restructure a note payable on December 31, 2014. The creditor was owed principal of P3,600,000 and interest of P400,000 but agreed to accept equipment worth P700,000 and note receivable from a Versatile Company's customer with carrying amount of P2,700,000. The equipment had an original cost of P900,000 and accumulated depreciation of P300,000. What amount should be recognized as gain from FINANCIAL ACCOUNTING MCQ – Problems: Debt Restructuring Page 24 extinguishment of debt on December 31, 2014? A. 0 C. 600,000 B. 400,000 D. 700,000 FA2 © 2014 Equity Swap 39. | On December 31,2013, Sunshine Company showed the following data with respect to its matured obligation: ' Note payable | 5,000,000 Accrued interest payable | 500,000The entity is threatened with a court suit if it could not pay its maturing debt. Accordingly, the entity entered into an agreement with the creditor for the issuance of share capital in full settlement of the note payable. The agreement provided for the issue of 35,000 shares with par value of P100. The share is currently quoted at P130. The fair value of the note payable on the date of restructuring is P4,700,000. Under the "equity swap", what amount should be recognized as gain from extinguishment of debt? A. 800,000 C. 1,000,000 B. 950,000 D. 2,000,000 Questions 40 & 41 are based on the following information. P1 © 2013 Seal Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to relieve its financial stress. Seal has a P2,500,000 note payable to United Bank. The bank accepted an equity interest in Seal Company in the form of 200,000 ordinary shares quoted at P12 per share. The par value is P10 per share. The fair value of the note payable on the date of restructuring is P2,200,000. 40. What amount should be recognized as gain from debt extinguishment as a result of the "equity swap"? A. 100,000 C. 400,000 B. 200,000 D. 500,000 41. What amount should be recognized as share premium from the issuance of the shares? A. 100,000 C. 400,000 B. 200,000 D. 500,000 Questions 42 & 43 are based on the following information. P1 © 2013 Quest Company is threatened with bankruptcy due to its inability to meet interest payments and fund requirements to retire P6,000,000 note payable with accrued interest payable of P600,000. The entity has entered into an agreement with the creditor to exchange equity instruments for the liability. The terms of the exchange are 300,000 ordinary shares with P5 par value and P10 market value, and 25,000 preference shares with P10 par value and P60 market value. Debt Restructuring MCQ – Problems: Debt Restructuring Page 25 42. What is the gain on the extinguishment of the note payable? A. 0 C. 2,100,000 B. 1,500,000 D. 2,750,000 43. What is the total share premium from the issuance of the preference and ordinary shares? A. 1,500,000 C. 2,750,000 B. 2,100,000 D. 4,850,000 Questions 44 & 45 are based on the following information. P1 © 2013 Sunset Company had bonds payable with face value of P5,000,000 and a carrying amount of P4,800,000. In addition, unpaid interest on the bonds was accrued in the amount of P250,000. The creditor had agreed to the settlement of the bonds payable in exchange for 50,000 shares of P50 par value. The shares have no reliable measure of fair value. However, the bonds are quoted at P3,500,000. 44. What is the gain on the extinguishment of the bonds payable? A. 0 C. 1,500,000 B. 1,300,000 D. 1,550,000 45. What is the share premium from the issuance of the shares? A. 0 C. 1,500,000 B. 1,000,000 D. 2,300,000 Substantial Modification of Terms 46. Due to adverse economic circumstances and poor management, Tagaytay Highlands Company had negotiated a restructuring of its 9% P6,000,000 note payable to Second Bank due on January 1, 2013. There is no accrued interest on the note. The bank has reduced the principal obligation from P6,000,000 to P5,000,000 and extend the maturity to 3 years or on December 31,2015. However, the new interest rate is 13% payable annually every December 31. The present value of 1 at 9% for those periods is .77 and the present value of an ordinary annuity of 1 at 9% for three periods is 2.53. What is the gain on extinguishment of debt to be recognized for 2013? A. 0 C. 505,500 B. 350,000 D. 1,000,000 P1 © 2013 FINANCIAL ACCOUNTING MCQ – Problems: Debt Restructuring Page 26 47. Jenny Company is indebted to Finance Company under a P600,000, 10%, five-year note dated January 1, 2012. Interest is payable annually on December 31. The interest was paid on December 31, 2012 and 2013. However, during 2014, the entity experienced severe financial difficulties and is likely to default on the note and interest unless some concessions are made. On December 31, 2014, Jenny Company and Finance Company signed an agreement restructuring the debt as follows: * Interest for 2014 was reduced to P30,000 payable March 31,2015. * Interest payments each year were reduced to P40,000 per year for 2015 and 2016. * The principal amount was reduced to P400,000. Under U.S. GAAP, what amount of gain on the debt restructure should be reported in the income statement for the year ended December 31, 2014? A. 120,000 C. 200,000 B. 150,000 D. 230,000 FA2 © 2014 Questions 48 & 49 are based on the following information. (20) FA2 © 2014 Due to extreme financial difficulties, Armada Company had negotiated a restructuring of a 10% P5,000,000 note payable due on December 31, 2014. The unpaid interest on the note on such date was P500,000. The creditor agreed to reduce the face value to P4,000,000, forgive the unpaid interest, reduce the interest rate to 8% and extend the due date three years from December 31, 2014. The present value of 1 at 10% for three periods is 0.75 and the present value of an ordinary annuity of 1 at 10% for three periods is 2.49. 48. What is the gain on extinguishment for 2014? A. 540,000 C. 1,703,200 B. 1,203,200 D. 2,000,000 49. What is the interest expense for 2015? A. 320,000 C. 400,000 B. 379,680 D. 500,000 Questions 50 & 51 are based on the following information. P1 © 2013 Granada Company had an overdue 8% note payable to First Bank at P8,000,000 and accrued interest of P640,000. As a result of a restructuring agreement on January 1,2013, First Bank agreed to the following provisions: • The principal obligation is reduced to P7,000,000. • The accrued interest of P640,000 is forgiven. • The date of maturity is extended to December 31,2016. • Annual interest of 10% is to be paid for 4 years every December 31. Debt Restructuring MCQ – Problems: Debt Restructuring Page 27 The present value of 1 at 8% for 4 periods is 0.735 and the present value of an ordinary annuity of 1 at 8% for 4 periods is 3.31. 50. What is the gain on extinguishment of debt to be recognized for 2013? A. 538,000 C. 1,178,000 B. 1,000,000 D. 1,640,000 51. What is the interest expense to be recognized for 2013? A. 596,960 C. 700,000 B. 640,000 D. 746,200 Questions 52 & 53 are based on the following information. P1 © 2013 On January 1,2013, Mara Company entered into a debt restructuring agreement with Clara Company which was experiencing financial difficulties. Mara Company restructured a P1,000,000 note receivable as follows: • Reduced the principal obligation to P700,000. Forgave P120,000 of accrued interest. • Extended the maturity date from January 1,2013 to December 31, 2014. • Reduced the interest rate from 12% to 8%. Interest is payable annually on December 31,2013 and 2014. Relevant present value factors: Single sum, two years at 8% .857 Single sum, two years at 12% .797 Ordinary annuity, two years at 8% Ordinary annuity, two years at 12% | 1.783 1.69052. What is the impairment loss on the note receivable for 2013? A. 347,460 C. 467,460 B. 442,100 D. 562,100 53. What is the interest income for 2013? A. 56,000 C. 80,000 B. 78,305 D. 81,155 Questions 54 thru 56 are based on the following information. FA2 © 2014 Due to adverse economic circumstances and poor management, Tagaytay Highlands Company had negotiated a restructuring of a 9% P6,000,000 note payable to Second Bank due on January 1, 2014. There was no accrued interest on the note on January 1, 2014. FINANCIAL ACCOUNTING MCQ – Problems: Debt Restructuring Page 28 The bank reduced the principal obligation from P6,000,000 to P5,000,000 and extended the maturity to three years on December 31, 2016. However, the new interest rate is 13% payable annually every December 31. Considering these terms, the new effective rate is 5.58%. The present value of 1 at 9% for three periods is .77 and the present value of an ordinary annuity of 1 at 9% for three periods is 2.53. 54. What is the present value of the new note payable on January 1, 2014? A. 3,850,000 C. 5,494,500 B. 5,000,000 D. 6,000,000 55. What is the gain on extinguishment of debt to be recognized for 2014? A. 0 C. 505,500 B. 350,000 D. 1,000,000 56. What is the interest expense for 2014 as a result of the debt restructuring? A. 334,800 C. 540,000 B. 450,000 D. 650,000 Questions 57 thru 59 are based on the following information. FA2 © 2014 On January 1, 2014, Granada Company had an overdue 10% note payable to First Bank at P8,000,000 and accrued interest of P800,000. As a result of a restructuring agreement on January 1, 2014, First Bank agreed to the following provisions: • The principal obligation is reduced to P6,000,000. • The accrued interest of P800,000 is forgiven. The date of maturity is extended to December 31, 2017. Annual interest of 12% is to be paid for 4 years every December 31. The present value of 1 at 10% for 4 periods is 0.683 and the present value of an ordinary annuity of 1 at 10% for 4 periods is 2.17. 57. What is the present value of the new note payable on January 1, 2014? A. 4,098,000 C. 6,000,000 B. 5,464,000 D. 6,380,400 58. What is the gain on extinguishment of debt to be recognized for 2014? A. 1,619,600 C. 2,419,600 B. 2,000,000 D. 2,800,000 59. What is the interest expense to be recognized for 2014? A. 600,000 C. 720,000 B. 638,040 D. 800,000 [Show More]

Last updated: 1 year ago

Preview 1 out of 43 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$13.00

Document information

Connected school, study & course

About the document

Uploaded On

Dec 01, 2020

Number of pages

43

Written in

Additional information

This document has been written for:

Uploaded

Dec 01, 2020

Downloads

0

Views

375